Kamino Reviews 2023

Concentrated liquidity is a relatively new feature in DeFi. It enables LPs to supply liquidity within a narrow price range close to the current market value of a token.

Such strategies help LPs optimize returns and increase the capital efficiency of their deposit. Since fewer tokens are necessary to earn similar yields available on traditional AMMs, LPs can deploy the extra tokens that would have gone unused on an AMM elsewhere in DeFi.

Today we'll cover Kamino Finance, the first ever concentrated liquidity market maker (CLMM) optimization protocol launched on the Solana network. From this article, you will learn about the main features of Kamino Finance and how you can benefit from using this platform.

- What Is Kamino?

- How Does Kamino Finance Work?

- The Benefits of Using Kamino

- Is Kamino Safe?

- Final Thoughts

What Is Kamino?

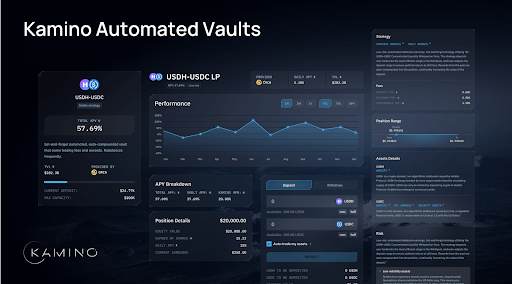

Kamino Finance is an automated CLMM yield optimizer launched on the next-generation decentralized exchange (DEX) Orca. Kamino vaults allow LPs to easily access optimized rewards through automatic rebalancing and compounding while passively providing liquidity in Orca's concentrated liquidity pools (Whirlpools).

Users who deposit crypto assets directly into Orca’s Whirlpools face a challenging time managing their positions by themselves. Instead, Kamino uses automation and quantitative modeling to ensure that positions are managed for maximum performance, and all users have to do is click a button to get started.

Kamino has been incubated by core members of Hubble Protocol, the DeFi project responsible for minting USDH, a Solana-native crypto-backed stablecoin.

Solana’s high speeds are crucial to Kamino’s success, because the prices on the crypto market are subject to extreme volatility, so CLMM positions require instant updates of the target price range.

Hubble Protocol’s Co-Founder, Marius Ciubotariu, has stated that he believes Kamino will trigger the new growth for Solana's DeFi sector. Kamino has been made as user-friendly as possible, and it could help bring new users to Solana Defi.

How Does Kamino Finance Work?

Kamino Finance is constantly adjusting concentrated liquidity positions around the most profitable ranges for supplying token swaps. By sticking to the most profitable range on a CLMM, users providing liquidity can earn the highest fees while providing deeper liquidity. Kamino also helps users by auto-compounding fees and rewards to increase the amount of liquidity being provided. Due to the technicalities of CLMM positions, users must otherwise compound fees and rewards manually.

On Kamino, liquidity deposit receipts are provided as fungible LP tokens, instead of the usual concentrated liquidity NFT. Users can deposit Kamino’s LP tokens, also known as kTokens, as collateral on Hubble and borrow USDH.

Kamino’s first vaults are focused on stable-asset and pegged-asset pairs. These pairings help users reduce the effects of impermanent loss, and they provide a stable form of passive income that limits exposure to price volatility.

The Benefits of Using Kamino

One of the obvious benefits of Kamino Finance is that users don't have to rebalance their CLMM positions manually. Kamino is a set-and-forget solution that allows users to grow their capital without keeping an eye on the market.

Kamino Finance allows users with little to no expertise to provide liquidity in Orca’s Whirlpools and earn yield. The complexity of providing concentrated liquidity is eliminated via automatization, and at the same time each position is backed by complex modeling performed by professional quants.

Another benefit of Kamino is the auto-compounding of fees and rewards. This feature increases returns over time as yield is compounded into larger and larger positions. As positions grow deeper, traders can swap their tokens with greater capital efficiency, and this incentivizes more trade, which means more fees LPs can earn.

Kamino Finance solves many of the complex and difficult issues that face concentrated liquidity providers. By using Kamino, users can forget the days of worrying about impermanent loss (IL) and trying to figure out optimal ranges by themselves.

Is Kamino Safe?

To ensure that Kamino Finance can be trusted as a secure protocol, the smart contracts that power its services have been subjected to independent audits by Sec3, Smart State, and PNM.

Additionally, Kamino has been rigorously tested during every stage of writing its code. Test-based coding has grown in popularity over the last few years, since it helps find bugs before anyone else can, and this strengthens the protocol against many attack vectors that are possible today.

Orca has also been rigorously audited and has a generous bug bounty for its open-sourced code. Unfortunately, Kamino cannot guarantee that Orca’s code will remain unexploitable, and users should always remember that anything can happen in such a new system like DeFi.

Final Thoughts

Over time, Kamino Finance will have to prove its efficiency as an automated management system in DeFi. Since the protocol is forging into new territory, it may have to undergo several adjustments to realize its potential fully, which includes adding new asset vaults that include volatile token pairs like SOL-USDC and BTC-ETH

However, even now, at the very earliest stage, Kamino Finance appears to be a solid product developed to address the known issues LPs have faced when dealing with concentrated liquidity..

All in all, Kamino looks like a promising and groundbreaking solution for the next generation of DeFi DEXs. It has the potential to shape the future of the CLMM protocols on Solana and introduce DeFi to a larger audience, as Kamino does an excellent job of providing an easy-to-use product.

Here are no reviews yet. Be the first!