Bitcoin (BTC) Price and Review 2023

Bitcoin is a protocol and cryptocurrency of the same name, created in 2009. Bitcoin laid down the basic principles underlying most blockchain projects: decentralization, the free exchange of funds and the use of cryptography to confirm the authenticity of transactions.

The currency in the Bitcoin system is the digital coin BTC. The minimum proportion is limited to the 8th digit after the decimal point and is called “Satoshi”. Thus, 1 satoshi is equal to 0.00000001 BTC. The limit on cryptocurrency issuance is limited to around 21 million bitcoins, which will be reached around 2140. There are currently 18 381 606 BTC in circulation.

You can also read about Bitcoin in these articles:

Bitcoin's Mission - The Role of the Crisis of 2008

14 Answers To The Question: How to get your first Bitcoin?

XRP outstrips Bitcoin and Ethereum in the number of transactions

From rages to riches: Will Bitcoin destroy banks in 10 years?

Escape From Tarkov- How to Mine Bitcoin

Why You Should Switch to Bitcoin as Your Primary Payment Option

Ex-Goldman Sachs Manager: Bitcoin Will Cost $1,000,000 In Three Years

Trading Forex with Bitcoin - The Key Considerations

Europe Loves Crypto: New Bitcoin Regulations Prepare for Full Embrace of Digital Currencies

How to choose the perfect moment to buy Bitcoin: 3 methods

Dave Ramsey on Bitcoin - Sell or Hold? Expert opinion

Should I Sell My Bitcoin? Investor’s Guide 2021

The Benefits of Trading Bitcoin Through Renowned Platforms

From zero to a million: The most daring forecasts for the Bitcoin exchange rate

Cyberpunk 2077, Pizza, and Bitcoin: Hot Collabs

Bitcoin Wallet - What is The Right One?

The Ultimate Guide to Bitcoin Casinos by Cryptogeek

How to Transfer Bitcoin From Coinbase to Kraken In 4 Steps

On Bitcoin and crypto regulation in the USA in 2021

Bitcoin (BTC) Price Prediction and Signals

How to Short Sell Bitcoin in 2021 - Ultimate Guide by Cryptogeek

Top 15 Bitcoin Investment Alternatives for 2021 | by Cryptogeek

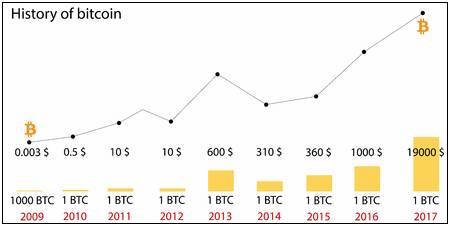

History

It all started in October 2008. This was the month that the creator of Bitcoin, Satoshi Nakamoto, published an official document called “Bitcoin: An Electronic Cash System for Peer-to-Peer Networking”. In his article, he emphasized the need to create new payment systems to solve existing problems of traditional currencies and financial institutions.

On August 18, 2008, the Bitcoin.org domain was registered by an anonymous person as a predecessor for a future project described in the Bitcoin protocol.

On January 3, 2009, Satoshi Nakamoto successfully created the founding block of the Bitcoin blockchain. The Genesis Block was hard-coded into Bitcoin software, and the first 50 BTC that were created could not be spent due to the way the code was written. The exact reasons for this are unknown, just another mystery that will amplify Satoshi Nakamoto’s secret.

The average time between creating new blocks is 10 minutes, but it took a full 6 days before the next block was added to the Bitcoin blockchain in accordance with the timestamps of these specific blocks.

The first Bitcoin transaction took place on January 12, 2009, between Nakamoto and the late Hal Finney, who was an early participant in the project. Nakamoto sent Finney 10 BTC as a test, and later a computer scientist himself began mining blocks.

Ten months later, on October 5, 2009, New Liberty Standard set the first exchange rate for bitcoin against the dollar. At that time, 1 dollar was equal to 2300.03 BTC.

On May 22, 2010, the first bitcoin transaction took place, in the framework of which physical goods were bought for cryptocurrency. We are talking about the famous Bitcoin pizza - more precisely, two pizzas that were bought for 10 thousand bitcoins. This amount was paid for them by Laszlo Hanyecz. The programmer offered users on the Bitcointalk.org forum bitcoins in exchange for two pizzas. A teenager named Jeremy Sturdivant, nicknamed Jercos, agreed to receive these bitcoins and sent Hanes two pizzas from Papa Johns.

Features

The main goal of Bitcoin is to ensure transaction security in the conditions of complete distrust between network users. In classical payment systems, accounting for payments and balances is maintained by a bank or other organization. The creator of the Bitcoin protocol proposed to transfer this function to independent nodes working according to uniform rules and controlled by different owners. To implement this approach, blockchain technology was developed.

Blockchain is a database in which each new block of information is associated with the previous one using cryptography tools. When you try to change the old data, the whole chain will be destroyed, which will immediately be known to all network users. Thus, the blockchain guarantees the immutability of information.

The blockchain is stored on many independent servers. A bitcoin wallet is completely anonymous and at the same time completely transparent. It is very simple to create a great many wallets without indicating your name, phone, etc. But the entire transaction history is stored on the bitcoin network. In case a user publicly advertises that this wallet related to him, then anyone can find out all the transactions and the number of BTC in the account. In order to ensure anonymity, a holder needs to use one wallet for one transaction. As soon as a new message (transaction) appears on the Bitcoin network, it is immediately sent to all participants for authentication. If the data in the transaction is correct, it can be included in a new block.

To protect the network from fraud, the Proof-of-Work algorithm is used. Each node busy checking the blocks must spend more processing power to confirm new information. For this, the owner of the node receives a reward in bitcoins - this is how new coins are issued in the system.

For sending transactions, users pay an arbitrary commission. In practice, its size is formed on a competitive basis: the larger the service charge, the faster the transfer will be included in the new block. Commissions are also part of the rewards of miners.

Contrary to popular belief, Bitcoin is not only a means of payment. Any information can be stored in the blockchain, so the scope of the system is much wider. In practice, two ways to use the protocol have gained popularity.

Bitcoin Rate

The popularity of bitcoin is associated with a fairly rapid growth rate against the US dollar. Newcomers to the financial markets often begin to learn what Bitcoin is with a detailed study of the dynamics of changes in their value.

Despite the lack of material support, cryptocurrencies are increasingly dependent on economic and political events taking place in individual countries and in the world. The following points affect the rate increase:

- Positive news in the world of cryptocurrency;

- The adoption by the state of bitcoin as an official means of payment;

- Distribution of payment by bitcoins for goods and services in online stores;

- The transition of freelance exchanges to pay for the work done with cryptocurrency.

The Bitcoin assessment has attracted a large number of investors buying it for real money, which further spurred sharp jumps in market value.

The fall in the rate is usually associated with negative cryptocurrency news.

How to Get Bitcoin

There are several ways to purchase BTC. However, you need to be extremely careful and check the resources that you are contacting in order to avoid scams.

The most common ways to acquire Bitcoin:

- Mining - mining of coins on your own equipment. Miners rent a hashrate of their ASICs and video cards to receive cryptocurrencies by using the computing power data. There are currently many BTC mass production farms.

- Cloud mining - is a rental of cloud mining service capacity in the form of a contract up to a year. All mined cryptocurrency is transferred to the user's account.

- Cryptocurrency purchase on proven services. You can buy electronic currency for money on cryptocurrency exchanges and on special exchangers that support the function of buying cryptocurrency with bank cards.

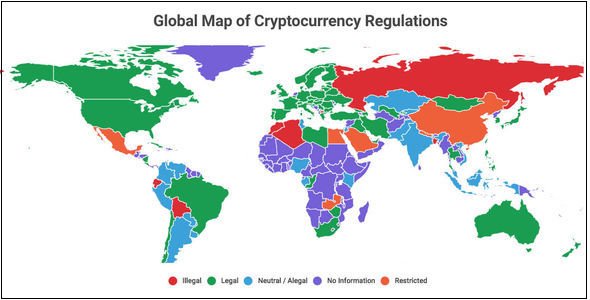

Is Bitcoin Legal?

Anonymity is the main reason for the popularity of cryptocurrencies among attackers. Since the participant in the operation cannot be traced, the user can thus pay for any service - from pizza order to the acquisition of weapons and forbidden substances.

However, the problem of cryptocurrencies is not only in the people who use them for illegal transactions. The main technological advantages - decentralization and anonymity - turn against Bitcoin. Since the cryptocurrency is decentralized, this means that it does not have at least some kind of control system. Moreover, in comparison with real cash reserves, it is not provided by any sources.

All these factors lead to fluctuations in the exchange rate and the inability to make even any accurate forecasts. In the spring of 2015, the Bitcoin rate jumped by 20%, and in the spring of 2017, the rate grew every day almost by 10%.

Such cases greatly undermine the trust of network participants. Due to its exoticism and randomness, cryptocurrencies will not yet be accepted by the whole society.

Bitcoin as Legal Tender

However, in a number of countries operations with cryptocurrencies are officially allowed. They are usually regarded as a good or investment asset and are subject to the relevant legislation for tax purposes.

In Germany and some other countries, bitcoins are recognized as a unit of account, in Japan and Singapore Bitcoin is legal tender with a purchase tax. In some countries (for example, China), operations with bitcoins are prohibited for banks, but allowed for individuals, while the country is leading in the field of mining due to the presence of the largest production capacities.

In Switzerland, cryptocurrencies are subject to the same rules as foreign currencies, and this country is one of the most favorable jurisdictions for Bitcoin startups and public blockchains.

Team

The identity of the creator of Bitcoin is still unknown. Since the source code is open to all comers, the development of the system was continued by a community of independent programmers. The Bitcoin Foundation, a non-profit organization registered in the United States, is engaged in promoting the system and financing work on the official Core client.

The Bitcoin Foundation is often criticized for inefficiency and bureaucratization, contrary to the very idea of free currencies. Despite some problems, the organization continues to play an important role in the life of the world's leading cryptocurrency, raising important issues and providing funding for the official client. It should be noted that the fund cannot determine the development of the Bitcoin protocol, which by its nature is decentralized. Key decisions are made by voting on all nodes that support the system.

It seems to me that Bitoin will never break this level..

pls give me bitcoins!