Revolut Reviews 2021

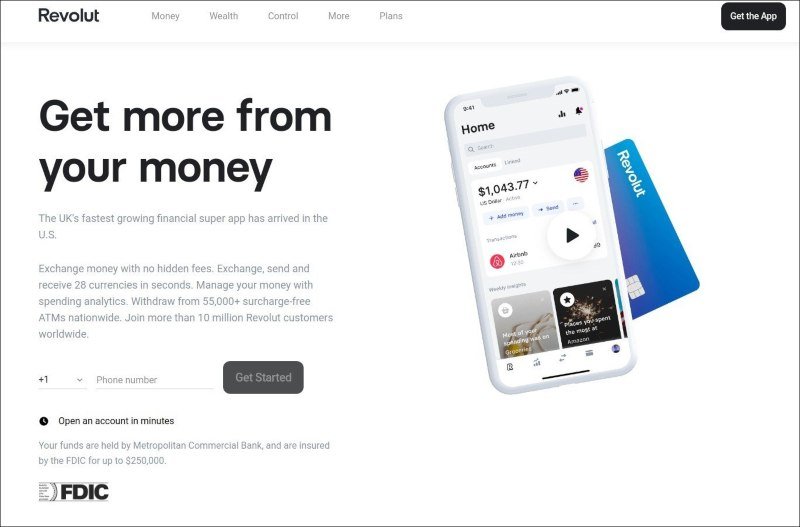

Revolut is mobile app-based banking service. The company allowed buying and selling cryptocurrencies in 2017. Revolut considers its cryptocurrency-related functionality to be a secondary set of features. However, the company has millions of users in Europe, exchanging cryptocurrencies via Revolut accounts. Moreover, it has crypto-backed cards. In May 2020, the company let the US residents open accounts on Revolut.

As cryptocurrency-related platforms are still approached with a bit of suspicion, in this review we will find out if Revolut is a scam or safe and legit company. We will do our best to provide all the principal facts that will help to understand whether you can trust your money to this platform or rather you should be cautious of using Revolut.

History

The company was founded in the UK by Nik Storonsky (CEO) and Vlad Yatsenko (CTO) in 2015. The initial idea behind Revolut was making a multi-currency card that helps travelers to avoid overpaying associated with high commissions charged when spending money in foreign lands. In the first days, the company was assisted by Level39, a London fintech incubator.

In 2016 Revolut had around 100,000 customers and accumulated around $15 in fundraising. In 2017 the company raised $66, launched a business scaling platform Revolut Business, and let their EEA customers buy and sell cryptocurrencies. The following year, Revolut gathered $250 million in fundraising, got several banking licenses in Europe, and launched Revolut Metal — a contactless 1% cashback metal bank card. In 2019 the company hired a number of high-profile specialists who had worked for Visa, Goldman Sachs, Deutsche Bank, and other top tier companies prior to Revolut. The same year, the collaboration with Visa began which expanded the company's scale. More than that, in 2019 Revolut became available for the residents of Australia and Singapore. Additionally, the same year the company launched fractional stock trading and began cooperation with over 30 charity organizations. In 2020, Revolut became available in the USA, the company raised $500 million and enabled an Open Banking function that allows managing multiple accounts through a single interface. To date, Revolute is the fintech startup with the highest value (over £4 billion) in the UK.

In 2016 Revolut had around 100,000 customers and accumulated around $15 in fundraising. In 2017 the company raised $66, launched a business scaling platform Revolut Business, and let their EEA customers buy and sell cryptocurrencies. The following year, Revolut gathered $250 million in fundraising, got several banking licenses in Europe, and launched Revolut Metal — a contactless 1% cashback metal bank card. In 2019 the company hired a number of high-profile specialists who had worked for Visa, Goldman Sachs, Deutsche Bank, and other top tier companies prior to Revolut. The same year, the collaboration with Visa began which expanded the company's scale. More than that, in 2019 Revolut became available for the residents of Australia and Singapore. Additionally, the same year the company launched fractional stock trading and began cooperation with over 30 charity organizations. In 2020, Revolut became available in the USA, the company raised $500 million and enabled an Open Banking function that allows managing multiple accounts through a single interface. To date, Revolute is the fintech startup with the highest value (over £4 billion) in the UK.

Functionality Review

Nowadays, Revolut presents a diverse set of features associated with different spheres of finance. The core services are a free fiat currencies exchange, fraction stock trading (with investments starting with as little as $1), GBP and EUR banking accounts management. The app is capable of sending money in 29 currencies including a row of cryptocurrencies. The Revolut users don't have to pay any fees while sending money to each other. Moreover, the app can be used for making purchases. The assets can be withdrawn through ATMs.

Premium account owners have access to cryptocurrency-related functionality. Bitcoin (BTC), Ether (ETH), Litecoin (LTC), Bitcoin Cash (BCH), and XRP can be exchanged for fiat money or vice versa. There are 25 fiat currencies that are available for crypto-to-fiat and fiat-to-crypto exchanges on Revolut. Besides that, the Premium account opens access to insurance features. Among them, there are phone insurance, baggage and flight delays insurance, medical insurance for customers going abroad, etc.

All the services are available through the app only. Online banking is not available for Revolut customers. The app has a really convenient interface with all the functions easily available for users. The balance is reflected right on the main tab so one doesn't even need to search for it. The app works smoothly both on Android and iOS-based devices and draws no criticism. Sending money between the Revolut users is really easy as it requires nothing besides a phone number of the receiving party and costs zero fees. It is fair to say that the app design is top-notch in terms of user-friendliness. Cryptocurrency transactions and bank transfers are also executed fast and easily.

Bank transfers available on Revolut are executed via Swift or SEPA. Each user gets an individual IBAN by default. It makes sending money abroad or receiving money from overseas incredibly convenient. Revolut customers are not limited by the single currency option. Instead, they can use several currencies from quite a big list including most popular national currencies and 5 crypto assets from the list of the top 10 cryptocurrencies by market cap. Customers can choose wisely which currencies are better in the country they are in, and use the proper currencies in order to avoid paying excessive fees. Unfortunately, so far the list of the countries where Revolut can be used is quite short. It includes over 30 countries-members of the European Economic Area, the USA, and the United Kingdom.

Bank transfers available on Revolut are executed via Swift or SEPA. Each user gets an individual IBAN by default. It makes sending money abroad or receiving money from overseas incredibly convenient. Revolut customers are not limited by the single currency option. Instead, they can use several currencies from quite a big list including most popular national currencies and 5 crypto assets from the list of the top 10 cryptocurrencies by market cap. Customers can choose wisely which currencies are better in the country they are in, and use the proper currencies in order to avoid paying excessive fees. Unfortunately, so far the list of the countries where Revolut can be used is quite short. It includes over 30 countries-members of the European Economic Area, the USA, and the United Kingdom.

The customers who want to collect some money for a certain purpose can use the Vault function. The user should set the goal and activate the vault. After that moment, the remaining sum is rounded after each transaction and the difference is sent to the vault in order to reach the desired amount of money at some point. More than that, it's possible to simply set the regular automatic payments to the vault (for instance, $10 once a week).

Another nice feature is budgeting. The user sets the monthly spending limit and the app starts to send her/him notifications with reports of the current budget state.

Revolut Cards

The company issues debit cards that can be used in any public place accepting MasterCard and in ATMs. The cards provided by Revolut can be physical (metal and plastic) or virtual. The virtual cards are stored in the application. The card can be ordered on the company website or received via the official Revolut giveaway. The users receive the types of cards corresponding to their account levels: Standard, Premium, or Metal. The differences are not so significant. The higher the level is the more is the monthly withdrawal limit per card (€200, €400, and €600 respectively). Moreover, the users that have the Standard level accounts cannot do cryptocurrencies transactions and cannot enjoy the insurance functionality. The Metal level accounts are good because of 0.1 to 1% cashback and other nice benefits. Metal level customers can use an around-the-clock concierge service. It can do such things as booking residency and tickets, finding the places to eat in an unfamiliar area, and other nice stuff. This service is especially useful for those who travel a lot. On the other hand, the Standard level is free while Premium accounts require monthly €7.99 payments, and Metal accounts cost €13.99 a month. Regardless of the account level, all the cards are contactless.

Besides the material cards, users can create one of two types of virtual cards. One card is referred to simply as a "virtual card" and the other one is a "Disposable Card". These cards can be created the following way: the Cards tab => the "Plus" button => an "Add new card" section => choose between Virtual or Disposable card option. A virtual card has the same functionality as the physical one except for the fact that it doesn't have a physical equivalent and exists only as part of the mobile application. Just like a "normal" card, a virtual card has its CVV, an expiration date, number, balance, and so on. The card can be used for purchasing goods online or paying for services. The users are free to adjust the card's parameters (setting a spending limit, etc).

The disposable cards are similar to regular virtual cards. The principle difference is that all the info identifying the card changes every time the card is used. It never has the same number, CVV, and so on. These cards are good for people wishing to stay more or less anonymous while paying for services and goods because none of these cards can be used twice. The virtual cards support the 3-D Secure protocol which makes them phishing resistant and safe while shopping on the Internet.

The disposable cards are similar to regular virtual cards. The principle difference is that all the info identifying the card changes every time the card is used. It never has the same number, CVV, and so on. These cards are good for people wishing to stay more or less anonymous while paying for services and goods because none of these cards can be used twice. The virtual cards support the 3-D Secure protocol which makes them phishing resistant and safe while shopping on the Internet.

Customer Service

In order to make it easier to use the app, Revolut developed a thorough FAQ section on the website. It provides detailed and clear information on the most important issues.

The support team can be reached via the community forum. This forum is a platform for communication between the customers, moderators, and Revolut personnel. When people have queries concerning the Revolut work they ask questions on the forum or look for the answers there, in older threads. Moreover, this forum serves as a means of feedback as users leave their impressions, share their user experience, and request to make certain improvements there.

Another channel for communication between the users and the company is the 24/7 live chat. Premium and Metal users can enjoy the priority when they contact the support via the live chat. The Standard level users sometimes have to wait for the answer for a few hours.

The bad thing is that when security algorithms block users from their accounts due to false suspicions, users lose access to the community forum. It makes finding justice and unblocking the account extremely hard for them. Nevertheless, it seems that these cases get solved and users get back to their accounts after investigation. At times, it can take up to several months.

Is It Safe to Use Revolut?

Revolut is doing its best to follow the law. It makes the company trustworthy. It means that Revolut is not a scam and customers can rest assured that in the case if the problems occur they can rely on the law. The company has banking licenses and is regulated by FCA. By the law, Revolut cannot invest the users' money or pay debts with it. This point is critically important as it makes the use of this company much safer. The app is protected by the password and fingerprint. The cards are secured with PINs and 3-D Secure protocol. The algorithm is detecting the suspicious patterns in the account activity. If such patterns get detected, the account gets frozen automatically, and the user loses access to the account. According to multiple reports, this algorithm makes mistakes frequently so users have to prove that they are legit owners of the accounts for extended periods of time. Nevertheless, the company recovers access if the mistake gets recognized. In general, it's safe to say that Revolut is a secure platform.

Avoid any trading of cryptos on Revolut. It’s very expensive and a scam. The app displays market price and when you hit execute order to buy and confirm the final amount that shows market price + 1.5% fees (premium or Metal account).

When you get a statement they changed the rate and crypto was sold to you up to 13% higher confirmed price. So you pay up to 14.5% over the market price. Same applies to sell transactions and they credit your account -14.5% less.

They reply that Revolut’s cryptocurrency prices are calculated using the volume-weighted average price (VWAP). Yes this is 13% different then displayed market price!! So they charge high fee and use very unfavourable VWAP rate that is shown to you only after the transaction is done. I have submitted a complaint by email and complaint form and there is no reply after 2 weeks.

Revolut uses fraudulent method and they are real scammers. Stay away from them.

It's a really multifunctional trading platform. They are able to issue the debit cards. I can do all exchange and trading operations just in the app. There are many cool features.