IEO vs ICO: advantages and disadvantages in 2022

Initial Exchange Offerings (IEO) is an initial investment collection event administered by a cryptocurrency exchange. Unlike the traditional Initial Coin Offering (ICO), the IEO startup team does not launch a fundraising platform and does not hold it, but undergoes a financial and legal check on the exchange. If the check is passed, the platform launches a token sale, in which all its users can participate.

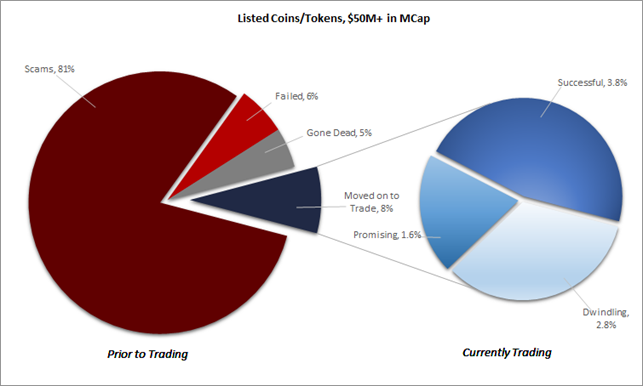

This approach allows us to solve the main problem of ICO - a large number of SCAM. According to the 2017 Satis Group LLC research, 80% of ICOs are fraudulent projects. The 2018 TokenData website data says that there are more than 90% of these (normal teams switched to IEO and STO). Among IEO-projects, scammers have not yet been found.

It is possible that a new way to attract initial investment will become a natural result of the development of ICOs, will repeat its success and restore investor confidence in the market. At the very least, this conclusion is reached by experts studying the differences between ICOs and IEOs, as well as the advantages of the latter for startups, investors, and stock exchanges.

Key differences between IEO and ICO

1: Availability of an intermediary

The main difference between ICO and IEO is the intermediary between the issuer and investors in the form of a cryptocurrency exchange. The trading platform takes over the verification of blockchain startups through the Due Diligence procedure: registration of a legal entity, statutory documents, investment potential, market demand, financial condition, investment risks, project viability and the like.

An agreement is concluded between the parties, which prescribes the key conditions for holding a token sale:

- start and end time of the coin sales;

- maximum volume of tokens per investor;

- base price to fiat or major cryptocurrencies (BTC, ETH);

- softcaps and hardcaps, actions after they are achieved;

- listing fee, percentage of sales;

- lottery procedure.

When an investor buys tokens during IEO, he transfers the money to the startup wallet on the exchange. These funds are under the full control of the exchange. Funds are allocated to a startup in the form of several tranches. Each tranche usually has a specific purpose, such as funding an MVP development, marketing campaign, or product deployment. If the goal of the tranche is not achieved, the remaining money is returned to investors.

2: Market centralization

Since IEOs are administered by cryptocurrency exchanges, this market is subject to two trends:

1. The organizers will try to hold IEO on exchanges with the largest user base, as this increases the chances of collecting the necessary funds in full.

2. Investors will try to participate in IEO on exchanges with the best reputation and the largest number of token sales hold, as this increases the likelihood that the project is not a scam.

The indicated trends will push the market towards centralization. This will also be facilitated by the general trend for the entire cryptocurrency market - the desire to trade on the most secure exchanges. Such sites are very few, if not the only one - Kraken.

Thus, there is a high probability that in a few years almost all IEOs will take place on 3-5 trading floors. If this happens, the exchanges will begin to dictate their terms to the organizers and investors, as the central banks, stock and trading exchanges do.

3: Transparency

To launch an ICO, a blockchain startup team need not disclose at least some information about the company and owners. It’s enough to create a website, write a whitepaper and launch a fundraising platform. Such high anonymity and a lot of money contributed to the fact that scammers began to use ICOs. And, judging by the Wall Street Journal, they managed to lure investors from more than $ 1 billion.

In the case of IEO, this is not possible, since the startup team must undergo Due Diligence, which involves the disclosure of information about the company, its employees and owners. Thanks to this, it has become much more difficult for fraudsters to deceive crypto investors.

However, not only IEO organizers should disclose information. Since fundraising takes place through cryptocurrency exchanges, investors must also undergo an identity verification, i.e. KYC procedure. So exchanges want to protect themselves from possible involvement in money laundering and / or terrorist financing.

4: Fundraising procedure

Let's look at a simple example of how the fundraising procedures through ICO and IEO differ. For example, we plan to launch a blockchain-based freelance platform and we are sorely lacking in money. To collect them using ICO or IEO, you need to do the following:

5: Lottery instead of "gas" war

The first IEOs appeared at the end of 2017. Binance trading platform held two tokensales on its specialized Binance Launchpad platform - BREAD ($ 6 million) and GIFTO ($ 3.4 million). Startup coins were sold in a very short time, which caused a big wave of criticism from investors who did not manage to take part in the token sale.

During the ICO, this problem was solved by the "gas" wars: investors overestimated the commission (gas) to become the first buyers who were entitled to a big discount - usually the sooner you join the project, the bigger the discount. In the case of IEO, the problem of competition between buyers was solved using a lottery. The investor may randomly win a ticket, which gives the right to purchase tokens among the first bidders.

The lottery is held using a transparent and randomized system, however, the distribution of tickets for participation in the lottery is carried out in accordance with the number of exchange tokens on the user's deposit over the past 20 days. Such a system was first tested on the Binance Launchpad during the IEO Matic Network (MATIC).

To sum up

In terms of investment attractiveness and reliability, IEO is undoubtedly better than ICO. However, do not think that the initial exchange offering will save from scammers or guarantee a return on investment.

And here is why:

- Cryptocurrency exchanges are vulnerable to hacker attacks;

- Due Diligence eliminates obviously weak projects, but it is unlikely to help against serious fraudsters (it is proved by fraudulent schemes with IPO, where the verification and requirements for the project are much stricter);

- The exchange checks projects and holds IEO, but does not guarantee a refund in case of force majeure.

In addition, the scheme where tokens get on the trading listings almost immediately after the token sale is vulnerable to market manipulation through Pump & Dump technology. This is a fairly simple and old way of earning money on exchanges, which implies “pumping” demand for an asset, which leads to an increase in its quotes, and then a sharp “dumping” of the asset.

Based on the Business Inside report, such manipulations are a frequent occurrence in the cryptocurrency market. Many Telegram communities have been identified (PumpKing Community, Pump.im, AltTheWay, We Pump, Crypto4Pumps and others), which are coordinated among themselves in order to artificially increase the rate of a particular cryptocurrency, and then drop it at the right time and make money on the difference in rates.

There is no doubt that such a high demand for tokens during IEO will be used in Pump & Dump schemes and others. Therefore, even if you invest in an initial public offering, this does not guarantee the “purity” of the project and return on investment.

What do you think about it? Share in comments and follow us on Twitter!

Stay tuned with Cryptogeek and follow the cryptocurrency blog together and you won't miss the breaking next news!

https://whydonate.com/de/spenden-sammeln-privat/