Paysend Reviews 2021

Throughout the existence of the financial market, many projects have appeared that make life easier for common users. One of these projects is Paysend, thanks to which you can send money from anywhere in the world to any card in any country. Is Paysend safe to use? Is it a legit platform? Should you really use it? Read this review and decide for yourself.

- Features

- Paysend Fees

- How to Get Started with Paysend

- How to Use Paysend

5.1 How to Transfer - Customer Service

- Is Paysend Safe?

- Conclusion

Paysend Overview

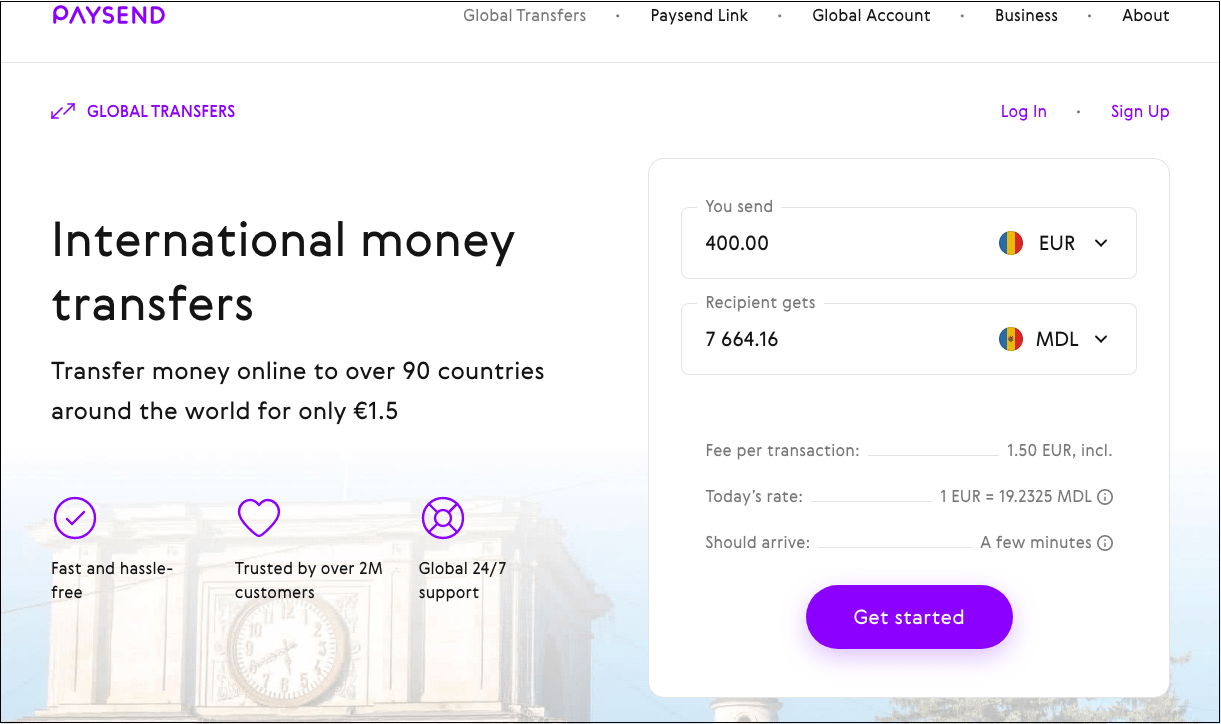

Paysend is a service that allows you to simply, quickly, and inexpensively transfer money anywhere in the world. This is one of the innovative platforms for making cashless transactions. The head office of the company is located in the UK. The organization's activities cover more than 90 countries.

Among the partners are many large banks with a worldwide reputation, as well as Visa, MasterCard, UnionPay, which allows you to offer customers instant and safe ways to transfer money 24 hours a day.

Paysend considers its mission to make the usual process of international money transfers easier and faster for everyone. For this, innovative solutions have been developed that make it possible to transfer funds using 16-digit Visa or MasterCard card numbers.

Paysend online cross-border transfer service for those who regularly transfer money from one card to another has set a fixed commission, which does not depend on the size of the transfer. For example, if the transfer is made from Europe, then the commission will be 1.5 euros or $ 2 from the USA. Money transfer is very fast, on average, a transfer can take from 30 seconds to 1 hour.

A large number of countries are connected to the system, among them are Finland, Switzerland, Sweden Azerbaijan, Mexico, Armenia, Austria, Albania, Andorra, Belgium, Bulgaria, Bosnia, Herzegovina, Vietnam, Germany, Greece, Georgia, Denmark, Indonesia, Ireland, Iceland, Croatia, Spain, Italy, Kazakhstan, Cyprus, Kyrgyzstan, Latvia, Lithuania, Luxembourg, Macedonia, Moldova, Monaco, Netherlands, Norway, Poland, Portugal, Russia, Romania, San Marino, Serbia, Singapore, Slovakia, Slovenia, USA, Tajikistan, Thailand, Turkey, France, Malta, Malaysia, Great Britain, Ukraine, Philippines, Montenegro, Czech Republic, Sri Lanka, Estonia, Hungary and so on.

Features

Paysend really has no "nuances", everything is simple and transparent. The exchange rate from the current bank is very little different, and in some cases, it is more profitable.

Service has a large number of advantages in comparison with other services:

- Global coverage. Paysend transfers money to over 90 countries, and regularly add new ones to the platform.

- Fixed fee. Paysend displays the rate, transfer fee, and receivable amount before you make the transfer.

- Simple transfer methods. Send your money the way that suits you – using bank cards & accounts, or simply using a mobile number via Paysend Link.

- Instant processing. Transfers are sent within seconds to your recipient’s bank.

- Bank-level security. All money transfers are certified by Visa, Mastercard, China UnionPay, the FCA, and are PCI DSS certified.

- Global 24/7 support. Money never sleeps, and neither does Paysend. The service is here to help at any time of the day.

Also:

- To transfer, just go to Paysend website or download the iOS / Android mobile application.

- All the details of the transfer are open before the transfer: the payer sees the amounts to be transferred and the rate.

- The exchange rate is often more profitable than the banking one: PaySend is registered on currency exchanges, and the exchange is carried out at the rate “at the moment of time + approximately 1% of the exchange commission” (usually the exchange commission for banks starts at 2.5%).

- For registration, you only need a phone and password.

Like any other service, this project has its drawbacks:

- Only 5 transfers can be sent per day. The amount of each is not more than 1000 euros.

- When registering by number, there is a binding to the country and transfers - to the currency.

Paysend Fees

The fee for transferring from any country abroad is always fixed. It doesn’t matter which country and how much you send (within the limits and geography of the service, of course). When sending from the eurozone, the transfer fee is always 1.5 euros (if debiting occurs in euros), from the USA it is always 2 dollars.

Paysend has direct cooperation with international payment systems Visa, MasterCard and UnionPay, as well as partner banks in some countries the service works with. Thus, the service does not have to pay a commission to intermediaries, so no additional fees are taken from clients.

How to Get Started with Paysend

To create a personal account, you need to press the “Sign Up” button in the upper right corner.

In the opened window you need to enter the mobile phone number on the official website or in the application.

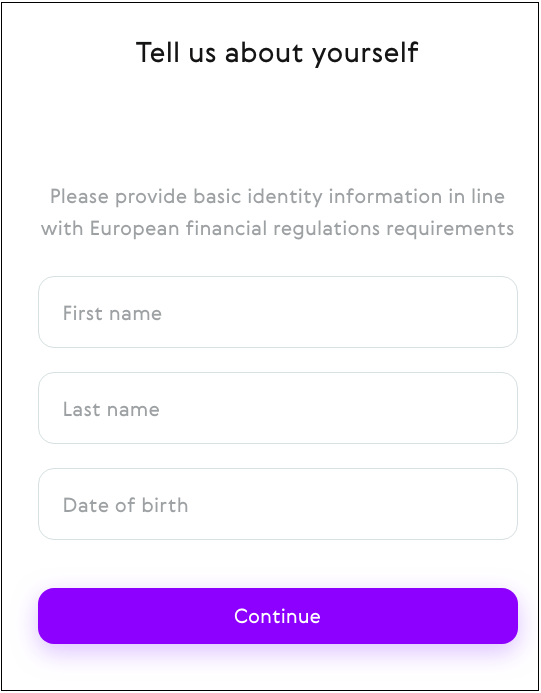

In the next window, you will need to provide minimal information about yourself: First name, last name, date of birth. Click “Continue”.

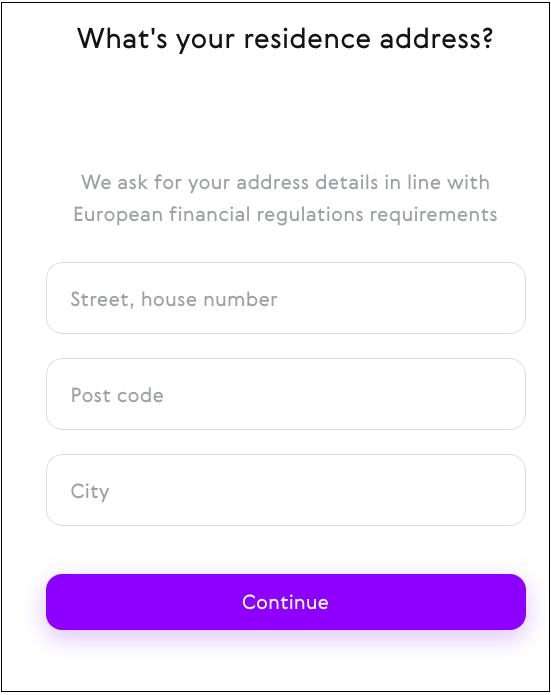

Next, you will need to provide your street of residence, postcode, and city. After filling in the fields, click “Continue”.

To confirm your account, the service will ask you to leave your mail address. Press “Continue”.

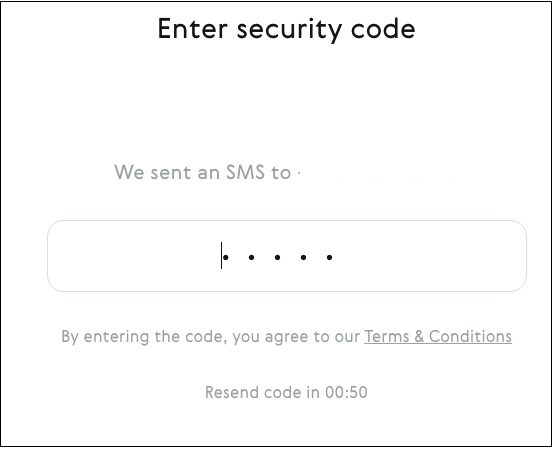

The final step will be to get a confirmation code on the phone number. Enter a 5-digit code in order to complete the registration process.

That’s it! You have successfully registered on Paysend and now can use all the service features.

How to Use Paysend

After you have completed the registration process, a personal account page will be opened in front of you. On the right you will see the options Transfers, Requests, Cards, Profile and Help Centre.

Next, you need to go through all the steps to make sure that you enter your card details and recipient information before sending money. Checks exist to ensure the safety and integrity of all international money transfers. There are several payment methods available for each country. The actual processes that need to be completed are easy to follow thanks to instructive video tutorials, frequently asked questions, and 24/7 customer support.

How to Transfer

You can transfer funds online 24/7 using any gadget. To make a transfer, you need to enter the appropriate amount, the country of debiting and receiving, and for some countries, you can choose the currency of crediting, and then click the "Transfer money" button. The amount is credited to the payment instrument instantly in national currency.

Please note that the amount receivable, the size of the commission, and the conversion rate are clearly indicated here.

Customer Service

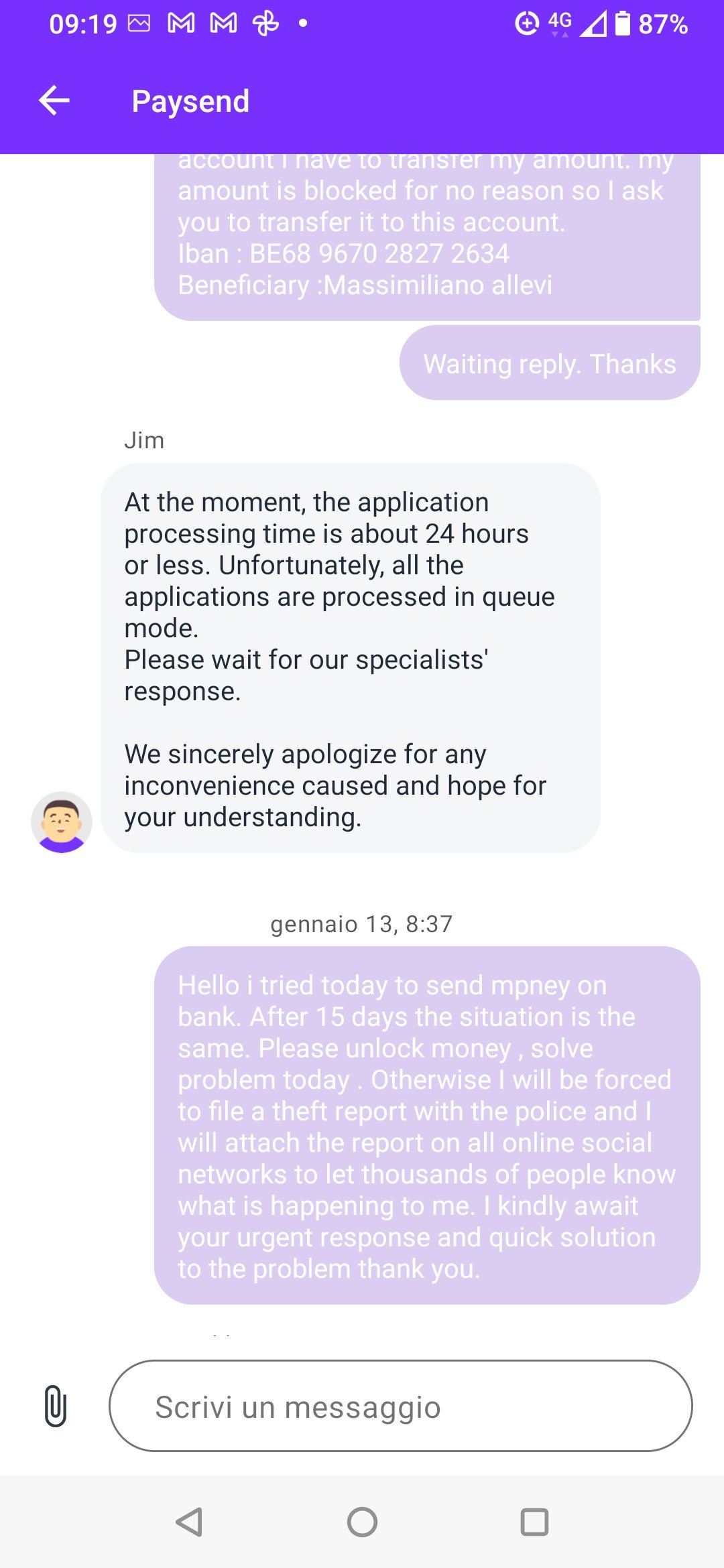

The customer support feature at Paysend is comprehensive. To contact support, simply click on the chat icon in the lower right corner of the screen or click to send an email to Help@Paysend.com, or use the callback. As a rule, they are aware of all aspects of international money transfers and can help with registration, payment processing methods, and other issues.

If you want to follow the latest Paysend news on social networks, you can easily connect with them on Facebook, Instagram, or YouTube.

Is Paysend Safe?

Security is the highest priority when translating. Transactions are performed in accordance with the laws of the country in the territory of which the cards of the sender and the recipient are issued. All international standard payment systems are complied with.

User personal data is protected from hackers and scammers by 3D-Secure technology. In addition, the confidentiality of each client is guaranteed both by the legislation of the Russian Federation and the United Kingdom.

And the introduction of the company's own technical developments, combined with the use of modern information encryption methods, ensures the safety of transactions at a high level.

Conclusion

Paysend service makes the process of sending money simple, quick and easy. Without intermediaries, queues, you can send money to a card at any time in more than 90 countries. It is enough to register on the site, and for this you only need a mobile phone number. The recipient can also simply withdraw money or pay for goods at the store. The commission is always fixed. When sending, you can see how much money will be debited, how much will come, the size of the commission. This service is clearly worthy of attention and is suitable for those who often perform money transfers.

Conto bloccato da più di 6 mesi senza alcun motivo non è possibile né prelevare né inviare soldi né chiudere il conto chiudendo il conto si perde il bilancio attivo presente non c'è numero di telefono dalla chat risponde un sistema automatico, che ripete sempre le stesse frasi inutili, ruba i soldi io vi ho avvisato.

Can you use the Biance Card with it?

Really decent platform