Okcoin Reviews 2021 - Is It Safe?

Lv1 < 100,000 0.10% 0.20%

P1 ≥ 100,000 0.07% 0.14%

P2 ≥ 500,000 0.05% 0.10%

P3 ≥ 2,000,000 0.03% 0.08%

P4 ≥ 5,000,000 0.01% 0.07%

P5 ≥ 10,000,000 -0.005% 0.06%

P6 ≥ 20,000,000 -0.01% 0.04%

P7 > 30,000,000 -0.01% 0.03% .

Full fee schedule:

https://www.okcoin.com/fees.html

Lv1 < 100,000 0.10% 0.20%

P1 ≥ 100,000 0.07% 0.14%

P2 ≥ 500,000 0.05% 0.10%

P3 ≥ 2,000,000 0.03% 0.08%

P4 ≥ 5,000,000 0.01% 0.07%

P5 ≥ 10,000,000 -0.005% 0.06%

P6 ≥ 20,000,000 -0.01% 0.04%

P7 > 30,000,000 -0.01% 0.03% .

Full fee schedule:

https://www.okcoin.com/fees.html

Cryptocurrencies are the brainchild of a small cypherpunk community. However, it took only a couple of years for digital money to turn into a multi-million industry. Some of the cryptocurrency exchanges have dozens of employees and offices around the world. Today we will speak about one such exchange. It is a veteran in the crypto trading field, an Okcoin exchange. In this review we will see what features does Okcoin offer, is Okcoin a scam, and is it safe to use it.

What Is Okcoin?

Okcoin was created in China by Star Xu in 2013. Star Xu has a background in search systems and tech management. Before launching an exchange, he was working for Alibaba and Yahoo. Later, he created one of the top crypto exchanges — OKEx.

The government of China isn't that cryptocurrency-friendly. No wonder, the Okcoin headquarters was relocated to San Francisco. Other offices can be found in Houston, Malta, Japan, Singapore, and Hong Kong. The service is available in most countries. You cannot use Okcoin in such states of the USA as Hawaii, Indiana, Louisiana, Nevada, New York, and West Virginia, and in all territories of the United States. More than that, the use of the exchange is not possible in the countries sanctioned by the US. Other countries where you cannot use Okcoin are Bangladesh, Bolivia, Ecuador, Kyrgyzstan, and Malaysia.

Okcoin is a large enterprise worth millions of dollars raised from 5 big investors by 2017. One of the key investors is a famous cryptocurrency proponent, venture investor Tim Draper. As of 2021, Okcoin is one of the top 100 cryptocurrency exchanges by daily trading volume, with dozens of supported currencies, mobile app, and some extra features (OTC trading and others). According to the exchange's website, Okcoin is used by over 100,000 traders.

Okcoin is a large enterprise worth millions of dollars raised from 5 big investors by 2017. One of the key investors is a famous cryptocurrency proponent, venture investor Tim Draper. As of 2021, Okcoin is one of the top 100 cryptocurrency exchanges by daily trading volume, with dozens of supported currencies, mobile app, and some extra features (OTC trading and others). According to the exchange's website, Okcoin is used by over 100,000 traders.

One of Okcoin's missions is making cryptocurrencies available to the public. What makes Okcoin beginner-friendly is the support for fiat-to-crypto positions. Okcoin is an entry-level exchange as it allows users with no cryptocurrencies to deposit their fiat money via credit card and wire transfer and buy cryptocurrencies via the exchange. To ensure the legitimacy of the operations and avoid troubles with the law, Okcoin is registered as a Money Services Business (MSB) with the Financial Crimes Enforcement Network (FinCEN) and is regulated via the Virtual Financial Asset Act (VFAA) by the Malta Financial Services Authority.

Main Features

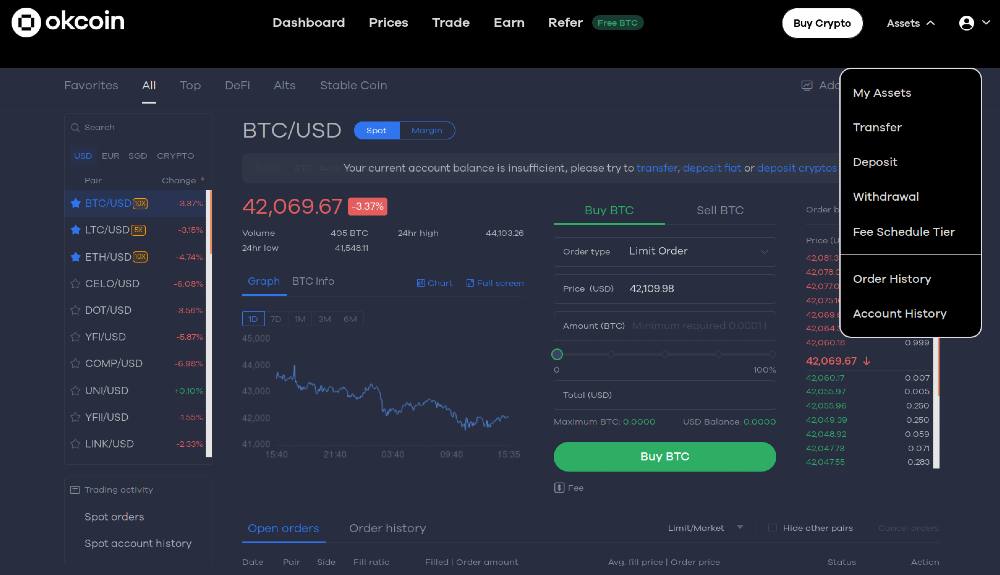

Okcoin provides users with numerous features. The basic functionality can be found in the dashboard tab. There, users can see quite a standard trading exchange interface with price charts, sell/buy boxes, and so on. The full-screen mode opens a more common trading interface with candlestick charts and a more standard layout.

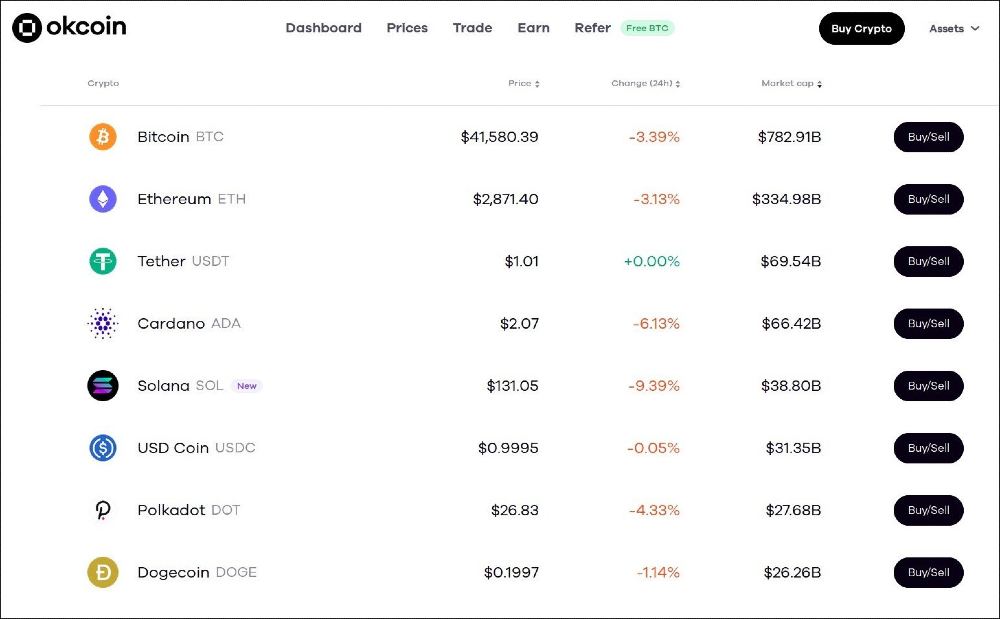

Fiat money supported on Okcoin are the US dollar, Euro, and Singapore dollar. As for cryptocurrencies, on Okcoin you can trade three of them with leverage: leverage for Bitcoin (BTC) and Ethereum (ETH) reaches a 10x rate, and Litecoin (LTC) is 5x. The rest supported cryptocurrencies are Polkadot (DOT), Tether (USDT), Chainlink (LINK), Dogecoin (DOGE), Algorand (ALGO), Maker (MKR), Tezos (XTZ), Tronix (TRX), EOS, and others.

Okcoin provides traders with a wide array of available trading orders that allow them to maximize profits and avoid losses. You can post limit and market orders, advanced limit orders, stop orders, trigger orders, trail orders, iceberg orders, and finally time-weighted average price (TWAP) orders.

Okcoin provides traders with a wide array of available trading orders that allow them to maximize profits and avoid losses. You can post limit and market orders, advanced limit orders, stop orders, trigger orders, trail orders, iceberg orders, and finally time-weighted average price (TWAP) orders.

The Earn section allows users to earn via staking of crypto coins. At the time of writing (September 28, 2021), the coin that can be staked is MIA (MiamiCoin). You can lock your MIA coins for one year in exchange for rewards paid in STX coins. The estimated profit is 430%. Alternatively, you are offered to stake STX in exchange for rewards in BTC. The estimated profit is 10%. Other coins that can be staked are Avalanche (AVAX), Tezos (XTZ), Polkadot (DOT), COSMOS (ATOM), and others.

Staking on Okcoin is possible via the side DeFi platforms where the coins supported on Okcoin can be staked. Okcoin selects the best offers for its users. The overall process is free of charge (no gas fees, no transaction fees, etc). The reward size for each offer is determined by the protocol, not by Okcoin. It's worth saying that as Okcoin is only an intermediary in staking and DeFi functionality, you can stake coins at your own risk. The rewards are not guaranteed, your investment is not insured, the potential vulnerabilities of DeFi platforms are not Okcoin's responsibility.

Seasoned traders may try an advanced trading program. It's called Okcoin Premier. This program provides instant funding options (SEN, PrimeX, and Signet) and wire pre-crediting (maximum $100,000). Premier users can enjoy lower transaction fees. High liquidity makers with Premier accounts can also get rebates. The program can be especially useful for ATM operators, payment business enterprises, and other business companies.

To avoid slippage, Okcoin users can trade via an OTC desk placing orders outside the order book. OTC trading doesn't affect the market. On Okcoin it has quite a deep liquidity. In the OTC section, you can buy Bitcoin, Ethereum, or Tether. The only supported fiat currency is USD.

Like many (if not any) crypto exchanges, Okcoin has an affiliate program. It allows you to get rewarded for bringing more people to the platform. On Okcoin, the affiliate program conditions are quite unusual. When the person registered on your platform via your referral link buys $100 worth of crypto, you get a $50 reward. What's more pleasant, this person gets $50, too. That's rather a generous referral reward. However, it might not fit certain influencers who earn via affiliate programs on an industrial level. However, Okcoin has another offer — an affiliate program that provides you with 30% of fees paid by your referrals. That's a more standard approach fitting a larger audience.

Fees

Making sure that the fees on the exchange are not excessive is a must. The withdrawal and trading fees seriously vary from exchange to exchange. If the fees are too high you can end up losing much of what you've earned via trading in commissions.

To keep the liquidity on high-level many exchanges incentivize traders via the maker-taker fee model. The model works this way: the traders who place limit orders (in other words, those who "make liquidity" or "makers") pay smaller fees or don't pay them at all while traders who buy or sell via market orders (those who "take liquidity" or "takers") pay higher fees. The maker-taker model is used on Okcoin. The trading fee on this exchange is 0.2% for takers (which is relatively high in comparison with some of the top exchanges, however, this rate is not extraordinarily high) and 0.1% for makers (which can be called quite a pleasant rate).

What’s better than low fees?

— Okcoin (@Okcoin) September 9, 2021

No fees 🔥🔥🔥

Set up daily, weekly, and/or monthly buys for any asset on Okcoin and you’ll pay 0 recurring fees through October 31.

Get started at https://t.co/kBEvd0U6LR 📈

On top of that, there are fee discounts for traders who trade a lot. Both takers and makers lose less in fees as their monthly trading volume reaches $100,000. The 30-day worth of half a million dollars grants traders a 50% discount in fees. Starting with $10 million worth of monthly trading volume, makers get freed of paying trading commissions. Instead, they get rewards for trades they make. This move is quite rare in the industry. The maximum reward is 0.01% of the trade. The minimum fee paid by takers on Okcoin is 0.03%. Takers pay this fee if the monthly volume exceeds $30 million.

What makes the Okcoin fee structure especially good is the lack of withdrawal commissions. Just think of that — you trade at industry-average trading fees and pay zero for withdrawals. Overall, you don't lose much in fees while using Okcoin. This makes Okcoin a competitive exchange.

Is Okcoin Safe?

Before you start using any crypto exchange, you should make sure, this exchange is safe enough and is not a scam. Unfortunately, some of the exchanges turn out to be scam platforms while other ones simply fall short in protecting the funds and data of their users.

Let's start with legitimacy. One can get concerned over if Okcoin is a scam because the exchange creator Star Xu was charged and has been arrested as a fraudster. Happily, the malicious activity of Xu didn't affect the Okcoin users (as it wasn't even directed at them). All in all, the exchange is maintained by a team different from Xu and is licensed in many countries. It means that the platform can be held accountable and sued if it does wrong.

What about user reviews? Even the top exchanges are called scams by users frustrated with their experience. Is Okcoin an exception? No, sir. There is some negative feedback and reports of vanished money online. Users complain about the unresponsive support team and difficulties when withdrawing coins. According to some reports, the KYC procedure can take months because of the slow and low-quality support work. It is not easy to tell if these problems are caused by the poor work of the platform, bad intentions of the Okcoin team, or as a result of the mistakes made by the users themselves. However, it's better to keep in mind that for some reason, you might face problems when completing KYC or withdrawing coins from Okcoin.

Now let's see if Okcoin provides enough tools for keeping the accounts safe. The website of the exchange claims that security is at the heart of everything the company does. The risks are allegedly detected, prevented, and addressed. Okcoin is busy doing audits to figure out if some anomalies take place and prevent security breaches before they take place. The data operated on Okcoin is concealed with masks. AES and SSL encryptions are used to protect transactions and user data. Okcoin utilizes end-to-end encryption which makes it an uneasy target for hackers. According to the Okcoin website, 95% of the coins are stored offline. The rest money is stored in the multi-signature hot wallets which are hard to hack.

As you access your profile for the first time, you are recommended to add a phone number and set 2-factor authentication. That's a reasonable recommendation as these two simple moves can drastically evolve the security of your account. As for available protection measures, Okcoin offers the following:

- the withdrawal password (a second password used during withdrawals only)

- mobile verification (requests a verification code from those who do critical actions such as withdrawals, change of password, etc)

- 2-factor authentication (same as mobile verification but instead of a code sent via message, it requests a one-time password that can be obtained via Google Authenticator or the other authentication app installed on the account owner's device)

- anti-phishing code (when enabled adds a unique code to all official correspondence coming from Okcoin)

Also, the website saves trusted email and IP addresses. You can monitor the activity on your account in the Security Settings tab.

In general, it’s fair to say that Okcoin does enough to keep your account safe. However, the exchange needs to take extra steps to improve the support team's work and address the complaints of users who claim that their money has disappeared for no adequate reason.

Simple to use and clean UI. When signature bank crashed there were a couple months where ACH wasn't available but they eventually got that resolved. I like the app and enjoy the recurring purchase feature. Good portfolio breakdown. A bit lacking on # of cryptos available to trade.

arnaque et fraude

Je voudrais un conseil s’il vous plaît comment récupérer mon argent sur okcoin , Parce que je pense avoir été victime d’une arnaque

Very poor customer support.

Website is not user friendly and hard to use.

Cancelled my account for an unknown Terms and Condition Section 4.6 violation. All of their website connections on Google for their Section 4.6 do not work. Also what is strange is that they cancelled me after I asked a question at their customer support.

Sounds to me like a very poorly run company where I at this point say keep as far away from them as possible.

Decent exchange!