Is the Polkadot investment worthwhile? This is one of the most common questions from both novice and experienced crypto investors. Polkadot is a widely recognized blockchain project, often associated with interoperability and scalability. Launched in 2020, it has steadily built a strong reputation. This article will cover what Polkadot is, how it was founded, the technology behind it, and the factors that may determine whether investing is worthwhile.

What is Polkadot?

Polkadot is an interoperability protocol designed to connect multiple blockchains in a unified network. Unlike Bitcoin or Ethereum, which operate as standalone blockchains, Polkadot enables different chains to communicate with one another securely and efficiently. The key principle here is interoperability, allowing various blockchains to interact seamlessly.

At the center of Polkadot is the Relay Chain, responsible for security and coordination of the network. Independent blockchains, called parachains, attach to the Relay Chain and can host specialized applications such as DeFi, gaming, or identity management. This structure makes the network more flexible compared to single-chain systems.

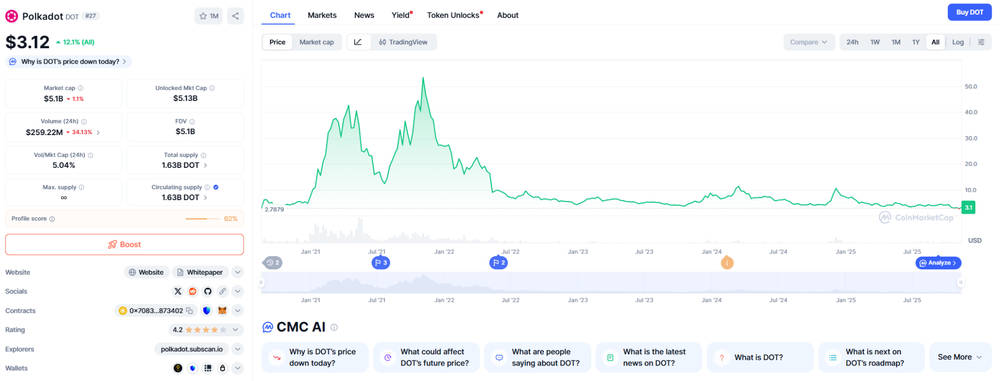

Polkadot’s native token, DOT, serves in governance, staking, and network security. DOT holders vote on proposals, stake tokens with validators, and access network services.

A Brief History of Polkadot

Polkadot was founded by Dr. Gavin Wood, who co-created Ethereum and developed the Solidity smart contract language. After leaving Ethereum in 2016, Wood launched the Web3 Foundation and later Parity Technologies to develop Polkadot.

The mainnet launched in May 2020, and Polkadot quickly became a top-20 cryptocurrency by market capitalization. Its technical framework and governance system have positioned it prominently in the blockchain industry.

Over time, Polkadot held parachain auctions where projects competed for slots on the Relay Chain. These auctions generated billions of dollars in DOT, showing strong community interest and developer engagement.

How Does Polkadot Work?

Polkadot operates on three main components: the Relay Chain, parachains, and bridges.

Relay Chain: The backbone of the network, managing consensus, security, and communication between parachains.

Parachains: Custom blockchains tailored for specific applications, such as DeFi or gaming, which connect to the Relay Chain.

Bridges: Bridges link Polkadot with external blockchains like Ethereum or Bitcoin, expanding its reach and utility.

Polkadot uses Nominated Proof-of-Stake (NPoS), where DOT holders nominate validators to secure the network. Validators earn DOT as rewards, while nominators share part of the rewards. This system encourages decentralization and fairness.

The Function of DOT Token

DOT is essential to the Polkadot ecosystem with three main roles:

Governance: DOT holders vote on network proposals, upgrades, and changes, giving them decision-making power.

Staking: DOT tokens are staked by validators and nominators to secure the network, making attacks costly and unlikely.

Bonding: DOT is bonded when new parachains are added, linking economic value to network expansion.

DOT’s value depends on ecosystem activity. As more parachains launch and use cases increase, DOT’s utility and value may rise.

Real-World Applications of Using Polkadot

Polkadot has supported numerous projects through parachain auctions. Notable examples include:

Acala: A DeFi hub providing stablecoins, lending, and decentralized exchanges.

Moonbeam: An Ethereum-compatible smart contract platform facilitating app migration.

Phala Network: A decentralized cloud computing solution.

These projects show that Polkadot is actively used to build applications leveraging cross-chain interoperability and scalability.

Advantages of Investing in Polkadot

Several factors make Polkadot an attractive investment:

Strong Leadership: Gavin Wood’s experience and credibility strengthen confidence.

Interoperability: Polkadot focuses on connecting blockchains more than any other project.

Active Ecosystem: Continuous parachain development ensures ongoing growth.

Staking Rewards: DOT staking provides passive income, typically 10–15% annually.

These aspects position Polkadot as a long-term contender in blockchain.

Risks and Concerns

Despite its advantages, Polkadot carries risks:

Competition: Cosmos, Avalanche, and other interoperability projects may limit growth.

Market Volatility: DOT, like most crypto, experiences large price swings, making short-term investment risky.

Adoption Rate: Broad adoption is uncertain; success depends on parachain integration and usage.

Investors should weigh these considerations independently.

Long-Term Outlook for Polkadot

Is Polkadot a solid long-term investment? The answer is nuanced. If blockchain interoperability becomes essential, Polkadot is well-positioned. Its governance system is responsive, and its community is active and supportive.

However, risks remain. Success depends on adoption, development, and market conditions. Those willing to accept volatility may see potential in Polkadot, while cautious investors may prefer to wait for further maturation.

Conclusion

Polkadot is an ambitious cryptocurrency venture focusing on interoperability and scaling. Its parachain architecture, experienced leadership, and expanding ecosystem contribute to its potential in a decentralized future. Investment value depends on risk tolerance, time horizon, and belief in the project’s vision. Research and portfolio diversification remain crucial.

FAQ

1. What is Polkadot’s main purpose?

Polkadot connects multiple blockchains to exchange information and value securely, creating an “internet of blockchains.”

2. Who created Polkadot?

Dr. Gavin Wood, Ethereum co-founder and Solidity creator, founded Polkadot along with the Web3 Foundation and Parity Technologies.

3. How does Polkadot differ from Ethereum?

Ethereum is a single blockchain focused on smart contracts. Polkadot connects multiple parachains via the Relay Chain, offering broader interoperability.

4. What is DOT used for?

DOT serves governance, staking, and bonding purposes within the network.

5. Is investing in Polkadot risk-free?

No. DOT price is volatile, and competition is growing. Only invest what you can afford to lose.