Cryptocurrency for Dummies - Tutorial by Cryptogeek

For nearly a decade, “cryptocurrency” has been no more than a synonym to ”Bitcoin”. Taking that into account, we started our tutorial series with a “Bitcoin for dummies” article.

However, the game changed a couple of years ago with the introduction of numerous new coins, and now most buzz in the crypto world comes from the altcoin side of the aisle (altcoin = everything that is not Bitcoin: Ethereum, Doge, Tron, etc).

So it is time to dig deeper and look wider. Let’s roll with our “Cryptocurrencies for dummies” guide!

What is a Cryptocurrency?

A cryptocurrency is a digital currency that operates through blockchain. The blockchain technology stores all of the transaction information on a public ledger, allowing everyone to see it and verify it.

Benefits of Cryptocurrency

- Security of assets. Although crypto is highly vulnerable to hacker attacks, this problem is being solved, while your fiat money is always under direct control of the government which can boost up its inflation through mismanagement or even seize all your assets (and there’s nothing you can do about it);

- Anonymity. On decentralized exchanges you do not even have to provide any kind of identity verification, so you and your assets stay completely anonymous;

- Volatility. While there are still no clear regulations concerning cryptocurrency around the world, its price fluctuates wildly. This means that your investments can boom overnight (although the reverse is equally possible).

A Brief History of Cryptocurrencies

People have been trying to create some form of an Internet currency ever since the Internet was around. However, the attempts that were made from the 1980s all the way through early 2000s all faced the same problem: double spending. Every bit of information on the Internet is replicable by nature, so how can we prevent people from spending e-money over and over again? Those projects solved the problem by creating a central authority for keeping track of all the transactions, but that kinda destroys the point of an Internet currency, right?

The answer was found in late 2008, when the mysterious developer of Bitcoin called Satoshi Nakamoto (we still don’t know who that was) published the white paper of his project. Satoshi suggested utilizing the technology called blockchain (will get into that a bit later). It has been around for about a decade and a half at that point, but only implemented its full potential with crypto.

On January 3, 2009, the Bitcoin network went live. For the first months, Bitcoin was circulated only among enthusiasts and did not hold any buying power. The first transaction of Bitcoin happened in late May 2010: two pizzas for 10,000 BTC. Later that same year, the first Bitcoin exchange went up: MT.GOX (it was hacked and shut down in 2014).

In 2011, the Bitcoin-based underground market was created, upon which some people are basing their opinion on crypto as a means for criminals to purchase criminal stuff. It was also shut down in 2013.

In 2014, Vitalik Buterin, then an editor at Bitcoin magazine, decided to launch his own crypto project – Ethereum. It aimed to fix the flaws of Bitcoin’s code and introduced smart contracts as a way for people in turn to build their own crypto projects on top of this one. From then on, we are in a boom period: hundreds of new coins are being introduced every month.

In 2016, the DAO attack happened. Somebody broke into Ethereum and stole $60 million from the system. The team decided to undergo a hard fork (using the original code to break away and create a new coin) in order to return that money. From that day on, we have Ethereum the hard fork and Ethereum classic, the original.

2017 was the golden year for crypto: perhaps the biggest bull run in the history of any asset. To jump on the bandwagon, many companies decided to undergo an ICO (initial coin offering) – a way to raise money alternative to IPO.

A lot of those ICOs turned out to be scams, so the reputation of crypto was damaged once again. Due to that, in 2018 the world was pretty hostile towards crypto, and major financial institutions even named Bitcoin a scam. This turned around in 2019, when those same financial institutions started involving themselves with cryptocurrency.

Since then, not much has changed: governments around the world are still trying to figure out the best way to regulate crypto, new coins are being introduced, price is fluctuating up and down.

The appearance of DeFi (decentralized finance) in 2020 was an important milestone, but this is a whole different topic and we recommend that you check our other articles on this topic.

Blockchain and its algorithms

Blockchain is the technology that is behind all the awesomeness of cryptocurrency. It was first introduced in the 1990s to combat spam emails but was meaningfully implemented only in the Bitcoin algorithm.

The term itself is very intuitive: a chain of blocks. In the case of crypto, blocks hold information about performance transactions. Every block is connected with the previous one (hence the “chain” part), so no alterations can be made in the old blocks without traces on the new ones. Because of this, the system is self-regulating and prevents fraud.

In order to appear on the blockchain, The information first has to be verified by nodes in the systems (the nodes are regular computers of crypto enthusiasts). This occurs through two main protocols: Proof of Work and Proof of Stake.

Proof of Work (PoW)

The Proof of Work system relies on mining. Mining is the action of solving math riddles called hash functions by regular nodes in the system. When the riddle is sold, the computer gets the right to confirm the transaction information is confirmed and record it on the public ledger. A new block has been added to the chain, and the winner of the miners’ race gets some crypto in reward.

This comes in the same cryptocurrency that was mined. The volume of the reward is determined by the difficulty rate, which is calculated from how many nodes are participating in the system. This way, if too many miners get in on the game, they all receive a lesser reward.

This algorithm has two flaws: the environmental impact and centralization. When combined, mining farms consume unimaginable amounts of energy (enough to power entire countries like Serbia) and thus may pose a risk to the environment. Moreover, many miners opt to stick together in entities called pools in order to combine their computing power and compete with huge farms. And that process severely undermines the decentralization selling point of crypto.

Proof of Stake (PoS)

With Proof of Stake, every node in the system contributes a certain amount of crypto which serves as a security deposit. If a node verifies fraudulent transactions, they lose their deposit, so it doesn’t make any financial sense to do so. Depending on the amount contributed, the nodes get chances of becoming the next validator (validators in PoS are the same as miners in PoW) – the more you deposit, the better your chances.

This theoretically solves the centralization problem, but in turn gives more power to those who have contributed more, playing into the wealth divide.

TYPES OF CRYPTOCURRENCIES

Coins vs. Tokens

There are two ways to look at this juxtaposition: the minters’ perspective and the buyers’ perspective.

From the standpoint of developers, issuing a token is much easier. To do that, you don’t need to fire up your own blockchain: tokens pay rent to use the blockchain power of another project.

Tokens can be used to:

- Invest in Dapps (DIY apps created on the blockchain) and then vote on important decisions concerning the platform;

- Represent ownership of another asset (the price of such a token should be directly pegged to the price of the asset it represents);

- Support the platform. Purchasing a token is essentially investing in a company;

- Bringing changes to the platform. The amount of tokens you purchased gives you certain voting rights in inner elections determined to implement a new policy decision.

However, tokens cannot be used in electronic payments, since they are mere presentations of value and do not hold it on their own. So, in order to simplify this, think of tokens as stock and of coins as your fiat currency: dollars, euros, etc.

When a company decides they have grown enough and now deserve their own coin, they announce a mainnet launch and a mainnet swap takes place. During this process, all previously issued tokens are being swapped for new coins with a 1:1 ratio. To go deeper into mainnet and its difference from testnet, check out our recent article.

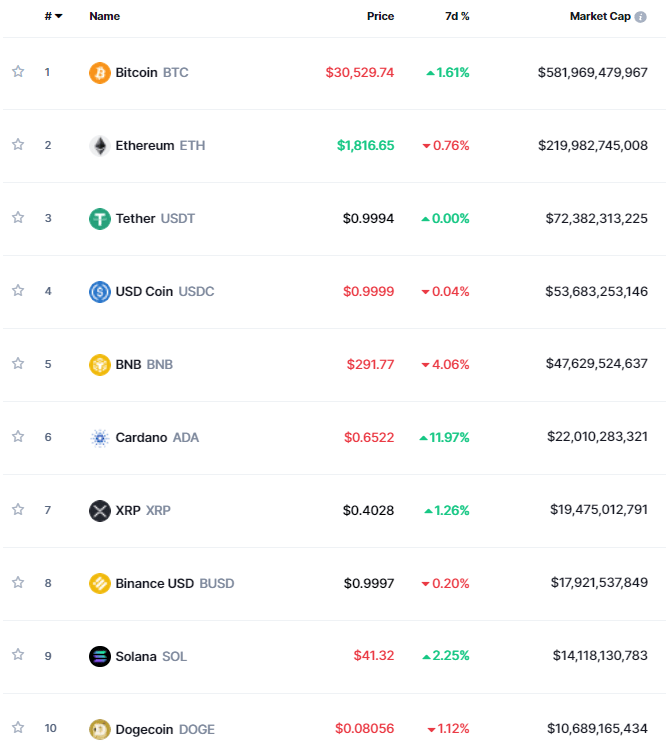

Top 10 coins (Coinmarketcap)

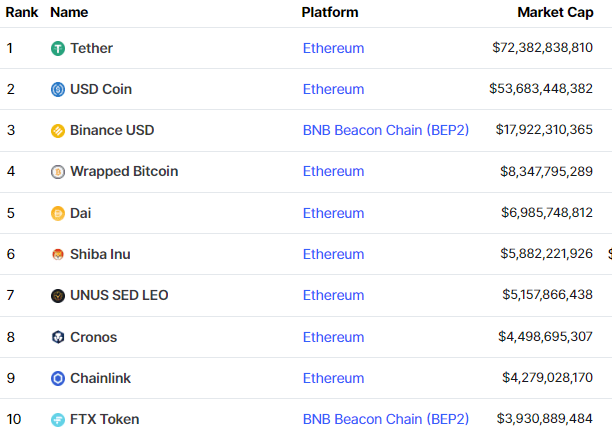

Top 10 tokens (Coinmarketcap)

Stablecoins

Stable coins are tokens that are pegged 1:1 to the price of a fiat currency (usually the dollar). Their goal is to retain the anonymity of a cryptocurrency and simultaneously provide you with the relative stability of regular currency.

There are two main ways the developers can sustain the 1:1 ratio. The first one is fiat collateralization; it means that for every stable coin you have, the company promises to own 1 dollar (or euro). The second way is through smart contracts; for example, the system can automatically mint one stablecoin when one is bought and burn one when one is sold.

Stablecoins can be used to secure your gains from crypto trading. They are also useful if you want to invest and earn interest on your crypto without worrying about price fluctuation.

Cryptocurrency Wallets

Before we dive into the different types of wallets, we need to stress how important it is to use them at all. Most exchanges allow you to store your newly purchased coins right there, but any crypto enthusiast would strongly advise against that. And they would be right: when keeping crypto on an exchange, you make your assets vulnerable to hacker attacks on the service, which happen more often than you might think. That’s where the famous “not your keys – not your crypto“ comes from.

Confusingly enough, a crypto wallet doesn’t hold your assets: it merely allows you to access them on the blockchain and then records your transaction there.

There are two components to every crypto wallet. The first one is your public address – this is something that you have to send other people so they can transfer crypto to you. The second one is a private key. This is something that you should never share, since it can be used to transfer crypto from your wallet. So the public address is like your email and your private key is like a password. We should also note that the public as address is generated through your private key, but there is no way you can calculate the former from the latter.

Hot Wallets (Software Wallets)

A hot wallet (or a software wallet) is connected to the Internet in some way. For example, it is a program that is installed directly on the web service or on a computer connected with the web. This might be convenient but it is also dangerous since this type of wallet is pretty vulnerable to hacker attacks.

Cold wallets (hardware wallets)

Cold wallets or hardware wallets, on the other hand, are independent of any Internet connection. They are a tiny computer that can only store your crypto and confirm transactions. In order to perform a transaction with a cold wallet, you need to connect it to a regular computer (kind of like a flash drive) and then use a bridge program. It is safer than the options mentioned above since your private key never leaves this tiny unhackable computer, but some people may find it inconvenient to carry a flash drive around.

An example of a hardware wallet

Paper Wallets

Paper wallets are just what they sound to be: a piece of paper with your private key written on it. Since you cannot hack paper it is rather safe, but we would advise creating multiple copies in case the original is lost.

There are online guides that help you choose the best wallet according to your purposes, like this one.

Investing in Cryptocurrencies

Since the crypto market is notoriously volatile, there are two sides to this coin (no pun intended). On the one hand, a cryptocurrency can go 10X, 30X or even 100X in a matter of days or even hours, so with enough luck crypto fortunes can be made literally overnight. But as it happens with money, easy made is also easy lost: as we’ve seen with the recent Luna crash, even a prominent cryptocurrency can crash to zero almost instantaneously.

If you want to get deeper into crypto investing, we’ve recently talked about five good strategies for it.

HODLing

HODL stands for ”Hold on for dear life”. It allegedly sprang from a misspelling on one of Bitcoin forums and then turned into a prominent meme.

HODLers are the true opposite of traders (whom the degradingly call “traitors”). Their philosophy is to accumulate as much coins as you can on alleged lows and then hold on to them as long as you can, resisting the temptation to sell at potential new all-time highs. It may seem the easiest tactic out there, but the psychological pressure of standing your ground when everyone else is selling and getting incredible returns might be almost unbearable.

HODLing can be not only an investment strategy but also a mentality: if you wholeheartedly believe that crypto is the future and it will eventually replace all fiat, then it makes sense to HODL almost forever (or until the widespread acceptance of crypto).

Earning Passive Income with Cryptocurrency

Mining

Mining crypto is participating in the Proof of Work algorithm (see above). 13 years ago you could easily mine with your CPU (central processing unit), 11 years ago people started utilizing their GPUs (graphic processing units) for the sake of mining, while around nine years ago started the era of ASICs – pricy special equipment tailored especially for mining.

Regular computers cannot compete with these monsters, and so this technology made mining Bitcoins for regular people obsolete. However you can still benefit from mining altcoins (everything that is not Bitcoin).

You cannot calculate how profitable it will be to mine Doge in advance: the profit figure depends on the difficulty level (the amount of miners currently at work) which changes rapidly. Before deciding what and when to mine, you should consult the current difficulty level or check a weekly / daily issue of mining return rates (like on the Freewallet’s Twitter)

Staking

Staking is participating in a Proof of Work algorithm (see above). Due to the specifics of the algorithm, it is much less technically demanding, but still requires a lot of technical knowledge.

Think of staking as a bank deposit with surprisingly high interest rates: this investment doesn’t require much effort from you after you’ve set up the node, but compared to banks crypto can offer you 10% or even 20% return rate.

Lending

Lending and borrowing crypto occurs on the platform called Aave. It is somewhat similar to traditional lending but also has some significant differences.

Firstly, lenders do not work with a centralized authority (like the bank), and they do not even work directly with each other (this was tried in the first version of Aave but was subsequently proclaimed inefficient). Instead, all transactions happen within smart contracts, and both parties never come in contact.

Secondly, all loans have to be overcollateralized. This means that if you want to borrow $100, you have to deposit $120. This may sound pointless, but the feature is aimed at traders that still make a profit with these terms. The idea behind overcollateralization is protecting the investors: if somebody decides to run with the borrowed money, they will still lose more.

Yield Farming

The term “yield farming“ itself means searching for the best place to invest your crypto in. It actually covers staking and lending which we’ve just described, but can also describe providing liquidity pools.

Trading Cryptocurrencies

Crypto trading is pretty similar to regular trading. Generally, you buy cheap and sell high. You can also short: first selling your stock high and then buying more cheap.

The most special thing about crypto trading is flash loans. A flash loan is a type of smart contract which allows you to borrow millions worth of crypto for seconds in order to resell them at a slightly higher price and return the loan while gaining huge profit. This may sound awesome but it is also highly complicated and is not a good strategy for beginners.

Conclusion

Our “crypto for dummies“ tutorial has come to an end. Hopefully now you won’t be confused by all the mysterious crypto slang and will be able to read fluently through the titles on Cointelegraph.

We at Cryptogeek realize that this world may be intimidating to outsiders. But we also believe that this is the future, and the more you learn the better. Besides, the crypto landscape is getting more complicated year-by-year, so the earlier you start, the better.

If you understood everything in this article and now you want more, you can dive into DeFi with our investing guide.

Here are no comments yet. Be the first!