How Does Crypto Gain Value?

Cryptocurrencies are notorious for their volatile prices. Bitcoin, the most famous among them, is known for its erratic price movements - one moment the media reports its decline, and the next, headlines trumpet its soaring value. For those unfamiliar with the intricacies of cryptocurrencies, deciphering the forces influencing their prices can be perplexing.

This article seeks to demystify the mechanism underpinning cryptocurrency valuation, shedding light on how these digital assets accrue value, the key drivers impacting cryptocurrency prices, the vital roles played by supply and demand dynamics, the significance of regulatory oversight, and more.

Contents

What is the Value of a Cryptocurrency?

The debate surrounding the value of cryptocurrencies shows no sign of calming down. Critics argue that cryptocurrencies lack inherent value, while proponents counter that fiat currencies share this characteristic. Just like traditional money, cryptocurrencies derive their value from people's collective agreement to utilize them as mediums of exchange. Those skeptical of cryptocurrencies' utility can simply opt out of using them. Nonetheless, the growing numbers indicate a significant portion of the population gravitates towards cryptocurrencies. Estimates suggest that anywhere from 300 million to 1 billion individuals have engaged with or currently hold cryptocurrencies.

Image source: Zippia

In practical terms, cryptocurrencies serve dual purposes as mediums of exchange and stores of value. Are they reminiscent of bubbles? Possibly. Do they have shortcomings? Undoubtedly. Do they facilitate illicit transactions and illicit funding? Unfortunately, yes, aligning them with fiat currencies in this respect.

However, distinctions exist from fiat money. While the value of national currencies is intertwined with state banking systems and market forces, cryptocurrencies' value is predominantly influenced by market conditions. Traditional banking institutions wield minimal direct influence over cryptocurrency valuations. Moreover, the underlying technology of a cryptocurrency plays a critical role in determining its perceived worth. Strong use cases can elevate the investment potential of native and utility tokens offered by blockchain-based services, while effective marketing strategies employed by these projects also significantly bolster their perceived value.

Multiple features set cryptocurrencies apart and draw individuals to them. Unlike fiat currencies, cryptocurrencies operate independently of traditional banking systems and jurisdictional boundaries. Transactions involving cryptocurrencies offer uniform conditions - consistent fees and transfer times regardless of the destination. The allure of conducting discreet transactions also contributes to the preference for cryptocurrencies over fiat money, further solidifying their value. Additionally, the concept of scarcity, particularly evident in deflationary cryptocurrencies such as Bitcoin, stands out as a fundamental factor contributing to the valuation of these digital currencies.

Furthermore, cryptocurrencies diverge from traditional investment instruments due to their heightened volatility and the adventurous nature of trading compared to traditional stocks. Seasoned traders and investors often leverage this volatility for swift gains. Additionally, the cryptocurrency industry offers a myriad of profit-making opportunities, spanning trading, yield farming, staking, mining, and various other avenues of generating income.

The lack of trust in traditional banking systems continues to shape the perceived value of digital assets, despite reports indicating that centralized exchanges and custodial platforms hold a significant proportion, purportedly exceeding 80%, of all cryptocurrencies.

Factors That Influence the Value of Cryptocurrencies

Scarcity, utility, decentralization, and marketing stand out as primary influencers impacting the valuation of cryptocurrencies. Let's delve deeper into each of these factors to gain a richer understanding of their significance in determining the value of digital assets.

1. Scarcity

Scarcity emerges as a critical determinant of cryptocurrency value. It is important to recognize that while some cryptocurrencies possess an unlimited supply, thereby undermining their scarcity, others, like Bitcoin, incorporate mechanisms to enforce a finite cap. Bitcoin, for instance, is designed with a predetermined total supply limit of 21 million coins.

Through the process of halving - a periodic event occurring approximately every four years wherein mining rewards are halved - the rate of new coin issuance gradually decreases. This characteristic, reminiscent of the scarcity associated with traditional commodities like gold, has contributed to Bitcoin's reputation as a secure store of value.

Image source: Crypto.com

The stock-to-flow model, which establishes a relationship between the asset's value and its scarcity, has gained traction among cryptocurrency enthusiasts, although its applicability to the broader cryptocurrency landscape remains subject to debate.

2. Utility

The utility of a cryptocurrency plays a pivotal role in shaping its value proposition. While some digital assets primarily function as mediums of exchange, exemplified by Bitcoin's predominant role as a digital currency, others serve as foundational or utility tokens within intricate digital ecosystems. Take, for example, Ether, the native token of the Ethereum blockchain. Ether serves as the fuel powering a diverse array of decentralized applications (dApps), platforms, and alternative cryptocurrencies that operate within the Ethereum network. Notably, the prevalence of non-fungible tokens (NFTs), which predominantly exist as Ethereum-based tokens, necessitates the utilization of Ether for transaction fees, thus enhancing the intrinsic value of Ether within the Ethereum ecosystem.

In addition, certain cryptocurrencies serve dual roles as governance instruments within specific blockchain networks. For instance, in networks operating on the Proof-of-Stake consensus mechanism, token holders wield voting rights and can participate in decision-making processes by staking a portion of their tokens. Several platforms incentivize user engagement through rewards; for instance, the Brave browser or certain video games that offer users the opportunity to earn and spend cryptocurrencies, leveraging these digital assets as in-game currencies that can seamlessly transition into tradable assets on various cryptocurrency exchanges.

3. Decentralization

The majority of established cryptocurrencies operate in a decentralized manner. This implies that no single entity possesses the authority to alter records stored on the blockchain, seize your funds, or restrict your use of the cryptocurrency. A cryptocurrency that upholds a high degree of decentralization while ensuring security maintains its credibility and value.

4. Marketing

Developing a robust product is one aspect, while marketing and promoting it is another crucial facet. Not all promising cryptocurrency projects ascend to the top 100 cryptocurrencies solely due to a lack of effective promotional efforts. A project may exhibit technical strength, but a compelling marketing campaign significantly accelerates its value growth. Certain cryptocurrencies experience rapid price appreciation once they are endorsed by public figures. A prominent example is Elon Musk's favorable tweets about Dogecoin, catapulting the coin into the top 10 cryptocurrencies.

Cryptocurrency Supply and Demand

The interplay of supply and demand, a potent market force, continuously shapes the value of cryptocurrencies, necessitating a dedicated exploration of this factor.

Traders engage in buying and selling cryptocurrencies across global markets all the time. Buyers seek to acquire assets at favorable prices, while sellers aim to secure lucrative selling prices, causing crypto prices to fluctuate on various exchanges. Traders and investors endeavor to resell acquired crypto assets at higher prices to capitalize on market movements.

A surge in demand for a specific crypto asset exceeding its supply triggers a price increase. Conversely, a surge in traders looking to sell the asset indicates an imminent downturn.

The desire to acquire a particular cryptocurrency is fueled by news stories, endorsements, advertisements that highlight the distinctive attributes of the asset, among other factors. Nonetheless, if the initial excitement fails to align with people's expectations, sentiment may swiftly shift, prompting rapid asset sell-offs and subsequent price declines.

Major cryptocurrencies exert substantial influence over the broader crypto market. Bitcoin stands out as the most impactful cryptocurrency. Market movements often follow Bitcoin's price trends in either direction. Reports of significant crypto thefts or security breaches on major crypto platforms can lead to market vulnerabilities and weaken overall market sentiment.

Regulations

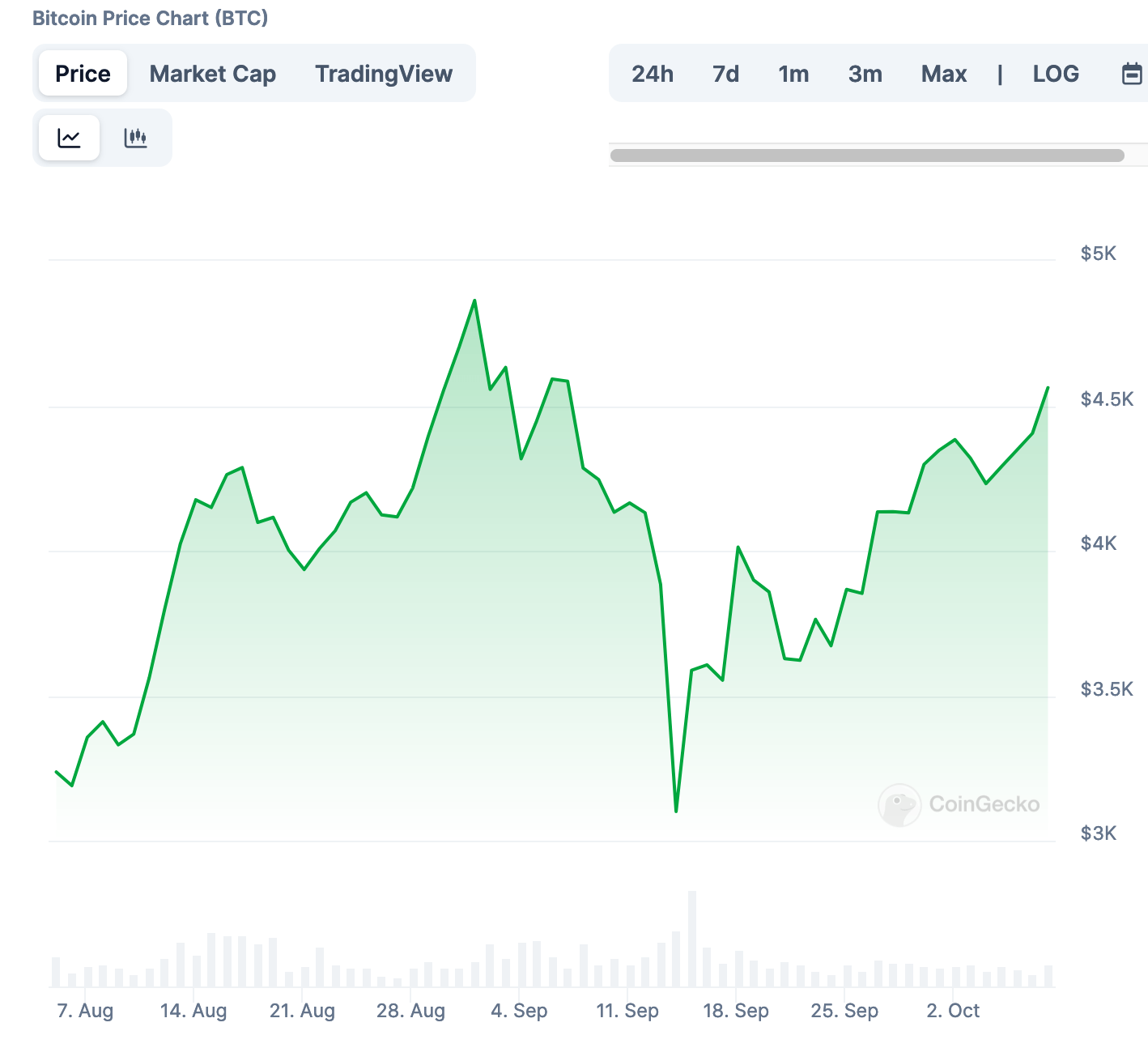

Regulations concerning cryptocurrencies can significantly influence prices in either direction. The decline in Bitcoin's value in September 2017 (see the picture below), for instance, was triggered by China's prohibition on Initial Coin Offerings (ICOs).

Conversely, a recent positive development occurred in January 2024 when the U.S. Securities and Exchange Commission (SEC) greenlit 11 new spot Bitcoin exchange-traded funds (ETFs), sparking a notable upward trend. This announcement, coupled with the impending Bitcoin reward halving, propelled Bitcoin to reach record-breaking price levels.

Conclusion

The skepticism surrounding cryptocurrencies' intrinsic value is largely inaccurate, as the value of crypto assets accrues in a manner akin to traditional fiat currency. However, certain distinctions exist.

Cryptocurrency value is influenced by a multitude of factors. Fluctuations in demand directly impact a cryptocurrency's market price. Yet, more profound determinants include the cryptocurrency's utility, technological sophistication, endorsements by notable figures, marketing strategies, the prevailing market conditions, and news specifically related to that cryptocurrency. Additionally, regulatory actions also play a significant role in shaping the value of cryptocurrencies.

Here are no comments yet. Be the first!