1 CORE to USD: Understanding the Value and Factors Behind the Conversion

1 CORE to USD is a commonly searched phrase by cryptocurrency users looking to understand the value of the CORE token in terms of US dollars. Whether you're an investor, a trader, or just curious, knowing how 1 CORE translates into USD is useful for making informed decisions. This article explains everything you need to know about the CORE token, its use cases, market factors affecting its price, and how to convert it accurately.

Contents

- What Is CORE?

- How Is the Price of CORE Determined?

- How to Convert 1 CORE to USD

- Where Can I Buy and Sell CORE?

- Why Is the CORE to USD Rate Important?

- Major Projects and Applications of the Core Blockchain

- Historical Performance of CORE

- Comparing CORE to Other Tokens

- How to Store CORE Securely

- Conclusion

- FAQ

What Is CORE?

CORE is the native token of the Core blockchain, a decentralized Layer 1 network that integrates Bitcoin’s security model with smart contract capabilities. Unlike many Layer 1s that rely on their own consensus methods, Core uses a unique hybrid approach called Satoshi Plus, which blends Bitcoin mining and delegated proof of stake (DPoS). The CORE token powers the network and plays a central role in its ecosystem.

Paying for transaction fees, staking, and securing the network is done through the CORE token. It is also employed for governance, where the holders can vote on proposals for the blockchain's future. As the network evolves and more programs are developed on Core, the demand for the coin is projected to increase.

How Is the Price of CORE Determined?

The price of CORE, like any cryptocurrency, is determined by market supply and demand. It is listed on multiple exchanges, where users can buy or sell it for various trading pairs, including USDT (Tether), BTC (Bitcoin), and ETH (Ethereum). These trades set the real-time market price of CORE.

Several factors affect the price of CORE:

- Market Sentiment: Positive developments, joint ventures, or integrations can boost demand.

- Token Utility: The more useful the CORE token is within its ecosystem, the greater its perceived value.

- Circulating Supply: Whenever additional tokens enter into circulation, prices can fluctuate based on the reaction of demand.

Because CORE is traded on open markets, its value can change rapidly based on investor behavior and external events.

How to Convert 1 CORE to USD

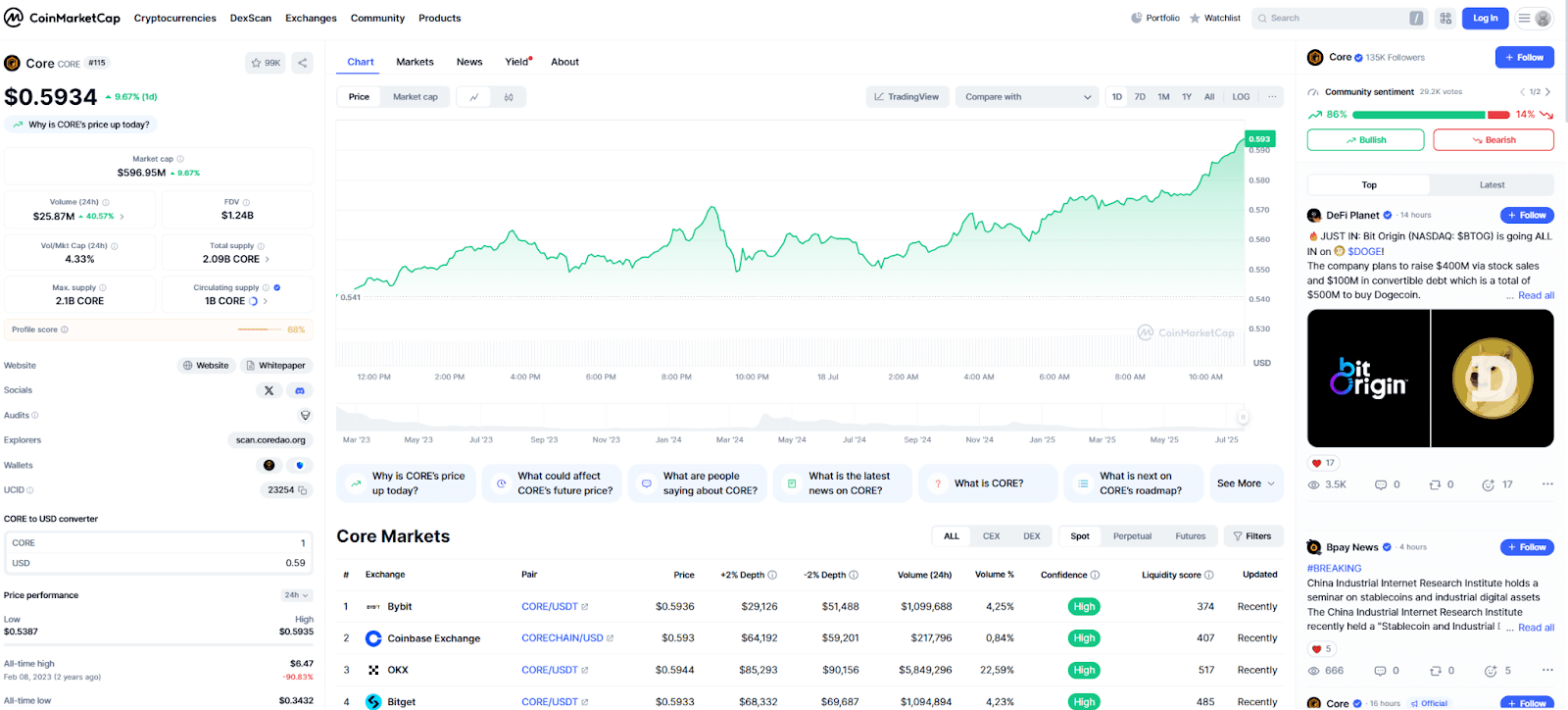

To convert 1 CORE to USD, you need to look at the current exchange rate on a cryptocurrency price aggregator like CoinGecko, CoinMarketCap, or directly on the exchange you’re using. These platforms provide up-to-the-minute price data based on the most recent trades.

For instance, if the price of 1 CORE is currently $0.85, then 1 CORE to USD would be equivalent to $0.85. For conversion of a large quantity, you merely multiply the quantity of your tokens by the USD price.

Keep in mind that the final amount you receive may be slightly lower due to exchange fees or slippage during the transaction process.

Where Can I Buy and Sell CORE?

CORE is listed on several centralized and decentralized exchanges. Major platforms that support CORE include:

- OKX

- Gate.io

- MEXC

- Uniswap (Core chain support)

To buy CORE, you would typically need to fund an exchange account with USDT or other base currency, and swap that for CORE. Exchanges also support P2P or direct card buying, depending on your location.

To sell CORE, you do the opposite: exchange CORE for USDT or for one of the supported stablecoins, and then withdraw to your bank or wallet.

Why Is the CORE to USD Rate Important?

Understanding the CORE to USD rate is important for several reasons:

- Investment Decisions: If you’re holding CORE, knowing its USD value helps you track profit or loss.

- Cross-Chain Transfers: Many decentralized apps use stablecoins like USD for liquidity. You may need to convert CORE to USD before using it on another chain.

- Fiat Off-Ramping: If you're planning to cash out, the CORE to USD rate helps determine how much you'll receive in fiat currency.

Due to this, there is often a tendency for old and even newbie users to check CORE's price versus the US dollar frequently.

Major Projects and Applications of the Core Blockchain

The Core ecosystem is expanding, and with it, the relevance of the CORE token. Here are some of the main use cases being developed:

- Decentralized Finance (DeFi): CoreDeFi applications such as DEXs, lending platforms, and staking interfaces are hosted on DeFi: Core. They employ CORE for gas fee and liquidity incentives.

- NFTs and Gaming: Non-fungible tokens (NFTs) and Web3 games are blockchain-backed, supporting transactions and rewards that use CORE.

- Linking Bitcoin: As part of its Satoshi Plus model, Core would bring BTC holders into DeFi by using Bitcoin miners for security across its network.

They create true utility for the CORE token, which affects its demand and, thereby, its USD price.

Historical Performance of CORE

Since its launch, CORE has seen significant price fluctuations, much like other crypto tokens. At times of high attention - such as new exchange listings, strategic partnerships, or product launches - CORE has experienced sharp upward movements. At other times, the price has dipped during general market slowdowns.

Although providing future prices is not possible, analyzing historical patterns can give an understanding of how CORE is affected by market conditions. Nevertheless, historical results can never serve as an assurance of future outcomes.

Comparing CORE to Other Tokens

When evaluating 1 CORE to USD, it’s helpful to compare it to similar tokens from other Layer 1 blockchains. For instance:

- Ethereum (ETH) powers a massive ecosystem, but has high gas fees and scalability challenges.

- Solana (SOL) is fast but has had network outages.

- Avalanche (AVAX) uses subnets for scalability but is more complex to use.

CORE has its speciality as being linked to Bitcoin miners. This is where its hybrid model comes into play, providing decentralization as well as scalability, but differently.

How to Store CORE Securely

After purchasing CORE, you must store it within a compatible wallet. You can store your CORE holdings in:

- Core DAO Web Wallet: Official wallet specifically designed for the Core blockchain.

- Metamask (through Core RPC settings): You can add the Core network manually and store CORE securely.

- Hardware Wallets: For long-term holders, using Ledger or Trezor with Core integration adds an extra layer of protection.

Always ensure that the wallet is compatible with the Core network before sending your funds.

Conclusion

The value of 1 CORE to USD depends on real-time market conditions, token utility, and broader trends in the cryptocurrency space. CORE is more than just a trading token - it represents a growing blockchain ecosystem that’s finding unique ways to blend Bitcoin security with smart contract flexibility. Whether you're trading, staking, or simply holding, understanding how to check and interpret the CORE to USD rate is a key part of staying informed and making smart choices.

FAQ

What is CORE in cryptocurrency?

CORE is the native token of the Core blockchain. It’s used for transaction fees, staking, governance, and interacting with apps in the Core ecosystem.

How do I convert CORE to USD?

You can check the latest CORE price on exchanges or price aggregators like CoinMarketCap, then multiply by the number of tokens you have. Selling it on an exchange will show the USD equivalent directly.

Where can I sell CORE?

CORE can be found on exchanges such as OKX, Gate.io, MEXC, and Uniswap. It can also be traded for USDT, ETH, and other tokens.

Is CORE built on Ethereum?

No, Core is its own Layer 1 blockchain but is compatible with Ethereum smart contracts and utilities.

What influences the price of CORE?

As is true for other tokens, CORE is also driven by forces of supply and demand, Core blockchain news, sentiment of the cryptocurrency market, and adoption of its ecosystem platforms.

Here are no comments yet. Be the first!