Should We Expect a Bitcoin Bull Run in 2022?

Cryptocurrency has experienced a number of volatilizes since it was discovered in 2009. As we already know, the price can’t just go up, and one of the latest declines happened not long ago, in 2021.

At the beginning of the year, the price of Bitcoin was around $30,000, while in the mid-spring, it doubled and hit $60,000. However, it didn’t take long for the price to return to the previous mark.

Let’s take a look at predictions and possibilities for the Bitcoin bull run in 2022.

Previous Bitcoin Bull Runs

● ICO Trend

One of the largest Bitcoin bull runs happened in 2017. The cryptocurrency, still gaining its popularity, reached nearly $20,000. It was the time when people took part in initial coin offerings or ICOs. It’s when companies issue new tokens and raise funds by attracting investors who become backers of the current blockchain project.

In 2018 most of the ICOs crashed, as well as the Bitcoin’s price.

● Libra

Another Bitcoin rally started in 2019, when Facebook started working on its own cryptocurrency Libra. But when it all came to the regulatory concerns, some Libra supporters gave up on it. As a result, Bitcoin’s price settled between $6,000 and $7,500. Now this currency has undergone a rebranding and is currently known as Facebook Diem.

● Pandemic

Bitcoin made the next move in 2020 during the Covid-19 pandemic. This period has made an impact on the cryptocurrency market. Yet, some cryptocurrencies made excellent gains during that year.

What is more, major payment providers like PayPal allowed customers to use cryptocurrencies, which encouraged investors to buy BTC.

And this time, more cryptocurrency exchange applications were ready for the bull run.

What Affects Bitcoin’s Price?

There are a lot of factors around the world that affect Bitcoin’s price. Including the fact that sometimes price depends on a cryptocurrency exchange.

1. Altcoins

Apart from Bitcoin, there are a lot of other cryptocurrencies (“altcoins”) on the market. The number of them is constantly growing and has already exceeded 18000. And when there’s a good opportunity on the horizon, investors sell some BTC to purchase altcoins instead.

If a promising ICO appears, it can easily attract attention and lead to a Bitcoin bull run.

2. Market Demand

The other main factor is the market demand when investors don’t know whether to buy or not:

● Good news encourages traders to get more BTC or other cryptocurrencies;

● Bad news causes some other types of investment or makes people buy Bitcoins at a higher price. Otherwise, bad news can lead to selling.

Another market demand is the supply and demand rule: many investors would like a piece of Bitcoin. But only 21,000,000 BTC will be produced. And this fact leads to another problem.

3. Production

Producing Bitcoin is a very expensive thing according to all the electricity and mining equipment. And it is one of the cryptocurrencies that can be mined: one Bitcoin block in ten minutes.

Mining has long ago become a long-scale and very expensive industry with a high entry threshold.

4. Market Manipulation

Market manipulation can be committed by huge financial institutions or individual investors. In the investment sphere, they are known as “whales.” When a significant amount of BTC is purchased or sold, the coin’s price can change drastically. A few cases are known when “whales” sold off large amounts of Bitcoins, causing the temporary crash of the market. And we are almost ready to say hello to a probable Bitcoin bull run.

5. Regulations

Cryptocurrency is still unregulated, however, many countries are trying to regulate it. As a result, the market dumps, leaving Bitcoin with a low price.

Chinese cryptocurrency regulations caused increased volatility in the crypto market.

6. Fiat Currency Crises

Through all these years, many people started preferring Bitcoin over fiat. Another reason might be living in a small country where there’s no access to banking or a country going through a fiat currency crisis.

What’s Holding Bitcoin Back?

The past few years have been difficult for Bitcoin. Here are several factors that have been holding BTC back. And some of them moved forward into 2022.

Adoption and Use

While dealing with new technology like Bitcoins, some companies still need more time to adopt it. It leads infrastructure to grow stronger and makes investors buy and sell BTC in one click.

Some people prefer long-term storage, whereas others use Bitcoin for everyday purchases. Nowadays, a lot of stores like Starbucks, Amazon, and KFC accept crypto payments.

Lack of Clear Regulation

Experienced investors tend to be very careful about what they invest in. If an asset doesn’t have clear legal regulations, they may not choose to take the risk of investing in it.

Regulations are still not clear with cryptocurrency, so that could be an important consideration for investors.

What Will Happen in 2022?

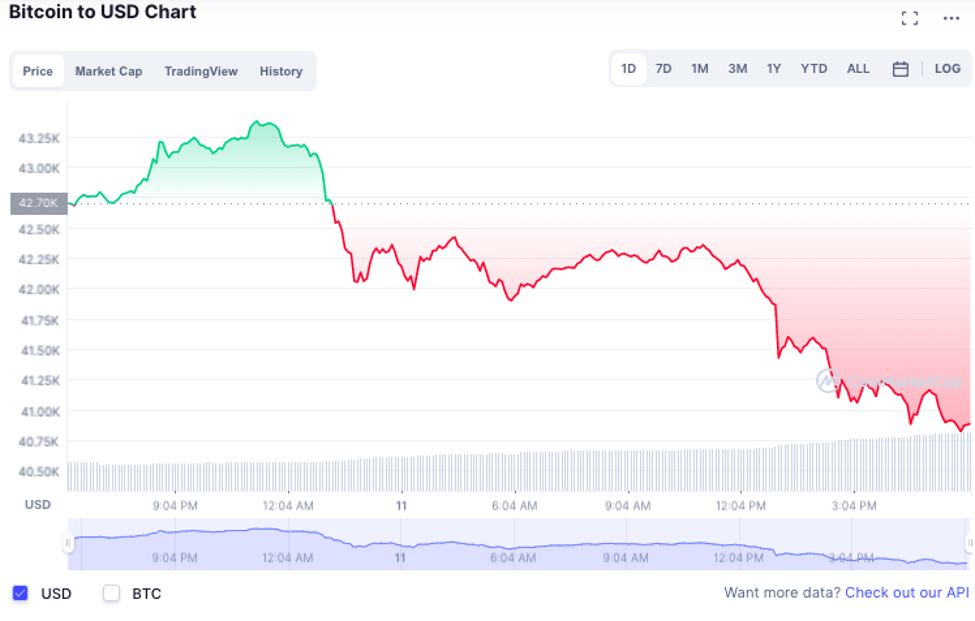

Almost every trader wants to know what will happen next and if we should expect a Bitcoin bull run in 2022. So far, this year shows a combination of global events influencing the cryptocurrency market negatively.

The US Economy

Quarantine measures still have some influence on the US economy. If it leads to the loss of faith in the US dollar, the cryptocurrency market might take the leading positions as BTC has all the potential to do so.

Technical Indicators

Bitcoin’s way in the direction of the bull run can be noticed by some technical indicators. It can predict BTC going both high and low. Yet, you can’t trust those predictions with 100% as it is only a combination of charts and analysis.

New Regulations

New regulations are more likely to come. Not only from China as it was mentioned before, but also from other governments telling that there are some more regulatory measures to be expected.

Stablecoins Across the World

Nowadays, many countries like the US, Russia or France are planning to release the state-backed digital currencies as well as stablecoins. However, China is the first to be because it has already launched a central bank digital currency (CBDC). It gives a real ability for challenging some fiat currencies.

Cryptocurrency Competition

Being the first cryptocurrency, Bitcoin is not the only one. The second most popular coin in Ethereum, while the third place goes to Tether.

Ethereum became popular and earned some interest thanks to the non-fungible tokens (NFTs) representing digital art or other items of interest linked to a blockchain. Tether is famous for having a fixed value to the US dollar.

Speaking of altcoins, Dogecoin had an enormous rise in 2021, thanks to the meme stocks like GameStop. Cardano joined the race and reached quite a high market cap.

Risks

Dealing with investments, no one can avoid risks. The cryptocurrency market is not an exception. So every investor, performing their own research and making predictions, should be wide-awake to the possible market changes.

The cryptocurrency market still has a lot of data to collect and discover. What else, some unpredictable circumstances can happen and lead to significant changes in the market.

Always remember that Bitcoin is a very risky investment and that investors should make their own decisions about the level of risk.

Another thing to remember is the fact that the past trend lines are not always a prediction of the future for an upcoming bull run. Stay alert and pay attention to other market signals.

Conclusion

2022 is full of surprises and events for cryptocurrencies as a whole and Bitcoin especially. It’s never too late to start buying crypto, paying more attention to the market, or just continue buying different coins and tokens to enlarge the portfolio.

The price could be changed in the short term soon after some good or bad news affecting the cryptocurrencies is published.

But will Bitcoin’s price and value compete during the long term, and whether Bitcoin bull run happens, only time knows.

Here are no comments yet. Be the first!