Binance Tax Reporting - How to Do It? | Ultimate Guide by Cryptogeek

Binance is one of the world's leading exchanges, and as such, it comes with everything you would need to know and do to settle a transaction, purchase a currency, invest and admittedly settle your tax reporting. Many consumers who are new to the cryptocurrency space often overlook this important aspect of crypto owners.

- What Is Tax Reporting?

- Does Binance Give Tax Info?

- Binance Tax Documents and Forms?

- A Quick Overview of the US

- How Do You Report Binance Tax in Canada?

- Settling Binance Tax Reporting in the UK

- How to Get Binance Tax?

What Is Tax Reporting?

Reporting tax is an essential part of purchasing a cryptocurrency and while you will need to familiarize yourself with some of the ways that work in your jurisdiction, be that the United Kingdom, the United States, or Canada, you absolutely must take pains to study the way it works.

There are several ways to approach the subject with a bit more understanding. You ought to familiarize yourself with what your specific country laws regarding cryptocurrency are. Binance tax reporting is a matter of continuous evaluation of changes in legislation, but it's also wise to consult with a tax specialist who may lead you through the more subtle aspects of Binance tax reporting.

Does Binance Give Tax Info?

Yes, Binance does provide tax info, but you need to understand what this entails. By law, the exchange needs to keep extensive records of every transaction that takes place on the platform. Three of the main jurisdictions where this happens are the United Kingdom, the United States, and Canada.

For legal reasons, Binance operates in the United States as a separate entity, Binance US, and does so legally and following the active regulatory stature. Binance US offers detailed breakdowns of customers' transactions based on historic trades as well as special forms that are prepared directly for the Internal Revenue Service (IRS), but more about this in a minute.

For legal reasons, Binance operates in the United States as a separate entity, Binance US, and does so legally and following the active regulatory stature. Binance US offers detailed breakdowns of customers' transactions based on historic trades as well as special forms that are prepared directly for the Internal Revenue Service (IRS), but more about this in a minute.

In the meantime, it's worth knowing that you have the documents necessary to complete your tax forms and submit them to your relevant authorities based on active laws in your country.

Some jurisdictions may be much stricter than others, so you ought to always consult with an accountant specialist who will help you figure out some of the subtler details of how crypto tax law works in your country and if there are any exceptions or special rules for Binance tax reporting as a whole.

Binance Tax Documents and Forms

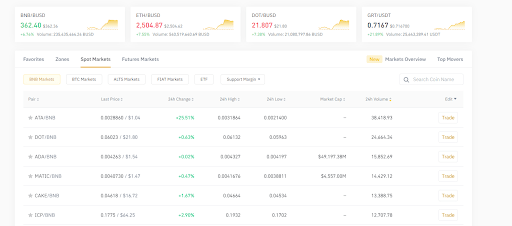

The most important thing in terms of Binance tax documentation is the quarterly reports you get on your activity on the exchange. Binance allows you to generate historical reports in breakdowns of three months at a time. So, when you want to download trade transactions history, you would need to do so in periods from January to March, April to June, July to September, and October to December.

Once you do that, you may want to go to withdrawals and deposits history next, as this will be another piece of relevant information you must download and submit to your tax office, whether this is the IRS, the Canada Revenue Agency, or the HM Revenue & Customs.

Binance allows you to withdraw your entire deposits and withdrawals history and then use the file to work out any relevant details you ought to submit to your government. Depending on what your jurisdiction is, Binance will be obliged to file different forms.

Binance allows you to withdraw your entire deposits and withdrawals history and then use the file to work out any relevant details you ought to submit to your government. Depending on what your jurisdiction is, Binance will be obliged to file different forms.

A Quick Overview of the US

In the United States, that is the 1099-K, which is filed to the Internal Revenue Source for certain transactions. By 2020, you ought to also need to add any use of crypto on Form 1040, which is better known as US Individual Income Tax Return.

The addition that the IRS introduced was answering the following question: "At any time during 2020, did you receive, sell, send, platform, or otherwise acquire any financial interest in any virtual currency."

As a result, you will need to confirm that you hold a Binance account or assets and that you have traded or received crypto on your Tax Reform. The additional information provided in terms of transaction history will help you stay on point.

Binance US does note, however, that the exchange is not there to provide you with financial advice and that you always must seek the services of a qualified professional who can make sure that your Binance tax reporting meets state and federal regulation to avoid trouble in the future.

How Do You Report Binance Tax in Canada?

While Binance US will provide you with detailed reports on occasion, you will have to carry out most of the work yourself in Canada. That is not to say that Binance is doing so on purpose.

Accounting services exist for service, and Binance is a Third Party Settlement Organization. As such, the exchange will provide you with a detailed list of everything you need to submit a legal tax return form, including transaction history, but calculating those relevant to Canadian regulation is your sole responsibility.

Based on current Canadian law, the Canada Revenue Service states that: "Capital gains from the sale of cryptocurrency are generally included in income for the year, but only half of the capital gain is subject to tax."

Based on current Canadian law, the Canada Revenue Service states that: "Capital gains from the sale of cryptocurrency are generally included in income for the year, but only half of the capital gain is subject to tax."

In other words, 50% of any proceedings you have generated through cryptocurrency trading, buying, or selling will be charged at the marginal tax rate, which is ideal and makes Canada one of the best jurisdictions to settle your tax.

However, you must be legally a resident of the country or at least qualify for such settlement legally. You may not go to Canada if you are a US resident to benefit from arguably a better tax rate on your crypto gains, for example.

Settling Binance Tax Reporting in the UK

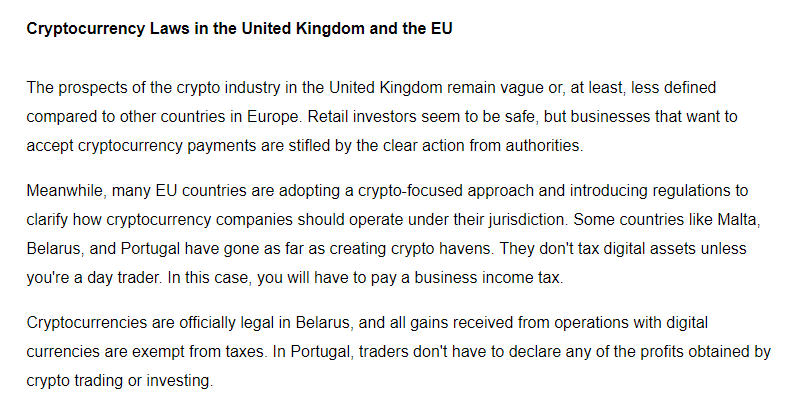

The United Kingdom is an interesting jurisdiction when it comes to sorting out your Binance tax reporting. The country was one of the first to introduce a preliminary crypto tax to serve as guidelines, covering a range of activities, including but not limited to:

- Payment Processors

- Service Providers

- Miners

- Traders

- Exchanges

The laws that tax individual activities will vary slightly, and you won't have to pay value-added tax or VAT on mining operations, but then again, businesses and shops ought to pay VAT on their crypto transactions if they have reached the threshold.

How to Get Binance Tax?

All of this so far maybe just a bit out of reach for you, but that is okay. Settling Binance tax reporting is important, and it's not too easy when you first try your hand at it. The good news is that once you get into the habit of keeping track of your operations, you will be on top of your tax game.

There are three ways we see as viable options to settle crypto tax. One is to use an automated website that will ask you to upload CSV files of your trading and transaction history.

Another is to always consult with an accountant who will be able to run the numbers for you and serve as a final stamp of approval that you are in the clear and can therefore proceed with submitting your tax form.

A third option is for you to do the numbers all by yourself. This is a good way to sort out Binance tax and keep your information safe and private. We recommend, though, that you do consult a specialist and gain the knowledge you would need before you do.

Here are no comments yet. Be the first!