Coinbase Pro API | Guide by Cryptogeek

Every exchange has special features to attract traders. Coinbase Pro has a special code helping to automate and simplify the trading. This code is the Coinbase Pro API.

It is absolutely free to create an account, as well as enable the Coinbase Pro API.

Coinbase and Coinbase Pro Differences

The two platforms do have something in common. At least Coinbase Global Inc owns both and the UIs resemble each other.

Yet, it is obvious that Coinbase and Coinbase Pro share quite a few differences. Coinbase is rather a cryptocurrency marketplace, whereas Coinbase Pro is a full-fledged crypto exchange. Coinbase resembles a cryptocurrency wallet, whereas Coinbase Pro is more likely a trading platform.

Innovative attributes and endpoints make trading on Coinbase Pro API much faster and better than on Coinbase.

Now Coinbase Pro API is available for more than 100 countries.

Pros and Cons of Using Coinbase Pro API

Here’s a short list of pros and cons traders should take into account.

Pros:

● Simple

● Intuitive

● Fully regulated in the US

● High liquidity

● Supports fiat (USD, EUR, GBP)

● Supports over 120 cryptocurrencies

Cons:

● High fees

● Slow customer support

● Too complicated for newbies

To sum up, Coinbase Pro API has twice as many pros rather than cons.

Does Coinbase Pro Take Fees?

Yes, it does. Coinbase Pro takes the usual trading fees from its users. It happens after a 30-day period when the final price is calculated. For the trader’s convenience, the sum is taken in USD.

As usually, fees are divided into “maker” and “taker”:

1. A user becomes a taker when a placed market order gets filled immediately. Fee: from 0.04% up to 0.50%.

2. Aser becomes a maker when a placed order is not filled at once and goes on the order book. So there’s a need to wait until it gets matched by another trader. Fee: 0.00% up to 0.50%.

3. And when the order gets filled only partially, both fees are paid. At first, a taker fee matching the filled portion is paid, while the rest of the order moves on the order book till later. And when it is matched, a maker fee is paid.

This table shows the current trading volume for both fees:

Do Other Exchanges Have an API?

Many other exchanges do have an API. That's why Coinbase Pro API can’t be the only choice for traders. Here are just several exchanges with API:

● Binance

● BitMex

● HitBTC

● Kraken

● Gemini

● KuCoin

● Bittrex

● Bitfinex

After completing proper research, traders can choose among those exchanges provided or find some other platforms which would meet their needs. However, let's get back to Coinbase Pro.

Creating an Account on Coinbase Pro

Traders have only two methods of creating an account on this platform:

1. If a trader already has a Coinbase account, the only thing left is to connect it with Coinbase Pro. Then funds transfer would be possible between the accounts.

2. Or just visit the Coinbase Pro start page and launch an account right there.

Having clicked the “Get started” button, newcomers have to fill up their basic account details, verify an email address and enable two-factor authentication. To complete the registration, users have to provide some personal information: name, date of birth, address, intent, source of funds, occupation, including an ID photo and a link to a bank account.

What is a Coinbase API Key?

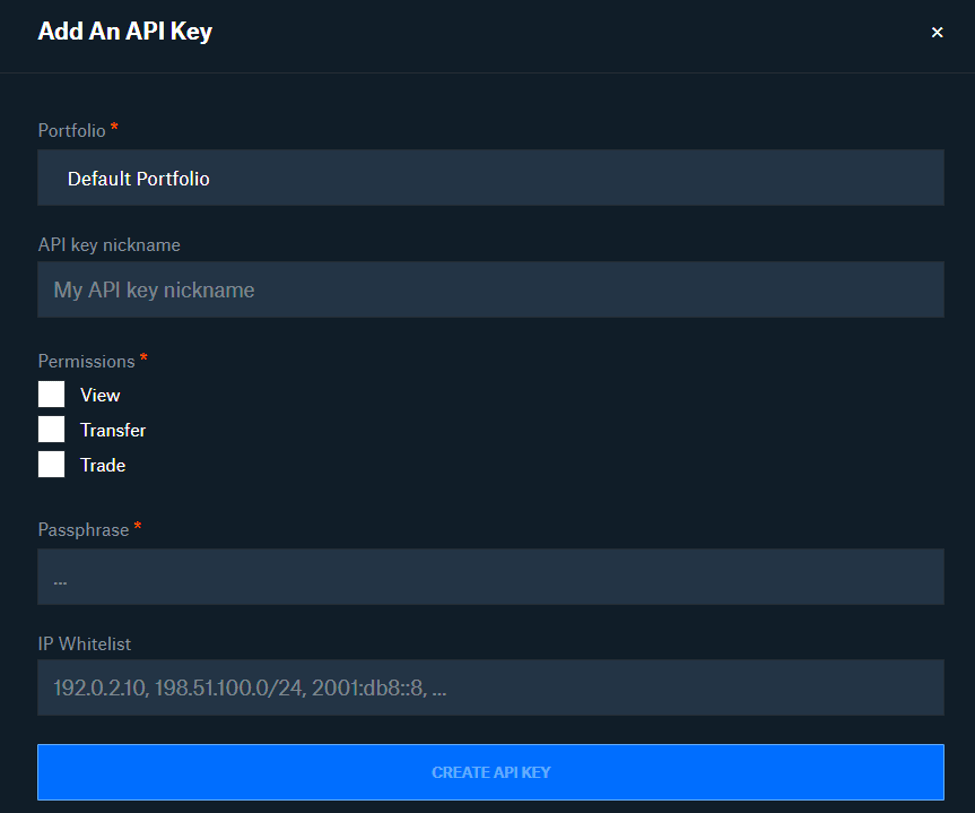

To deal with a Coinbase Pro API, traders require a Coinbase API key. First of all, click on the “API” and then on the “+ New API Key” button. Then users have to choose permissions for the API Key, set the nickname and a passphrase, an extra level of authentication and a security feature realized by Coinbase.

Before the API Key could start working, traders need to complete one more step: enter a verification code to get a secret key. Moreover, users should keep that secret key in a safe place so as not to lose it.

Finally, the Coinbase Pro API is created. Let’s move on and talk about its abilities.

Useful Python Coinbase Pro API Commands

Each trader can choose their favorite client out of five supported:

Python is the most popular client for writing commands on Coinbase Pro API. That’s why examples would consist only of it.

Let’s begin:

pip install cbpro

Trading Pairs Info With Python Coinbase API

In the Coinbase Pro API python library uses get_products endpoint to get the information on Trading Pairs. Next step is importing the library, initializing the client, obtaining products data:

import cbproimport pandas as pdc = cbpro.PublicClient()data = pd.DataFrame(c.get_products())data.tail().

Price Data With Python Coinbase API

To get the information on Price Data, use get_product_ticker endpoint and specify the ticker parameter. For Cardano it would be:

ticker = c.get_product_ticker(product_id='ADA-USD')ticker

The second way to obtain the date is with the help of Coinbase Pro REST API endpoints:

import requests ticker = requests.get('https://api.pro.coinbase.com/products/ADA-USD/ticker').json()ticker

Historical Data With Python Coinbase API

To get the information on Historical Data, use get_product_historic_rates endpoint. It is possible to specify the granularity, start and end date.

Look how simple is obtaining ETH-USD historical data with the default parameters and arranging it all into an orderly data frame:

historical = pd.DataFrame(c.get_product_historic_rates(product_id='ETH-USD')) historical.columns= ["Date","Open","High","Low","Close","Volume"]historical['Date'] = pd.to_datetime(historical['Date'], unit='s')historical.set_index('Date', inplace=True)historical.sort_values(by='Date', ascending=True, inplace=True)historical

If needed, later this data could be used to create a simple indicator and produce a candlestick chart.

Accessing Technical Indicators With Python Coinbase API

Unfortunately, Coinbase Pro API doesn’t offer any preset indicators. However, it’s possible to make them using in-built pandas features or just relying on the btalib library.

That’s how to create a simple 20 SMA indicator with pandas:

historical['20 SMA'] = historical.Close.rolling(20).mean()historical.tail()

And having all these data, it’s possible to create an interactive chart:

import plotly.graph_objects as gofig = go.Figure(data=[go.Candlestick(x = historical.index,open = historical['Open'],high = historical['High'],low = historical['Low'],close = historical['Close'], ),go.Scatter(x=historical.index, y=historical['20 SMA'], line=dict(color='purple', width=1))])fig.show()

Order Book Data

To reach the Order Book data, use the get_product_order_book Coinbase Pro API endpoint. Here’s an example of obtaining data for BTC-USD and arranging the bids and asks.

order_book = c.get_product_order_book('BTC-USD')order_book

Next step is creating the two data frames:

bids = pd.DataFrame(order_book['bids'])asks = pd.DataFrame(order_book['asks'])bids.head()

Now merging them and rename the columns to be more informative:

df = pd.merge(bids, asks, left_index=True, right_index=True)df = df.rename({"0_x":"Bid Price","1_x":"Bid Size", "2_x":"Bid Amount","0_y":"Ask Price","1_y":"Ask Size", "2_y":"Ask Amount"}, axis='columns')df.head()

Trades Data

To obtain the Trades Data, use the get_product_trades endpoint. Don’t forget to enter the asset obtaining the data on; ETH-USD in this example.

trades = pd.DataFrame(requests.get('https://api.pro.coinbase.com/products/ETH-USD/trades').json())trades.tail()

Not to get the Python library stuck, use the REST API.

How to use Coinbase Pro WebSocket API?

To access Coinbase Pro WebSockets use the WebscoketClient endpoint. Thanks to it, traders can easily stay updated on the interesting data.

import cbprowsc = cbpro.WebsocketClient(url="wss://ws-feed.pro.coinbase.com", products="ADA-USD",channels=["ticker"])

To close the WebSocket, just use a simple command:

wsc.close()

The next command helps to collect the ticker price data up to a certain number of WebSocket messages and print them out:

import time, cbproclass myWebsocketClient(cbpro.WebsocketClient):def on_open(self):self.url = "wss://ws-feed.pro.coinbase.com/"self.products = ["ETH-USDT"]self.channels=["ticker"]self.message_count = 0def on_message(self, msg):self.message_count += 1if 'price' in msg and 'type' in msg:print ("Message type:", msg["type"],"\t@ {:.3f}".format(float(msg["price"])))def on_close(self):print("Closing")wsClient = myWebsocketClient()wsClient.start()print(wsClient.url, wsClient.products, wsClient.channels)while (wsClient.message_count < 50):print ("\nmessage_count =", "{} \n".format(wsClient.message_count))time.sleep(1)wsClient.close()

Executing Trades on Coinbase Pro API

With the python Coinbase API commands, it is quite simple to execute trades. Let’s have a look at two examples: executing a trade on ETH when BTC hits a certain price and executing an ETH trade when BTC moves 5% in the last 5 minutes.

How to Execute a Trade on ETH When BTC Hits a Certain Price?

Now let’s find out how to properly launch an order with specified requirements: begin a trade on ETH when BTC hits a certain price (e.g. $38500).

1. Set an order foundation;

2. Create a loop that will check whether the price level is hit or not;

3. Once the price is hit, a market order will be executed;

4. Wait for a few seconds and check if the order has been really filled.

After setting the logic, it’s time to import the relevant libraries and set up the APIs:

import cbproimport base64import json from timeimport sleepkey = ''secret = ''passphrase = ''encoded = json.dumps(secret).encode()b64secret = base64.b64encode(encoded)auth_client = cbpro.AuthenticatedClient(key=key, b64secret=secret, passphrase=passphrase)c = cbpro.PublicClient()

As for the main trading logic, here’s an important notice to make the order safer. To do so, place a limit order by taking the current ETH-USD price and adding a few dollars on the top.

while True:try:ticker = c.get_product_ticker(product_id='BTC-USD')except Exception as e:print(f'Error obtaining ticker data: {e}')if float(ticker['price']) >= 38500.00:try:limit = c.get_product_ticker(product_id='ETH-USD')except Exception as e:print(f'Error obtaining ticker data: {e}')try:order=auth_client.place_limit_order(product_id='ETH-USDT',side='buy',price=float(limit['price'])+2,size='0.007')except Exception as e:print(f'Error placing order: {e}')sleep(2)try:check = order['id']check_order = auth_client.get_order(order_id=check)except Exception as e:print(f'Unable to check order. It might be rejected. {e}')if check_order['status'] == 'done':print('Order placed successfully')print(check_order)breakelse:print('Order was not matched')breakelse:print(f'The requirement is not reached. The ticker price is at {ticker["price"]}')sleep(10)

How to execute an ETH trade when BTC moves 5% in the last 5 minutes?

The task gets slightly complicated. The new loop will have to get the prices of the two cryptocurrencies and calculate the percentage change in between:

● If the percentage change is less than 5%, the program will be sleeping for 5 more minutes;

● If the percentage change is equal to or more than 5%, the trade will execute.

Wait for a few seconds after the accomplishment, and check on the trade again.

while True:try:ticker_old = c.get_product_ticker(product_id='BTC-USD')except Exception as e:print(f'Error obtaining ticker data: {e}')sleep(300)try:ticker_new = c.get_product_ticker(product_id='BTC-USD')except Exception as e:print(f'Error obtaining ticker data: {e}')percent = ((float(ticker_new['price']) - float(ticker_old['price']))*100)/float(ticker_old['price'])if percent >= 5:try:limit = c.get_product_ticker(product_id='ETH-USDT')except Exception as e:print(f'Error obtaining ticker data: {e}')try:order=auth_client.place_limit_order(product_id='ETH-USDT',side='buy',price=float(limit['price'])+2,size='0.007')except Exception as e:print(f'Error placing order: {e}')sleep(2)try:check = order['id']check_order = auth_client.get_order(order_id=check)except Exception as e:print(f'Unable to check order. It might be rejected. {e}')if check_order['status'] == 'done':print('Order placed successfully')print(check_order)breakelse:print('Order was not matched')breakelse:print(f'The requirement is not reached. The percent change is at {percent}')

How to cancel orders with Coinbase Pro API?

It is very simple to cancel an order. Go to the cancel_order API endpoint and enter the order id as a parameter:

client.cancel_order(order_id = "ORDER-ID-HERE")

Conclusion

In this article, we took a closer look at Coinbase Pro API and gave a few python code examples. The full code may be found on the platform’s GitHub page.

покупок. Здесь можно найти товары разных категорий, от бытовой техники до уникальных аксессуаров.

Скидки и акции делают покупки ещё более экономными, а отзывы помогают выбрать проверенных продавцов.

Защита сделок на платформе mega зеркало гарантирует безопасность каждой

покупки. Именно mega сайт тор ссылка продолжает быть одним из самых популярных онлайн-ресурсов.

https://xn--mg-sb-6za9404c.com — mega link

Здесь доступен широкий выбор товаров: от бытовой техники до эксклюзивных

аксессуаров. Скидки и акции

делают покупки ещё более экономными, а

отзывы помогают выбрать проверенных продавцов.

Защита сделок на платформе mega маркетплейс гарантирует

безопасность каждой покупки.

Именно мега официальный сайт продолжает

быть одним из самых популярных онлайн-ресурсов.

https://xn--mg-sb-6za9404c.com — mega onion

возможность найти всё, что угодно, не выходя из дома.

Ассортимент включает в себя как

новые, так и бывшие в употреблении товары – от одежды и электроники

до винтажных украшений и аксессуаров.

Удобные функции поиска на что с мегой делают процесс

нахождения нужных товаров быстрым и лёгким.

Mega радует своих пользователей

частыми скидками и акциями. Совершайте покупки на mg11 at для экономии и приобретения проверенных товаров.

сайт мега даркнет: https://xn--mg-sb-6za9404c.com

I like how you put it together so neatly.

гарантия качества делают шопинг комфортным и безопасным.

Мега предоставляет широкий выбор

техники, модной одежды, украшений

и других товаров. Простой интерфейс, выгодные предложения и надёжная защита

превращают шопинг в удовольствие.

Покупатели доверяют mega как попасть за качество и доступность.

Благодаря этим особенностям mega ссылка

tor удерживает лидерские позиции среди торговых

площадок.

мега онион ссылку: https://xn--mg-sb-6za9404c.com

Mega предлагает широкий ассортимент товаров,

включая электронику и редкие аксессуары.

На hidemega защита сделок гарантирует безопасные покупки.

Не лишним будет добавить, mega fo ссылка предлагает акции

и скидки, благодаря которым покупатели могут сэкономить.

https://xn--mea-sb-j6a.com — ссылка mega sb

▶ https://maltaeng.com/

— Enroll in English classes at the leading language

school in Malta at discounted prices — Improve your English fluency...

✅ Studying English in Malta — Study English in Malta —

the destination where it is the mother tongue!

http://F.R.A.G.Ra.Nc.E.Rnmn%40.R.OS.P.E.R.Les.C@Pezedium.Free.fr/?a%5B%5D=%3Ca+href%3Dhttp%3A%2F%2Fmcgrewfam.com%2F__media__%2Fjs%2Fnetsoltrademark.php%3Fd%3DHttps%25253a%25252folv.E.L.u.pc%2540Haedongacademy.org%252Fphpinfo.php%253Fa%25255B%25255D%253D%25253Ca%252Bhref%25253Dhttps%25253A%25252F%25252Fwww.mythmoor.com%25252Freasons-to-choose-malta-for-english-studies-debunking-myths-and-seizing-opportunities%25252F%25253EEnglish%252Bfor%252Badults%252Bin%252BMalta%25253C%25252Fa%25253E%25253Cmeta%252Bhttp-equiv%25253Drefresh%252Bcontent%25253D0%25253Burl%25253Dhttps%25253A%25252F%25252Fcroptech.com.sa%25252Flanguages-in-malta-maltese-locals-see-english-as-their-native-language-and-use-it-throughout-their-entire-education-language-travel%25252F%252B%25252F%25253E%3ELanguage+courses+in+Malta%3C%2Fa%3E%3Cmeta+http-equiv%3Drefresh+content%3D0%3Burl%3Dhttp%3A%2F%2F%28...%29Xped.It.Io.N.Eg.D.G%40Burton.Rene%40bestket.com%2Finfo.php%3Fa%255B%255D%3D%253Ca%2Bhref%253Dhttp%253A%252F%252FHttps%2525253A%2525252F%252525Evolv.E.L.U.PC%2540Haedongacademy.org%252Fphpinfo.php%253Fa%25255B%25255D%253D%25253Ca%252Bhref%25253Dhttps%25253A%25252F%25252Fwww.mythmoor.com%25252Freasons-to-choose-malta-for-english-studies-debunking-myths-and-seizing-opportunities%25252F%25253EEnglish%252Bin%252BMalta%25253C%25252Fa%25253E%25253Cmeta%252Bhttp-equiv%25253Drefresh%252Bcontent%25253D0%25253Burl%25253Dhttps%25253A%25252F%25252Fscientific-programs.science%25252Fwiki%25252FInternational_English_Language_Schools_In_Malta%25253A_Acquire_English_Proficiency_And_Expand_Your_Social_Circle_Without_Even_Trying...%252B%25252F%25253E%253ELearn%2Band%2Bpractise%2BEnglish%2Bin%2BMalta%253C%252Fa%253E%253Cmeta%2Bhttp-equiv%253Drefresh%2Bcontent%253D0%253Burl%253Dhttp%253A%252F%252FHttps%25253a%25252folv.E.L.u.pc%2540Haedongacademy.org%252Fphpinfo.php%253Fa%25255B%25255D%253D%25253Ca%252Bhref%25253Dhttps%25253A%25252F%25252Fnerdgaming.science%25252Fwiki%25252FUser%25253AAdalbertoEspinal%25253ELanguage%252Bschools%252Bin%252BMalta%25253C%25252Fa%25253E%25253Cmeta%252Bhttp-e — English in Malta, best english school in Malta

Is this a paid theme or did you customize

it yourself? Either way keep up the nice quality writing,

it is rare to see a nice blog like this one today.

http://socleads.com/

Gather emailing addresses from social media and google

maps simply!

email scraper from website — email address scraper, email scraper from website, web email scraper

https://link.inverser.pro/r?l=aHR0cDovL2h0dHBzJTI1M2ElMjUyZiUyNWV2b2x2LkUubC5VLlBjQGhhZWRvbmdhY2FkZW15Lm9yZy9waHBpbmZvLnBocD9hJTVCJTVEPSUzQ2EraHJlZiUzRGh0dHAlM0ElMkYlMkZLZXBlbmslMjUyMHRyc2ZjZGhmLmhmaGpmLmhkYXNnc2RmaGRzaHNoZnNoJTQwRm9ydW0uQW5uZWN5LW91dGRvb3IuY29tJTJGc3VpdmlfZm9ydW0lMkYlM0ZhJTI1NUIlMjU1RCUzRCUyNTNDYSUyQmhyZWYlMjUzRGh0dHBzJTI1M0ElMjUyRiUyNTJGYXJ0c3RpYy5jb20lMjUyRmdyb3VwcyUyNTJGbGVhZGluZy1lbWFpbGluZy1hZGRyZXNzZXMtZXh0cmFjdG9ycy1hbmQtbWFya2V0aW5nLXNvZnR3YXJlLWZvci1lZmZlY3RpdmUtb3V0cmVhY2glMjUyRiUyNTNFZW1haWwlMkJsaXN0JTJCc2NyYXBlciUyNTNDJTI1MkZhJTI1M0UlMjUzQ21ldGElMkJodHRwLWVxdWl2JTI1M0RyZWZyZXNoJTJCY29udGVudCUyNTNEMCUyNTNCdXJsJTI1M0RodHRwcyUyNTNBJTI1MkYlMjUyRnlvZ2Fhc2FuYXMuc2NpZW5jZSUyNTJGd2lraSUyNTJGTWFzdGVyaW5nX1dlYnNjcmFwaW5nX0Zvcl9FbWFpbF9PdXRyZWFjaCUyQiUyNTJGJTI1M0UlM0VzY3JhcGVyK2VtYWlsJTNDJTJGYSUzRSUzQ21ldGEraHR0cC1lcXVpdiUzRHJlZnJlc2grY29udGVudCUzRDAlM0J1cmwlM0RodHRwJTNBJTJGJTJGb3AuQXRhcmdldCUzRCUyNTVDJTI1MjJfQmxhbmslMjU1QyUyNTIyJTI1MjBocmVmbWFpbHRvJTNBZSU0MEVob3N0aW5ncG9pbnQuY29tJTJGaW5mby5waHAlM0ZhJTI1NUIlMjU1RCUzRCUyNTNDYSUyQmhyZWYlMjUzRGh0dHBzJTI1M0ElMjUyRiUyNTJGbmVyZGdhbWluZy5zY2llbmNlJTI1MkZ3aWtpJTI1MkZVc2VyJTI1M0FKb3NlZmFQb3J0MTQwNTYlMjUzRWVtYWlsJTJCc2NyYXBpbmclMjUzQyUyNTJGYSUyNTNFJTI1M0NtZXRhJTJCaHR0cC1lcXVpdiUyNTNEcmVmcmVzaCUyQmNvbnRlbnQlMjUzRDAlMjUzQnVybCUyNTNEaHR0cHMlMjUzQSUyNTJGJTI1MkZtb3JwaG9taWNzLnNjaWVuY2UlMjUyRndpa2klMjUyRlVzZXIlMjUzQUthaXRseW5IdXBwJTJCJTI1MkYlMjUzRSslMkYlM0U

Look advanced to more added agreeable from you!

By the way, how can we communicate?

▶ MALTAENG

— Enroll in English classes at the best language school in Malta at discounted prices .

▶ Language courses in Malta — Learn and practise English in Malta — the

country where it is native.

http://aaib.info/__media__/js/netsoltrademark.php?d=pattern-wiki.win%2Fwiki%2FUser%3ABethHines3 — Language courses in Malta, Learn English in Malta at

the best price

may just anybody get that type of information in such an ideal way

of writing? I have a presentation next week, and I am on the look for such information.

⭐ socleads.com

Gain email addresses from gmaps and social media comfortably!!!

email id scraper — scraper email, web email scraper, scraper email

http://www.2ndgenerationvehicles.biz/__media__/js/netsoltrademark.php?d=links.gtanet.com.br%2Fjoyceharriso

7200 N Broadway Ave,

Rochester, MN 55906, United Ꮪtates

18005352375

Rockwood wal mergers

{аркада казино зеркало на сегодня|https://mj-go.kr/bbs/board.php?bo_table=free&wr_id=2021242}|{Аркада|Arkada} – {официальный|рабочий} {вход|зеркало} {сегодня|прямо сейчас}

{arkada свежее зеркало|https://viewbookmark.com/story.php?title=arkada-KAZINO-%E2%80%93-FRISPINY}|{Регистрация|Аккаунт} в {Аркада|Arkada} – {бонус|фриспины} за {первый

депозит|вход} {онлайн казино аркада|https://www.buyfags.moe/User:LaureneVgi}|{Вход|Доступ} через {зеркало|официальный

сайт} {Аркада|Arkada} {arkada casino зеркало|http://www.snye.co.kr/bbs/board.php?bo_table=free&wr_id=1181805}|{Рабочее|Актуальное} {зеркало|альтернативный сайт}

{Аркада|Arkada} {2024|сегодня} {мобильное приложение

arkada|http://www.olangodito.com/bbs/board.php?bo_table=free&wr_id=4296586}|{Аркада зеркало|Arkada casino}

– {обход блокировки|бесперебойный доступ}

{официальный сайт аркада онлайн|http://www.olangodito.com/bbs/board.php?bo_table=free&wr_id=4323435}|{Как|Где} {найти|открыть} {зеркало|сайт} {Аркада|Arkada}?

{arkada com интернет казино|http://www.snye.co.kr/bbs/board.php?bo_table=free&wr_id=1182201}|{Зеркало|Альтернативный вход} {Аркада|Arkada} – {играть|выигрывать} без {проблем|ограничений} {аркада казино онлайн

вход|https://pubhis.w3devpro.com/mediawiki/index.php?title=Gebruiker:EldenCoates8788}|{Свежее|Новое} {зеркало|ссылка} {Аркада|Arkada} – {рабочее|проверенное} {аркада

казино официальный|https://dohasearch.com/index.php?page=user&action=pub_profile&id=4945}|{Бонус|Фриспины} за {регистрацию|первый депозит} в {Аркада|Arkada} {аркада казино

официальный сайт зеркало|http://www.dotank.kr/bbs/board.php?bo_table=free&wr_id=229059}|{Промокод|Бонус-код} {Аркада|Arkada}

– {получить|активировать} {выгодно|бесплатно} {аркада зеркало на сегодня|https://presslibrary.wiki/index.php?title=User:StephaniaSeagle}|{Бездепозитный бонус|Фриспины} в

{Аркада казино|Arkada casino} {аркада доступное зеркало|https://ssjcompanyinc.official.jp/bbs/board.php?bo_table=free&wr_id=4257880}|{Выгодные|Эксклюзивные} {акции|бонусы} в {Аркада|Arkada} {аркада фриспины|https://www.snye.co.kr/bbs/board.php?bo_table=free&wr_id=1181986}|{Как|Где} {получить|использовать} {бонус|промокод} в {Аркада|Arkada}?

{arkada онлайн казино официальный сайт вход|https://namosusan.com/bbs/board.php?bo_table=free&wr_id=1492831}|{Игровые автоматы|Слоты}

{Аркада|Arkada} – {топ|лучшие} игры {2024|сегодня} {рио

бет официальный сайт|http://me-d.kr/_board/bbs/board.php?bo_table=free&wr_id=49662}|{Играть|Выигрывать} в {Аркада казино|Arkada casino} – {хиты|популярные

слоты} {аркада ставки на

спорт|http://punbb.8u.cz/topic34690-arkada-prilozhenie-dlya-ios.html}|{Рейтинг|Обзор} {игровых автоматов|слотов} {Аркада|Arkada} {аркада онлайн|http://zerodh.co.kr/bbs/board.php?bo_table=free&wr_id=33113}|{Новые|Лучшие} {слоты|игры} в {Аркада|Arkada} – {попробуй|испытай удачу}

{казино аркада вход|http://hotissuemedical.com/bbs/board.php?bo_table=free&wr_id=1754805}|{Играть бесплатно|Демо-режим} в {Аркада|Arkada} –

{без риска|без регистрации} {аркада казино играть зеркало|http://biz.godwebs.com/bbs/board.php?bo_table=free&wr_id=113617}|{Рулетка|Лайв-рулетка} в {Аркада|Arkada} – {стратегии|выигрышные тактики} {casino arkada официальный сайт|http://stephankrieger.net/index.php?title=Benutzer:HermanHerrington}|{Live-казино|Лайв-дилеры} {Аркада|Arkada} – {реальный|азартный} опыт {arkada официальный|https://fakenews.win/wiki/%D0%97%D0%B5%D1%80%D0%BA%D0%B0%D0%BB%D0%BE_%D0%90%D1%80%D0%BA%D0%B0%D0%B4%D0%B0_%E2%80%93_%D0%A1%D1%82%D0%B0%D0%B1%D0%B8%D0%BB%D1%8C%D0%BD%D1%8B%D0%B9_%D0%94%D0%BE%D1%81%D1%82%D1%83%D0%BF_%D0%9A_%D0%9E%D1%84%D0%B8%D1%86%D0%B8%D0%B0%D0%BB%D1%8C%D0%BD%D0%BE%D0%BC%D1%83_%D0%A1%D0%B0%D0%B9%D1%82%D1%83}|{Как|Секреты} {выиграть|обыграть}

в {рулетку|блэкджек} {Аркада|Arkada} {аркада рулетка|http://www.reviews.ipt.pw/out/PROMOKOD-ARKADA-KHALYAVA-%E2%80%93-IGRAT-I-VYIGRYVAT/}|{Лучшие|Топовые} {live-игры|столы} в

{Аркада казино|Arkada casino} {аркада под|http://animo.house/bbs/board.php?bo_table=free&wr_id=836287}|{Играть в рулетку|Ставки} в {Аркада|Arkada} – {реально|с выигрышем} {аркада

зеркало рабочее на сегодня официальный сайт|http://hajepine.com/bbs/board.php?bo_table=free&wr_id=266996}|{Аркада|Arkada} – {мобильная версия|приложение} для {Android|iOS}

{arkada casino бездепозитный

бонус|https://ssjcompanyinc.official.jp/bbs/board.php?bo_table=free&wr_id=4268210}|{Скачать|Установить} {Аркада|Arkada} на {телефон|планшет} – {быстро|удобно} {казино аркада зеркало|https://www.snye.co.kr/bbs/board.php?bo_table=free&wr_id=1182678}|{Мобильное казино|Игра с

телефона} {Аркада|Arkada} – {доступно|в любое время}

{аркада зеркало на сегодня|https://www.eaccwiki.com/wiki/%D0%90%D1%80%D0%BA%D0%B0%D0%B4%D0%B0_%D0%9A%D0%B0%D0%B7%D0%B8%D0%BD%D0%BE_%D0%9E%D1%84%D0%B8%D1%86%D0%B8%D0%B0%D0%BB%D1%8C%D0%BD%D1%8B%D0%B9_%D0%A1%D0%B0%D0%B9%D1%82_%D0%97%D0%B5%D1%80%D0%BA%D0%B0%D0%BB%D0%BE}|{Как|Где} {скачать|установить} {приложение|APK} {Arkada|Аркада}?

{казино аркада альтернативный сайт|https://www.murraybridge4wdclub.org.au/forums/users/vaughnspell46/}|{Играть|Делать ставки} в {Аркада|Arkada} с

{телефона|мобильного} {сайт

arkada casino|http://www.r2tbiohospital.com/bbs/board.php?bo_table=free&wr_id=5000629}|{Вывод средств|Выплаты} в {Аркада|Arkada} – {быстро|без задержек} {аркада официальный сайт зеркало на сегодня|https://xn--vf4bqiy7povj.net/bbs/board.php?bo_table=free&wr_id=11232}|{Как|Способы} {вывести|получить} {деньги|выигрыш} в {Аркада|Arkada} {arkada casino

официальный сайт зеркало рабочее|http://old.remain.co.kr/bbs/board.php?bo_table=free&wr_id=4198184}|{Минимальная|Максимальная} {сумма|ставка} для {вывода|депозита} в {Аркада|Arkada} {игровой аппарат arkada|http://naviondental.com/bbs/board.php?bo_table=free&wr_id=1960408}|{Быстрые|Мгновенные} {выплаты|транзакции} в {Аркада казино|Arkada casino} {аркада

зеркало сайта|http://stephankrieger.net/index.php?title=Benutzer:HermanHerrington}|{Проблемы|Задержки} с {выводом|выплатами} в {Аркада|Arkada} – {решение|советы}

{arkada 500 рублей|http://xn--9d0br01aqnsdfay3c.kr/bbs/board.php?bo_table=free&wr_id=2807056}|{Лицензионное|Надежное} казино {Аркада|Arkada} – {безопасность|честность} {аркада лайф рулетка зеркало|https://funsilo.date/wiki/User:RomanClemmons4}|{Как|Почему} {проверить|доверять} {Аркада казино|Arkada casino}?

{arkada вход официальный сайт|https://library.kemu.ac.ke/kemuwiki/index.php/Arkada_%D0%97%D0%B5%D1%80%D0%BA%D0%B0%D0%BB%D0%BE_%D0%9D%D0%B0_%D0%A1%D0%B5%D0%B3%D0%BE%D0%B4%D0%BD%D1%8F_%E2%80%93_2024}|{Защита|Конфиденциальность} данных в {Аркада|Arkada} –

{безопасно|надежно} {arkada бонус за регистрацию|http://bwiki.dirkmeyer.info/index.php?title=Benutzer:Ilse69R7712}|{Честная игра|Без обмана} в

{Аркада|Arkada} – {гарантии|проверка} {казино аркада официальный сайт|https://hikvisiondb.webcam/wiki/User:MajorLhotsky811}|{Мошенничество|Развод} в {Аркада|Arkada}

– {правда|миф}? {arkada микроставки|https://wiki.snooze-hotelsoftware.de/index.php?title=Benutzer:CollinProud96}|{Отзывы|Реальные мнения} о {Аркада казино|Arkada casino} {аркада автоматы|https://gummipuppen-wiki.de/index.php?title=Benutzer:KateRingrose9}|{Плюсы|Минусы} {Аркада|Arkada} – {честный обзор|мнение экспертов} {казино аркада|http://gmeco.org/bbs/board.php?bo_table=free&wr_id=982447}|{Рейтинг|Топ} {онлайн-казино|игровых клубов} – {Аркада|Arkada} в

{списке|рейтинге} {казино аркада альтернативный сайт|https://medhost.com.mx/forums/users/lateshaborders4/}|{Почему|За что} {игроки|пользователи} {любят|выбирают} {Аркада|Arkada}?

{аркада казино играть зеркало|https://seconddialog.com/question/%d0%b1%d0%be%d0%bd%d1%83%d1%81-%d0%b7%d0%b0-%d1%80%d0%b5%d0%b3%d0%b8%d1%81%d1%82%d1%80%d0%b0%d1%86%d0%b8%d1%8e-%d0%b2-%d0%b0%d1%80%d0%ba%d0%b0%d0%b4%d0%b0-%d1%8d%d0%ba%d1%81%d0%ba%d0%bb/}|{Реальные|Негативные} {отзывы|истории} о {Аркада|Arkada} {аркада десктоп|https://wiki.arsbi.com/index.php/%D0%A3%D1%87%D0%B0%D1%81%D1%82%D0%BD%D0%B8%D0%BA:FinleyStapylton}|{Секреты|Стратегии} {выигрыша|успеха} в {Аркада|Arkada} {аркада официальный

arkada-psd.ru|https://lamantstudio.net/bbs/board.php?bo_table=free&wr_id=8945996}|{Как|Советы} {играть|выигрывать}

в {слоты|рулетку} {Аркада|Arkada} {казино аркада официальный|https://ssjcompanyinc.official.jp/bbs/board.php?bo_table=free&wr_id=4251563}|{Тактики|Методы} для {начинающих|опытных} в {Аркада казино|Arkada casino} {аркада депозит за регистрацию|https://xn--pm2b0fr21aooo.com/bbs/board.php?bo_table=free&wr_id=964245}|{Управление банкроллом|Ставки}

в {Аркада|Arkada} – {правила|советы} {аркада доступное зеркало|https://itformula.ca/index.php?title=User:EltonWilde93}|{Как|Почему} {проигрывать|терять} в {Аркада|Arkada} – {ошибки|разбор} {аркада казино

официальный сайт вход|https://ssjcompanyinc.official.jp/bbs/board.php?bo_table=free&wr_id=4263859}|{Топ-10|Лучшие} {игровых автоматов|слотов} в

{Аркада|Arkada} {2024|в этом году} {скачать аркада казино|http://hajepine.com/bbs/board.php?bo_table=free&wr_id=263398}|{Новинки|Свежие} {слоты|игры} в {Аркада казино|Arkada casino} – {испытай|попробуй} первым {играть рулетка аркада|https://nowwedws.com/bbs/board.php?bo_table=free&wr_id=8531793}|{Высокий|Максимальный} RTP в {Аркада|Arkada}

– {где|какие} {слоты|автоматы} {лучшие|выгодные} {аркада промокод|https://ssjcompanyinc.official.jp/bbs/board.php?bo_table=free&wr_id=4164309}|{Джекпот|Крупный выигрыш}

в {Аркада|Arkada} – {истории|реальные} {побед|выплат} {официальный

сайт аркада онлайн казино|http://www.seong-ok.kr/bbs/board.php?bo_table=free&wr_id=3067805}|{Слоты с бонусами|Игры с

фриспинами} в {Аркада|Arkada} – {актуальный|полный} {список|обзор} {arkada андроид|https://stayzada.com/bbs/board.php?bo_table=free&wr_id=123307}|Рулетка и live-игры (продолжение)

{казино arkada официальный сайт|http://kcmas.co.kr/bbs/board.php?bo_table=free&wr_id=173549}|{Стратегии|Тактики} для {рулетки|блэкджека} в {Аркада|Arkada} –

{работают|проверено} {arkada официальный сайт|http://www.sjpaper.kr/bbs/board.php?bo_table=free&wr_id=330500}|{Лучшие дилеры|Топовые столы} в {лайв-казино|live-рулетке}

{Аркада|Arkada} {аркада казино зеркало на

сегодня|https://ppr.depzdrav.kz/question/%d0%b0%d1%80%d0%ba%d0%b0%d0%b4%d0%b0-%d0%be%d1%84%d0%b8%d1%86%d0%b8%d0%b0%d0%bb%d1%8c%d0%bd%d1%8b%d0%b9-%d1%81%d0%b0%d0%b9%d1%82-%d0%b4%d0%bb%d1%8f-%d0%b8%d0%b3%d1%80%d1%8b/?lang=ru}|{Как выиграть|Секреты}

в {лайв-играх|live-дилерах} {Аркада|Arkada} {рулетка arkada|https://socialrator.com/story10213277/%D0%91%D0%B5%D0%B7%D0%B4%D0%B5%D0%BF%D0%BE%D0%B7%D0%B8%D1%82%D0%BD%D1%8B%D0%B9-%D0%B1%D0%BE%D0%BD%D1%83%D1%81-arkada-%D0%B2%D1%8B%D0%B8%D0%B3%D1%80%D1%8B%D0%B2%D0%B0%D1%82%D1%8C}|{Минимальные|Максимальные} {ставки|лимиты}

в {рулетке|блэкджеке} {Аркада|Arkada}

{аркада бонусы через компьютер|http://hajepine.com/bbs/board.php?bo_table=free&wr_id=254112}|{Режимы|Виды} {рулетки|баккары} в {Аркада казино|Arkada casino}

{аркада моя страница|https://wikigranny.com/wiki/index.php/Arkada_%C3%90%C2%A1%C3%91%E2%80%9A%C3%90%C2%B0%C3%90%C2%B2%C3%90%C2%BA%C3%90%C2%B8_%C3%A2%E2%82%AC%E2%80%9C_%C3%90%C3%A2%E2%82%AC%E2%84%A2%C3%91%E2%80%B9%C3%90%C2%B8%C3%90%C2%B3%C3%91%E2%82%AC%C3%91%E2%80%B9%C3%91%CB%86%C3%90%C2%BD%C3%91%E2%80%B9%C3%90%C2%B5_%C3%90%C2%A1%C3%91%E2%80%9A%C3%91%E2%82%AC%C3%90%C2%B0%C3%91%E2%80%9A%C3%90%C2%B5%C3%90%C2%B3%C3%90%C2%B8%C3%90%C2%B8}|{Эксклюзивный|Специальный} {бонус|промокод} для {новых|постоянных} игроков {Аркада|Arkada} {arkada casino официальный сайт вход|http://service.megaworks.ai/board/bbs/board.php?bo_table=hwang_form&wr_id=2398270}|{Как отыграть|Условия} {бездепозитный бонус|фриспины}

в {Аркада|Arkada} {arkada онлайн казино

официальный сайт вход|https://ehealthmeetlat.nl/forums/users/brandieboucicaul/edit/?updated=true/users/brandieboucicaul/}|{Кэшбэк|Возврат} в {Аркада казино|Arkada casino} – {размер|условия} получения {аркада фриспины|http://sellthisguitar.com/index.php?page=user&action=pub_profile&id=22018}|{Турниры|Акции} в {Аркада|Arkada} – {крупные|еженедельные} {разыгрыши|призы} {аркада зеркало рабочее|http://www.consis.kr/board/bbs/board.php?bo_table=as&wr_id=194942}|{Фриспины|Бесплатные вращения} за {депозит|активность} в {Аркада|Arkada} {аркада казино онлайн|http://hotissuemedical.com/bbs/board.php?bo_table=free&wr_id=1754805}|{Аркада|Arkada} на {Андроид|iOS}

– {скачать|установить} {бесплатно|официально} {аркада играть|https://plamosoku.com/enjyo/index.php?title=%C3%90%C3%91%E2%82%AC%C3%90%C2%BA%C3%90%C2%B0%C3%90%C2%B4%C3%90%C2%B0_%C3%90%C3%A2%E2%82%AC%E2%84%A2_%C3%90%E2%80%98%C3%91%E2%82%AC%C3%90%C2%B0%C3%91%C6%92%C3%90%C2%B7%C3%90%C2%B5%C3%91%E2%82%AC%C3%90%C2%B5_%C3%A2%E2%82%AC%E2%80%9C_%C3%90%E2%80%98%C3%90%C2%B5%C3%90%C2%B7_%C3%90%C2%A1%C2%BA%C3%90%C2%B0%C3%91%E2%80%A1%C3%90%C2%B8%C3%90%C2%B2%C3%90%C2%B0%C3%90%C2%BD%C3%90%C2%B8%C3%91}|{Мобильная версия|Приложение} {Аркада|Arkada} – {плюсы|минусы} {использования|игры} {arkada регистрация|https://ssjcompanyinc.official.jp/bbs/board.php?bo_table=free&wr_id=4256152}|{Как играть|Делать ставки} в {Аркада|Arkada} с {телефона|планшета} {аркада зеркало рабочее на сегодня официальный сайт|https://ssjcompanyinc.official.jp/bbs/board.php?bo_table=free&wr_id=4264915}|{Оптимизация|Скорость} {мобильного

казино|игры} {Аркада|Arkada} – {обзор|тест} {arkada казино сайт|http://43.199.183.204/wiki/Arkada_%D0%92%D1%85%D0%BE%D0%B4_%E2%80%93_%D0%A0%D0%B0%D0%B1%D0%BE%D1%87%D0%B8%D0%B5_%D0%A1%D0%BF%D0%BE%D1%81%D0%BE%D0%B1%D1%8B_%D0%92%D1%85%D0%BE%D0%B4%D0%B0_%D0%92_2024}|{Официальное приложение|APK-файл} {Аркада|Arkada} – {где|как}

{скачать|установить} {arkada бонус за регистрацию|https://ssjcompanyinc.official.jp/bbs/board.php?bo_table=free&wr_id=4170741}|{Минимальная сумма|Лимиты} для

{вывода|депозита} в {Аркада|Arkada} {arkada

зеркало рабочее на сегодня|https://ssjcompanyinc.official.jp/bbs/board.php?bo_table=free&wr_id=4168732}|{Быстрые выплаты|Мгновенные транзакции} в

{Аркада казино|Arkada casino} –

{способы|сроки} {arkada андроид|http://lhtalent.free.fr/modules.php?name=Your_Account&op=userinfo&username=RaulAckerm}|{Проблемы с выводом|Задержки выплат} в

{Аркада|Arkada} – {решение|поддержка} {мобильное приложение arkada|https://fa.earnvisits.com/index.php?page=user&action=pub_profile&id=221902}|{Криптовалюты|Биткоин} в

{Аркада|Arkada} – {пополнение|вывод} {анонимно|быстро} {аркада онлайн

казино официальный сайт|https://xeuser.gajaga.work/index.php?mid=board&document_srl=1554300}|{Безопасные платежи|Проверенные методы} в {Аркада|Arkada} {казино

аркада зеркало|https://ssjcompanyinc.official.jp/bbs/board.php?bo_table=free&wr_id=4282433}|{Лицензия|Регуляция} {Аркада казино|Arkada casino} – {проверка|подлинность} {arkada casino официальный сайт|https://valetinowiki.racing/wiki/User:JudyStonehouse}|{Мошенничество|Развод} в {Аркада|Arkada} – {как|почему}

{избежать|проверить} {аркада казино зеркало сегодня|http://www.pottomall.com/bbs/board.php?bo_table=free&wr_id=3273208}|{Честная игра|Генератор случайных чисел} в {Аркада|Arkada} –

{гарантии|тесты} {аркада казино зеркало|http://gyeongshin.co.kr/kscn/bbs/board.php?bo_table=free&wr_id=174734}|{Защита данных|Конфиденциальность} в {Аркада|Arkada} – {шифрование|безопасность} {аркада

казино онлайн|http://m.harimint.com/bbs/board.php?bo_table=free&wr_id=973196}|{Проверенные отзывы|Реальные

игроки} о {Аркада|Arkada} – {доверять|сомневаться} {аркада свежее зеркало|http://naviondental.com/bbs/board.php?bo_table=free&wr_id=1949855}|{Аркада vs Риобет|Сравнение казино} – {плюсы|минусы} каждого {аркада обзор|http://wiki.naval.ch/index.php?title=Benutzer:RebbecaBaron4}|{Аналоги|Похожие казино} на

{Аркада|Arkada} – {обзор|рейтинг} {игровые аппараты аркада зеркало|http://bluetf.com/bbs/board.php?bo_table=free&wr_id=41144}|{Почему|За что} {игроки|новички} выбирают {Аркада|Arkada}?

{arkada андроид|http://www.heart-hotel.com/comment/html/?181390.html}|{Лучшие альтернативы|Топ-замены} {Аркада|Arkada}

в {2024|этом году} {аркада официальный сайт рабочее зеркало

на сегодня|https://www.100seinclub.com/bbs/board.php?bo_table=E04_1&wr_id=1409729}|{Аркада или другое казино|Что лучше?} – {сравнение|выводы} {аркада официальный

сайт зеркало на сегодня|http://125.141.133.9:7001/bbs/board.php?bo_table=free&wr_id=5022047}|{Как увеличить|Секреты} {выигрыш|банкролл} в {Аркада|Arkada}

{аркада официальный сайт зеркало|https://alnoorsoft.com/blog/index.php?entryid=2408}|{Ошибки|Главные промахи} {новичков|игроков} в {Аркада казино|Arkada

casino} {аркада депозит за регистрацию|http://www.seong-ok.kr/bbs/board.php?bo_table=free&wr_id=3061340}|{Психология|Тактика} {азартной игры|ставок} в {Аркада|Arkada} {аркада

промокод фриспины|http://www.seong-ok.kr/bbs/board.php?bo_table=free&wr_id=3153863}|{Как не проиграть|Сберечь депозит}

в {Аркада|Arkada} – {советы|правила} {arkada официальный|http://hajepine.com/bbs/board.php?bo_table=free&wr_id=263398}|{Управление деньгами|Банкролл-менеджмент} в

{Аркада|Arkada} {аркада вывод средств|http://inter-tek.co.kr/bbs/board.php?bo_table=as&wr_id=177274}|{Фриспины за регистрацию|Бездепозитный бонус} в {Аркада|Arkada} – {как получить|активировать} {аркада бонусы через

компьютер|https://unitenplay.ca/forums/users/pamalaluttrell6/}|{Бесплатные вращения|Фриспины} в {Аркада казино|Arkada casino} – {правила|условия}

{аркада онлайн казино официальный сайт|http://bominecamping.com/bbs/board.php?bo_table=free&wr_id=1218}|{Как отыграть|Вывести} {фриспины|бездепозитный бонус} в {Аркада|Arkada} {аркада

доступ|https://www.delibird.co.kr/bbs/board.php?bo_table=free&wr_id=31}|{Лучшие слоты|Игры} для {фриспинов|бонусных вращений} в

{Аркада|Arkada} {arkada онлайн казино зеркало|https://wikis.ece.iastate.edu/cpre488/index.php?title=Arkada_%D0%9A%D0%B0%D0%B7%D0%B8%D0%BD%D0%BE_%E2%80%93_%D0%98%D0%B3%D1%80%D0%BE%D0%B2%D1%8B%D0%B5_%D0%90%D0%B2%D1%82%D0%BE%D0%BC%D0%B0%D1%82%D1%8B}|{Ограничения|Вейджер} {фриспинов|бездепозитных бонусов} в

{Аркада|Arkada} {аркада доступное зеркало|http://xn--vj4bq0gdb49l.com/bbs/board.php?bo_table=free&wr_id=292}|{Турниры|Соревнования} в {Аркада|Arkada} – {крупные призы|топовые игроки} {аркада

казино играть зеркало|https://plamosoku.com/enjyo/index.php?title=%C3%90%C3%91%E2%82%AC%C3%90%C2%BA%C3%90%C2%B0%C3%90%C2%B4%C3%90%C2%B0_%C3%90%C3%A2%E2%82%AC%E2%84%A2_%C3%90%E2%80%98%C3%91%E2%82%AC%C3%90%C2%B0%C3%91%C6%92%C3%90%C2%B7%C3%90%C2%B5%C3%91%E2%82%AC%C3%90%C2%B5_%C3%A2%E2%82%AC%E2%80%9C_%C3%90%E2%80%98%C3%90%C2%B5%C3%90%C2%B7_%C3%90%C2%A1%C2%BA%C3%90%C2%B0%C3%91%E2%80%A1%C3%90%C2%B8%C3%90%C2%B2%C3%90%C2%B0%C3%90%C2%BD%C3%90%C2%B8%C3%91}|{Как участвовать|Правила} в {турнирах|акциях] {Аркада

казино|Arkada casino} {казино arkada онлайн официальный сайт|http://ww.enhasusg.co.kr/bbs/board.php?bo_table=free&wr_id=268681}|{Рейтинговые игры|Лотереи}

в {Аркада|Arkada} – {шансы|выигрыши} {arkada скачать программу|https://wikigranny.com/wiki/index.php/Arkada_%C3%90%C2%A1%C3%91%E2%80%9A%C3%90%C2%B0%C3%90%C2%B2%C3%90%C2%BA%C3%90%C2%B8_%C3%A2%E2%82%AC%E2%80%9C_%C3%90%C3%A2%E2%82%AC%E2%84%A2%C3%91%E2%80%B9%C3%90%C2%B8%C3%90%C2%B3%C3%91%E2%82%AC%C3%91%E2%80%B9%C3%91%CB%86%C3%90%C2%BD%C3%91%E2%80%B9%C3%90%C2%B5_%C3%90%C2%A1%C3%91%E2%80%9A%C3%91%E2%82%AC%C3%90%C2%B0%C3%91%E2%80%9A%C3%90%C2%B5%C3%90%C2%B3%C3%90%C2%B8%C3%90%C2%B8}|{Еженедельные|Ежемесячные} {турниры|раздачи} в {Аркада|Arkada} {arkada казино зеркало|https://xn--pm2b0fr21aooo.com/bbs/board.php?bo_table=free&wr_id=964245}|{Джекпот-турниры|Крупные розыгрыши} в {Аркада|Arkada}

{аркада скачать|http://sellthisguitar.com/index.php?page=user&action=pub_profile&id=22018}|{Реальные отзывы|Мнения экспертов} о {Аркада казино|Arkada casino}

{рабочее зеркало аркада|http://naviondental.com/bbs/board.php?bo_table=free&wr_id=1958408}|{Почему|За что}

{ругают|хвалят} {Аркада|Arkada}? {казино аркада зеркало на сегодня|https://ip.vialek.ru/question/arkada-%d1%80%d0%b0%d0%b1%d0%be%d1%87%d0%b5%d0%b5-%d0%b7%d0%b5%d1%80%d0%ba%d0%b0%d0%bb%d0%be-%d0%bd%d0%b0-%d1%81%d0%b5%d0%b3%d0%be%d0%b4%d0%bd%d1%8f-%d0%b0%d0%bb%d1%8c%d1%82%d0%b5%d1%80/}|{Плюсы и минусы|Достоинства и

недостатки} {Аркада|Arkada} {официальный

сайт аркада онлайн|http://www.ntep2008.com/index.php?name=webboard&file=read&id=326665}|{Истории выигрышей|Крупные выплаты} в {Аркада|Arkada} {скачать

аркада казино|http://wiki.naval.ch/index.php?title=Benutzer:RebbecaBaron4}|{Можно ли доверять|Надежность} {Аркада казино|Arkada casino}?

{аркада играть бесплатно|http://naviondental.com/bbs/board.php?bo_table=free&wr_id=1959544}|{Ошибки|Глюки} в {Аркада|Arkada}

– {решение|исправление} {актуальное зеркало

аркада|http://naviondental.com/bbs/board.php?bo_table=free&wr_id=1963610}|{Не работает зеркало|Проблемы с доступом} {Аркада|Arkada} – {что делать|альтернативы}

{аркада официальный arkada-psd.ru|https://marriagesofa.com/profile/maribainton0257/}|{Как обновить|Переустановить}

{приложение|игру} {Аркада|Arkada} {скачать аркада казино|https://www.yewiki.org/User:DallasLanglais5}|{Техподдержка|Помощь} {Аркада казино|Arkada casino} – {как связаться|отзывы}

{казино аркада рабочее зеркало|http://www.edusejong.co.kr/bbs/board.php?bo_table=free&wr_id=249946}|{Оптимизация|Настройки} для {игры|ставок} в {Аркада|Arkada} {аркада

заблокирован|https://ykentech.com/bbs/board.php?bo_table=free&wr_id=3338378}|{VIP-клуб|Программа лояльности} в {Аркада|Arkada} – {бонусы|привилегии} {arkada casino

официальный сайт зеркало рабочее|https://hifrequency.live/community/profile/florrie91a41766/}|{Как стать VIP|Уровни} в {Аркада казино|Arkada casino} {аркада лайф рулетка зеркало|http://fsianh01.nayaa.co.kr/bbs/board.php?bo_table=sub01_02&wr_id=44351}|{Эксклюзивные предложения|Персональные бонусы} для

{VIP|постоянных игроков}

{Аркада|Arkada} {arkada свежее зеркало|http://www.snye.co.kr/bbs/board.php?bo_table=free&wr_id=1182084}|{Кэшбэк|Возврат средств} для {VIP-игроков|постоянных клиентов} {Аркада|Arkada} {аркада

приложение|http://naviondental.com/bbs/board.php?bo_table=free&wr_id=1959088}|{Специальные условия|Привилегии} {высоких ставок|крупных игроков} в {Аркада|Arkada} {аркада

зеркало|http://www.aiwadata.com/bbs/board.php?bo_table=free&wr_id=1889058}|{Биткоин|Криптовалюты} в {Аркада|Arkada} – {пополнение|вывод} {казино аркада официальный сайт|https://ssjcompanyinc.official.jp/bbs/board.php?bo_table=free&wr_id=4170712}|{Анонимные платежи|Без верификации} в

{Аркада казино|Arkada casino} {аркада зеркало вход|https://kumhomarket.co.kr/bbs/board.php?bo_table=free&wr_id=422137}|{Крипто-слоты|Игры за биткоин} в {Аркада|Arkada} {аркада вывод средств|http://www.kumkangenc.com/bbs/board.php?bo_table=inquiry&wr_id=478450}|{Быстрые транзакции|Мгновенные выплаты} через {крипту|USDT} в {Аркада|Arkada} {аркада казино|https://toto-site.com/bbs/board.php?bo_table=free&wr_id=2120124}|{Методы|Способы} {пополнения|вывода}

в {Аркада|Arkada} {аркада официальный arkada-psd.ru|http://ch-marine.co.kr/bbs/board.php?bo_table=qna&wr_id=94451}|{Новости|Обновления} {Аркада казино|Arkada casino} – {свежая информация|анонсы} {arkada официальный сайт онлайн|https://chrisophia.wiki/index.php/Arkada_Casino_%C3%90%C3%A2%E2%82%AC%E2%84%A2%C3%91%E2%80%A6%C3%90%C2%BE%C3%90%C2%B4_%C3%A2%E2%82%AC%E2%80%9C_%C3%90%E2%80%98%C3%91%E2%80%B9%C3%91%C3%91%E2%80%9A%C3%91%E2%82%AC%C3%90%C2%BE}|{Новые игры|Слоты} в {Аркада|Arkada} – {анонс|обзор} {казино

аркада зеркало на сегодня|http://win1905.kr/bbs/board.php?bo_table=free&wr_id=890}|{Изменения в правилах|Обновление условий} {Аркада|Arkada} {аркада онлайн зеркало|http://www.ideakong.co.kr/board/bbs/board.php?bo_table=free&wr_id=96890}|{Акции|Спецпредложения} в {Аркада|Arkada} – {не пропусти|успей получить} {аркада казино

играть|http://www.xn--2s2b270b.com/bbs/board.php?bo_table=free&wr_id=177639}|{Тренды|Популярное} в

{Аркада казино|Arkada casino} {2024|в этом

сезоне} {аркада рабочее зеркало на сегодня|https://bbarlock.com/index.php/User:GertrudeGaray}|{Итоговый обзор|Выводы}

о {Аркада казино|Arkada casino} {аркада зеркало рабочее на сегодня официальный сайт|https://amazingsweets.lms-fbid.com/blog/index.php?entryid=53304}|{Стоит ли играть|Рекомендации}

в {Аркада|Arkada}? {аркада официальный сайт казино|https://xnrca.com/groups/arkada-%d0%b7%d0%b5%d1%80%d0%ba%d0%b0%d0%bb%d0%be-%d1%80%d0%b0%d0%b1%d0%be%d1%87%d0%b5%d0%b5/}|{Почему {Аркада|Arkada} –

{лучший выбор|топовое казино}? {аркада обход блокировки|http://kakaokrewmall.com/bbs/board.php?bo_table=free&wr_id=328535}|{Финальный вердикт|Мое мнение} о {Аркада|Arkada} {официальный сайт аркада онлайн казино|https://pr1bookmarks.com/story19700751/%D0%97%D0%B0%D1%89%D0%B8%D1%82%D0%B0-%D0%B0%D0%BA%D0%BA%D0%B0%D1%83%D0%BD%D1%82%D0%B0-%D0%B2-arkada-casino-%D1%81%D0%BE%D0%B2%D0%B5%D1%82%D1%8B}|{Аркада|Arkada} – {правда|мифы} о {казино|игровом клубе}

{аркада официальный сайт

рабочее зеркало|https://medifore.co.jp/bbs/board.php?bo_table=free&wr_id=2183125}}

и {вход|доступ} {casino arkada официальный сайт|http://sk303.com/bbs/board.php?bo_table=free&wr_id=797984}|{Как|Легко} {зарегистрироваться|войти}

в {Аркада казино|Arkada casino}?

{казино аркада рабочее зеркало|http://classicalmusicmp3freedownload.com/ja/index.php?title=%D0%90%D1%80%D0%BA%D0%B0%D0%B4%D0%B0_%D0%9E%D0%B1%D0%B7%D0%BE%D1%80_%E2%80%93_%D0%9F%D0%BB%D1%8E%D1%81%D1%8B_%D0%98_%D0%9C%D0%B8%D0%BD%D1%83%D1%81%D1%8B}|{Аркада|Arkada} – {официальный|рабочий} {вход|зеркало} {сегодня|прямо сейчас} {аркада официальный arkada-psd.ru|https://hitommy.net/xe1/my_thoughts/608757}|{Регистрация|Аккаунт} в {Аркада|Arkada} – {бонус|фриспины}

за {первый депозит|вход} {игровые автоматы аркада|https://namosusan.com/bbs/board.php?bo_table=free&wr_id=1420144}|{Вход|Доступ} через {зеркало|официальный сайт} {Аркада|Arkada} {arkada casino бездепозитный бонус|https://ssjcompanyinc.official.jp/bbs/board.php?bo_table=free&wr_id=4170712}|{Рабочее|Актуальное} {зеркало|альтернативный сайт} {Аркада|Arkada} {2024|сегодня} {arkada рабочее зеркало на сегодня|http://www.snye.co.kr/bbs/board.php?bo_table=free&wr_id=1179775}|{Аркада зеркало|Arkada casino} – {обход блокировки|бесперебойный доступ} {лайв рулетка

аркада|https://orphelins-apocalypse.synology.me/mediawiki/index.php?title=Discussion_utilisateur:Hubert7840}|{Как|Где} {найти|открыть} {зеркало|сайт}

{Аркада|Arkada}? {аркада казино официальный сайт|https://www.danhanbok.co.kr/bbs/board.php?bo_table=free&wr_id=8531262}|{Зеркало|Альтернативный вход} {Аркада|Arkada} –

{играть|выигрывать} без {проблем|ограничений} {аркада вывод средств|https://semantische-richtlijnen.wiki/wiki/User:JaclynSheppard}|{Свежее|Новое} {зеркало|ссылка} {Аркада|Arkada} – {рабочее|проверенное} {аркада промокод фриспины|https://sexkontaktanzeige.at/author/deannad7708/}|{Бонус|Фриспины} за

{регистрацию|первый депозит} в {Аркада|Arkada} {arkada зеркало

casino|https://www.xn--3e0bv8ac8eg0f89cktghwh0nqynu5gl.com/bbs/board.php?bo_table=free&wr_id=512}|{Промокод|Бонус-код} {Аркада|Arkada} – {получить|активировать} {выгодно|бесплатно} {arkada онлайн зеркало|http://punbb.8u.cz/topic34690-arkada-prilozhenie-dlya-ios.html}|{Бездепозитный бонус|Фриспины} в

{Аркада казино|Arkada casino} {лицензионное казино аркада|https://ssjcompanyinc.official.jp/bbs/board.php?bo_table=free&wr_id=4164292}|{Выгодные|Эксклюзивные} {акции|бонусы} в {Аркада|Arkada} {аркада десктоп|https://ssjcompanyinc.official.jp/bbs/board.php?bo_table=free&wr_id=4164239}|{Как|Где} {получить|использовать} {бонус|промокод} в

{Аркада|Arkada}? {casino arkada официальный сайт|http://icecap.co.kr/bbs/board.php?bo_table=sub0403_en&wr_id=5921}|{Игровые автоматы|Слоты} {Аркада|Arkada} – {топ|лучшие} игры {2024|сегодня} {casino

arkada официальный сайт|https://www.honolulu.mojovillage.com/user/profile/496778}|{Играть|Выигрывать} в {Аркада

казино|Arkada casino} – {хиты|популярные слоты} {аркада асг|http://ch-marine.co.kr/bbs/board.php?bo_table=qna&wr_id=94451}|{Рейтинг|Обзор} {игровых автоматов|слотов} {Аркада|Arkada} {зеркало аркада|https://xtalentpro.com/%D0%B1%D0%BE%D0%BD%D1%83%D1%81-%D0%BA%D0%BE%D0%B4-%D0%B0%D1%80%D0%BA%D0%B0%D0%B4%D0%B0-%D0%BF%D0%BE%D0%BB%D1%83%D1%87%D0%B8%D1%82%D1%8C-%D1%81%D0%B5%D0%B9%D1%87%D0%B0%D1%81/}|{Новые|Лучшие} {слоты|игры} в {Аркада|Arkada} – {попробуй|испытай удачу} {arkada казино

зеркало|https://www.snye.co.kr/bbs/board.php?bo_table=free&wr_id=1179870}|{Играть бесплатно|Демо-режим} в {Аркада|Arkada} – {без риска|без регистрации}

{arkada свежее зеркало|http://www.annunciogratis.net/author/odessa18u28}|{Рулетка|Лайв-рулетка} в {Аркада|Arkada} – {стратегии|выигрышные тактики} {arkada онлайн казино официальный сайт|http://www.summerband.co.kr/bbs/board.php?bo_table=qa&wr_id=249730}|{Live-казино|Лайв-дилеры} {Аркада|Arkada} – {реальный|азартный} опыт {аркада официальный сайт рабочее зеркало на сегодня|http://service.megaworks.ai/board/bbs/board.php?bo_table=hwang_form&wr_id=2398270}|{Как|Секреты} {выиграть|обыграть} в {рулетку|блэкджек} {Аркада|Arkada} {arkada зеркало рабочее|https://namosusan.com/bbs/board.php?bo_table=free&wr_id=1445472}|{Лучшие|Топовые} {live-игры|столы} в {Аркада казино|Arkada casino} {аркада онлайн

казино|https://rstem.net/%D0%90%D1%80%D0%BA%D0%B0%D0%B4%D0%B0_%D0%94%D0%B5%D0%BF%D0%BE%D0%B7%D0%B8%D1%82_%E2%80%93_%D0%92%D1%8B%D0%B2%D0%BE%D0%B4_%D0%A1%D1%80%D0%B5%D0%B4%D1%81%D1%82%D0%B2}|{Играть в рулетку|Ставки} в {Аркада|Arkada} –

{реально|с выигрышем} {arkada casino бездепозитный бонус|https://wikibusinesspro.com/index.php/%D0%90%D1%80%D0%BA%D0%B0%D0%B4%D0%B0_%D0%9A%D0%B0%D0%B7%D0%B8%D0%BD%D0%BE_%D0%97%D0%B5%D1%80%D0%BA%D0%B0%D0%BB%D0%BE_%D0%9D%D0%B0_%D0%A1%D0%B5%D0%B3%D0%BE%D0%B4%D0%BD%D1%8F}|{Аркада|Arkada} – {мобильная версия|приложение} для

{Android|iOS} {arkada официальный сайт зеркало|https://blog.crdievarieties.com/doku.php?id=a_kada_%D0%B1%D0%BE%D0%BD%D1%83%D1%81_%D0%BA%D0%BE%D0%B4_%D0%B0%D0%BA%D1%82%D0%B8%D0%B2%D0%BD%D1%8B%D0%B5_%D0%BF%D1%80%D0%B5%D0%B4%D0%BB%D0%BE%D0%B6%D0%B5%D0%BD%D0%B8%D1%8F}|{Скачать|Установить} {Аркада|Arkada} на {телефон|планшет} –

{быстро|удобно} {казино

аркада зеркало на сегодня|https://www.yewiki.org/User:DallasLanglais5}|{Мобильное казино|Игра с

телефона} {Аркада|Arkada} – {доступно|в любое время} {arkada ставки

на спорт|https://stir.tomography.stfc.ac.uk/index.php/%C3%90%C3%91%E2%82%AC%C3%90%C2%BA%C3%90%C2%B0%C3%90%C2%B4%C3%90%C2%B0_%C3%90%C5%A1%C3%90%C2%B0%C3%90%C2%B7%C3%90%C2%B8%C3%90%C2%BD%C3%90%C2%BE_%C3%90%C5%BE%C3%90%C2%BD%C3%90%C2%BB%C3%90%C2%B0%C3%90%C2%B9%C3%90%C2%BD_%C3%90%C3%A2%E2%82%AC%E2%84%A2%C3%91%E2%80%A6%C3%90%C2%BE%C3%90%C2%B4_%C3%A2%E2%82%AC%E2%80%9C_%C3%90%E2%80%98%C3%91%E2%80%B9%C3%91%C3%91%E2%80%9A%C3%91%E2%82%AC%C3%90%C2%BE}|{Как|Где} {скачать|установить} {приложение|APK} {Arkada|Аркада}?

{arkada бездепозитный бонус|https://thefreeadforum.top/index.php?page=item&id=126623}|{Играть|Делать ставки} в {Аркада|Arkada} с {телефона|мобильного} {приложение arkada|https://unamath.com/blog/index.php?entryid=11023}|{Вывод средств|Выплаты} в {Аркада|Arkada} – {быстро|без задержек} {аркада онлайн

казино официальный сайт|https://aulaclinic.cat/blog/index.php?entryid=316945}|{Как|Способы} {вывести|получить} {деньги|выигрыш} в {Аркада|Arkada} {игровые аппараты аркада зеркало|http://naviondental.com/bbs/board.php?bo_table=free&wr_id=1948494}|{Минимальная|Максимальная} {сумма|ставка} для {вывода|депозита} в {Аркада|Arkada} {аркада казино

официальный сайт вход|https://nowwedws.com/bbs/board.php?bo_table=free&wr_id=8531793}|{Быстрые|Мгновенные} {выплаты|транзакции} в {Аркада казино|Arkada casino} {arkada casino

официальный сайт|http://naviondental.com/bbs/board.php?bo_table=free&wr_id=1944129}|{Проблемы|Задержки} с {выводом|выплатами} в {Аркада|Arkada} – {решение|советы}

{аркада депозит за регистрацию|http://pangclick.com/bbs/board.php?bo_table=free&wr_id=928116}|{Лицензионное|Надежное} казино {Аркада|Arkada} – {безопасность|честность} {аркада официальный сайт рабочее зеркало на сегодня|http://naviondental.com/bbs/board.php?bo_table=free&wr_id=1948593}|{Как|Почему} {проверить|доверять} {Аркада казино|Arkada

casino}? {аркада официальный сайт рабочее зеркало на сегодня|https://ssjcompanyinc.official.jp/bbs/board.php?bo_table=free&wr_id=4168721}|{Защита|Конфиденциальность} данных в {Аркада|Arkada} – {безопасно|надежно} {аркада депозит за

регистрацию|http://xn--2s2b1p822a.net/bbs/board.php?bo_table=free&wr_id=1283663}|{Честная игра|Без обмана}

в {Аркада|Arkada} – {гарантии|проверка} {arkada официальный сайт онлайн|https://glbian.com/prd/bbs/board.php?bo_table=free&wr_id=747009}|{Мошенничество|Развод} в {Аркада|Arkada} – {правда|миф}?

{arkada ставки|https://ssjcompanyinc.official.jp/bbs/board.php?bo_table=free&wr_id=4160056}|{Отзывы|Реальные мнения} о {Аркада

казино|Arkada casino} {аркада компьютерная версия|http://www.banno.kr/free/33}|{Плюсы|Минусы} {Аркада|Arkada}

– {честный обзор|мнение экспертов} {казино аркада

рабочее зеркало|https://wiki.zibocademy.com/index.php?title=User:HalleyWarburton}|{Рейтинг|Топ} {онлайн-казино|игровых клубов}

– {Аркада|Arkada} в {списке|рейтинге} {аркада свежее

зеркало|https://global.boligdirekte.com/index.php?page=user&action=pub_profile&id=245}|{Почему|За что}

{игроки|пользователи} {любят|выбирают} {Аркада|Arkada}?

{сайт arkada casino|https://sijms.org/arkada-casino-%D0%BF%D1%80%D0%BE%D0%BC%D0%BE%D0%BA%D0%BE%D0%B4-%D0%B1%D0%B5%D0%B7-%D0%B2%D0%BB%D0%BE%D0%B6%D0%B5%D0%BD%D0%B8%D0%B9/}|{Реальные|Негативные} {отзывы|истории} о {Аркада|Arkada}

{аркада казино зеркало на сегодня|http://signcast.co.kr/bbs/board.php?bo_table=free&wr_id=67467}|{Секреты|Стратегии} {выигрыша|успеха} в {Аркада|Arkada} {аркада казино зеркало сегодня|http://www.r2tbiohospital.com/bbs/board.php?bo_table=free&wr_id=5000629}|{Как|Советы} {играть|выигрывать} в {слоты|рулетку} {Аркада|Arkada} {аркада зеркало сегодня|http://hajepine.com/bbs/board.php?bo_table=free&wr_id=254433}|{Тактики|Методы} для {начинающих|опытных} в {Аркада казино|Arkada casino} {казино аркада зеркало на сегодня|https://xn--xe5bj4c.com/bbs/board.php?bo_table=free&wr_id=2153}|{Управление банкроллом|Ставки} в

{Аркада|Arkada} – {правила|советы} {arkada онлайн казино официальный сайт на русском|http://stephankrieger.net/index.php?title=Arkada_%D0%A0%D1%83%D0%BB%D0%B5%D1%82%D0%BA%D0%B0_%E2%80%93_%D0%9B%D0%B0%D0%B9%D0%B2_%D0%9A%D0%B0%D0%B7%D0%B8%D0%BD%D0%BE}|{Как|Почему} {проигрывать|терять} в {Аркада|Arkada} – {ошибки|разбор} {arkada casino вход|http://www.ansanam.com/bbs/board.php?bo_table=report_status2&wr_id=437642}|{Топ-10|Лучшие} {игровых автоматов|слотов} в {Аркада|Arkada} {2024|в этом году} {аркада казино официальный сайт вход|https://ssjcompanyinc.official.jp/bbs/board.php?bo_table=free&wr_id=4164292}|{Новинки|Свежие} {слоты|игры} в {Аркада казино|Arkada casino} – {испытай|попробуй} первым {аркада депозит

за регистрацию|https://haloleagues.com/arkada-%D0%BE%D1%84%D0%B8%D1%86%D0%B8%D0%B0%D0%BB%D1%8C%D0%BD%D1%8B%D0%B9-%D1%80%D1%83%D0%BB%D0%B5%D1%82%D0%BA%D0%B0/}|{Высокий|Максимальный} RTP в {Аркада|Arkada} – {где|какие} {слоты|автоматы} {лучшие|выгодные}

{аркада казино зеркало на сегодня|https://seobsp.com/seo-questions-and-answers/arkada-%D0%B2%D1%8B%D0%BF%D0%BB%D0%B0%D1%82%D1%8B-%D0%B1%D0%B5%D0%B7-%D0%B7%D0%B0%D0%B4%D0%B5%D1%80%D0%B6%D0%B5%D0%BA/}|{Джекпот|Крупный выигрыш} в {Аркада|Arkada} – {истории|реальные} {побед|выплат} {аркада казино вход|http://xn--9d0br01aqnsdfay3c.kr/bbs/board.php?bo_table=free&wr_id=2807056}|{Слоты с бонусами|Игры с фриспинами} в {Аркада|Arkada} – {актуальный|полный} {список|обзор} {доступное зеркало казино аркада|http://wiki.rumpold.li/index.php?title=%D0%90%D1%80%D0%BA%D0%B0%D0%B4%D0%B0_%D0%9A%D0%B0%D0%B7%D0%B8%D0%BD%D0%BE_%D0%91%D0%BE%D0%BD%D1%83%D1%81_%E2%80%93_%D0%9C%D0%B8%D0%BA%D1%80%D0%BE%D1%81%D1%82%D0%B0%D0%B2%D0%BA%D0%B8}|Рулетка и live-игры (продолжение) {лайв казино аркада|https://bookslibrary.wiki/content/User:DomingaCowan6}|{Стратегии|Тактики} для {рулетки|блэкджека} в {Аркада|Arkada}

– {работают|проверено} {arkada игра с минимальной ставкой|https://wiki.dulovic.tech/index.php/Arkada_Casino_%C3%90%C5%BE%C3%91%E2%80%9E%C3%90%C2%B8%C3%91%E2%80%A0%C3%90%C2%B8%C3%90%C2%B0%C3%90%C2%BB%C3%91%C5%92%C3%90%C2%BD%C3%91%E2%80%B9%C3%90%C2%B9_%C3%90%C2%A1%C3%90%C2%B0%C3%90%C2%B9%C3%91%E2%80%9A_%C3%90%C3%A2%E2%82%AC%E2%84%A2%C3%91%E2%80%A6%C3%90%C2%BE%C3%90%C2%B4}|{Лучшие дилеры|Топовые столы} в

{лайв-казино|live-рулетке} {Аркада|Arkada} {лицензионное казино аркада|https://www.buyfags.moe/User:LaureneVgi}|{Как выиграть|Секреты} в {лайв-играх|live-дилерах}

{Аркада|Arkada} {arkada casino зеркало|https://bafoundation.org/%D0%B0%D1%80%D0%BA%D0%B0%D0%B4%D0%B0-%D0%BE%D0%BD%D0%BB%D0%B0%D0%B9%D0%BD-%D0%BA%D0%B0%D0%B7%D0%B8%D0%BD%D0%BE-%D0%B7%D0%B5%D1%80%D0%BA%D0%B0%D0%BB%D0%BE/}|{Минимальные|Максимальные} {ставки|лимиты} в

{рулетке|блэкджеке} {Аркада|Arkada} {официальный сайт казино аркада|https://shareplat.net/bbs/board.php?bo_table=free&wr_id=1536972}|{Режимы|Виды} {рулетки|баккары} в {Аркада казино|Arkada casino} {казино аркада официальный|https://ssjcompanyinc.official.jp/bbs/board.php?bo_table=free&wr_id=4164309}|{Эксклюзивный|Специальный} {бонус|промокод} для {новых|постоянных} игроков {Аркада|Arkada}

{аркада под|http://www.edid.co.kr/bbs/board.php?bo_table=free&wr_id=1248655}|{Как отыграть|Условия} {бездепозитный бонус|фриспины}

в {Аркада|Arkada} {arkada зеркало casino|https://hwekimchi.gabia.io/bbs/board.php?bo_table=free&tbl=&wr_id=581743}|{Кэшбэк|Возврат} в {Аркада казино|Arkada casino} – {размер|условия} получения {промо

аркада|https://bbarlock.com/index.php/%D0%9C%D0%BE%D1%88%D0%B5%D0%BD%D0%BD%D0%B8%D1%87%D0%B5%D1%81%D1%82%D0%B2%D0%BE_%D0%98%D0%BB%D0%B8_%D0%9D%D0%B5%D1%82_%D0%9E_%D0%90%D1%80%D0%BA%D0%B0%D0%B4%D0%B0_%D0%9A%D0%B0%D0%B7%D0%B8%D0%BD%D0%BE}|{Турниры|Акции} в {Аркада|Arkada} – {крупные|еженедельные} {разыгрыши|призы} {аркада казино

играть зеркало|http://dcfkorea.com/bbs/board.php?bo_table=free&wr_id=219370}|{Фриспины|Бесплатные вращения} за {депозит|активность}

в {Аркада|Arkada} {аркада вход|http://bwiki.dirkmeyer.info/index.php?title=%D0%98%D0%B3%D1%80%D0%BE%D0%B2%D1%8B%D0%B5_%D0%90%D0%B2%D1%82%D0%BE%D0%BC%D0%B0%D1%82%D1%8B_%D0%90%D1%80%D0%BA%D0%B0%D0%B4%D0%B0_%E2%80%93_%D0%91%D0%B5%D1%81%D0%BF%D0%BB%D0%B0%D1%82%D0%BD%D0%BE}|{Аркада|Arkada} на {Андроид|iOS} – {скачать|установить} {бесплатно|официально} {аркада зеркало

сегодня|http://www.aptjob.co.kr/bbs/board.php?bo_table=free&wr_id=480356}|{Мобильная версия|Приложение} {Аркада|Arkada}

– {плюсы|минусы} {использования|игры} {сайт аркада|http://naviondental.com/bbs/board.php?bo_table=free&wr_id=1948494}|{Как играть|Делать ставки} в {Аркада|Arkada} с {телефона|планшета} {аркада

мобильное казино|http://jbfbio.com/g5/bbs/board.php?bo_table=free&wr_id=1525727}|{Оптимизация|Скорость} {мобильного казино|игры} {Аркада|Arkada} – {обзор|тест} {аркада зеркало рабочее на сегодня официальный|http://jimiantech.com/g5/bbs/board.php?bo_table=w0dace2gxo&wr_id=73798}|{Официальное приложение|APK-файл} {Аркада|Arkada} – {где|как} {скачать|установить} {казино

аркада официальный|https://techuswiki.xyz/index.php/User:SylviaA099523135}|{Минимальная сумма|Лимиты} для

{вывода|депозита} в {Аркада|Arkada} {arkada вход|https://inspo.wiki/index.php/User:IraBannister}|{Быстрые выплаты|Мгновенные транзакции} в

{Аркада казино|Arkada casino} – {способы|сроки}

{лайв рулетка аркада|http://wiki.wild-sau.com/index.php?title=Benutzer:MadonnaR55}|{Проблемы с выводом|Задержки выплат}

в {Аркада|Arkada} – {решение|поддержка} {аркада зеркало на сегодня казино|http://projectingpower.org:80/w/index.php/%D0%90%D1%80%D0%BA%D0%B0%D0%B4%D0%B0_%D0%97%D0%B5%D1%80%D0%BA%D0%B0%D0%BB%D0%BE_%D0%9E%D1%84%D0%B8%D1%86%D0%B8%D0%B0%D0%BB%D1%8C%D0%BD%D1%8B%D0%B9_%D0%A1%D0%B0%D0%B9%D1%82}|{Криптовалюты|Биткоин} в {Аркада|Arkada}

– {пополнение|вывод} {анонимно|быстро} {аркада мобильный|https://pipewiki.org/wiki/index.php/%D0%98%D0%B3%D1%80%D0%BE%D0%B2%D0%BE%D0%B9_%D0%90%D0%B2%D1%82%D0%BE%D0%BC%D0%B0%D1%82_Arkada_%E2%80%93_%D0%9D%D0%B0_%D0%A2%D0%B5%D0%BB%D0%B5%D1%84%D0%BE%D0%BD}|{Безопасные платежи|Проверенные

методы} в {Аркада|Arkada} {arkada компьютерная версия|http://wiki.schragefamily.com/index.php?title=%D0%90%D1%80%D0%BA%D0%B0%D0%B4%D0%B0_%D0%98%D0%B3%D1%80%D0%BE%D0%B2%D1%8B%D0%B5_%D0%90%D0%B2%D1%82%D0%BE%D0%BC%D0%B0%D1%82%D1%8B_%D0%97%D0%B5%D1%80%D0%BA%D0%B0%D0%BB%D0%BE}|{Лицензия|Регуляция} {Аркада казино|Arkada casino} –

{проверка|подлинность} {рио бет официальный сайт|https://ssjcompanyinc.official.jp/bbs/board.php?bo_table=free&wr_id=4164231}|{Мошенничество|Развод} в

{Аркада|Arkada} – {как|почему} {избежать|проверить} {аркада официальный|http://www.kumkangenc.com/bbs/board.php?bo_table=inquiry&wr_id=478450}|{Честная игра|Генератор случайных чисел} в {Аркада|Arkada} – {гарантии|тесты} {arkada микроставки|http://classicalmusicmp3freedownload.com/ja/index.php?title=%E5%88%A9%E7%94%A8%E8%80%85:TobyQuirk424232}|{Защита данных|Конфиденциальность} в {Аркада|Arkada}

– {шифрование|безопасность} {казино аркада альтернативный сайт|https://mychampionssport.jubelio.store/2025/04/11/arkada-%D0%B7%D0%B5%D1%80%D0%BA%D0%B0%D0%BB%D0%BE-%D1%80%D0%B0%D0%B1%D0%BE%D1%87%D0%B5%D0%B5/}|{Проверенные отзывы|Реальные игроки} о

{Аркада|Arkada} – {доверять|сомневаться} {казино риобэт|http://xn--9d0br01aqnsdfay3c.kr/bbs/board.php?bo_table=free&wr_id=2808788}|{Аркада vs

Риобет|Сравнение казино} – {плюсы|минусы} каждого {аркада бонус за регистрацию|https://wooca.co.kr/bbs/board.php?bo_table=free&wr_id=855}|{Аналоги|Похожие казино} на {Аркада|Arkada} – {обзор|рейтинг} {аркада десктоп|https://aulaclinic.cat/blog/index.php?entryid=316945}|{Почему|За что} {игроки|новички} выбирают {Аркада|Arkada}?

{аркада на деньги|http://sarahsojourns.net/index.php?title=User:AnyaSho741769}|{Лучшие альтернативы|Топ-замены} {Аркада|Arkada} в {2024|этом году} {arkada

официальный сайт зеркало|http://interiorwork.co.kr/bbs/board.php?bo_table=free&wr_id=30666}|{Аркада или другое казино|Что лучше?} – {сравнение|выводы} {аркада рабочее зеркало|http://www.thehouseloanexpert.com/question/%d0%b1%d0%be%d0%bd%d1%83%d1%81-%d0%b7%d0%b0-%d1%80%d0%b5%d0%b3%d0%b8%d1%81%d1%82%d1%80%d0%b0%d1%86%d0%b8%d1%8e-%d0%b2-%d0%b0%d1%80%d0%ba%d0%b0%d0%b4%d0%b0-%d0%b1%d0%b5%d0%b7-%d0%b2%d0%bb/}|{Как увеличить|Секреты} {выигрыш|банкролл} в {Аркада|Arkada} {аркада онлайн казино|http://kimtec.co.kr/bbs/board.php?bo_table=free&wr_id=1278623}|{Ошибки|Главные промахи} {новичков|игроков} в {Аркада казино|Arkada casino} {аркада промокод фриспины|http://stephankrieger.net/index.php?title=Arkada_%D0%A0%D1%83%D0%BB%D0%B5%D1%82%D0%BA%D0%B0_%E2%80%93_%D0%9B%D0%B0%D0%B9%D0%B2_%D0%9A%D0%B0%D0%B7%D0%B8%D0%BD%D0%BE}|{Психология|Тактика} {азартной игры|ставок} в {Аркада|Arkada} {arkada онлайн казино официальный сайт|https://itformula.ca/index.php?title=User:EltonWilde93}|{Как не

проиграть|Сберечь депозит} в {Аркада|Arkada} – {советы|правила} {аркада казино официальный сайт зеркало|https://glhwar3.com/forums/users/rex4761249860593/}|{Управление деньгами|Банкролл-менеджмент} в {Аркада|Arkada} {аркада промокод фриспины|https://whisong.com/bbs/board.php?bo_table=free&wr_id=502083}|{Фриспины за регистрацию|Бездепозитный бонус}

в {Аркада|Arkada} – {как получить|активировать} {аркада казино играть

зеркало|http://d.daehansign.com/bbs/board.php?bo_table=free&wr_id=2669482}|{Бесплатные вращения|Фриспины} в {Аркада казино|Arkada casino} – {правила|условия} {аркада зеркало на сегодня|http://sarahsojourns.net/index.php?title=User:AnyaSho741769}|{Как отыграть|Вывести} {фриспины|бездепозитный бонус} в {Аркада|Arkada} {аркада бонус|http://pasarinko.zeroweb.kr/bbs/board.php?bo_table=notice&wr_id=5361957}|{Лучшие слоты|Игры} для {фриспинов|бонусных вращений} в {Аркада|Arkada}

{arkada онлайн казино официальный сайт вход|https://mediawiki.salesianos.es/index.php?title=Arkada_%D0%91%D0%B5%D0%B7%D0%B4%D0%B5%D0%BF%D0%BE%D0%B7%D0%B8%D1%82%D0%BD%D1%8B%D0%B9_%D0%91%D0%BE%D0%BD%D1%83%D1%81_%E2%80%93_2024}|{Ограничения|Вейджер} {фриспинов|бездепозитных бонусов} в {Аркада|Arkada} {лицензионное

казино аркада|https://2017.asiateleophth.org/community/profile/vivienthiel3102/}|{Турниры|Соревнования} в {Аркада|Arkada} – {крупные призы|топовые игроки} {лицензионное казино аркада|http://shop.ororo.co.kr/bbs/board.php?bo_table=free&wr_id=2557916}|{Как участвовать|Правила} в {турнирах|акциях] {Аркада казино|Arkada casino} {аркада зеркало рабочее|https://helpdesk-test.zcu.cz/wiki/User_talk:UlrikeHawes239}|{Рейтинговые игры|Лотереи} в {Аркада|Arkada} – {шансы|выигрыши}

{онлайн казино arkada зеркало сайта

сегодня|https://libchrist.wiki/index.php/%D0%90%D1%80%D0%BA%D0%B0%D0%B4%D0%B0_%D0%9A%D0%B0%D0%B7%D0%B8%D0%BD%D0%BE_%D0%91%D0%BE%D0%BD%D1%83%D1%81_%E2%80%93_%D0%9C%D0%B8%D0%BA%D1%80%D0%BE%D1%81%D1%82%D0%B0%D0%B2%D0%BA%D0%B8}|{Еженедельные|Ежемесячные} {турниры|раздачи} в {Аркада|Arkada}

{аркада вход на сайт|https://sijms.org/arkada-casino-%D0%BF%D1%80%D0%BE%D0%BC%D0%BE%D0%BA%D0%BE%D0%B4-%D0%B1%D0%B5%D0%B7-%D0%B2%D0%BB%D0%BE%D0%B6%D0%B5%D0%BD%D0%B8%D0%B9/}|{Джекпот-турниры|Крупные розыгрыши} в

{Аркада|Arkada} {arkada com букмекерская контора|https://dawayo.net/bbs/board.php?bo_table=free&wr_id=106164}|{Реальные отзывы|Мнения экспертов} о {Аркада казино|Arkada casino} {аркада рабочее зеркало|https://www.escortskart.com/user/profile/DomingoFolt}|{Почему|За что} {ругают|хвалят} {Аркада|Arkada}?

{аркада казино официальный сайт|http://efactgroup.com/bbs/board.php?bo_table=free&wr_id=1298216}|{Плюсы и минусы|Достоинства

и недостатки} {Аркада|Arkada} {аркада зеркало на

сегодня казино|http://ttceducation.co.kr/bbs/board.php?bo_table=free&wr_id=2742551}|{Истории выигрышей|Крупные выплаты} в

{Аркада|Arkada} {arkada casino официальный сайт|http://kobom.co.kr/bbs/board.php?bo_table=free&wr_id=911385}|{Можно ли доверять|Надежность} {Аркада казино|Arkada casino}?

{arkada casino официальный сайт вход|http://xn--989a5b812cq1h8xxvfb.kr/bbs/board.php?bo_table=pension_free2&wr_id=177120&sca=}|{Ошибки|Глюки} в {Аркада|Arkada} – {решение|исправление} {arkada 500 рублей|http://xn--9d0br01aqnsdfay3c.kr/bbs/board.php?bo_table=free&wr_id=2810086}|{Не работает зеркало|Проблемы с доступом}

{Аркада|Arkada} – {что делать|альтернативы} {arkada

casino официальный сайт|https://www.wiki.klausbunny.tv/index.php?title=User:CJWRafael67}|{Как обновить|Переустановить} {приложение|игру}

{Аркада|Arkada} {аркада официальный сайт зеркало|https://oeclub.org/index.php/Arkada_%D0%9E%D1%84%D0%B8%D1%86%D0%B8%D0%B0%D0%BB%D1%8C%D0%BD%D1%8B%D0%B9_%D0%A1%D0%B0%D0%B9%D1%82_%D0%97%D0%B5%D1%80%D0%BA%D0%B0%D0%BB%D0%BE}|{Техподдержка|Помощь} {Аркада казино|Arkada casino} – {как

связаться|отзывы} {arkada доступ|https://aulaclinic.cat/blog/index.php?entryid=316945}|{Оптимизация|Настройки} для {игры|ставок} в {Аркада|Arkada} {arkada зеркало рабочее|http://cambiareilcampo.it/mediawiki-1.42.1/index.php?title=Utente:AnnelieseMcCoin}|{VIP-клуб|Программа лояльности} в {Аркада|Arkada} – {бонусы|привилегии} {arkada рабочее зеркало|http://zerodh.co.kr/bbs/board.php?bo_table=free&wr_id=33113}|{Как стать VIP|Уровни} в

{Аркада казино|Arkada casino} {аркада официальный сайт зеркало|https://pigeon.bdfort.com/author/jamelquezad/}|{Эксклюзивные предложения|Персональные бонусы}

для {VIP|постоянных игроков} {Аркада|Arkada}

{аркада бонусы через компьютер|https://croptech.com.sa/%D0%B0%D1%80%D0%BA%D0%B0%D0%B4%D0%B0-%D0%B7%D0%B5%D1%80%D0%BA%D0%B0%D0%BB%D0%BE-%D0%BD%D0%B0-%D1%81%D0%B5%D0%B3%D0%BE%D0%B4%D0%BD%D1%8F-%D0%B2%D1%8B%D0%B8%D0%B3%D1%80%D1%8B%D0%B2%D0%B0%D1%82/}|{Кэшбэк|Возврат средств} для {VIP-игроков|постоянных клиентов} {Аркада|Arkada} {arkada

игра с минимальной ставкой|http://heana.bluechips.co.kr/bbs/board.php?bo_table=bbs4&wr_id=439}|{Специальные условия|Привилегии} {высоких

ставок|крупных игроков} в {Аркада|Arkada} {рулетка arkada|http://machinekorea.net/bbs/board.php?bo_table=free&wr_id=764403}|{Биткоин|Криптовалюты} в {Аркада|Arkada} – {пополнение|вывод} {аркада автоматы|https://hikvisiondb.webcam/wiki/User:MajorLhotsky811}|{Анонимные платежи|Без верификации}

в {Аркада казино|Arkada casino} {аркада мобильный|https://presslibrary.wiki/index.php?title=%C3%90%E2%80%98%C3%90%C2%BE%C3%90%C2%BD%C3%91%C6%92%C3%91_%C3%90%E2%80%94%C3%90%C2%B0_%C3%90_%C3%90%C2%B5%C3%90%C2%B3%C3%90%C2%B8%C3%91%C3%91%E2%80%9A%C3%91%E2%82%AC%C3%90%C2%B0%C3%91%E2%80%A0%C3%90%C2%B8%C3%91%C5%BD_%C3%90%C3%A2%E2%82%AC%E2%84%A2_%C3%90%C3%91%E2%82%AC%C3%90%C2%BA%C3%90%C2%B0%C3%90%C2%B4%C3%90%C2%B0_%C3%A2%E2%82%AC%E2%80%9C_%C3%90%C3%A2%E2%82%AC%E2%84%A2%C3%91%E2%80%B9%C3%90%C2%B3%C3%90%C2%BE%C3%90%C2%B4%C3%90%C2%BD%C3%91%E2%80%B9%C3%90%C2%B5_%C3%90%C5%B8%C3%91%E2%82%AC%C3%90%C2%B5%C3%90%C2%B4%C3%90%C2%BB%C3%90%C2%BE%C3%90%C2%B6%C3%90%C2%B5%C3%90%C2%BD%C3%90%C2%B8%C3%91}|{Крипто-слоты|Игры за биткоин} в {Аркада|Arkada} {доступное зеркало казино аркада|https://ctpedia.org/index.php/Arkada_%D0%A1%D0%BB%D0%BE%D1%82%D1%8B_%E2%80%93_%D0%91%D0%B5%D1%81%D0%BF%D0%BB%D0%B0%D1%82%D0%BD%D0%BE}|{Быстрые транзакции|Мгновенные выплаты} через {крипту|USDT}

в {Аркада|Arkada} {arkada бездепозитный бонус|https://www.yewiki.org/Arkada_Casino_%D0%9E%D1%84%D0%B8%D1%86%D0%B8%D0%B0%D0%BB%D1%8C%D0%BD%D1%8B%D0%B9_%D0%A1%D0%B0%D0%B9%D1%82_%D0%92%D1%85%D0%BE%D0%B4}|{Методы|Способы} {пополнения|вывода} в {Аркада|Arkada} {arkada

компьютерная версия|http://naviondental.com/bbs/board.php?bo_table=free&wr_id=1948951}|{Новости|Обновления} {Аркада казино|Arkada casino} – {свежая информация|анонсы}

{рио бет официальный сайт|https://vntta.com/index.php?page=user&action=pub_profile&id=219024}|{Новые игры|Слоты} в {Аркада|Arkada} –

{анонс|обзор} {аркада бонус|https://www.adpost4u.com/user/profile/3624476}|{Изменения в правилах|Обновление условий} {Аркада|Arkada} {казино риобэт|https://wifidb.science/wiki/User:TXAAlphonso}|{Акции|Спецпредложения} в {Аркада|Arkada} –

{не пропусти|успей получить}

{arkada зеркало на сегодня|http://cambiareilcampo.it/mediawiki-1.42.1/index.php?title=Utente:AnnelieseMcCoin}|{Тренды|Популярное} в {Аркада казино|Arkada casino} {2024|в

этом сезоне} {аркада казино зеркало сегодня|https://mychampionssport.jubelio.store/2025/04/11/arkada-%D0%B7%D0%B5%D1%80%D0%BA%D0%B0%D0%BB%D0%BE-%D1%80%D0%B0%D0%B1%D0%BE%D1%87%D0%B5%D0%B5/}|{Итоговый обзор|Выводы} о {Аркада

казино|Arkada casino} {казино риобэт|https://www.eaccwiki.com/wiki/%D0%90%D1%80%D0%BA%D0%B0%D0%B4%D0%B0_%D0%9A%D0%B0%D0%B7%D0%B8%D0%BD%D0%BE_%D0%9E%D1%84%D0%B8%D1%86%D0%B8%D0%B0%D0%BB%D1%8C%D0%BD%D1%8B%D0%B9_%D0%A1%D0%B0%D0%B9%D1%82_%D0%97%D0%B5%D1%80%D0%BA%D0%B0%D0%BB%D0%BE}|{Стоит ли играть|Рекомендации} в {Аркада|Arkada}?

{arkada онлайн казино зеркало|https://ssjcompanyinc.official.jp/bbs/board.php?bo_table=free&wr_id=4170741}|{Почему {Аркада|Arkada} – {лучший выбор|топовое казино}?

{аркада зеркало вход|https://www.snye.co.kr/bbs/board.php?bo_table=free&wr_id=1179870}|{Финальный вердикт|Мое мнение} о {Аркада|Arkada} {arkada зеркало

рабочее|https://lovewiki.faith/wiki/User:AgnesKeefer9}|{Аркада|Arkada} – {правда|мифы} о {казино|игровом клубе} {игровые автоматы arkada|https://www.jangsuori.com/bbs/board.php?bo_table=free&wr_id=1339}}