Tether (USDT) Staking Guide

The Tether (USDT) Staking Guide is your comprehensive resource for navigating the opportunities and intricacies of staking one of the most popular stablecoins in the cryptocurrency market. Tether has revolutionized the digital currency space by providing a bridge between traditional fiat currencies and cryptocurrencies, offering stability in the often volatile crypto market. This guide delves into the platforms where you can stake USDT, the process of staking, and the unique features these platforms offer to their users. Furthermore, we'll explore the history, technology, and potential of Tether to give you a well-rounded understanding of your investment.

USDT: A Brief Overview

Tether (USDT) stands out as a cornerstone in the cryptocurrency market due to its role as a stablecoin. Pegged 1:1 with the US dollar, USDT provides a bridge between traditional fiat currencies and cryptocurrencies, offering stability in a market known for its volatility.

The Project's History and Technology

Launched in 2014, Tether aimed to meld the best of both worlds: the stability of fiat currency with the flexibility and innovation of cryptocurrency. It operates on several blockchains, including Bitcoin (via the Omni Layer and Liquid Network), Ethereum, Tron, and others, ensuring wide accessibility and utility.

Understanding Tether (USDT)

Before we dive into the specifics of staking, it's essential to grasp what Tether (USDT) is and why it holds a significant place in the crypto ecosystem. Tether is a blockchain-based cryptocurrency whose coins in circulation are backed by an equivalent amount of traditional fiat currencies, like the dollar, euro, or Japanese yen, which are held in a designated bank account. The premise of USDT is to combine the unrestricted nature of cryptocurrencies, which can be sent between users without a trusted third-party intermediary, with the stable value of fiat currencies.

The Genesis of Tether

Launched in 2014, Tether was the first cryptocurrency to peg its market value to a fiat currency. This innovation aimed to offer the best of both worlds: the immediate processing and security of blockchain transactions and the volatility-free stable valuations of fiat currencies. It has since become a foundational component of the crypto market, providing a safe haven for traders and a stable medium of exchange.

Technology Behind Tether

Tether operates on several blockchains, including but not limited to Bitcoin (via the Omni Layer protocol), Ethereum (as an ERC-20 token), and Tron (as a TRC-20 token). This multi-chain presence ensures that Tether can leverage the strengths of different blockchains, such as faster transaction times or lower fees, catering to a wide range of user preferences.

Platforms for Staking Tether (USDT)

Staking USDT involves locking up your Tether tokens on a platform to earn rewards or interest. While traditional staking mechanisms common to cryptocurrencies like Ethereum might not directly apply to a stablecoin like USDT, several platforms offer yield-generating opportunities for holding USDT. These include centralized finance (CeFi) platforms, decentralized finance (DeFi) protocols, and crypto savings accounts.

Centralized Finance (CeFi) Platforms

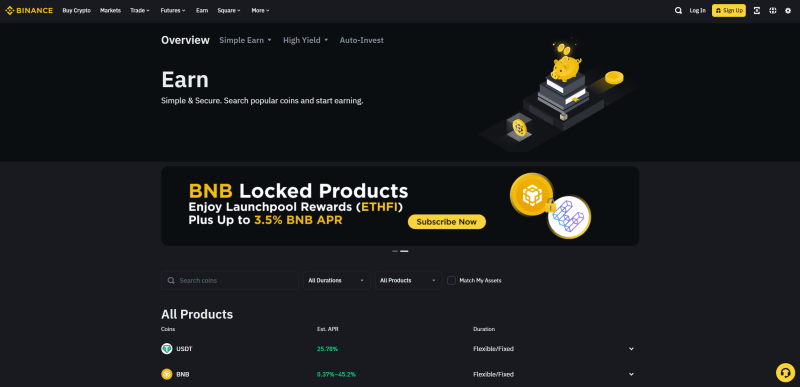

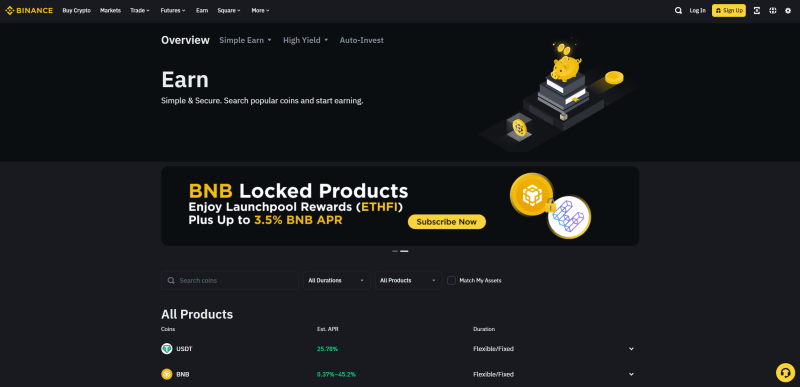

- Binance Earn: Binance offers a flexible savings account where users can earn interest on their USDT holdings. The platform frequently updates its interest rates and provides a user-friendly interface for both beginners and seasoned traders.

- Crypto.com: Known for its versatile crypto services, Crypto.com allows users to stake USDT among other cryptocurrencies, offering competitive interest rates, especially for users who hold and stake the platform's native CRO tokens.

Decentralized Finance (DeFi) Protocols

- Aave: Aave is a decentralized lending protocol that enables users to lend and borrow a wide range of cryptocurrencies, including USDT. Lenders earn interest on their deposits, while borrowers pay interest on their loans.

- Compound: Similar to Aave, Compound is a DeFi platform that offers lending and borrowing services. Users can supply USDT to the protocol's liquidity pool and earn interest based on the current market demand for borrowing USDT.

Crypto Savings Accounts

- BlockFi: BlockFi's interest account allows users to earn interest on their USDT deposits. Interest rates are subject to change based on market conditions, but BlockFi is known for its competitive rates and easy-to-use platform.

- Nexo: Offering a high-yield interest account for USDT and other cryptocurrencies, Nexo provides a straightforward way to earn interest on your digital assets, with the added benefit of daily payouts and no minimum deposit requirements.

The Process of Staking USDT

Staking USDT typically involves a few simple steps, although the exact process can vary depending on the platform:

- Choose a Platform: Research and select a platform that meets your needs, considering factors such as interest rates, security measures, and ease of use.

- Deposit USDT: Transfer your USDT to your account on the chosen platform. Ensure you're using the correct address and blockchain network supported by the platform.

- Start Earning: Depending on the platform, you may need to enroll your USDT in a staking program or simply holding the tokens in your account will automatically start earning rewards or interest.

Key Features to Consider

When selecting a platform for staking USDT, consider the following features:

- Interest Rates: Compare the interest rates offered by different platforms. Higher rates can significantly increase your earnings over time.

- Security: Opt for platforms with robust security measures, such as two-factor authentication (2FA), cold storage of assets, and insurance against hacks.

- Flexibility: Some platforms offer flexible staking, allowing you to withdraw your USDT at any time, while others may require locking up your tokens for a fixed period to earn higher interest rates.

- Fees: Be aware of any fees for depositing, withdrawing, or earning interest on your USDT. Lower fees mean you keep more of your earnings.

Conclusion

Staking Tether (USDT) can be a lucrative way to earn passive income on your cryptocurrency holdings, especially for those looking to avoid the volatility of the crypto market while still participating in its economic opportunities. By carefully selecting a staking platform that aligns with your investment goals and risk tolerance, you can optimize your earnings and enjoy the benefits of the growing DeFi and CeFi spaces. Always conduct thorough research and consider diversifying your staking portfolio to mitigate risks and maximize returns.

Remember, the world of cryptocurrency staking is ever-evolving, with new platforms and opportunities emerging regularly. Keeping abreast of the latest trends and developments will ensure you make informed decisions and continue to thrive in the dynamic landscape of crypto investments.

Here are no comments yet. Be the first!