What is Veil Exchange?

Veil Exchange is a swap-style crypto service focused on privacy and simplicity. The site describes veil exchange as an anonymized exchange with no sign-ups or limits, where you send one asset and receive another to a wallet address you provide.

Instead of a traditional order book, veil exchange presents itself as a "bridge" between networks and assets that routes swaps end to end.

How does Veil Exchange work?

The core idea is straightforward. You pick the "You Send" coin, choose the "You Receive" coin, enter a receiving wallet address, and create an exchange order.

After that, you send funds to the deposit address generated for the order. Veil exchange then processes the swap and sends the output to the wallet address you provided, and you can track progress using an order number.

Sounds simple? It is, but the safety details depend on what happens between "send" and "receive," so it helps to understand the moving parts.

Key features of Veil Exchange

Based on Veil's own public pages, the main veil exchange features are:

- No account creation and "no sign-up" flow

- Privacy positioning, described as "privacy-driven" and "anonymized exchange"

- Order tracking, so you can check the status of a swap

- Token-linked ecosystem, where a separate utility token is promoted alongside the service

Veil exchange also publishes headline volume figures on its homepage (lifetime swapped and 24-hour volume). Treat these as self-reported indicators, not audited market stats.

Supported cryptocurrencies and trading pairs on Veil

Veil exchange states it supports BTC, ETH, MATIC, and "100+ other cryptocurrencies."

It also posts "New Token Supported" updates on the exchange page (examples shown include Flare, GraphLinq Chain, and Official Trump(SOL) with a release date).

Because veil exchange is not an order book exchange, "trading pairs" are better understood as swap routes. Your practical check is whether the exact send and receive assets you want are available at the moment you place the order.

Trading interface and user experience on Veil Exchange

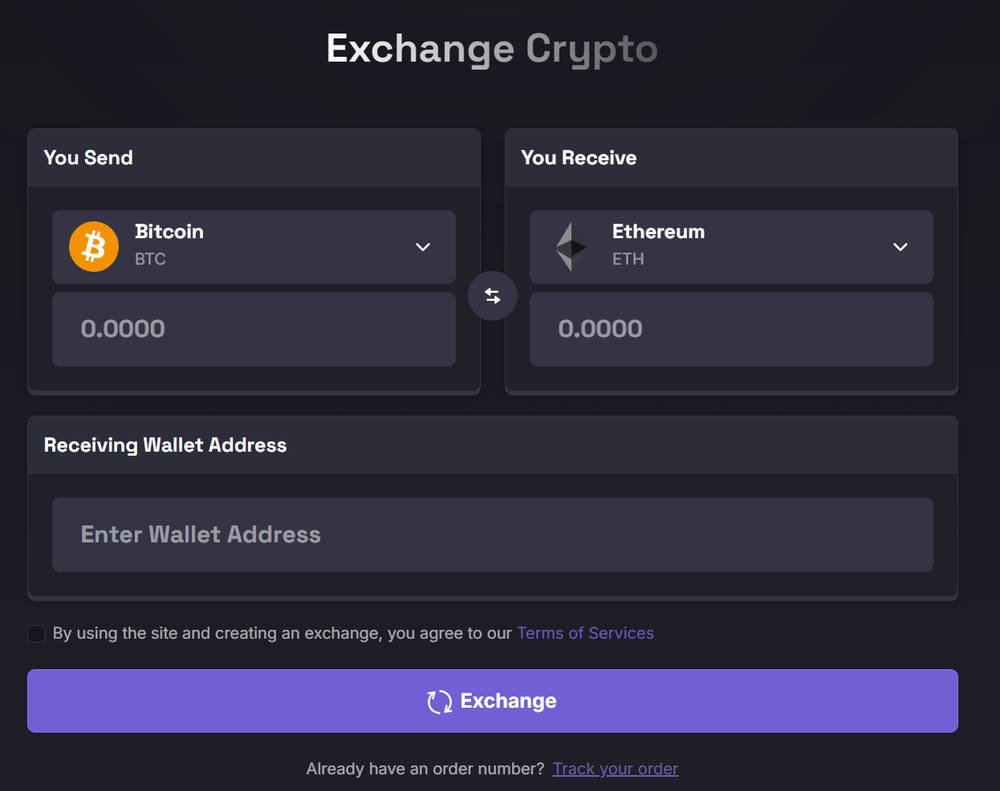

The interface is minimal: coin selectors, a receiving address field, and an agreement checkbox to proceed.

This simplicity has a tradeoff. With veil exchange, you are not placing limit orders, setting maker fees, or managing an account dashboard. You are initiating a one-time swap that depends on execution, liquidity sources, and network confirmations.

Fees on Veil Exchange: trading, deposits, and withdrawals

Veil's Terms of Service confirms that fees may apply, but it does not publish a full fee table on that page.

In practice, for a swap service like veil exchange, users usually encounter fees in three buckets:

- Service or processing fee (the platform's cut, often embedded in the quote)

- Network fees on the sending chain and receiving chain (paid to miners/validators)

- Price spread or slippage if the route needs multiple hops or liquidity is thin

The safest approach is to treat the quote screen as the source of truth for "what you will receive," then compare the same route on another reputable swap or aggregator before sending funds. If the difference is large, do not assume it is "free privacy." It can simply be pricing.

Liquidity and trading volume on Veil

Veil exchange shows two high-level volume numbers on its homepage: lifetime volume swapped and past 24-hour volume.

Those numbers are useful for a basic reality check, but they do not replace transparent liquidity data like you would see on a DEX pool or a major centralized exchange. With veil exchange, you should assume liquidity is sourced externally. That means execution quality can vary by asset, by time, and by network conditions.

A practical test in 2026: try a small swap first, confirm end-to-end delivery, then decide if the route is consistent enough for larger amounts.

Is Veil Exchange safe? Security measures explained

Safety with veil exchange is less about "account hacks" and more about operational risks during swaps.

Here is what Veil publicly claims or shows:

- It emphasizes privacy and security as a core theme.

- It provides order tracking, which reduces "black box" anxiety during processing.

- It publishes Terms of Service with an effective date and a contact email.

Here is what is not clearly disclosed on the pages above:

- Detailed custody and settlement mechanics (who holds funds during processing, and where)

- A public security policy, audits, or incident history

- A clear fee schedule and dispute resolution workflow beyond general ToS language

So is veil exchange safe? It can be "safe enough" for small swaps if you use careful checks, but it does not offer the same transparency you get from on-chain DEX pools or large regulated exchanges.

Custody model and user fund protection on Veil

Veil exchange is not a self-custody DEX. Its own FAQ says it is not a DEX and instead acts as a protocol and bridge enabling swaps across networks.

That implies a temporary custody or routing step during processing. The user fund protection model, in that case, depends on Veil's internal controls and partners, not on smart contract guarantees you can verify on-chain.

The main protection you control is limiting exposure: start small, verify outputs, and avoid treating veil exchange like a long-term storage venue.

KYC and privacy policy on Veil Exchange

Veil exchange markets "no sign-up," which usually means no standard KYC onboarding for basic usage.

However, "no sign-up" is not the same thing as "no compliance." The Terms of Service states you must comply with applicable laws and that Veil can update services and terms.

If you need strict privacy guarantees, the honest answer is: you should treat veil exchange as a privacy-oriented user experience, not as a legally binding anonymity promise. Your transaction still exists on public blockchains, and network-level metadata can still matter.

How to trade on Veil Exchange

A safe, repeatable way to use veil exchange looks like this:

1. Select the send and receive assets and double-check the networks.

2. Paste a correct receiving address for the receive asset. If you paste an address on the wrong chain, you can lose funds.

3. Create the order and copy the deposit address that veil exchange generates.

4. Send a small test amount first, especially if it is your first time using veil exchange.

5. Track the order using the order number until it completes.

6. Only then scale size, and keep receipts like transaction hashes for both chains.

Pros and cons of using Veil Exchange

Pros

- Veil exchange is simple to use and does not require an account flow.

- It supports many assets and positions itself as cross-network friendly.

- Order tracking improves visibility compared with fully opaque swap services.

Cons

- Veil exchange is not a DEX, so you lose some on-chain transparency and control.

- Fee disclosure is limited on the public ToS page, so you must rely on quotes.

- Public documentation access was inconsistent at the time of writing (docs site fetch failed), which makes due diligence harder.

Risks and limitations of Veil Exchange

The biggest risks with veil exchange are practical, not theoretical:

- Address risk: one wrong character or wrong chain can be irreversible.

- Execution risk: quotes can change if liquidity is thin or networks are congested.

- Counterparty risk: because veil exchange is not a DEX, there is some dependence on the service completing the swap.

- Support and dispute limits: the ToS limits liability and does not describe a detailed arbitration process.

If you are swapping a large amount, these risks matter more than the convenience.

Who is Veil Exchange best suited for?

Veil exchange tends to fit users who:

- Want a quick swap without creating an account

- Are comfortable self-managing wallet security and address hygiene

- Prefer a simple interface over advanced trading tools

Veil exchange is less suitable if you need: audited transparency, strict compliance clarity, fiat on-ramps, or deep order book execution.

Conclusion: Is Veil Exchange safe to use in 2026?

Veil exchange presents a clean, privacy-driven swap experience with no sign-up, order tracking, and support contact details in its Terms of Service.

Is veil exchange safe in 2026? For many users, it can be safe for small, careful swaps if you verify assets and addresses, test with small amounts, and treat quotes and network fees seriously. For larger sizes, the lack of detailed public disclosures means you should either split swaps, compare alternatives, or use venues with clearer transparency and protections.