Fringe Finance Reviews 2022

The DeFi space continues to expand, offering people new services and ways to earn passive income through digital currencies. Amongst a series of emerging, innovative DeFi protocols, Fringe Finance is one worth shining our beams on.

While most DeFi platforms provide lending/borrowing functionalities focused on the top cryptocurrencies, Fringe Finance goes one step further, allowing its users to borrow stablecoins by depositing smaller cryptocurrencies as collateral. Let us review Fringe Finance’s functionalities and background, and look into its safety mechanisms to try and determine whether it could be a scam.

What Is Fringe Finance?

Fringe Finance is a DeFi platform providing users with opportunities to lend, borrow, and stake cryptocurrencies. The project was founded in 2020 as Bonded Finance but rebranded to Fringe Finance in 2021.

It features a multi-cultural core team with members from various continents, including Australia, Asia, South, and North America. Two important names for Fringe are Paul Mak (CEO) and Brian Pasfield (CTO). Mak brings years of experience and expertise in the crypto world.

Paul got into the digital currency ecosystem in 2014 and has been a professional investor and operator since the early 2000s. Before embracing crypto, Mak operated in the Traditional Financial sphere, which helped him develop the knowledge that he put into play with the build-up of Fringe Finance.

Pasfield has 10+ years of experience in the FinTech and blockchain sectors. Currently, his main focus is DeFi. Apart from the technological side, Brian has experience in bridging blockchain startups with legislators. Before Fringe Finance, Pasfield worked for different companies in Australia, Switzerland, and other countries.

Through the power of smart contracts, Fringe Finance aims to allow its users to earn from small-cap coins. It provides less popular assets with a way to enter DeFi, become more capital-efficient, and therefore makes them a worthier investment.

Aside from functions like lending, borrowing, and staking, Fringe Finance also provides users with insurance and other features. Entrepreneurs will be able to seamlessly embed Fringe Finance’s functionalities into their platforms and maintain smooth cross-platform connectivity.

The platform uses two native tokens as fuel, including the $USB stablecoin and the FRIN token. The platform collects small fees, which are accumulated in Reward Pools and paid out as a reward to FRIN token stakers.

Fringe Finance has gained traction since its inception and has an active partnership with several notable crypto platforms such as Chainlink, Polygon, HitBTC, Uniswap, Bancor, AscendEx, and others. The Twitter community of Fringe Finance has also exceeded 12,000 followers.

Main Features

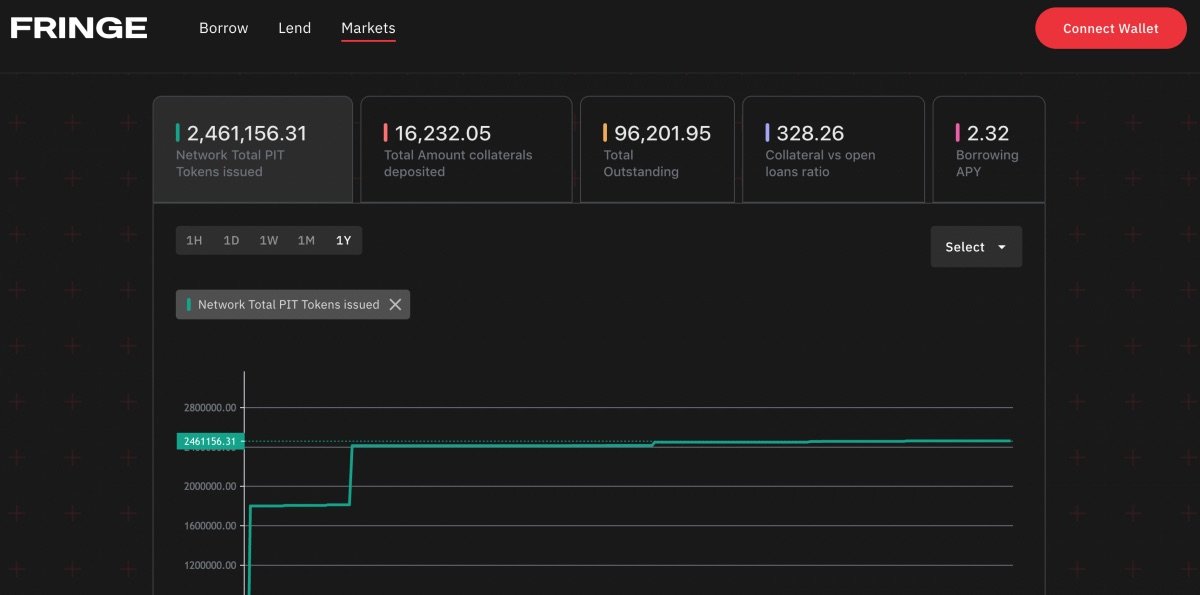

As mentioned before, the main features of Fringe Finance are borrowing, lending, and staking. Fringe Finance’s Platform has many facilities through which it achieves its goals to bring value to supported altcoins. These facilities include the Primary Lending Platform (PLP), the USB Stablecoin Platform, The FRIN Staking & Rewards Platform, and Yield farming incentives.

Within the Primary Lending Platform, lenders can deposit stablecoins to earn a yield on their deposits. In turn, borrowers can take out these stablecoins as overcollateralized loans with friendly interest rates. Within the PLP, the interest charged to borrowers is used to pay lenders, who deposit liquidity to power the entire lending protocol.

Within the Primary Lending Platform, lenders can deposit stablecoins to earn a yield on their deposits. In turn, borrowers can take out these stablecoins as overcollateralized loans with friendly interest rates. Within the PLP, the interest charged to borrowers is used to pay lenders, who deposit liquidity to power the entire lending protocol.

The USB Stablecoin Platform is also a pivotal facility in the Fringe Finance ecosystem, through which minters can deposit altcoin collateral into a USB Collateral Safe of their own and receive a Line of Credit (LOC). Minters can generate $USB stablecoins based on their credit, which they can deploy to harness various opportunities in the DeFi ecosystem. Users can regain their credit line by burning their USB stablecoins.

DAO Evolution

When the platform’s functionalities have fully evolved, Fringe Finance will operate as a Decentralized Autonomous Organization (DAO), which will cede total control of the platform into the hands of its community. FRIN token stakers will act as the stakeholders of the protocol and will secure the decision-making process through their activities. That will present Fringe as a truly decentralized value addition platform.

As a community-driven platform, the Fringe DAO Fringe Finance could theoretically be attacked by malicious voters. To protect the platform from shady proposals, Fringe implemented a simple yet elegant solution — a "delay" period given to voters before they cast their decisions.

Is Fringe Finance Safe?

For one, the platform is fully decentralized, as it’s non-custodial and users’ funds operate exclusively within smart contracts. Fringe also doesn't collect sensitive data.

The fact that the platform is open-source and has many solid partners including Chainlink, Polygon, and Ren vouches for Fringe’s transparency and makes it unlikely for it to be a scam. The platform has also been twice audited by independent professional firms, which guarantees its trustworthiness.

Success Factors

As of 2022, the platform is yet to roll out its operation. However, this delay is notably a necessity for Fringe Finance to build a strong product and focus on customers' needs and safety. Time will show whether the protocol succeeds and manages to live up to the hype the project has generated. As for now, it seems like Fringe has a good chance to grow the DeFi ecosystem and build a strong reputation in the future.

Here are no reviews yet. Be the first!