What is Sachocoin (SACHO)?

Sachocoin (SACHO) is a small Solana-based token that appears in meme categories and is tracked by major crypto data platforms. In 2026, most people approach Sachocoin as a Sacho crypto asset to watch, trade, or simply track, rather than as a complex protocol with many moving parts.

A practical way to think about Sachocoin is this: it is a token that lives inside the Solana ecosystem and gets its "market reality" from liquidity pools, trading activity, and community attention.

How does Sachocoin work?

On a technical level, Sachocoin works like a typical Solana SPL token. It exists as an on-chain asset with a defined supply and a token address, and it can be swapped through decentralized exchanges where liquidity is available.

For many readers, the most important "how it works" detail is verification. Sacho crypto tokens can share similar names and tickers with unrelated assets, so the contract address is the safest identifier when you track Sachocoin in a wallet or on a DEX.

The idea and background behind Sachocoin

Sachocoin is presented publicly as part of the Solana meme and Pump.fun style ecosystem, where tokens often emerge quickly and gain attention through community activity. That background shapes expectations: the story can matter as much as the technology, and market moves can be driven by liquidity more than long-term fundamentals.

So, if you are trying to understand Sacho crypto in 2026, it helps to treat it as a token whose "background" is largely social and market-driven.

What makes Sachocoin (SACHO) unique?

For a small meme-category token, uniqueness usually comes from three things: recognizability, on-chain transparency, and where it trades. With Sachocoin, the clearest differentiator is that its token identity is easy to verify through its Solana address and its primary trading venue data.

Another practical point is supply structure. Trackers show Sachocoin with a circulating supply close to 1 billion tokens and a max supply near 1 billion, which means the "fully diluted" view is often close to the circulating view. That does not make the token safer, but it simplifies supply interpretation for Sacho crypto watchers.

What can Sachocoin be used for?

Sachocoin is primarily used as a tradable asset. In most cases, the real "use" of Sacho crypto is:

- Swapping on Solana DEX venues where liquidity exists

- Tracking the token in wallets and portfolio tools

- Following short-term market activity, volume, and liquidity shifts

If you are looking for utility in the sense of "paying for a service" or "unlocking protocol features," public data pages do not emphasize that. For Sachocoin, market behavior tends to be the main story.

Sachocoin (SACHO) price today

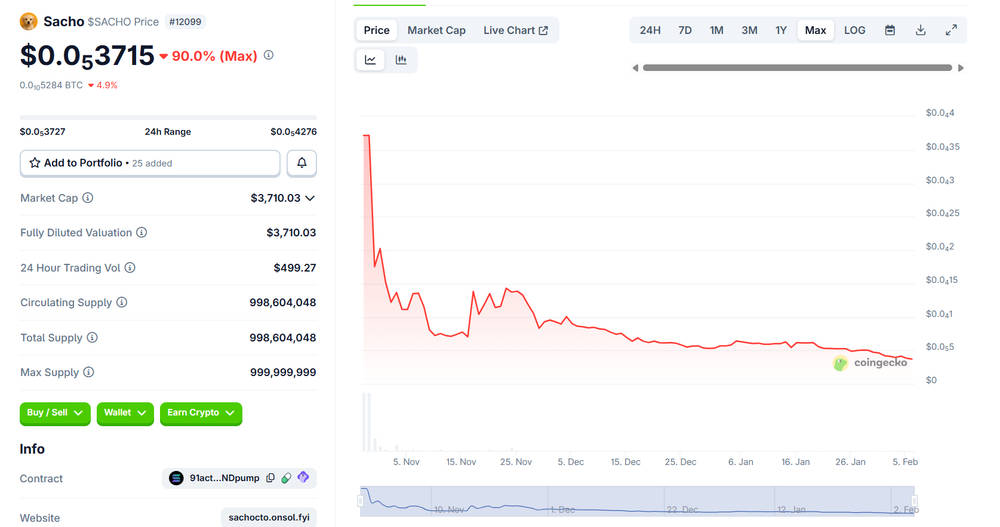

The Sachocoin price today is best treated as a snapshot, because small-cap tokens can move on minimal volume. Data platforms show that Sacho crypto trading volume can be very low on some days, which means the last traded price may not represent a deep market.

If you want a quick reality check for Sachocoin in 2026, look at two numbers together: 24-hour volume and liquidity in the main pool. When those are thin, price can be jumpy and spreads can be wide.

Sachocoin price history and performance

Sachocoin price history on public trackers shows an all-time high around late October 2025, and an all-time low in early February 2026. Those reference points help you understand how volatile Sacho crypto can be, even within a short time window.

One useful habit is to read the history in phases rather than single peaks:

- Launch or early discovery phase (often the most volatile)

- Liquidity settling phase (volume drops or stabilizes)

- Attention spikes (short bursts that may reverse quickly)

This framing keeps you from overinterpreting one candle on the chart.

Sachocoin (SACHO) price chart overview

A chart is only as meaningful as the liquidity behind it. For Sachocoin, market pages show that the main trading activity is on Solana DEX venues such as PumpSwap, and external pool dashboards publish liquidity and FDV estimates for that pool.

Sounds simple? Here is the practical takeaway: if Sacho crypto liquidity is a few thousand dollars, even a modest swap can move the price significantly. That is not a "bug" in Sachocoin, it is a feature of thin markets.

Market cap, circulating supply, and total supply of SACHO

For Sachocoin, trackers report circulating supply near 998.6 million tokens, total supply near the same figure, and a max supply of 999,999,999. That makes the supply model relatively easy to read compared to tokens with large future emissions.

Market cap is typically computed as price multiplied by circulating supply. In early February 2026 snapshots, the market cap shown for Sachocoin is only a few thousand dollars, which places it firmly in micro-cap territory. For Sacho crypto investors, that is a direct signal that liquidity and price impact matter a lot.

Trading volume and liquidity of Sachocoin

Trading volume is a strong indicator of whether the market is active or quiet. Coin tracking pages for Sachocoin show that daily volume can be very small, but it can also jump sharply from one day to the next, which is common for Sacho crypto assets with thin liquidity.

Liquidity is the second half of the story. Pool dashboards for the main SACHO/SOL pair provide liquidity estimates and FDV snapshots. If liquidity is low, slippage rises and the chart can become easier to move with fewer trades.

Where to buy Sachocoin (SACHO)?

Most listings indicate that Sachocoin is traded through decentralized exchanges on Solana, with PumpSwap being presented as the primary venue on some trackers.

If you use an aggregator wallet interface, it may route swaps to the same underlying pool. Some "how to buy" guides also explicitly instruct users to paste the token address to avoid confusion with other assets that share similar tickers, which is especially relevant for Sacho crypto.

How to store SACHO safely

Because Sachocoin is a Solana token, it is typically stored in a Solana-compatible wallet. The basic safety checklist for storing Sacho crypto is straightforward:

- Use a reputable Solana wallet and secure your recovery phrase offline

- Verify the token by its address, not just by the name "Sachocoin"

- Avoid signing unknown transactions, especially when exploring new meme tokens

If you hold any SACHO at all, the most common operational risk is not "hacking the token," but user error: signing something you did not understand, or interacting with a lookalike asset.

Risks and considerations when investing in Sachocoin

Sachocoin carries the typical risk profile of a micro-cap meme-category token:

- Thin liquidity: price impact and slippage can be large on normal-sized trades

- Low or inconsistent volume: the market may be hard to enter or exit cleanly

- High volatility: short attention cycles can drive sudden spikes and drops

- Identity confusion: similar names and tickers can exist, so address verification is critical

None of these points are unique to Sachocoin, but they are especially relevant for Sacho crypto because the market size is small.

How does Sachocoin compare to similar crypto projects?

Sachocoin's closest comparisons are other Solana meme tokens that trade mainly on DEX pools and have supply near 1 billion. In that peer group, what matters most is not a whitepaper, but market structure: where it trades, how deep the liquidity is, and whether volume is consistent.

Another comparison angle is platform categorization. Trackers place Sachocoin inside Solana ecosystem and meme-related categories, which is a signal that the market treats it as Sacho crypto for attention and trading, not as infrastructure.

Conclusion

Sachocoin (SACHO) is a Solana-based micro-cap token most often viewed through a trading and tracking lens. In 2026, the clearest way to understand Sacho crypto like Sachocoin is to focus on verifiable facts: the token address, the main trading venue, the liquidity behind the price, and the key historical reference points.