Introduction

Will XYO coin reach $1 is something any investor or interested party can ask themselves when they see XYO exchanging hands for under a penny.

What is XYO? How does the XYO token work? How many exist in a $1 price, and what real-life occurrences and market occurrences must occur for that to happen? Those are the things answered in this post in a neutral and practical manner.

XYO — Definition in Simple Words

XYO is the XYO Network's own token, a venture focusing on harvesting and verifying real-world data and moving such data onto blockchains. XYO Network regards itself as a data-first blockchain and one of the original DePINs (decentralised physical infrastructure networks), where nodes and devices are rewarded for taking part with location and sensor data.

XYO, in a nutshell, aims to convert evidence of a real-world event having taken place — e.g., an asset having been in a place and at a time — into something that can be fed to smart contracts, tracking, or anything else. Think of it as a bridge from sensors in the physical world to on-chain records.

It combines a hardware and a software element: device owners or node operators run sensors or small pieces of software agents who are gathering data, then the network verifies and rewards them. Such data then can underlie services such as asset tracking, logistics proofs, or DePIN-type applications.

One example of an XYO Bridge hardware device used to collect real-world geospatial data.

Tokenomics — Supply, Market Cap and What $1 Means

XYO's supply is vast. Its current circulating supply is around 13.6 – 13.9 billion tokens, depending on the data set and time. That's a significant supply figure, in that a $1 XYO token would represent a market cap of enormous size.

At approximately 13.9 billion tokens, a $1 price indicates a market cap of approximately $13.9 billion — achieved through price multiplied by circulating supply. To put it in perspective, many projects in the top 50 reach those kinds of market caps only through mass adoption or overwhelming utility growth. That simple math is why a price shift from $0.01 to $1 is not a 100x — it's a change in what the market believes the whole project is worth.

Real-time market data places XYO firmly below a dollar by a significant amount — current prices range around $0.009 – $0.01. Check real-time market pages like CoinGecko, CoinMarketCap or major exchanges for the latest data before making a decision.

Historical Price and Milestones

XYO is not a new token — the token and network have existed for a few years, with characteristic spikes in the midst of broader price rallies. Its record high is up near $0.08, set in a peak for the 2021/2022 cycle. That indicates the token must have fluctuated tens of percent in the past, but $1 would represent a much steeper ascent.

History is a guide but no guarantee. Crypto markets are sectoral and cyclical — a healthy data demand or DePIN cycle could lift projects like XYO, but bear markets could compress valuations for months or years.

Key dates to watch out for are mainnet upgrades, real-world partnership integrations, greater node engagement, and significant exchange listings. Those events are known to bring about heightened awareness and sporadic price gains.

Key Technology and Practical Application Cases

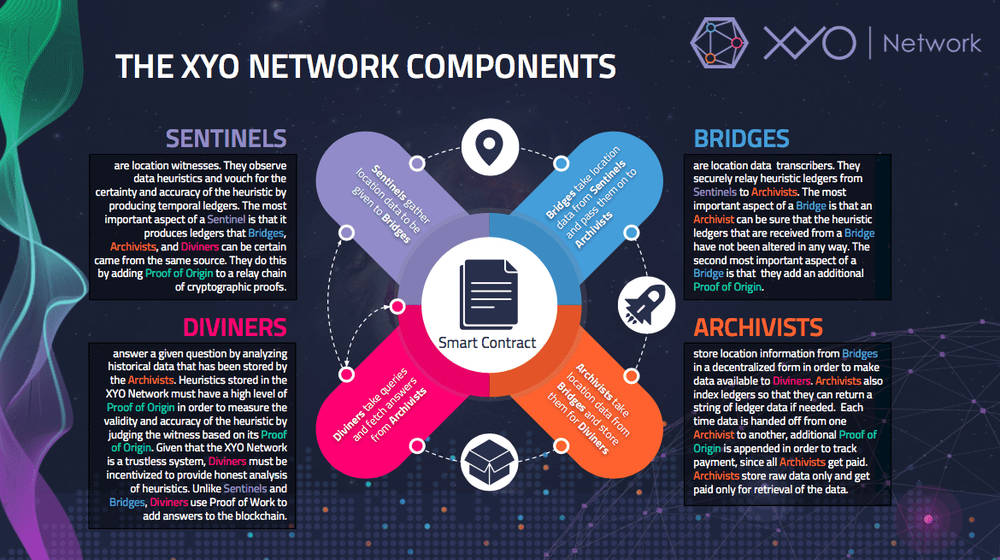

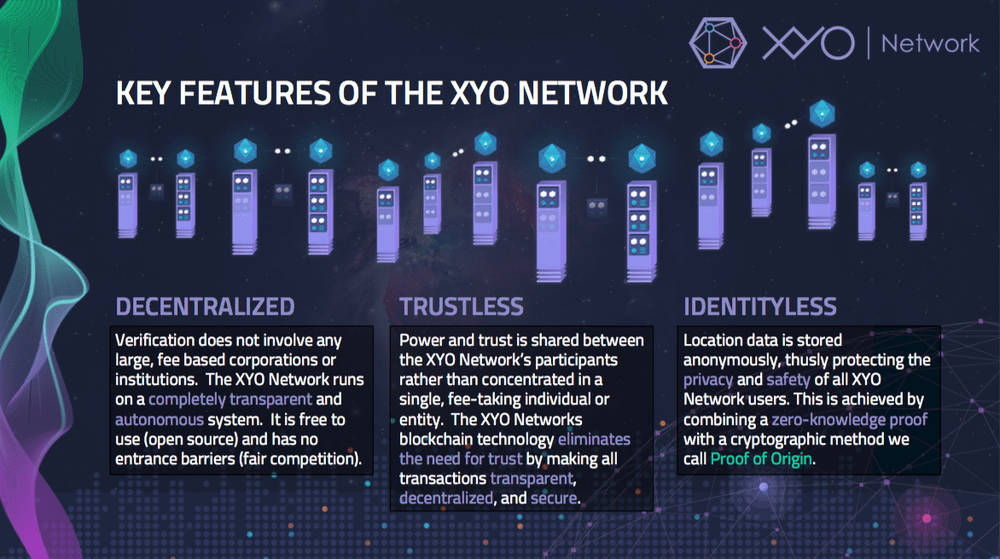

XYO focuses on gathering real-world data reliably and proving it on-chain. Supply chain proofs, proof-of-location services, use in IoT integrations, and any service in which a collateral record is required for something physically having taken place are areas where it can benefit. Data scaling, verification, and monetization are noted as essential elements by the team.

Architecture of the XYO Network: Sentinels, Bridges, Archivists, Diviners, and how they interact around the Smart Contract.

Key features of the XYO Network: decentralized, trustless, real-world data capture and verification.

Practical use cases include tracking assets, verification of logistics locations, and powering DePIN projects, in which devices are rewarded for reporting correct data.

For example, staking is one of the mechanisms driving adoption in similar ecosystems, see the Solana (SOL) Staking Guide.

If businesses use XYO-type proofs on a large scale — e.g., logistics companies utilizing validated location data — it can generate consistent demand for on-chain verification and tokenized incentives. But it’s moving at a slow pace and requires explicit cost-vs-benefit for businesses.

Who's Building XYO — People and Partners

XYO Network leadership presented the project as an early initiator of DePIN and device-level incentives. Cofounders and the entity have hastened partnerships, pilot projects, and investment into research and infrastructure. News reports have mentioned XYO as a DePIN project having many nodes and early revenue from data services.

Ecosystem partners and supporters are useful insofar as they bring use cases, pilot projects, and awareness. XYO publishes partner updates and strategy on the website, and these can affect investor sentiment in the event they achieve scale.

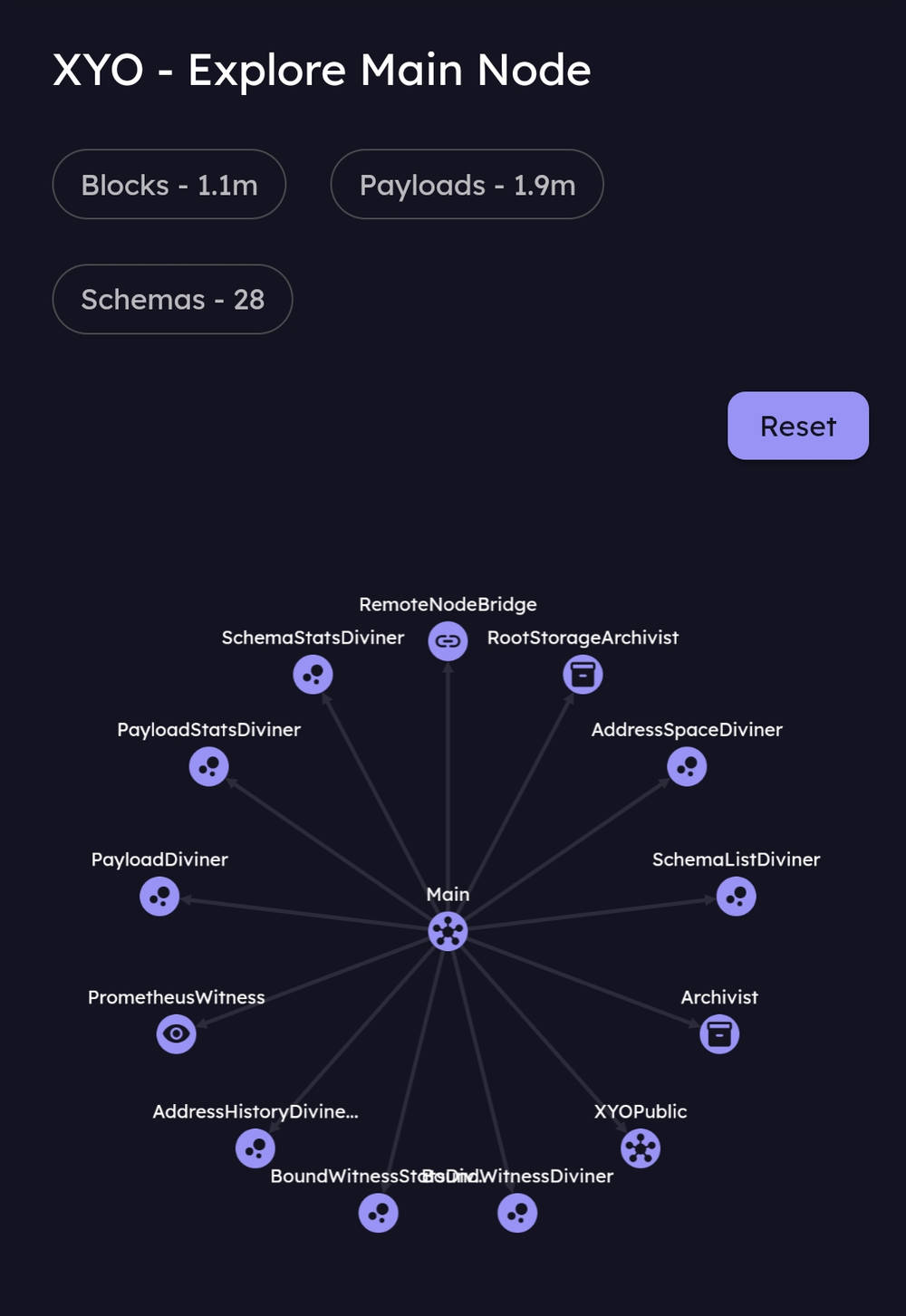

XYO node dashboard example: showing blocks, payloads and schema counts on the Explore Main Node.

You can also look at how staking models support ecosystem growth in other networks, such as XDC Staking Guide.

Look for integrations with logistics companies, IoT platforms, or major DePIN funds. Those are the kinds of updates most likely to affect adoption rates.

What Must Shift in Order for XYO to Reach $1

It would need three significant transitions:

- Acceleration in real-world application growth.

- Reduction in effective token supply through burning or locking.

- Mass-scale market re-rating for DePIN and data-blockchain themes.

Together, they can push price up — but each is challenging to initiate.

Regardless of product-market fit, investor sentiment and cycles in the market motivate big chunks of crypto price fluctuations. A bull market raises many projects simultaneously, and bear stages punish even practical projects.

Finally, liquidity and listing on exchanges matter. Wider availability and high liquidity on big exchanges can help a price run through allowing greater inflow of capital.

Risks and Obstacles

A few clear dangers:

- Competition — other proof-of-location or data-verification initiatives can take market share.

- Token supply — a large circulating supply equals big per-token returns are harder without huge inflows.

- Execution risk — pilots won't always scale to enterprise-level implementation.

Market risk matters too. Crypto is correlated, and a macro headwind or a prolonged bear market can bring even good projects to a halt in terms of appreciating in price.

Finally, beware of hype-driven tales. A $1 price is attractive in headlines, but fundamentals and flows must warrant that valuation.

Reasonable Price Scenarios

- Conservative case — XYO remains a niche DePIN token trading under $0.20 for years in case of slow adoption.

- Bull case — widespread enterprise uptake, token burns or prolonged staking, and a boom in the DePIN sector could bring XYO higher; reaching $1 still requires huge uptake or token supply change.

- Speculative case — a mass market bubble or tokenomics change could cause a paroxysmal run, but such phenomena often correct sharply.

Use scenario thinking rather than absolute prediction.

How to Follow XYO and What to Watch Next

Obtain current price and supply data on CoinGecko, CoinMarketCap, and major exchanges. Follow XYO Network updates for partnerships, mainnet releases, and device adoption metrics. Follow DePIN sector updates as well, since XYO's future is contingent on demand for on-chain real-world data.

If you invest, consider position size, long-term focus, and high volatility potential. This is educational, not financial advice.

Conclusion

Can XYO reach $1? Mathematically, yes — but such a drastic fluctuation in market value would involve a significant shift in real-world adoption or token quantity modifications. $1 is a high price considering the token's current supply and market cap in comparison to its price in the past and present.

Watch fundamentals — adoption, partnerships, tokenomics — and the broader DePIN trend to assess the possibility over time.

FAQ

Q: What market cap would XYO have at $1?

A: With ~13.9 billion tokens, that's a $13.9 billion market cap. That tier puts XYO in major mid-cap crypto projects, so adoption must keep up with that valuation.

Q: Did XYO come close to $1 before?

A: No. XYO’s all-time high is around $0.08, far below $1. Past highs show upside exists, but the gap to $1 is large.

Q: What real-world use could bring XYO up from here?

A: Widespread enterprise use of verified location and sensor data — for logistics, insurance proofs, or IoT billing — could create steady demand; DePIN-type economies in which nodes are rewarded in XYO could help too. Scaling up adoption is necessary.

Q: Where can I see real-time XYO data?

A: On CoinGecko, CoinMarketCap, Coinbase, Kraken, or the XYO Network website.

Q: Is this financial advice?

A: No. Do your own research and consult a licensed financial advisor before investing.