A cheat sheet is a concise reference summarizing the essential principles, patterns, and rules applied in the financial markets. Whether you trade stocks, cryptocurrencies, forex, or commodities, a cheat sheet can save time and improve decision-making. Instead of searching through lengthy books or courses, traders use these quick guides to recall strategies and technical patterns instantly. This article explains what a cheat sheet is, how it works, and the typical information it includes.

What is a Trading Cheat Sheet?

A trading cheat sheet is simply a reference sheet. It can take the form of a chart, PDF, infographic, or even a notebook page where traders note key reminders. These sheets typically cover candlestick patterns, chart formations, risk management rules, and order types.

Think of it like a pilot’s pre-flight checklist. Just as pilots confirm critical steps, traders consult cheat sheets to recall market fundamentals before entering trades. This helps prevent emotion-driven decisions and ensures strategies remain consistent.

Historical Background of Cheat Sheets on Trading

The concept of cheat sheets has existed for decades. Early stock traders used printed cards displaying chart formation signals. Technical analysis texts later standardized candlestick charts, often summarized in quick-reference posters.

With the internet, cheat sheets became globally accessible in digital formats. In crypto trading, they gained popularity among beginners looking to quickly grasp chart signals without reading hundreds of pages. Today, many websites and educators provide cheat sheets to train newcomers efficiently.

Key Points on a Cheatsheet for Traders

Most cheat sheets include several categories of information:

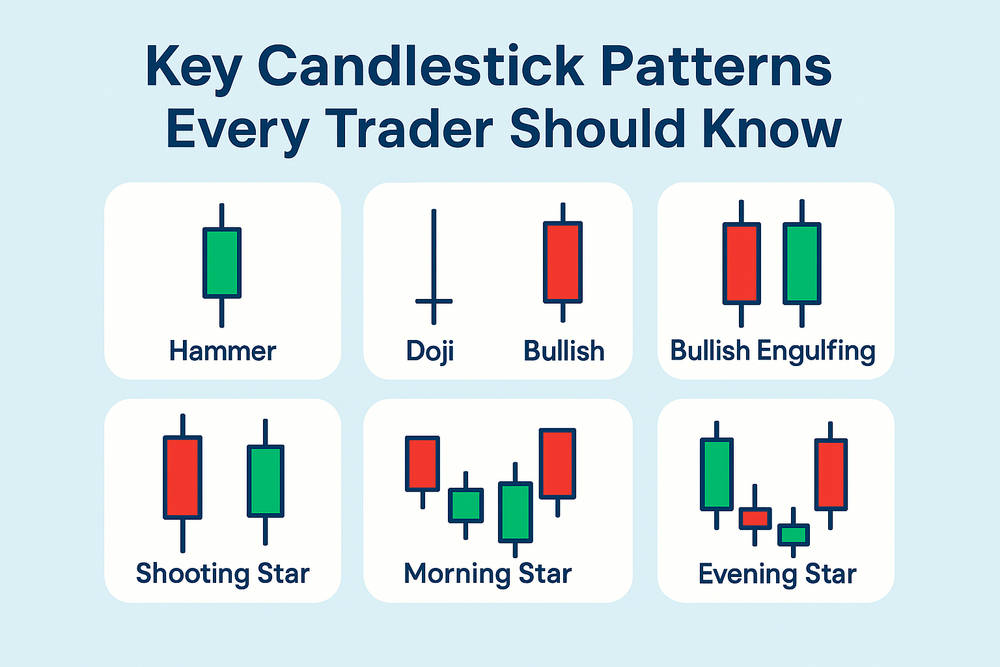

Candlestick Patterns

They show price action visually. Cheat sheets typically list bullish and bearish patterns like Doji, Hammer, Shooting Star, Engulfing, and Morning Star, each indicating market sentiment.

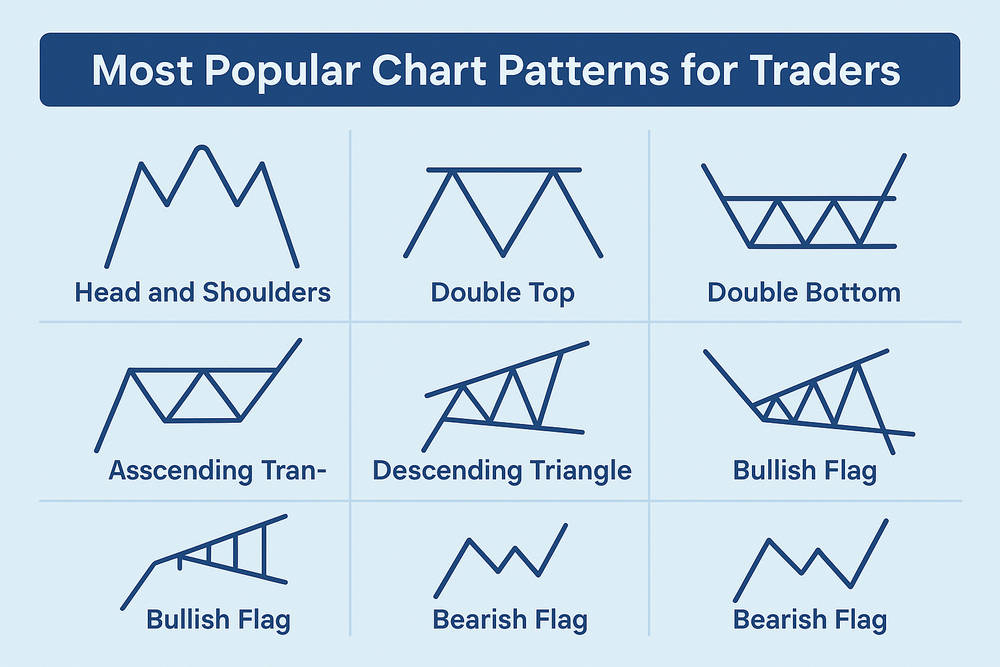

Chart Patterns

Long-term formations such as Head and Shoulders, Double Top, Double Bottom, Flags, and Triangles are included. These patterns help predict trend continuations or reversals.

Prioritizing Risks

Cheat sheets remind traders to use stop-loss orders, control position size, and follow the “risk 1-2% of capital per trade” guideline.

Indicators

Common technical indicators on cheat sheets include Simple Moving Averages (SMA), Relative Strength Index (RSI), and MACD, helping traders identify trends and momentum.

Why Traders Keep Cheat Sheets

Trading involves decision-making under uncertainty, often influenced by emotions. Cheat sheets help in three ways:

Speed: Rapid reference saves time.

Consistency: Reinforces principles and reduces errors.

Education: Beginners learn to recognize patterns quickly.

Professional traders may rely less on cheat sheets, but most maintain brief notes as a reference.

Case Studies: Practical Usage of Cheat Sheets

In 2020, during pandemic-related market volatility, many novice traders entered stock and crypto markets. They used candlestick cheat sheets to understand sudden price movements. Social media amplified the sharing of these charts for fast learning.

Forex traders also benefit. Brokers provide cheat sheets with key chart patterns and indicator explanations. Traders often keep printed guides next to their setups, making cheat sheets a practical survival tool in rapidly changing markets.

Projects and Influencers Promoting Cheat Sheets

Several projects and influencers have popularized cheat sheets:

- ChartSchool (StockCharts.com) offers video lessons on chart patterns.

- TradingView community members share cheat sheets via public scripts.

- Twitter and Telegram influencers create simple guides for crypto traders.

However, the authenticity of content is crucial. Not all cheat sheets are expert-prepared, and misinterpreted patterns can lead to losses.

Benefits and Limitations of a Trading Cheat Sheet

Like any tool, cheat sheets have pros and cons.

Benefits:

- Easy to understand and remember.

- Quick to implement.

- Encourages discipline and organized trading.

Limitations:

- Oversimplification may give false confidence.

- They cannot replace in-depth market knowledge.

- Real-world trading requires deeper analysis than a cheat sheet offers.

How to Create Your Own Trading Cheat Sheet

Traders often develop personalized cheat sheets:

- Collect Key Patterns: Select candlestick and chart patterns relevant to your strategy.

- Add Risk Management Rules: Include stop-loss, risk per trade, and money management notes.

- Customize Indicators: Set your commonly used RSI, MACD, or moving averages.

- Keep It Brief: One-page or one-screen format works best for quick reference.

A customized cheat sheet boosts productivity and reinforces learning through repetition.

Goal-based Cheat Sheet Evaluation

Cheat sheets are tools, not guarantees. Traders relying solely on them without understanding the market may struggle. When paired with education, practice, and discipline, cheat sheets enhance consistency and confidence.

They serve as reminders, not predictive systems. Market conditions, news, and economic events can override apparent patterns.

Conclusion

A trading cheat sheet condenses critical patterns, rules, and strategies into a quick reference. It simplifies advanced concepts into actionable visuals and reminders for fast decision-making. While it cannot replace thorough market knowledge, it is invaluable for beginners and helps experienced traders maintain discipline. Successful trading depends on the combination of knowledge, discipline, and tools like cheat sheets.

FAQ

What is included in a trading cheat sheet?

Typically, candlestick patterns, chart patterns, risk management rules, and key indicators are included.

Are cheat sheets good resources for beginners?

Yes. They accelerate learning and reduce reliance on memory when entering trades.

Do professional traders use cheat sheets?

Some do. Professionals keep quick reference guides, though experience and detailed study remain essential.

Can one be successful using only a cheat sheet?

No. Cheat sheets guide, but effective trading requires education, practice, and market familiarity.

How can I create my own cheat sheet?

Compile recurring patterns, signs, and rules from your practice. Keep it concise for rapid reference.