How to Benefit From Automated Trading on HitBTC | Ultimate Guide by Cryptogeek

One of the pioneering crypto exchanges, HitBTC, urges traders to try out using TradeSanta, a trading bot that connects to HitBTC accounts smoothly. The bot itself has gained much attention in the last few years. If you are new to trading bots, this article will shed some light on automated trading basics. More than that, we will tell you about TradeSanta and HitBTC in short.

- What Is Automated Trading?

- Benefits of Trading Bots

- Possible Disadvantages of Trading Bots

- TradeSanta & HitBTC

- How to Use TradeSanta With HitBTC?

- Why Does TradeSanta Match HitBTC So Well?

What Is Automated Trading?

Crypto traders have lots of available tools, multiple trading strategies to choose from, thousands of coins to invest in, and myriads of info channels that can help make the right and timely decision. However, there is one thing that no trader can do. No trader can surpass human abilities. Probably you can even control your emotions while trading (that's what makes you a human and not the machine), but you cannot, let's say, post 90 orders simultaneously. You cannot trade non-stop as you need to rest or do other things, live your life, after all. Expanding your trading abilities beyond your human experience is possible, though. Probably you have already heard about trading bots or even tried some. As more and more people get involved in crypto trading, the role of crypto trading bots grows respectively.

The trading bot is a program that automatically performs trading activity following the preferred strategy. The program acts on the user's behalf, placing buy and sell orders on the exchanges the bot user selects. Where traders are not safe from panic, greed, FOMO, and other harmful factors, bots just keep on following the plan. Besides, bots don't get tired; they don't lose focus and attention. It makes possible the 24/7 trading on dozens of markets simultaneously.

As the strategy is configured to be profitable in the current market reality, it's crucial to update specific parameters when the market trends change. You can benefit from both bearish and bullish markets. It all depends on the strategy you set. It's understood that if you see that the bot configuration can be improved, you are free to change it at any time.

Benefits of Trading Bots

Reasons for using trading bots are multiple. Just look:

You can forget about posting trades manually. Instead, you set the bot, which works for you to save your time and nerves. You won't need to dedicate the best time of your life to monitoring the charts and looking for the best options. The bot selects all the best positions with full respect to your demands (if you set them accurately). Unlike humans, the bot won't miss a single chance to make the proper trade. Bots find opportunities and trade dozens of times quicker than we do. Imagine the enormous burden you get rid of when you use the bot.

Additionally, let's not forget that the crypto market never sleeps. It is global, and trading takes place all the time. That's beyond the human possibilities to work on the market around the clock. But the bot can do this.

The trading speed of the bots deserves more attention. For a bot, it takes less than a second to place several trading orders at once. What does it mean in terms of profits? If your strategy is profitable, you can multiply your profits tremendously as you will get bigger money in a shorter time. More than that, your bot can trade on different markets at once, filling your portfolio with diverse assets. It would be impossible for you to enjoy such returns even without posting a single trade yourself.

The bot cannot be influenced by emotions or misinformation. It just executes the programmed trading strategy without panic or dizziness from success. It makes you money the way it is supposed to. If you don't like the bot's performance, you can adjust it to make it more profitable. A bot is not gambling; it's just an algorithm collecting some money.

Possible Disadvantages of Trading Bots

It's understood that automated trading has specific risks and downsides, too. Let's see what you should be aware of.

You shouldn't think that you can leave it alone and enjoy regular passive income once a bot is launched. Prices on the crypto market move up and down with high volatility. If you miss the moment when the trends change directions and won't adjust the bot's strategy on time, you risk losing a lot of money. Some risks can't be prevented automatically.

Bots are not interested in making money; they only do what you have told them. If you mistakenly set a strategy that brings losses instead of profits, no one will be able to help except yourself. Using trading bots requires extra attention to the market situation and trends. Because if you do the wrong trade yourself is not that bad. But if you set up a superfast program that will post dozens of unprofitable orders in the blink of an eye, that can seriously damage your wealth.

There is a risk of choosing a scam bot that won't let you withdraw your money. You should make sure that the bot is operating through your exchange account. If the bot requires depositing funds into its "smart contract" or other places that are not your exchange account, then you should discard this bot immediately. Another thing you must pay attention to is that the bot shouldn't have the ability to withdraw money from your account. No one but you should be allowed to do that. If you trust your funds to a scam bot, you won't see your money again. TradeSanta is a reputable bot, and HitBTC offers using it as a safe option. Additionally, the exchange names Haas online and Trality as two more trustworthy trading bots.

TradeSanta & HitBTC

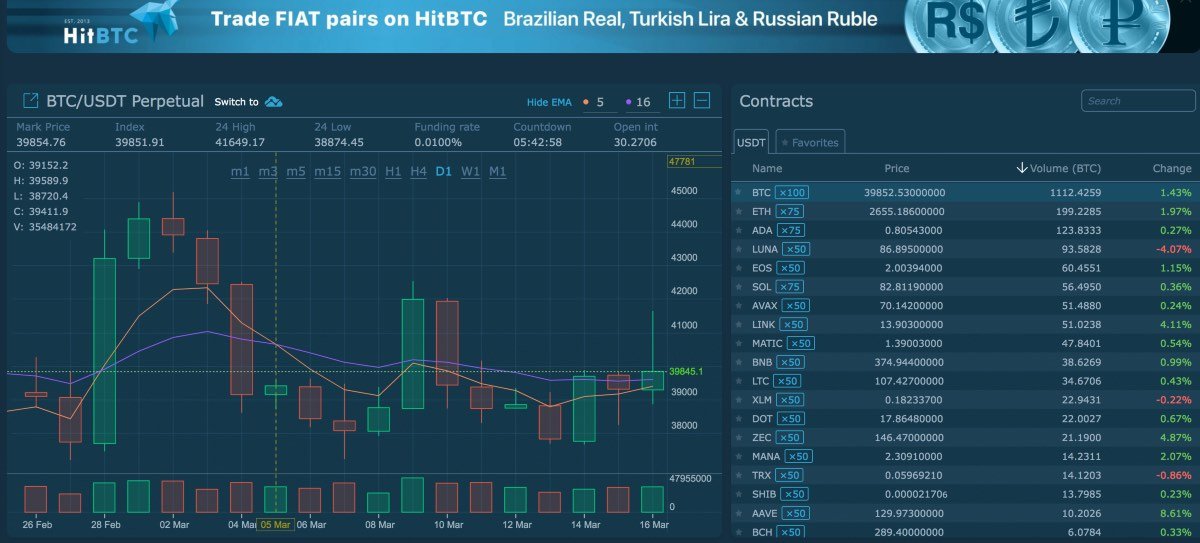

HitBTC was founded back in 2013 and was one of the first modern crypto exchanges at that time. Throughout the years, the dev team behind HitBTC worked hard to keep the exchange up to date. Now, it offers rich functionality for all kinds of traders. It includes margin trading, futures market, p2p exchange, etc. Moreover, HitBTC collects nearly the smallest fees in the industry and supports hundreds of coins and over 1,000 trading pairs.

TradeSanta was created in 2018. Due to ease of use, profitability, and flexibility, it quickly gained a considerable following. TradeSanta is compatible with several biggest exchanges, and HitBTC was among the first partners of this trade bot platform.

How to Use TradeSanta With HitBTC?

It's not hard to start using TradeSanta with the HitBTC account. In TradeSanta, you should connect your HitBTC account using API. The next step is choosing a trading pair and configuring the strategy. The latter is the most crucial moment as the well-set strategy will minimize your risks without jeopardizing profits. Alternatively, you can subscribe to an already existing strategy offered by one of the experts.

When you finish with the strategy configuration, you may start. The bot will scan the market, looking for opportunities for trades fitting the strategy. As these opportunities will be found, they will be immediately used. The bot will open and close positions and grow your wealth if the strategy turns out to be efficient. The trading process will be repeated again and again following the plan. It's essential to realize that the use of the trading bot requires your active participation as the market situation tends to change. The strategy can be good today but will be disastrous tomorrow. So you should keep your eye on the market state and adjust your strategy accordingly.

Why Does TradeSanta Match HitBTC So Well?

HitBTC recommends using TradeSanta not only because the exchange team acknowledges the quality of this bot but also because TradeSanta supports all the specific features of HitBTC.

Trailing Take Profit Explained https://t.co/DMGkBaKIiO

— TradeSanta (@trade_santa) October 30, 2020

HitBTC has futures markets. Those HitBTC users who trade futures can boost their returns via TradeSanta as this trading bot supports futures trading. More than that, HitBTC offers over ten order types to manage your risks. TradeSanta supports most if not all of them. It helps to configure trading strategies precisely. HitBTC was one of the first exchanges to introduce a demo mode in which users can perform trades and test all features of the exchange without using the real money — just to learn the capabilities of the exchange and get training. TradeSanta provides the same feature.

TradeSanta allows using numerous indicators and trade signals, whether pre-built or custom ones. TradeSanta sends notifications via Telegram and displays the real-time data to let users stay tuned. One of the cool features of TradeSanta is the opportunity to quickly close all the positions and withdraw all funds in BTC and USDT. This feature can be helpful in the case of an emergency like a sudden market crash or something like that. Another tool that makes TradeSanta convenient is that the bot interface has an in-built trading terminal that can be used to post trades manually. So you can combine automated trading with posting trades yourself and benefit from both types of trading.

Here are no comments yet. Be the first!