Introduction

Tectonic crypto news is about the latest goings-on around Tectonic — a DeFi money-market protocol running predominantly on Cronos with the TONIC token. This article outlines what Tectonic is, the background, the protocol's operation, latest on-chain data, security position, who is involved, and where the biggest dangers are.

What is Tectonic?

Tectonic is a cross-chain borrowing and lending protocol that enables users to deposit assets in order to earn yield or to borrow against collateral. It positions itself as a Compound-like money market but focuses on being cross-chain and compatible with Cronos.

Tectonic's native token, TONIC, has utility and governance roles — rewards and protocol incentives are received in TONIC, and token-holders are vote-eligible in the future. TONIC incentives are engaged in the majority of user activity on Tectonic — supplying, borrowing, staking — as constituents of the protocol's economics.

In short, Tectonic is where you can earn passive income on dormant crypto and unlock loans without having to liquidate assets, using smart contracts to monitor interest rates, collateral, and liquidations. It's a familiar DeFi template optimized for the Cronos ecosystem.

Short History and Key Dates

Tectonic released its mainnet in late 2021 and was among the first major DeFi money markets on Cronos. Tracking websites document the protocol's publicly available mainnet activity from around December 23, 2021.

Its early architecture borrowed from Compound's codebase and protocol, then added integrations and cross-chain ambitions particular to Cronos. Such a lineage is why much of Tectonic's core mechanics — supply, borrow, collateral factor — will feel familiar to those who engaged with Compound or Compound forks.

Since the start, the protocol implemented isolated pools, staking mechanism and growth incentives in a bid to attract liquidity from Cronos and related chains. Roadmap additions and community posts within the period 2022–2025 outline steady feature development and promotional activity in seeking to build TVL and user base.

Core Technology and Operation

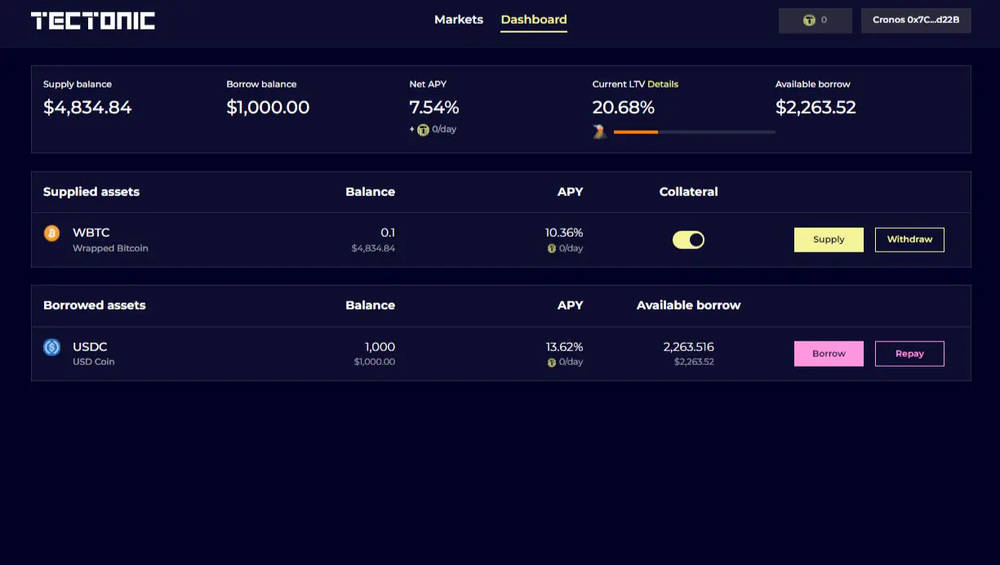

Tectonic's core is a set of smart contracts tracking supplied assets, borrowed coins, and interest accrued in real time. Interest rates float on supply-demand curves so the protocol tweaks the reward to achieve balanced markets — the same overall approach taken in on-chain money markets.

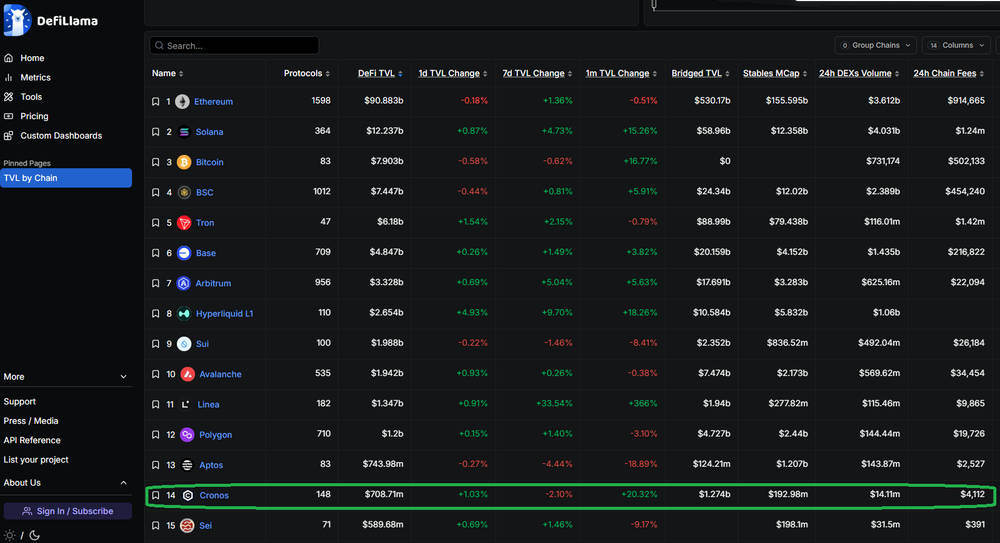

Tectonic dashboard snapshot showing total supply, borrowed volume, and utilization rates.

Collateral settings establish the ratio of what you can borrow relative to what you collateralize. If the value of collateral falls and an account crosses through liquidation, forced partial liquidations are triggered to maintain solvency.

On the Cronos chain, Tectonic also integrates oracles and bridging tools such that funds from other chains are also brought in. That cross-chain aim yields greater capital efficiency where liquidity from different ecosystems is channeled towards one money market.

Recent On-Chain Data and Activity

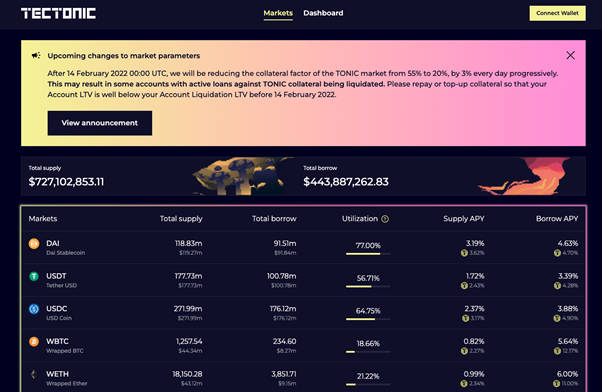

Total Value Locked (TVL) and borrowed volume are a means to quantify Tectonic's utilization. Aggregators confirm Tectonic remains one of the larger DeFi apps on Cronos with TVL in the hundreds of millions at times, and high borrowed volume relative to other protocols on Cronos.

DeFi Llama ranking of blockchains by Total Value Locked (TVL), with Cronos highlighted among the top ecosystems.

TONIC's listing and price data are available on mainstream aggregators and exchange websites, ensuring liquidity for traders and individuals who are looking to bring funds from CEXs to DeFi.

Live TONIC price, trading volume, and market cap data from CoinMarketCap.

For long-term outlooks, see our TONIC Price Prediction 2023–2030.

Apart from raw price and TVL, Tectonic has also conducted incentive initiatives — such as temporary payouts for supplying stablecoins — in order to incentivize funds in specific pools. Such campaigns can spike use and must be monitored since they account for much short-term growth in borrowing or TVL.

Audits, Security and Risk Controls

Security is most vital for money markets as they store user funds in smart contracts. Tectonic has published a few external audits and reports with summaries from entities such as SlowMist and BlockSec, and it cites those audit reports in guides.

On-chain risk controls are built into the design — over-collateralization, liquidation mechanics, and price feeds from oracles are included to reduce the possibility of systemic insolvency. However, bugs in the smart contracts, oracle manipulations, or unforeseen market shocks could lead to losses.

Real-World Cases and Examples

Classic Tectonic use case is a depositor putting stablecoins in a USDT or USC pool in order to earn yield while keeping assets available. Another is a borrower taking a leveraged short position borrowing assets without liquidating long-term assets. Such strategies are representative of common DeFi money-market activity seen on Compound, Aave and others.

At promotional events, Tectonic has offered dual rewards — e.g., paying TONIC and a stablecoin reward — in an effort to offer liquidity in specially designated pools. Such incentives normally manifest in the short-term APY spikes and are why TVL may spike when an incentivized reward program is active.

Tectonic's Founders and Ecosystem Partners

Tectonic is built for Cronos and is closely identified with the Cronos ecosystem, including projects such as VVS Finance and various DeFi protocols who together make up the chain's liquidity layer.

Project Team and Community post updates on official channels — the project site and social media — and large listings (CoinMarketCap, CoinGecko, Coinbase pages) help with the transparency and discoverability.

Audit partners, oracles and bridges — such as SlowMist, BlockSec, Chainlink or similar providers — are in the security and infrastructure stack. Such integrations are necessary for the protocol to operate but do not replace conscientious personal due diligence.

Conclusion

Tectonic is an everyday DeFi money market for the Cronos ecosystem, with supply and borrowing markets comparable to those known in DeFi. It has real-world use cases, publicly released audits and functional incentive programs — all positive signs — but it also shares the typical DeFi dangers of bugs in the smart contracts, oracle issues and liquidation cases.

If you follow Tectonic crypto updates, beware of TVL, audit reports, incentive schemes, and governance updates. Those factors usually explain the big fluctuations in use and token activity.

FAQ

Q: Is Tectonic safe for lending and borrowing?

A: No on-chain protocol is fully risk-free. Tectonic has had third-party audits and integrates standard DeFi controls like over-collateralization and liquidation automation, mitigating some of those risks. Smart contract defects, oracle failure and unexpected market fluctuations are still possible. Start out in small amounts only and review the latest audit reports and GitBook documentation.

Q: Where can I acquire Tectonic's latest market data?

A: Aggregation platforms such as DeFiLlama track TVL and borrowed amounts on Tectonic, and price/listing platforms such as CoinMarketCap and CoinGecko show token market data.

Q: What token do I need to interact with Tectonic?

A: The TONIC token is used for incentives and governance, but you interact with markets through the assets supported (stablecoins and mainstream tokens) on Cronos.

Q: Does Tectonic support cross-chain assets?

A: Yes, Tectonic's vision is cross-chain liquidity such that assets bridged from other ecosystems are present on markets in Cronos.

Q: Where can I check Tectonic crypto price updates?

A: Follow official project channels — the project website, Tectonic X/Twitter account, and the GitBook docs — and monitor major aggregators (CoinMarketCap, DeFiLlama) for data updates.