MEXC countries prohibited is a topic that arises frequently when investors are searching for the best crypto trading platform. Like other exchanges globally, MEXC must follow local regulations and cannot provide services everywhere. For users curious about where MEXC is allowed and why some countries are restricted, this review gives a concise and informative explanation. After reading, you will understand the main reasons for prohibitions, which countries are impacted, and what this means for crypto traders.

What is MEXC?

MEXC is a cryptocurrency exchange founded in 2018 that has grown into an international platform serving millions of clients. The platform offers spot trading, futures trading, staking, and access to a wide range of cryptocurrencies. MEXC is known for a large number of listed tokens and competitive trading fees. It is open to both new and experienced investors.

Like all exchanges, MEXC is registered in multiple jurisdictions but must comply with local finance regulations. This is where the concept of prohibited countries comes into play.

MEXC aims to serve global users while adhering to international requirements, meaning some regions face restrictions or complete bans.

Understanding Restricted Countries

Restricted countries are those where MEXC cannot operate fully or only provides limited services due to legal or regulatory constraints. This usually occurs because of three main factors:

- Local laws prohibiting crypto exchanges: Some nations ban trading or make registration for exchanges complex.

- Sanctions and global compliance: Countries under sanctions are rarely included on international financial platforms.

- Licensing requirements: Some jurisdictions require licenses that MEXC does not hold, limiting available services.

For users, this means that although MEXC is accessible in most countries worldwide, access may be blocked based on location.

Historical Background of Exchange Restrictions

Blocked countries are not unique to MEXC. Almost all major exchanges, including Coinbase, KuCoin, and Binance, have had to adapt due to regulations.

In the early days, crypto exchanges often served customers regardless of local laws. Over time, authorities required compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations.

As rules tightened, exchanges like MEXC created lists of countries where they could not legally operate. This helps avoid penalties, maintain licenses, and build trust with regulators.

Nations Commonly barred from MEXC

While the list may change as regulations evolve, MEXC generally restricts users from jurisdictions with strict or unclear crypto rules. These usually include:

- United States: Due to strict financial regulations and SEC/CFTC requirements.

- Mainland China: Complete government ban on crypto trading.

- North Korea, Iran, Syria, and Crimea: Compliance with international sanctions.

- Other high-risk jurisdictions: Countries with weak financial systems or political instability.

Some countries may have partial restrictions, allowing registration but limiting access to certain services like futures trading.

Technology and Compliance

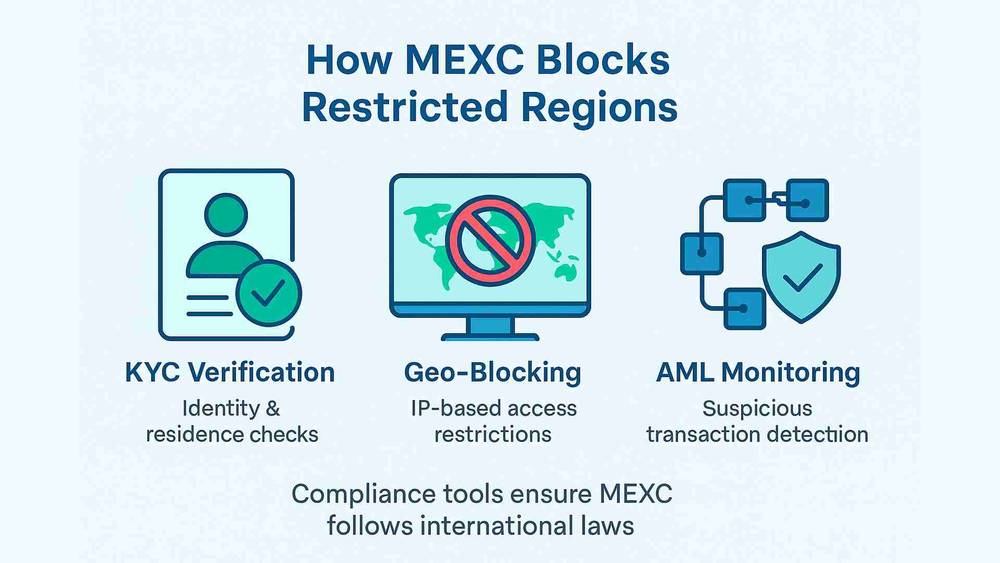

MEXC uses advanced compliance tools to detect user location and ensure adherence to international laws. These measures include:

- KYC verification: Requiring proof of identity and residence before granting full access.

- Geo-blocking: Restricting access from certain IP addresses.

- AML monitoring: Checking transactions to prevent money laundering and illegal activities.

These measures protect both the platform and users from risks while ensuring legal compliance.

Implications on the Crypto Community

Sanctions affect both individuals and traders. Users in restricted countries may turn to local exchanges or international platforms that serve their region.

Globally, restrictions create a gap between those with full access and those without. While adoption may be slowed in some areas, it can also encourage local regulatory development, improving long-term security in crypto trading.

MEXC’s strategy shows the challenge of international expansion while respecting national laws.

Case Studies and Practical Applications

In the United States, despite a large crypto user base, most international exchanges, including MEXC, avoid offering services due to strict regulations. American users typically use U.S.-licensed platforms like Coinbase or Kraken.

In Mainland China, after crypto trading was banned, exchanges including MEXC suspended operations. Although unofficial crypto trading continued, demand persisted under restrictions.

These examples show that MEXC’s country restrictions align with industry-wide trends rather than being unique.

Pros and Cons of Restrictions

Restrictions can be inconvenient but also have benefits.

Pros:

- Protect transactions from legal penalties.

- Ensure compliance with global regulations.

- Build regulator confidence, supporting long-term platform stability.

Cons:

- Limit accessibility in certain regions.

- May push users to unofficial platforms.

- Can cause confusion for travelers or relocating investors.

MEXC, like other exchanges, balances these advantages and disadvantages.

Future Outlook for MEXC and Regulations

The list of prohibited countries may expand or shrink depending on global crypto regulations. If more countries adopt clear rules, MEXC could obtain licenses and reopen access.

Conversely, stricter regulations would require adding more restricted regions. Traders and investors should stay updated on policy changes.

MEXC’s future depends on adaptation, with announcements via its website guiding users on compliance updates.

Conclusion

MEXC’s country restrictions highlight the importance of regulatory compliance in crypto trading. While the platform operates globally, it must block or limit services in certain jurisdictions due to legal, financial, or political factors. Awareness of these restrictions helps users avoid legal risks and consider safer alternatives. MEXC will continue updating policies as laws evolve, maintaining the priority of compliance.

FAQ

- Which countries are barred from MEXC?

Prohibited countries are restricted due to local laws, international sanctions, or missing licenses. This ensures MEXC complies with global standards. - Does MEXC operate in the United States?

No. MEXC does not serve U.S. citizens due to strict financial regulations. U.S. investors should use licensed local exchanges. - Is MEXC trading allowed in China?

No. Mainland China bans crypto trading, so MEXC cannot legally operate there. - How does MEXC block restricted users?

MEXC uses KYC verification and geo-blocking to prevent access from prohibited regions. - Will the restricted countries list change?

Yes. The list is updated as regulations evolve. MEXC continuously adapts its terms to comply with new rules.