itBit Exchange Review 2021 - Is It Safe?

Taker:

BTC 0-2500 : 0.20%

BTC 2500+ : Special Low Fees

Taker:

BTC 0-2500 : 0.20%

BTC 2500+ : Special Low Fees

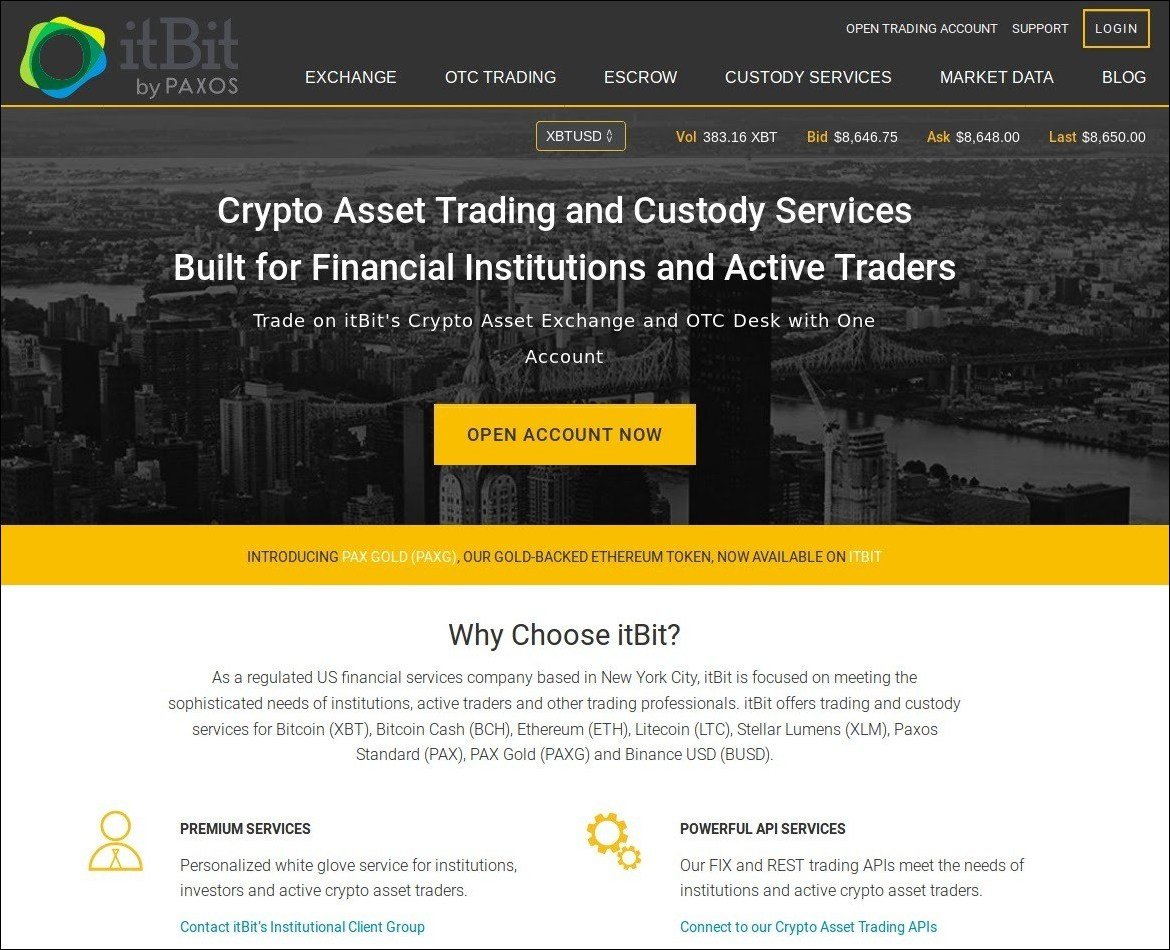

itBit is a strongly regulated financial platform based in New York City. The company has an international office in Singapore. itBit was founded in 2013. It serves as an exchange of digital assets providing the opportunity to trade such cryptocurrencies such as Bitcoin, Bitcoin Cash, Ethereum, Stellar Lumens, and Binance USD (BUSD), Paxos Standard (PAX), and PAX Gold (PAXG). More than that, the US dollar, Singapore dollar, and Euro are also supported on the platform, making itBit a gateway cryptocurrency exchange. Formally itBit is a bank regulated by the New York State Department of Financial Services (NYDFS). Actually, itBit became the first regulated Bitcoin exchange in the US in 2015. The company claims to be the only platform that allows trading on exchange and OTC desk using the same account. It is widely considered that itBit exchange fits high-volume and institutional traders the best. It is absolutely safe to say that itBit fits those who seek 100% legal ways of interaction with cryptocurrencies quite well.

- itBit Features

- Available Deposit and Payment Methods

- itBit Fees

- itBit API

- How to Get Started?

- How to Use itBit?

- Customer Support

- FAQ

The CEO of the platform is Chad Cascarilla. He managed to raise around $25 million worth investment and co-found the very first American cryptocurrency bank. The fact that itBit is a regulations-friendly service helped it to become available in all the 50 states of America as well as in the other countries. The reported 24-hour trading volume is around 13,000 BTC. The reported circulation of assets on itBit is equal to 18 million BTC. Among the notable partnerships of itBit, one can name CME Group, Binance, Paxos, Send.com, and others.

One of the most notable specifics of ItBit is a high level of security. As users can't even see the graphs unless they have verified their identities, it is understood that stealing on this exchange would be not an easy task. People performing any kind of malicious activity will face consequences as their identities are known, and law enforcement will be able to take action. An experienced team is working on the safety of the assets. Users can trust itBit as much as they trust huge banks.

itBit Features

itBit introduces three types of services for the users: itBit exchange, OTC desk, and the custody service.

The exchange platform boasts deep liquidity and the order book maintained by traders from around 100 countries. itBit provides the opportunity to use REST, FIX, and Market Data APIs in order to ease the trading experience through automatization. According to the itBit website, 100% of the users' crypto assets are stored offline. itBit grants ETH market makers with rebates.

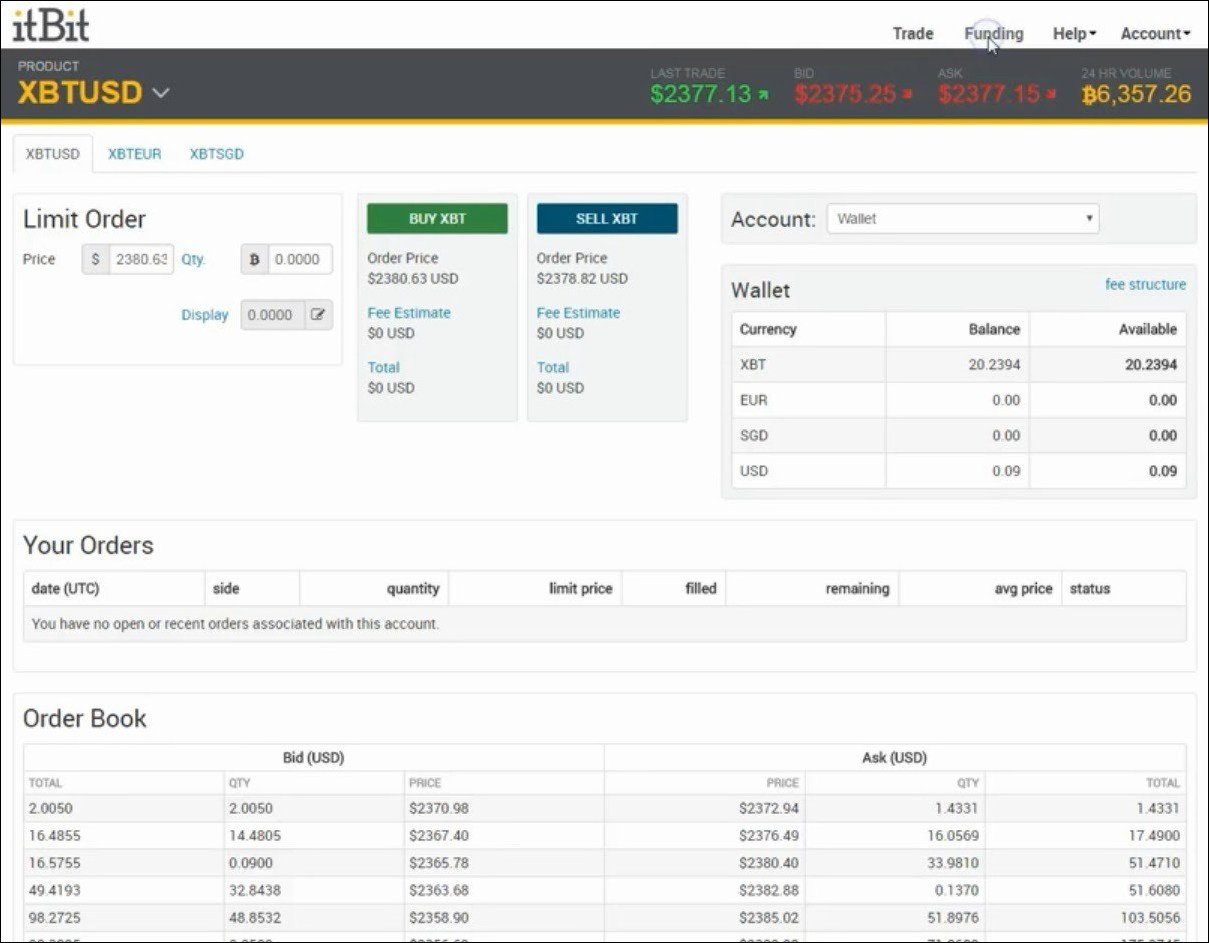

On one hand, the interface of itBit exchange is quite simple and intuitive, but partly this simplicity is a result of the limited functionality (at least compared to many other big exchanges). For example, it is possible to post a limit order (bid or ask) but at the same time, stop-loss orders are not among the options on itBit. Also, itBit lacks margin trading that became quite a popular feature among cryptocurrency traders around the world. Although the design is modern and user-friendly, it’s important to mention that the only available interface language is English while it’s quite a usual thing for other cryptocurrency platforms to offer several languages to choose from.

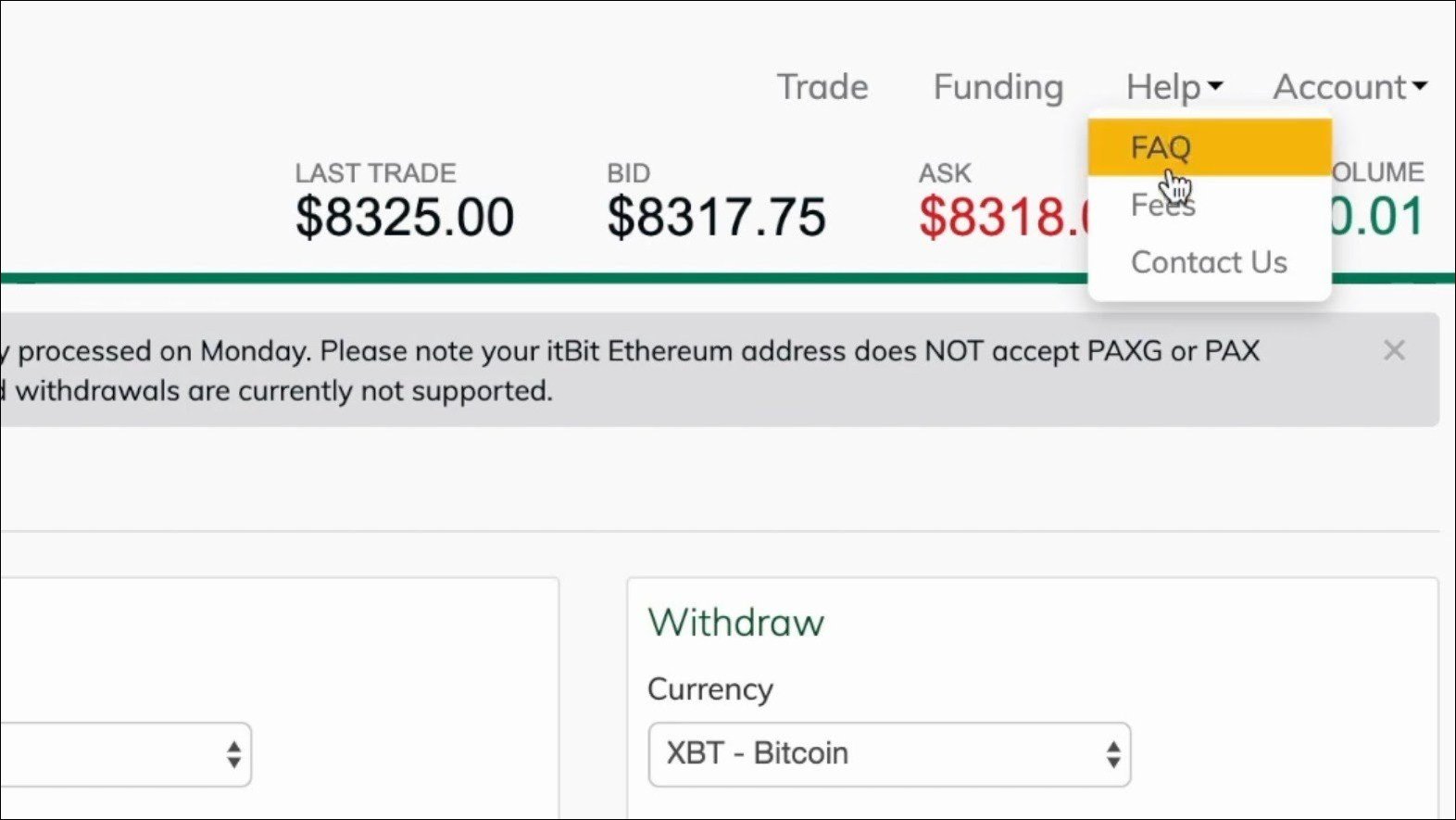

The exchange has a horizontal menu in the upper part of the window. It has only four tabs: Trade, Funding, Help, and Account. Under the menu, there is market data (24h volume, the amount of the last trade, and so on). On the left of this data, one can choose the needed trading pair. Below there are buy and sell boxes, the type of order, quantity, and the account information (including balances in different currencies). Below there is a list of the user's orders and at the bottom of the window, one can see the order book. In general, it is fair to say that the interface is very clear and can be convenient both for absolute beginners and experienced traders.

Despite the fact that itBit doesn't exist in the form of the mobile app, the website is well-suited for mobile devices and runs on smartphones and pads smoothly.

Fiat currencies are traded only against BTC. However, it's not that bad considering the fact that not many exchanges grant the opportunity to use fiat money at all.

There are two types of accounts available for traders on itBit. One type is an institutional investor account and the other one is the individual trader account. Different types of accounts require different sets of data for verification.

Probably the best conditions are presented to the US citizens. The US dollars circulating on itBit exchange are held in the legal US banks. This money is FDIC-insured and backed by mandatory capital reserves. Moreover, in order to report taxes, US-based users receive 1099 forms from the company annually.

Institutionalized and high-volume traders may prefer to use OTC (over-the-counter) trading. To those who are going to try the OTC desk, itBit offers personal assistance from the company's trading experts. itBit is striving to settle all OTC trades as soon as possible (at least in 24 hours). The minimum sum to start OTC trading is f $50,000.

Custody service provided by itBit is special because unlike many rivals on the cryptocurrency market, itBit leans exclusively on the legal and regulated means of custody. It's a known fact that strict local cryptocurrency regulations are tough in New York City. Nevertheless, itBit has managed to meet the legal requirements and provide the service that guards the users' assets with the help of these regulations. Customer trading accounts are never mixed with the assets in custody. So all the time the assets are ready for redemption and verification, audited, and secure. As it was already mentioned, 100% of the users' money is held in the cold storage. Audits can be conducted annually, quarterly or once a month. On business days custody customers may receive personalized assistance from Institutional Client Group (ICG) of itBit.

Available Deposit and Payment Methods

itBit allows funding an account with fiat money using bank transfer. No other way to deposit fiat money is supported on itBit. Such convenient and popular (and rare at the same time) way of depositing fiat money as the use of credit or debit cards is not available on this platform. Bitcoins can be deposited in a regular way using the wallet addresses (the user wallet address and the exchange wallet address).

There are no limitations for the deposited amount of money, but one should be aware of depositing fees that can strike hard when depositing fiat money (at least $10 for the US citizens and more for the residents of other countries). At the very same time, the exchange doesn't collect deposit fees for a funding account with Bitcoin (the only fee the users are paying is the transfer fee).

itBit Fees

The US residents who deposit fiat money on itBit have to pay at least $10 USD for the transfer. The residents of other countries are charged with higher deposit fees (up to $40 in some cases). There are such options for depositing fiat money as SWIFT and SEPA transfers. Such fees fit generally those traders who want to trade in large amounts. That's the reason why some consider itBit mainly as an OTC trading platform. Depositing BTC is much cheaper — the trader only pays a network fee while the platform doesn't take any pay for the deposit.

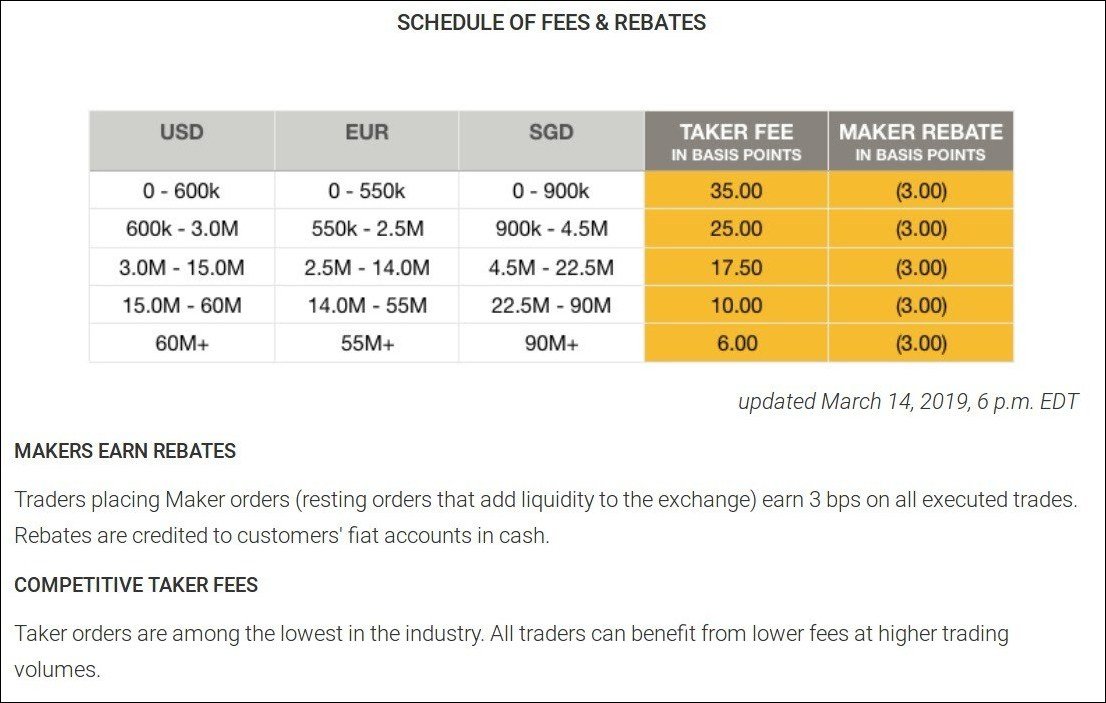

Now we'll speak of itBit trading fees. The fees system is designed to strongly incentivize traders to place new limit orders (to increase or "make" liquidity). The exchange favors makers by giving them a rebate instead of charging them with fees while takers (those who "take" orders from the order book decreasing liquidity) have to pay fees which are higher than the market average.

For takers, orders equal to 600k USD, 550k EUR, or 900k SGD or below these amounts are charged with 0.35% fee. The higher amounts are charged with lower fees (the lowest possible taker fee is 0.06% for orders worth over 60M USD). According to the itBit website, the fees collected from takers are among the lowest on the market. That's far from the truth in most cases. The fees are quite low only if we speak about the orders with the highest value. At the same time regardless of the sum, makers are receiving rebates equal to 0.03% of the order amount. These rebates are credited to the account of traders and are paid in cash.

As for itBit withdrawal fees, users can withdraw fiat money for free via Automated Clearing House (ACH). It's important to mention that ACH has some limitations: only US citizens can withdraw money for free and only if the amount is not overstating $3,000. The bigger amounts can't be withdrawn for free. The fee is $20 for the USA residents, and at least $40 for the residents of other countries. The withdrawals of Euro below €50,000 are charged with an €8.14 fee while €70.32 is charged if the amount is above €50,000. BTC and Singapore dollars can be withdrawn for free.

ItBit API

In order to improve the trading process, itBit traders can use one of three API options. The automatization tools can fit institutional and algorithmic traders as well as individual active traders.

FIX API is recommended for companies and those who trade frequently.

REST API is an HTTP-based solution that can be useful for algorithmic traders and those who trade frequently and on a large scale.

Market Data API is another HTTP-based API that is useful for all itBit traders as it's giving access to order books, trade data, and information about prices.

How to Get Started?

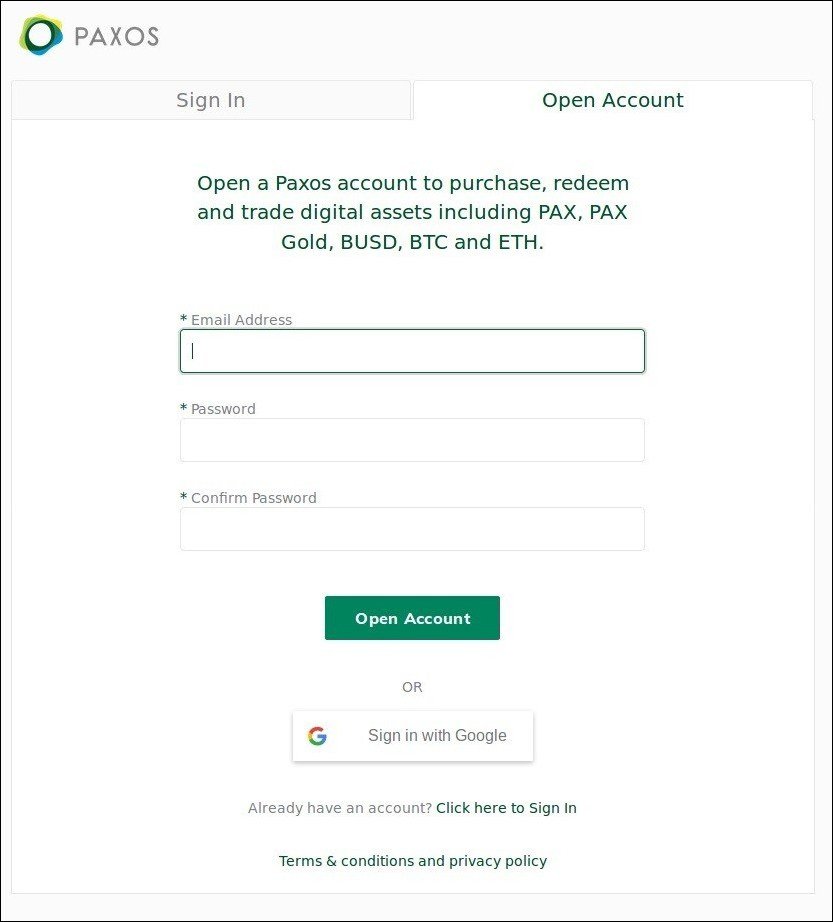

First off, the potential user should sign up. In order to do that, one should create an account on Paxos.com. It requires providing an email address and setting the password. The next step is confirmation via the email address.

When the confirmation is done, the website requires to set a multifactor authentication that can be conducted via Authy or Google Authenticator apps. Without setting this protection measure one cannot start using the platform.

The next step is the verification of the account and identification of the trader or institution he/she presents. This step requires the providing of personal data, photos of documents, face photo, and so on. After the verification, the trader is free to use the itBit platform.

As was mentioned above, itBit is a law-compliant platform so it is no surprise that it has developed KYC and AML-compliance programs. The company requests such information as SSN (actual only for American citizens), ID or passport, address of residence, ZIP code, email address, driver's license. It is required to provide the photos of two sides of the identity documents. It is necessary to complete verification of the identity and set multi-factor authentication to start using itBit. This measure improves the security and frees users from the following unexpected identity checks.

How to Use itBit?

When the account is set one can start depositing some money and trading. To fund the account with fiat currency the user should tap on the Funding button in the upper part of the exchange home page. The user should choose the wallet and follow the "Cash Wire Deposit Instructions". On itBit fiat money can be deposited exclusively via bank wire transfer. There are two options: SEPA and SWIFT transfers.

If depositing cryptocurrencies, the user should do almost the same actions but choose Bitcoin or Ethereum wallet (please note that on itBit Bitcoin is labeled as XBT, not BTC). The wallet address provided by itBit can be copied as a text or scanned as a QR-code. Deposit addresses are one-time.

The process of buying crypto on itBit is quite commonplace. The user can choose an existing order in the order book or create one (a limit order) to get a chance to buy some currency for a better price.

The OTC option can be chosen right on the homepage of the website. Over-the-counter trading is assisted by the itBit team so the potential users may get all the needed info from them.

In order to withdraw the funds, the user should proceed to the Funding tab on the default page of the itBit website and choose the proper currency and the address. The user should specify the currency he/she wants to withdraw and the bank account or the receiving address. Individual account holders can withdraw only to verified addresses associated with the account. Institutional traders can withdraw only to the bank accounts associated with the institution. New addresses can be whitelisted by request.

Customer Support

Besides such a usual thing as online customer support, itBit provides support via the phone calls (from Monday to Friday). It's worth mentioning that (just like many other cryptocurrency exchanges) the itBit support team receives a lot of criticism over the web. Some frustrated users claim that the company doesn't really care about its customers. Most of these complaints relate to the past years, so it seems that the company does progress in the support of its users.

FAQ

Is itBit a scam?

As it was mentioned above, itBit is a legit company that does all the best to maintain a legal cryptocurrency platform that can exist even in the strict conditions of the regulations relevant in New York City.

Is itBit safe?

As we have already learned, the company itself is not involved in any criminal activity. The team working for the project is public. The next important fact we should consider is that there are no known cases of successful hacker attacks of itBit servers. There were no cases when any users' assets were stolen. That's a good sign considering the fact that the platform operates from 2013. The website is DDoS-attack proof. Moreover, the assets are kept in cold storage and secured by the New York Department of Financial Services. The funds of the customers from the US are insured.

After searching on the web, we had discovered no single complaint associated with the work of this platform. Some people don't like the conditions of this exchange, but it seems that there are no security issues at all. As it was mentioned, all actions on this exchange are verifiable and cannot be anonymous. In the case of potential misconduct, the violator will have to face consequences.

All these factors combined make itBit quite a safe platform.

The only reported issue that harms the reputation of the security of itBit is that fraudsters are sending phishing emails on behalf of the platform.

What is the itBit withdrawal limit?

The daily withdrawal limit for individuals is $50,000 USD. Monthly one can withdraw up to $300,000 USD. Institutional traders can withdraw $100,000 USD daily, and $1,000,000 USD monthly. The increase in these limits can be discussed with the company representatives individually.

Does itBit allow fiat exchange?

Yes.

What to do if itBit is not letting me sign up?

The only reasonable action that can be done in this situation is reaching out to the support team.

Itbit has a decent liquidity and customizable interface. It allows to trade without failures and long pending. I'm satisfied with the exchange.

Itbit seemed good. The fiat transfers could be a great opportunity. But I used to make a couple of the fiat transactions, and all of them failed. I was glad that I didn't lose my money, they just returned to my account. But anyway I couldn't deposit my funds and I don't know why

I easily opened an account I started to use it right way. I like the possibility of making a wire transfer and use itbit like the fully operated exchange platform. It's been a month now and all my actions were successfully finished. I appreciate it.

I found itbit is a kind of credible exchange.it provides intuitive website and not bad trading system. The crypto exchanges are developing and I am a witness of the place like this, it's a good sign. The scums are getting less.

I'm tired of using the exchange, everything is to slow and failure, I've got no chance to do anything without having the problem, I'm done with that. That's hard to trade here when you are supposed to wait forever