Vergleichen BitMart vs Hotbit Exchange

In this article, we will compare two high-liquidity exchanges (both from the top 20 by 24h trading volume). Both trading platforms offer hundreds of trading pairs and are considered beginner-friendly. We will review the main characteristics of these exchanges and compare their features, so it will be easier for you to decide which platforms best fit your needs.

Please note that both exchanges have many negative reports from users claiming their funds were compromised by the platforms.

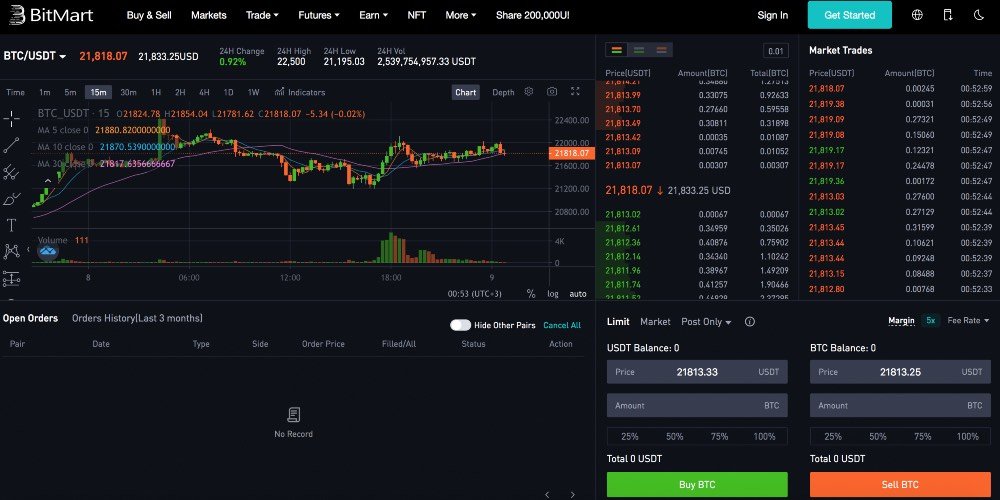

What Is Bitmart?

Bitmart is one of the most significant crypto exchanges in terms of the daily trading volume. As of July 2022, the Bitmart liquidity exceeds $1.4 billion. It is more than on the Coinbase exchange and OKX. The platform supports over 600 cryptocurrencies and provides traders with diverse and vast functionality. The exchange exists in the form of a mobile app. More than that, it can be accessed via the web browser.

Functionality-wise, Bitmart provides such features as crypto-to-crypto trading, earning rewards, lending, and staking. The exchange was founded in 2017 by Sheldon Xia. The platform is registered in the Cayman Islands. The reputation of the exchange is not flawless. Bitmart was subjected to a multi-million hack in 2021, and allegedly the compensations to affected users are still pending. However, such things can take time, and it's early to write this platform off, especially considering its best sides, such as liquidity, coins selection, good functionality, etc.

What Is Hotbit?

Hotbit is a crypto exchange that supports the biggest number of coins among the top centralized exchanges. On Hotbit, you can trade around 2,000 cryptocurrencies at high speed (thankfully, liquidity is relatively high). However, it's understood that no one really needs all of these coins in the roster, so the rest characteristics of Hotbit play a more prominent role when you decide whether you should use it.

The exchange was launched in 2018, just before the entire crypto market's long-term decline. Some allege that the exchange is based in China. As for features, it allows you to buy crypto via fiat money (bank card, etc.), trade cryptos, and ETFs. Hotbit is characterized by tremendous withdrawal fees (e.g., 0.001 BTC for Bitcoin). As for trading fees, takers pay a high 0.2% fee while makers are rewarded instead. The reward is 0.05% of the trade amount. That's an unusual rule.

Bitmart vs. Hotbit (table)

| Factor | Bitmart | Hotbit |

| Supported coins (as of July 2022) | 611 | 1,912 |

| 24h trading volume (as of July 2022) | $1.46 billion | $316 million |

| Trading fees | 0.25% | 0.2% (taker); -0.05% (maker) |

| Withdrawal fees (BTC) | 0.0005 BTC | 0.001 BTC |

| Regulated? | Yes | No |

| Security | 99% of money are stored in the cold wallets, 2fa, DDoS-proof, withdrawal confirmation (email/phone call) | 2fa, withdrawal confirmation (many options) |

| Security breaches | 2021, $200 million worth of crypto was stolen from users | 2021, a hacking attempt that didn't result in stealing of money |

| Additional features | NFT market, staking service, lending, futures trading, margin trading | ETFs market |

| Available | available in most unsanctioned countries including the USA | not available in the USA, Japan, and numerous sanctioned countries |

Bitmart vs. Hotbit (details)

Supported coins & 24h trading volume

Regarding the number of supported coins, Hotbit is superior to any centralized crypto exchange in the world. No other trading platform supports 2,000 cryptocurrencies. Bitmart supports over 600 crypto coins. This selection is wide enough for most traders, but still, Hotbit outperforms Bitmart by this measure.

Liquidity is a more important characteristic. Bitmart has considerably higher liquidity (5x) than Hotbit and nearly the highest 24-hour trading volume in the industry. Both exchanges have high liquidity, though. It's understood that the least known coins are harder to sell/buy.

Fees

In terms of fees, Hotbit collects twice as much as Bitmart. When it comes to trading fees, Hotbit is a more pleasant platform. It collects lower fees from takers and doesn't collect anything from makers. However, Bitmart will grant you serious fee discounts if you trade in large amounts. Futures trading is much cheaper than regular spot trading on Bitmart.

Regulated?

Bitmart is regulated by the U.S. by the Financial Crimes Enforcement Network (FinCEN), which makes Bitmart a relatively trustworthy company. Hotbit is not regulated at all. More than that, some claim that Hotbit's claims about registration in Estonia and Hong Kong can't be verified and are denied by the officials of these countries. We can't say if these accusations are true. Nevertheless, it means that you should approach using Hotbit with extra caution.

Security

No matter what security features were used on Bitmart, it didn't stop hackers from stealing $200 million worth of crypto belonging to the exchange users. It means that not enough money was held in the cold storage, and not enough effort was put into making this platform safe.

Some hacker tried to steal money from Hotbit in April 2021, but the exchange sustained the attack. It came at the cost of closing services for several days. However, no money was stolen. We should conclude that Hotbit seems to have more robust security.

Additional features

Bitmart is a more versatile platform than Hotbit. The latter exchange offers ETF markets on top of regular crypto trading, and that's probably the only "extra" feature. Bitmart gives users more opportunities to make money out of crypto investments. It includes futures trading, lending, staking, etc. Margin trading and NFT markets are also in place.

Available

Both exchanges don't provide service to residents of many countries; however, it's safe to say that Hotbit has more geographical restrictions as it's not available for the entire U.S. population, Japan, and some other countries that can use Bitmart instead.

| Unternehmen | ||

|---|---|---|

| User rating | 14 Benutzerbewertungen | 87 Benutzerbewertungen |

| Cryptogeek rating | ||

| Vertrauenswertung Wie es funktioniert |

User rating

| 14 Benutzerbewertungen | 87 Benutzerbewertungen |

Cryptogeek rating

Vertrauenswertung

Wie es funktioniertÜber

|

BitMart wurde 2017 gegründet und verfügt über Niederlassungen auf dem chinesischen Festland, in Hongkong, Seoul und New York. Es zielt darauf ab, eine Top-Handelsplattform für digitale Assets zu werden.

|

Hotbit ist eine der jüngsten Börsen, die Anfang 2018 eröffnet wurde. Der Austausch funktioniert nicht mit fiat-Währungen. Hotbit hat auch einige fortschrittliche Technologien wie GSLB, verteilte Servercluster und Speicher übernommen. Es geht mit einer High-speed-Speicher - basierten trading-engine, die alle in mehreren Maschinen gesichert, Kühllager und hot wallets mit offline privaten Schlüsseln.

|

Gründungsdatum

| 2018 | 2017 |

Land

| Cayman Islands | China |

Art

| Centralized | Centralized |

Sprachen

| English, Japanese, Korean, Russian, Traditional Chinese, Simplified Chinese, Vietnamese, Turkish | English, Korean, Russian, Chinese, Vietnamese, Thai |

Mobile Anwendung

| iOS, Android | iOS, Android |

Vollständige Adresse

| Offices located in New York, Greater China, Seoul and Hong Kong. (The exchange does not disclose the exact location of its office) | Central Ave Shanghai, Shanghai 200120, CN |

Gebühren

|

Default Fee: Maker 0.2500% / Taker 0.2500%. Full fee schedule: https://www.bitmart.com/fee/en |

BTC 0.00047 Withdrawal Fee • 0.20% Taker Fee • -0.05% Maker Fee |

| Über |

BitMart wurde 2017 gegründet und verfügt über Niederlassungen auf dem chinesischen Festland, in Hongkong, Seoul und New York. Es zielt darauf ab, eine Top-Handelsplattform für digitale Assets zu werden.

|

Hotbit ist eine der jüngsten Börsen, die Anfang 2018 eröffnet wurde. Der Austausch funktioniert nicht mit fiat-Währungen. Hotbit hat auch einige fortschrittliche Technologien wie GSLB, verteilte Servercluster und Speicher übernommen. Es geht mit einer High-speed-Speicher - basierten trading-engine, die alle in mehreren Maschinen gesichert, Kühllager und hot wallets mit offline privaten Schlüsseln.

|

|---|---|---|

| Gründungsdatum | Gründungsdatum 2018 | Gründungsdatum 2017 |

| Land | Land Cayman Islands | Land China |

| Art | Art Centralized | Art Centralized |

| Sprachen | Sprachen English, Japanese, Korean, Russian, Traditional Chinese, Simplified Chinese, Vietnamese, Turkish | Sprachen English, Korean, Russian, Chinese, Vietnamese, Thai |

| Mobile Anwendung | Mobile Anwendung iOS, Android | Mobile Anwendung iOS, Android |

| Vollständige Adresse | Vollständige Adresse Offices located in New York, Greater China, Seoul and Hong Kong. (The exchange does not disclose the exact location of its office) | Vollständige Adresse Central Ave Shanghai, Shanghai 200120, CN |

| Gebühren |

Gebühren

Default Fee: Maker 0.2500% / Taker 0.2500%. Full fee schedule: https://www.bitmart.com/fee/en |

Gebühren BTC 0.00047 Withdrawal Fee • 0.20% Taker Fee • -0.05% Maker Fee |

Handel

BitMart des Unternehmens ist 424,500,917.0. Die Börse hat 183 verfügbare Handelspaare. Fiat-Handel ist an der Börse nicht verfügbar. Margin-Handel ist verfügbar.

Hotbit des Unternehmens ist 720,191,869.0. Die Börse hat 675 verfügbare Handelspaare. Fiat-Handel ist an der Börse verfügbar. Margin-Handel ist nicht verfügbar.

Bitte beachten Sie: Die größere Anzahl verfügbarer Handelspaare bietet Ihnen mehr Handelsmöglichkeiten, kann jedoch gleichzeitig technologische Mängel verursachen.

Volumen

| 424500917 | 720191869 |

Paare

| 183 | 675 |

Münzen

| 99 | 287 |

Fiat-Handel

| - |

Einzahlung

| Free | Free |

Gebühren

| Percentage | Percentage |

Spanne

| - |

| Volumen | Volumen 424500917 | Volumen 720191869 |

|---|---|---|

| Paare | Paare 183 | Paare 675 |

| Münzen | Münzen 99 | Münzen 287 |

| Fiat-Handel | Fiat-Handel - | Fiat-Handel |

| Einzahlung | Einzahlung Free | Einzahlung Free |

| Gebühren | Gebühren Percentage | Gebühren Percentage |

| Spanne | Spanne | Spanne - |

Sicherheit

Zwei-Faktor-Authentifizierung

Verifiziert

| Unverified | Unverified |

| Zwei-Faktor-Authentifizierung | Zwei-Faktor-Authentifizierung | Zwei-Faktor-Authentifizierung |

|---|---|---|

| Verifiziert | Verifiziert Unverified | Verifiziert Unverified |

Sozial

Webseite

| www.bitmart.com | www.hotbit.io |

| @BitMartExchange | @Hotbit_news |

Anzahl der Follower

| 34247 | 3211 |

| Webseite | Webseite www.bitmart.com | Webseite www.hotbit.io |

|---|---|---|

| Twitter @BitMartExchange | Twitter @Hotbit_news | |

| Anzahl der Follower | Anzahl der Follower 34247 | Anzahl der Follower 3211 |

Bewertung

| User rating | 14 Benutzerbewertungen | 87 Benutzerbewertungen |

|---|---|---|

| Cryptogeek rating |

Cryptogeek Zusammenfassung

We would have said that by many points, Bitmart seems to be a more robust exchange than Hotbit; however, we can't do that. The recent hack and troubles of the Bitmart team in compensating the losses are dropping the long shadow at this platform decent by the rest measures.

Hotbit is an old-fashioned no-KYC unregulated exchange. Still, it stands firm in terms of security. However, the reputation issues are not serving it very well. All in all, we should conclude that both exchanges have room to grow, and we believe that the facts we provide in this article will help you to choose which of the exchanges fits you better.

| Wir wählen den Gewinner basierend auf unserer Vertrauenswertung. Bitte denken Sie daran, es liegt immer noch an Ihnen, welches Unternehmen Sie wählen! Wie berechnen wir den Vertrauensfaktor? |

|---|

| Wir wählen den Gewinner basierend auf unserer Vertrauenswertung. Bitte denken Sie daran, es liegt immer noch an Ihnen, welches Unternehmen Sie wählen! Wie berechnen wir den Vertrauensfaktor? |

Auf dieser Seite können Sie BitMart mit Hotbit vergleichen. Welcher Austausch ist besser zu nutzen? Sie können Börsenmerkmale, Gebühren, Handelsfunktionen, Sicherheit und soziale Netzwerke vergleichen Medienpräsenz.

Am Ende dieser Seite sehen Sie unsere endgültigen Bewertungen für beide Börsen.

In der folgenden Tabelle finden Sie allgemeine Informationen zu beiden Börsen. BitMart wurde gegründet in 2018 in Cayman Islands. Hotbit wurde gegründet in 2017 in China.

Bei der Auswahl einer Börse für den Handel sollten Sie berücksichtigen, wie lange sie bereits ein aktiver Marktteilnehmer ist. Ältere Börsen haben normalerweise einen guten Ruf und sind in der Regel zuverlässiger. Es kann eine gute Entscheidung sein, die ältere Börse zu verwenden, nämlich Hotbit. Gleichzeitig können neuere Projekte technologisch weiter fortgeschritten sein.

Sie sollten auch darauf achten, wo sich die Vermittlungsstelle befindet. Einige Länder haben strenge Finanzvorschriften, was es schwierig macht, bei Bedarf gerichtliche Unterstützung zu suchen.

BitMart ist Centralized und Hotbit ist Centralized. Weitere Informationen zu den Vor- und Nachteilen eines zentralisierten und dezentralisierten Austauschs finden Sie in diesem Artikel.

BitMart verfügt über eine mobile App für iOS undAndroid. Hotbit verfügt über eine mobile App für iOS undAndroid.

BitMart verfügt über 8 verfügbarer Sprachen, einschließlich English, Japanese, Korean, Russian, Traditional Chinese, Simplified Chinese, Vietnamese undTurkish. Hotbit verfügt über 6 verfügbarer Sprachen, einschließlich English, Korean, Russian, Chinese, Vietnamese undThai.