Uniswap Overview 2024 - Is It Safe?

At some point in the 2010s, centralized crypto exchanges were ruling the entire industry. Decentralized exchanges, or DEXs, had significantly lower liquidity which made them less preferable for traders. Low liquidity means more time needed for order to get executed which results in less predictable outcome of trading, often at worse rates than on centralized exchanges.

By the end of the decade, the situation had changed dramatically. Automated liquidity pools helped to revitalize the DEX brand and DEXs as a part of a trendy DeFi sphere became a huge part of the crypto exchanges industry.

Uniswap is one of the flagship projects that defined the new era of decentralized exchanges. This article reviews Uniswap, explains how it works, highlights pros and cons of this platform, and answers if Uniswap is safe to use.

Contents

What Is Uniswap?

Uniswap is an Ethereum-based non-custodial platform that operates instant token swaps. For this, it uses non-upgradable smart contracts and draws liquidity from automated liquidity pools to ensure fast, secure crypto exchanges.

The exchange acts as a wide network that benefits both traders and liquidity providers who rent out their tokens for the exchange operations. Other passive income options include lending and staking of UNI tokens, a native token of the Uniswap platform.

The exchange was launched in 2018 by Hayden Adams, who previously worked for Siemens. The Uniswap Labs company headquarters in New York City.

As of 2024, it supports over 3,000 tokens and 9,000 pairs. On top of swapping the tokens based on a sole blockchain (Ethereum), Uniswap uses bridging to allow people swap tokens based on different blockchains without losing that much money due to slippage.

Uniswap has a unique position in the history of decentralized exchanges as it was the first platform to introduce automated market making (AMM) model that revolutionized the sector and made DEXs viable.

How Uniswap Works?

The AMM model addresses the liquidity shortage problem that was usual for pre-AMM DEXs. Instead of relying on unstable liquidity from an order book AMM provides regular liquidity via the constant product formula.

The pricing generation is regulated automatically and aligns with the current market trends through automated arbitrage trading. It requires constant tokens which are provided by liquidity providers that rent their tokens out to the Uniswap liquidity pools in exchange for incentives.

These incentives include a share of transaction fees. The liquidity provided to an LP (liquidity pool) can be withdrawn at any moment which makes it more comfortable and flexible than staking. More than that, Uniswap allows users providing their funds to LPs set the desired amount they rent out.

All the token exchange transactions are operated via the Swap smart contract. The rest transactions are operated through the Factory contact.

The UNI Token

UNI token is a Uniswap governance token. It was launched in 2020. Token holders can vote for the changes in fees structure, token distribution, and other changes to the Uniswap platform.

Image source: Coin Market Cap

As of July 2024, the UNI price exceeds $8. The market cap reaching roughly $5 billion ranks 21st.

How to Use Uniswap?

To start using Uniswap you need a web3-ready cryptocurrency wallet supporting ERC-20 tokens. A self-custody web3 wallet by Freewallet can be a decent fit. Trust Wallet and Meta Mask are other popular options. These wallets are non-custodial. They are accessed via a seed phrase. It’s crucial to keep this phase in a safe place away from strangers' view.

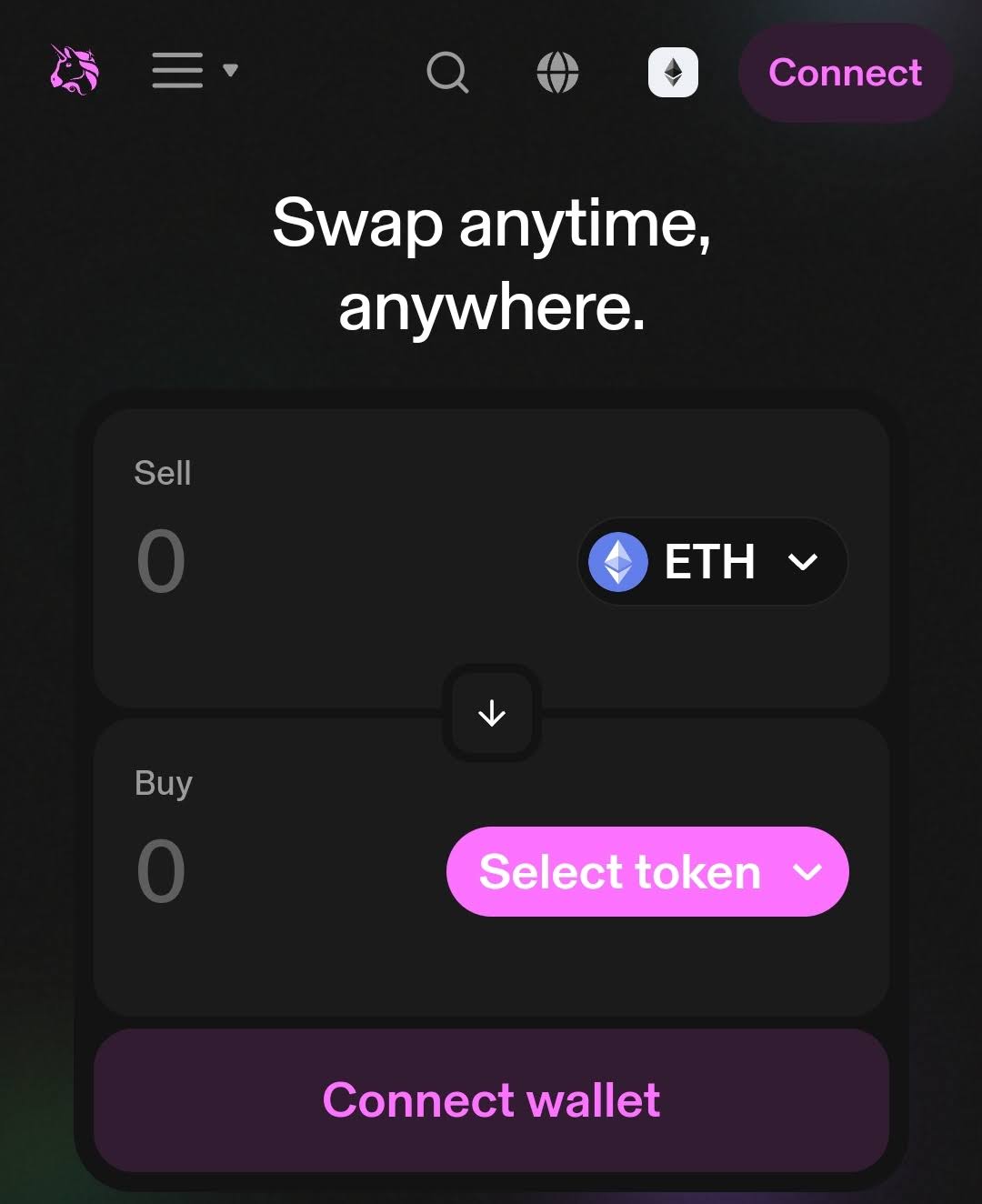

Unlike centralized cryptocurrency platforms, Uniswap doesn't require registration, logging in, or any personal data. All you have to do is to connect your crypto wallet to Uniswap via a Launch App button. As soon as you get your wallet connected you can start swapping tokens, earning interest on the tokens you lock in LPs or staking.

To swap tokens just choose the Swap section of Uniswap. If you're going to earn interest on your crypto tokens, proceed to the Pool section and deposit a pair of tokens. To make an informed decision you can check the popular tokens on Uniswap.

No user data or funds are collected or stored by Uniswap. To swap tokens you just should set the pair, check if you are fine with the exchange rate and the estimated fee and swap your tokens if everything's OK. Please note that swapping tokens is technically not the same as buying and selling them. The latter type of transaction is not supported on Uniswap.

Pros & Cons

We mentioned a lot of advantages of Uniswap. Let's sum them up. Also, we should add the downsides of this platform.

Pros

Wide range of supported tokens: Uniswap sports all the ERC-20 tokens. This is a pretty wide set of cryptocurrency that can satisfy many people.

Easy onboarding: The platform doesn't require registration and doesn't ask for your data. Just connect your wallet and start your journey.

User-friendly interface: The app developers did a great job of making Uniswap as easy and appealing for beginners as possible. The interface is clean and intuitive. There is little to no chance that you will have problems understanding what to do.

Opportunities for passive income generating: Uniswap offers much more than swapping one token for another. The platform supports various methods of making money (liquidity mining, staking, etc).

Cons

No support for the fiat currencies: On Uniswap you can't perform any action with fiat money.

Bitcoin is not supported either: The most popular and sought after cryptocurrency is not available for transactions on Uniswap as BTC is not an ERC-20 token.

High gas fees: Some transactions may cost much.

Risk of impermanent loss: Market volatility and other reasons can continue to possible impermanent loss of your investment on Uniswap.

Is Uniswap Safe?

One of the features that make Uniswap safer than most crypto exchanges is that it’s a non-custodial platform, meaning that it operates without intermediaries and treats every user equally. No central authority can interfere with the swapping process.

Uniswap cannot be hacked, the user data cannot be stolen from Uniswap servers. The platform only connects two wallets algorithmically and lets the transaction take place. No man is involved. Scammery is out of the question. The Uniswap protocol is open-source and its smart contracts undergo regular third party audits. It guarantees the total transparency of the service and makes fraud on the platform creators’ side impossible.

As Uniswap utilizes non-upgradable smart contracts, it is free of censorship and risks associated with centralized governance.

The real risk is making bad choices for liquidity mining, staking, or even swapping. If you spend money on the tokens that lose their value or the validator staking your tokens on your behalf violates the rules which results in your money getting slashed, you may face an impermanent loss of your investment.

FAQs

What is the Uniswap protocol?

Uniswap protocol is the open-source protocol that allows users to provide liquidity and swap ERC-20 tokens. The protocol is non-upgradable and provides a censorship-free self-custody fully automated service.

How are token prices determined?

On Uniswap the token price is determined by the lowest price the sellers offer and the highest price the buyers are ready to pay. The price is calculated via the constant maths equation based on supply and demand. The equation looks like this: Token 1 amount x Token 2 = X where X is a constant number.

Martin wants to exchange some ADA for Ether. He uses the ADA/ETH Uniswap pool. The ADA amount x the ETH amount should equal X no matter how much ADA is in the pool. Martin deposits ADA. The more ADA he deposits, the cheaper ETH gets in order to keep the multiplying of the tokens amount equal X. The more tokens in the pool are, the more sustainable their prices are.

The ux editors made a great job. It looks really convenient.

Not the high level, but it matches if you want to diverse your funds and exchanges.

The design is something dress, never seen smth like that before

An interesting design. It's got a good mark, I suppose

I'm looking for a big review. I think it deserves to it. The interface is quite unique and convenient.