Best Crypto Staking Platform

On top of being a handy way of cross-border payments cryptocurrencies offer various ways to make money. None of these methods, whether it is trading, staking, yield mining, or other, go without its risks, however, if you understand how to do everything right, dedicate some time to research, you will be able to benefit from your spare crypto.

This guide is dedicated to crypto staking. It explains what crypto staking is, how it works, how to choose a token for staking, what are the pros and cons of staking, and which crypto staking platforms are the best.

Contents

What is Crypto Staking?

On a user side, staking is the way to generate passive income via locking a certain amount of cryptocurrency for a blockchain that uses Proof-of-Stake (PoS) as a consensus mechanism.

On the side of the PoS-based blockchains, staking is a tool that attracts more people to hold the blockchain's native token and to hold it for long periods of time instead of dumping it on the market. The locking period is usually specified beforehand. It can take several days, months, or over a year.

Image source: swyftx

To incentivize people to hold these tokens (to stake them), the platform gives these people staking rewards. On top of that, staking gives holders some privileges. For instance, they can participate in the transactions validation and platform development through voting. The weight of the votes is usually measured by the crypto staked.

If users who validate transactions violate the platform's rules, they lose the tokens they stake. It serves as a guarantee that stakers will strive to keep with the platform's rules.

How Does It Work?

You can use staking platforms that aggregate staking instruments from various blockchains and provide them all in a user-friendly interface. Each platform has its own conditions and layout. Usually, you can choose the crypto, specify the locking period, see if the rewards size satisfies you and start staking or look for a better option elsewhere. For staking you will need to deposit crypto on the platform and provide an address for rewards.

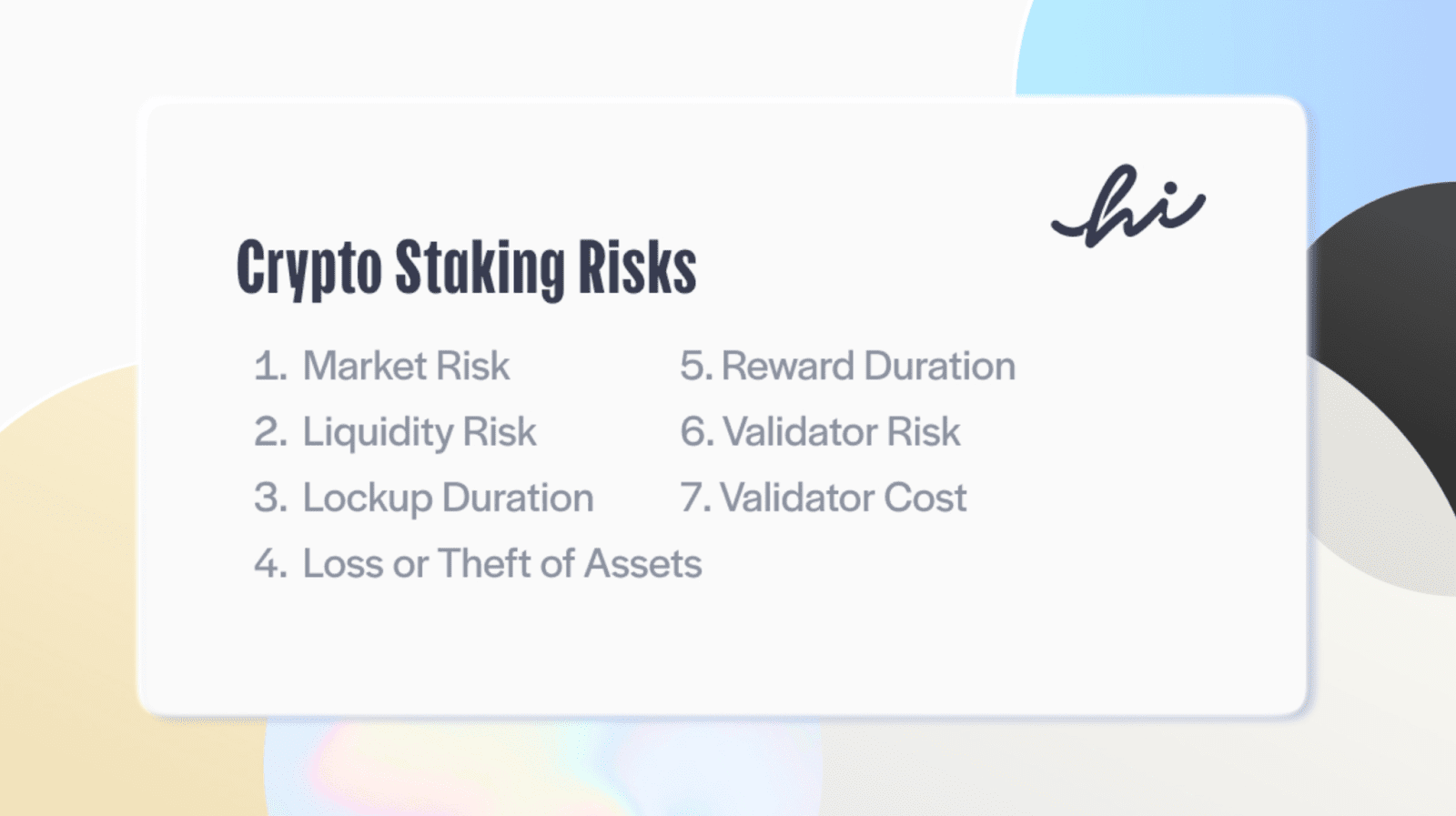

Risks of Crypto Staking

One of the risks is that if the platform standing behind the token you stake gets hacked and the network associated with the platform is compromised, the token is likely to be delisted from most crypto exchanges. You risk losing your tokens while remaining ones will be hard to sell.

Another risk is that while your assets are locked they can drop in price. And instead of selling or spending them, you'll have to wait for the locking period to end only to get worthless or much cheaper tokens. Even rewards can end up not enough to cover the loss.

Image source: Hi Resources

The other factors creating risk are the local prohibitive regulations, scams, hackers, the weak software of the staking platform you choose, etc.

Pros and Cons of Staking

Like any other passive income method, staking has its pros and cons:

Pros

- Staking generates a passive income

- Staking has many options (platforms, tokens, conditions, etc), so you are free to look for the one that satisfies you the best

Cons

- Staking is associated with some risk

- Crypto market is volatile, it can affect your profits negatively

How to Choose a Token For Staking?

Choosing the right crypto for staking requires doing some research. First off, you should outline how risk tolerant you are.

If you are not going to risk that much, you'd better stick with the top cryptocurrencies. Most of them are well-established brands with 5 to 10 years in the game. They can lose part of their value for a period but most probably they won't lose that much and they will probably regain their value in the future. More than that, they have a good chance of keeping growing. This growth is gradual and slow, but relatively steady.

The little-known tokens are usually worthless and they stay worthless forever. But a few of them can gain significant value in a short time span. Staking these coins is risky, but if you are lucky enough or if you correctly calculate which one of them has the future, you will win more than in the case of staking a top crypto.

Image source: Shutterstock

The general rules for choosing a good crypto for investment are relevant for staking too. You should look for a coin with a good market performance, it should have a strong use case, the team shouldn't be anonymous, the whitepaper and the roadmap should be neat. The supportive community of the project and the solid partners are another good sign. The lack of it all is a red flag.

How to Choose a Staking Platform?

You should take choosing a staking platform seriously as the service they provide and conditions they apply can significantly differ. Many preferences are individual so you should choose the platform that fits you the best. However there are several things you should hold in mind before you choose a platform for staking:

Availability in your region: Check if the platform works in your country before you spend time to signup and read tons of info about this platform.

The tokens roster: Make sure that the staking platform supports the tokens you want to stake. If it doesn't support the tokens you need, look for another platform.

Support for fiat money: This feature makes life much easier. It's much more convenient to buy the desired crypto by card right on the platform or sell crypto for fiat money after you received the rewards instead of using third-party platforms for this.

Security: If you have any doubt about the platform's security, stay away from it. Check what security measures the platform provides. Use the one that has all the protection features you need. Unfortunately, hackers and thieves are flooding the crypto platforms and you should be prepared for this.

Customer support: Check how you can contact the support team. Try to find the user reports to figure out if the customer support responds timely and provide actual help, not useless automated replies.

Convenience: Ensure that the platform is easy to use and provides all the necessary features. Finding yourself not understanding what to do (or how to do it) may be not pleasant in the situation when your money is involved.

Educational materials: An additional factor is the availability of educational materials on the platform. Although you may find info outside the staking platform, it's always easier to have all the needed things at the same platform.

Best Crypto Staking Platforms

KuCoin: This huge international crypto trading platform supports the staking feature. On KuCoin, you can stake over 40 cryptocurrencies and enjoy up to 16% APY

Crypto.com: Crypto.com is one of the top international crypto exchanges. It has a staking service that supports over 10 tokens with a maximum APY set at 14%. The holders of the native token of the exchange enjoy additional rewards

Coinbase: The leading American crypto exchange and a public company provides its branded staking platform. It supports 15 cryptocurrencies and promises up to 13% APY

Kraken: Kraken is another popular American crypto exchange. Its staking platform supports around the same number of tokens as Coinbase but the maximum APY rate is set at 28%. More than that, Kraken has an advantage offering a flexible rate and lock up period policy

Stakely: Unlike the platforms above, Stakely is a non-custodial platform. It supports over 35 crypto tokens and offers a maximum APY of 17%. Also, it has no minimum deposit amount

Binance: Binance is a multi-faceted crypto exchange with the biggest liquidity. It is not available in many countries though. Binance DeFi staking service provides a roster of over 60 crypto tokens and offers up to 33% APY for some options. The Ethereum staking platform is also in place.

Los mejores tutoriales

-

Что такое хард-форк?Jul 27, 2020

-

Стейкинг на Ethereum 2.0 и его основные особенностиAug 01, 2020

-

Инновации на основе блокчейна в сфере энергетикиAug 03, 2020

No hay comentarios aún. ¡Sé el primero!