Lybra Finance Review: The Complete Guide to the Project

The Lybra Finance Review is extremely important for anyone looking to achieve a thorough understanding of this decentralized finance (DeFi) project. Lybra Finance is a blockchain-based crypto platform that provides stablecoin solutions for enhancing the effectiveness and availability of crypto investments. The project impresses the DeFi community with the incorporation of novel technology and user-centric qualities.

Contents

What is Lybra Finance?

Lybra Finance is a non-custodial protocol designed explicitly for the issuance of stablecoins collateralized using Ethereum (ETH). The platform provides investors with the option of putting up ETH and generating eUSD, a stablecoin pegged on the US dollar. The approach gives crypto investors a stable instrument for hedging volatility while still keeping entry into the crypto space intact.

Lybra Finance simplifies DeFi, even for the inexperienced crypto individual. It offers a platform for clear visibility, decentralization, and easy asset management with intuitive interfaces.

The Tech Behind Lybra Finance

Lybra Finance employs blockchain technology, specifically Ethereum smart contracts, for the secure management of stablecoin minting and collateral deposits. Smart contracts enable automatic transactions, supporting transparency and the elimination of brokers. With the implementation of Ethereum’s high-security and mature network, Lybra provides its clients with stable and secure financial services.

The Lybra Finance stablecoin eUSD is kept stable with the use of Ethereum collateral. ETH deposits are made and the smart contract delivers the eUSD according to a given collateralization ratio. When the ETH value goes down or up rapidly, the platform adjusts the collateral automatically and maintains the eUSD stable.

For a broader perspective on stablecoin mechanisms and centralization issues, check out Cryptogeek’s in‑depth guide: Stablecoins: a world‑wide battleground.

Moreover, Lybra Finance incorporates oracle services for the purpose of supplying precise and real-time price information. It enables the system to manage collateral dynamically and remain stable, which boosts user trust.

Background and History of Lybra Finance

Lybra Finance was created due to the increasing demand for the decentralized stablecoin products among the crypto community. The founders have observed the need for the simpler and easily accessible DeFi tools for the purpose of wider adoption.

The project was actively involved in the development of easy-to-use interfaces and proper security controls since the start. Lybra Finance became a favorite among crypto enthusiasts due to its clear-cut value proposition and open-book modes of operation.

Lybra Finance continues to get better, often upgrading its technology and responding to the users' input for keeping the platform as efficient and seamless as possible.

Role within the Crypto Community

Lybra Finance makes a remarkable impact on the crypto universe through the non-conventional approach for the current fiat-attached stablecoins. Unlike centralized stablecoins, eUSD offers decentralization and complete clarity for the end-users.

By enabling the hedging of crypto volatility without converting the entire holdings into fiat form, Lybra Finance accommodates long-term investment strategies. It enhances the confidence and stability among investors and within the crypto ecosystem.

The project engages the community directly through education and support, enabling the users to gain a greater understanding of the concepts of decentralized finance. That initiative has given Lybra Finance a well-earned place among the DeFi players.

As DeFi protocols like Lybra and Acala gain traction, users can explore proven models—see Cryptogeek’s Acala (ACA) staking guide to compare collateralized stablecoin approaches.

How to Use Lybra Finance

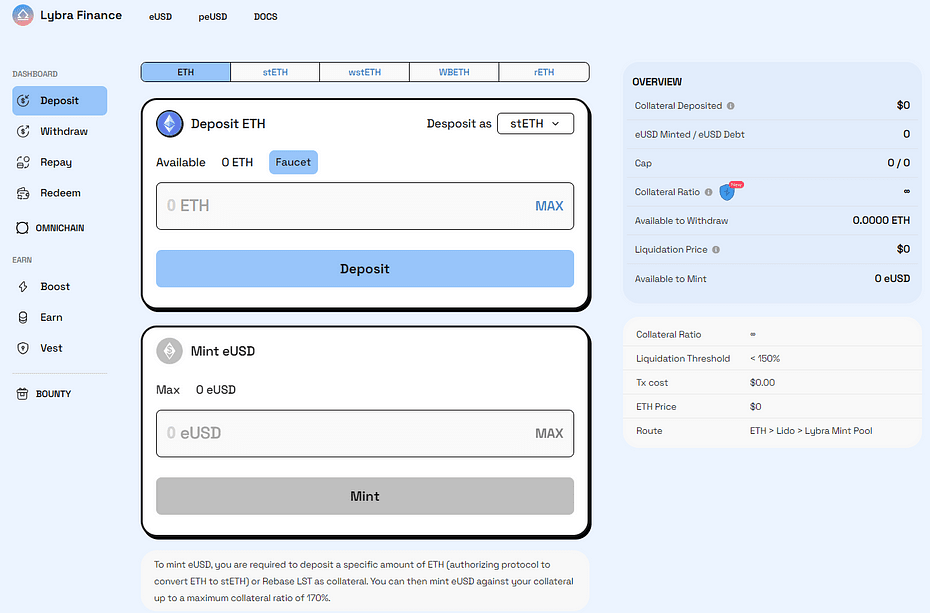

Using Lybra Finance is straightforward. Users first set up ETH on the platform using crypto wallets. Reputable wallets like MetaMask can be accepted, which makes it convenient for onboarding.

The users can mint eUSD based on their ETH collateral after the verification of the deposit. The amount of eUSD minted depends on the collateralization ratio set up by Lybra Finance. The users should regularly check their collateral ratio to prevent possible liquidation.

Security

Security comes before everything else in DeFi, and Lybra Finance tackles it by using various security measures. First, it leverages the safe blockchain platform of Ethereum to process all transactions transparently and irreversibly.

Moreover, the project conducts regular smart contract checks with the most well-known cybersecurity firms for possible vulnerabilities and resolves them. The smart contract checks provide a second layer of security guarantee for the end-users.

Finally, Lybra Finance possesses a non-centralized governance system where decisions are voted on by the tokeners. It prevents centralized risk and ensures the interests of the community are given utmost preference.

Pros for Using Lybra Finance

Another strength of Lybra Finance is simplicity. The user does not need high technical expertise to use the platform, and therefore it becomes highly accessible.

The second advantage is the transparency provided with decentralization. The members can verify transactions on the blockchain, giving credence to the platform.

In addition, Lybra Finance supports long-term crypto holdings via the offer for stability during volatile markets, qualifying it as a good option for balanced investors.

Cons of Using Lybra Finance

Despite its benefits, Lybra Finance poses risks. It depends significantly on the performance of Ethereum. Any serious disruption or drop on the part of Ethereum can impact the stability of eUSD.

In addition, risks for smart contracts always remain on a decentralized platform. Although the audit can reduce risks, potential vulnerabilities cannot be negated.

Finally, the users have to keep a close watch on collateral ratios since the failure here could result in liquidation and loss of the deposited ETH.

Conclusion

Lybra Finance offers an attractive DeFi option via the issuance of decentralised, Ethereum-secured stablecoins. Its simplicity, security measures, and communal-based system make it an attractive platform for the new and the established crypto trader. The end-user, however, must be on the lookout for collateral risks such as the dependence on Ethereum and potential vulnerabilities within smart contracts. Overall, Lybra Finance offers a realistic option for the player seeking stability within the volatile crypto arena.

FAQ

What is eUSD on Lybra Finance?

eUSD is a stablecoin that's secured against the US dollar and minted when Ethereum is deposited as collateral on Lybra Finance.

Is Lybra Finance a safe platform?

Lybra Finance uses decentralized governance, regular smart contract audits, and blockchain security to safeguard users' holdings.

Is Lybra Finance suitable for beginners?

Lybra Finance provides a simple and user-friendly interface.

What are the wallets supported for Lybra Finance?

Most popular wallets like MetaMask are supported on Lybra Finance, which makes it convenient for deposits and transactions with stablecoins.

Is Lybra Finance completely decentralized?

Decentralization permeates Lybra Finance's business and governance, empowering token holders and engaging them in key decisions.

此处没有评论。 成为第一个!