Wyckoff Pattern Explained: Key Strategies for Trading Success

The Wyckoff pattern is a technical analysis methodology designed to identify market trends through price movements and volume activity. Traders utilize the Wyckoff pattern to anticipate market behavior by understanding the psychology behind market movements. Originating from Richard D. Wyckoff, this analytical approach provides traders with a structured method to gauge supply and demand shifts in the market.

Contents

- What is the Wyckoff Pattern?

- Historical Background of the Wyckoff Method

- Core Principles Behind the Wyckoff Pattern

- Key Phases of the Wyckoff Pattern

- Real-world Examples and Case Studies

- Influential People and Institutions

- Related Research and Publications

- Examining the Strengths and the Limits

- Conclusion

- FAQ

What is the Wyckoff Pattern?

The Wyckoff pattern consists of a set of market stages designed for the purpose of discovering latent signals on the basis of price charts. The pattern helps the trader anticipate future market directions based on stages of accumulation and distribution, markup and markdown. These stages indicate the various behaviors displayed by market players.

Accumulation entails buying endeavors during informed investors when prices remain low, expecting a future increase. Distribution entails the activity of selling when prices have peaked. Markup and markdown periods reflect the movement of the price increasing and decreasing, respectively, facilitated by the supply and demand conditions within the market. Understanding the stages helps the trader take a strategic stance.

Historical Background of the Wyckoff Method

The Wyckoff pattern can be traced back to the works of Richard D. Wyckoff, which he developed sometime in the early 20th century. Wyckoff was a prominent trader and instructor and was a keen observer of market actions, primarily actions made by big investors or "market operators."

He disseminated his methods and conclusions widely during the 1920s and the 1930s, and had a tremendous impact on later generations of investors. He continues to be highly respected today for his attention to the psychology of the market and the investors' behavior, rather than technical indicators alone.

His original works and procedures remain cited by modern-day traders and institutions. Wyckoff's approach is deemed fundamental for learning market trends and patterns by many traders and analysts.

Core Principles Behind the Wyckoff Pattern

The Wyckoff method is based on some fundamental principles:

- Market Cycles: Markets go through predictable cycles of accumulation, markup, distribution, and markdown. Recognizing such cycles can significantly improve the timing and profitability of trades.

- Supply and Demand: Prices adjust based on supply and demand factors. When demand goes above supply, the prices increase (markup). When supply goes above demand, the prices decrease (markdown).

- Volume and Price Interaction: The Wyckoff method focuses on the examination of volume and movement of prices. Heavy volume on movement confirms probable market directions.

These basic concepts help the trader discern market cues more easily and place trades more accurately and with greater conviction.

For traders interested in combining Wyckoff analysis with staking strategies, check out the Ethereum staking guide on Cryptogeek for deeper insights into passive income in crypto markets.

Key Phases of the Wyckoff Pattern

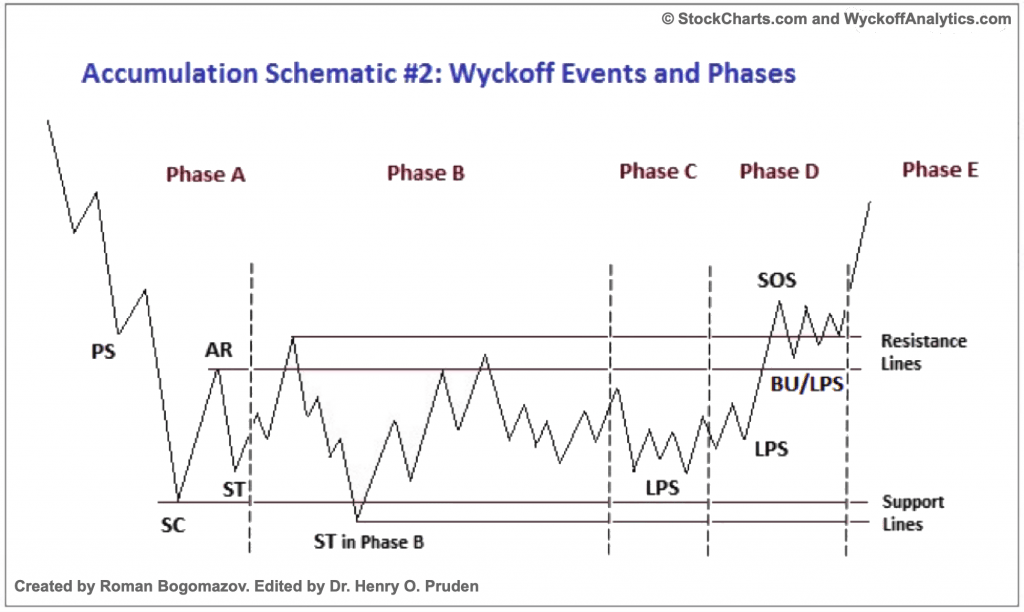

Understanding the Wyckoff pattern includes the ability to identify its four stages:

- Accumulation Phase: It usually occurs when there's a protracted downtrend. Intelligent investors initiate buying asset holdings when the prices are low. Volume remains average, and the prices become stable.

- Markup Phase: After the buildup, the price starts increasing gradually. Growing purchasing strength and increasing volume validate the up movement and entice more buyers into the market.

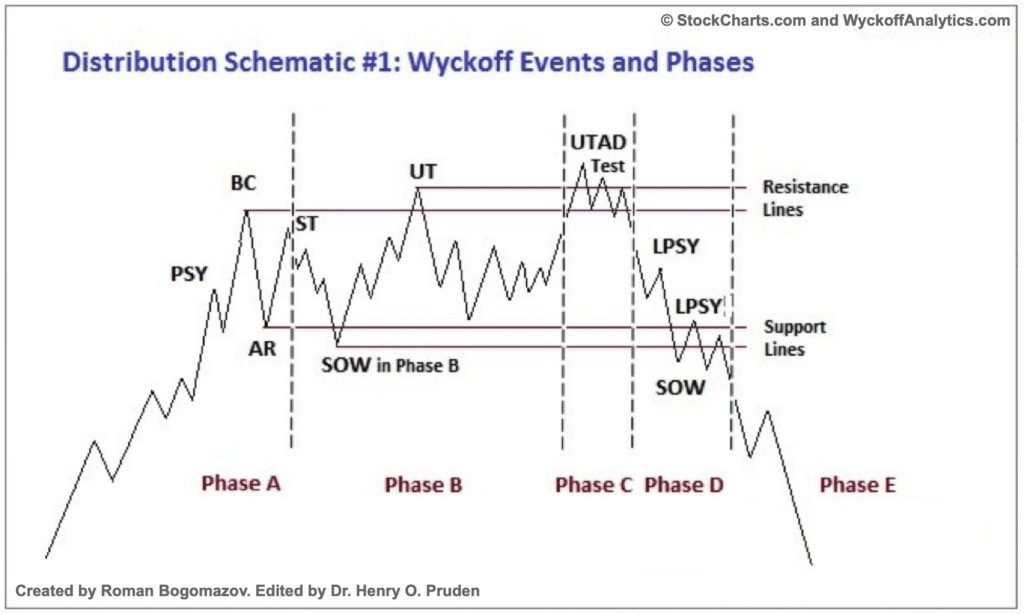

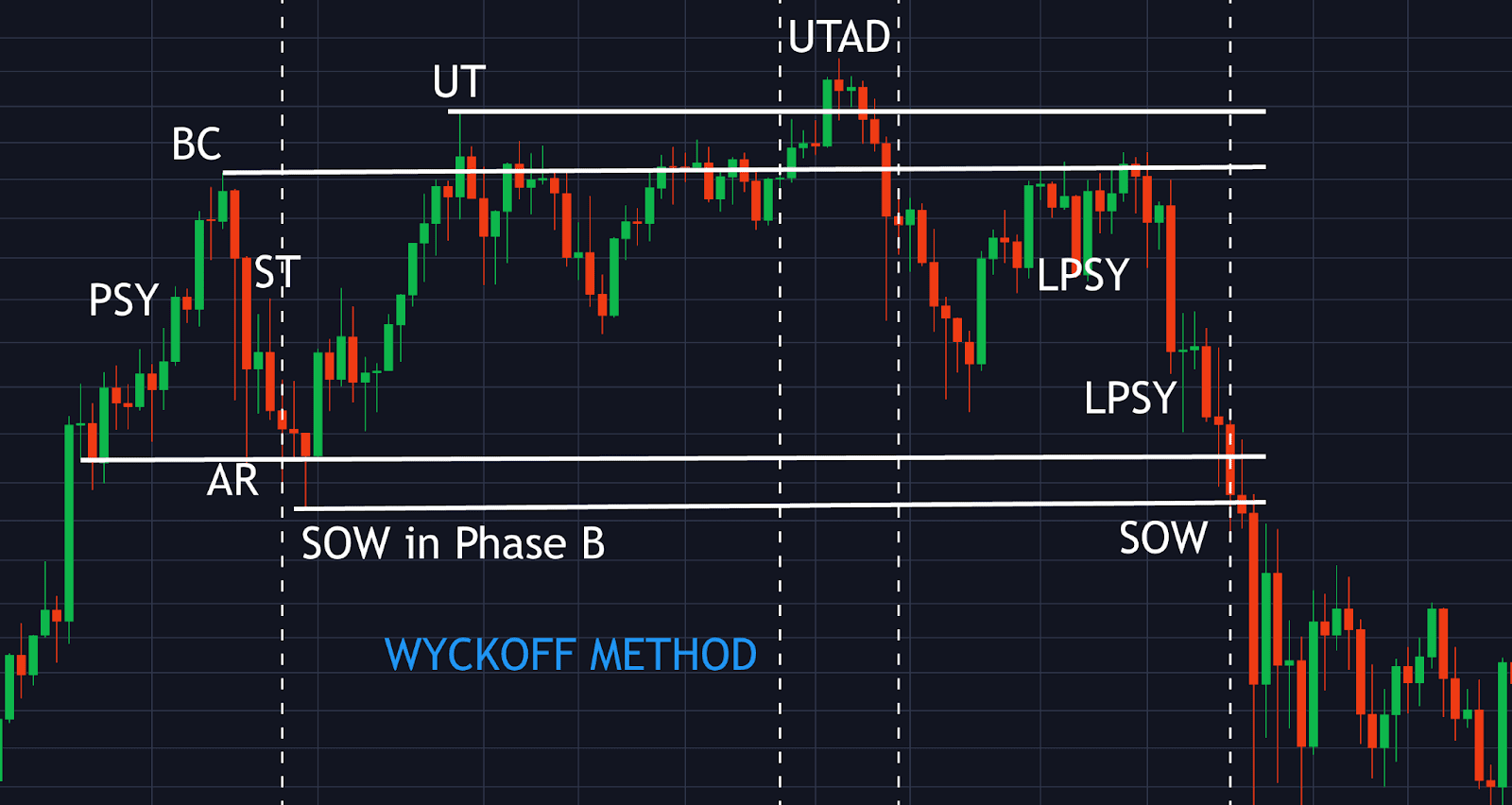

- Distribution Phase: At the peak of the markup, major investors and institutions start selling their holdings to latecomers. The price often fluctuates with increased volatility as supply and demand balance out.

- Markdown Stage: Ultimately, when demand is overwhelmed by supply, prices fall dramatically. The stage exhibits a general selling attitude as late entrants close positions.

Real-world Examples and Case Studies

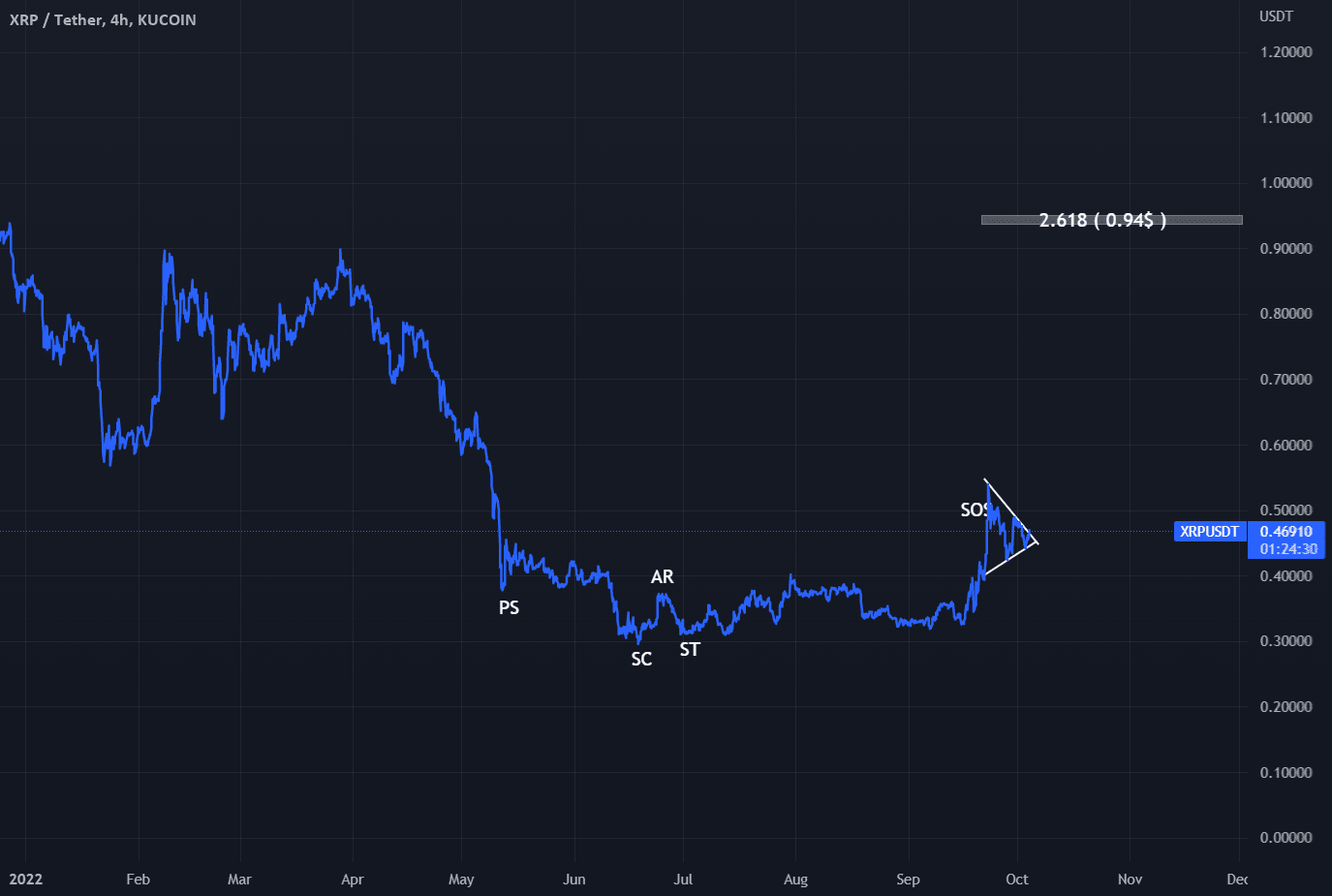

One practical example of the Wyckoff pattern was observed in Bitcoin's price behavior between 2018 and 2021. After Bitcoin peaked in December 2017, it entered a markdown phase with a significant price decline. The market then moved into accumulation through most of 2019 and early 2020.

In late 2020, Bitcoin was in a markup phase, reaching a new high in 2021 before moving into distribution and markdown phases. Traders aware of these phases could position themselves into and out of positions effectively, improving their profitability considerably.

Similarly, combining Wyckoff timing with staking opportunities — like Polygon (MATIC) staking — can enhance overall portfolio returns.

Likewise, investors utilized Wyckoff methodology on stocks such as Tesla (TSLA), successfully determining periods of accumulation and later markup phases triggered by rising institutional buying demand.

Influential People and Institutions

A number of contemporary analysts and tradesmen have developed and made widely available the Wyckoff system. Traders such as Gary Dayton and David Weis have utilized the Wyckoff concepts heavily and have produced publications and given talks expanding the understanding among tradesmen.

Specialized organizations like Wyckoff Analytics have also materialized and they provide thorough training and resources solely for the education and application of Wyckoff methods. These organizations assist global traders in learning the formidable technical analysis approach.

Related Research and Publications

Research and professional writings support the concepts of Wyckoff. For example, articles published in major journals such as the Journal of Technical Analysis and the International Journal of Economics and Finance support the effectiveness of Wyckoff techniques.

Books like Trades About to Happen by Wyckoff scholar David Weis and the original Stock Market Technique by Wyckoff still carry tremendous influence, giving the trader detailed descriptions and modern applications of the technique.

Examining the Strengths and the Limits

The Wyckoff pattern's primary strength lies in its logical, structured approach to understanding market movements. Traders appreciate its practicality and applicability across various markets, including stocks, commodities, and cryptocurrencies.

The pattern has a limitation that it necessitates a lot of practice for mastery. The trader should have a good eye for discerning subtle interactions between volumes and prices that require a long time and experience for mastery.

Furthermore, conditions on the market occasionally produce noise that can mislead newcomers. Thus, it's best to support Wyckoff techniques with further technical indicators for the purpose of confirming trading signals and mitigating the chances for false understandings.

Conclusion

The Wyckoff pattern offers traders a sophisticated yet intuitive framework to interpret market trends effectively. By understanding its phases, principles, and practical applications, traders can better predict market movements and enhance their overall trading strategies. While mastering the Wyckoff method takes effort, its long-term benefits can significantly contribute to trading success.

For more trading tools, tutorials, and guides on crypto strategies, visit Cryptogeek.

FAQ

What’s the general intent of the Wyckoff pattern?

The primary goal of the Wyckoff pattern is to identify market trends by analyzing price and volume to predict future movements accurately.

Who developed the Wyckoff method?

The Wyckoff method was developed by Richard D. Wyckoff, an influential trader and market analyst in the early 20th century.

Is the Wyckoff pattern applicable for cryptocurrency trading?

Yes, the Wyckoff pattern works extremely well for cryptocurrency trading, for the simple fact that most cryptocurrencies experience distinct periods of accumulation, markup, distribution, and markdown.

What are the most common mistakes when using the Wyckoff method?

Frequent errors are mistaking market noise for real signals, ignoring the analysis for volumes, and insufficient practice for discerning pattern nuances correctly.

How long does it take to learn the Wyckoff pattern?

Mastery of the Wyckoff pattern varies from person to person but generally requires several months of intense learning, practice, and real-market exposure.

Los mejores tutoriales

-

Что такое хард-форк?Jul 27, 2020

-

Стейкинг на Ethereum 2.0 и его основные особенностиAug 01, 2020

-

Инновации на основе блокчейна в сфере энергетикиAug 03, 2020

No hay comentarios aún. ¡Sé el primero!