Is Hedera a Good Investment? A Deep Dive into HBAR

Should you put your money into Hedera? It's a question being raised increasingly now that blockchain tech is set to move beyond Bitcoin and Ethereum. Hedera, with its native cryptocurrency HBAR, offers an alternative approach to open, decentralized networks. Whereas others use blockchain, they utilize tech called Hashgraph. It's this characteristic that's put investors, coders, and business end-users in contention. In this article, we're going to examine what Hedera is, how they accomplish what they do, who's behind them, and whether they have the traits of a successful long-term investment.

Contents

What is Hedera?

Hedera is an open-source distributed ledger platform that is intended to provide a speedier, more secure, and more power-efficient solution than the typical blockchains. The most distinguishable characteristic is that a Hashgraph consensus algorithm is used instead of blockchain.

The network offers three principal services:

- HBAR cryptocurrency (for transaction fees and staking)

- Smart contracts (e.g., of Ethereum)

- Tokenization and file storage (through its Hedera Token Service and File Service)

As it does not rely on the mining or the traditional proof-of-work, Hedera provides high throughput, low costs, and fast finality.

Understanding Hashgraph Technology

The selling point of Hedera is the underlying tech. In blockchain, the data is written in continuous blocks, but Hashgraph applies a virtual voting and a gossip protocol. The following is how it does that:

- The nodes randomly communicate with each other and “gossip” about transactions.

- All nodes keep a record of who talked to whom and when.

- Virtual voting is then used to decide the order of transactions.

It is designed to be faster and more fair than the traditional blockchain consensus processes. Hedera claims that it will be able to process thousands of transactions per second with uniformly low fees and very low power usage.

The Role of HBAR

HBAR is the Hedera network's own token. It is used for the following:

- Transaction fees: HBAR holders pay to conduct transactions or run smart contracts.

- Network security: The HBAR is used in a proof-of-stake scheme for protecting the network from harmful actors.

- Incentives: Members receive HBAR for running nodes or as contributors to the ecosystem.

The token's total supply is 50 billion HBAR, of which some is gradually made available in circulation.

Governance: The Hedera Governing Council

Among the most important traits that set Hedera apart from the majority of the other projects is the Governing Council. The council is composed of a group of up to 39 global organizations, all of them having equal vote power and limited terms. The members are engaged in software upgrades, pricing, and treasury decisions.

These are among the council's high-profile members:

- IBM

- Boeing

- LG Electronics

- Dell

- Standard Bank

The council's structure is intended to avoid centralization but guarantee responsible governance. Nevertheless, the critics say that such a structure is also more centralized than the majority of permissionless networks.

Real-World Use Cases and Adoption

Hedera has been implemented in some practical uses, particularly in enterprise environments. A couple of them are:

- Avery Dennison’s atma.io: A real-time supply chain tracing platform that operates on Hedera, handling billions of distinct items throughout the world.

- ServiceNow: Uses Hedera to provide audit trails for IT workflows.

- Dropper: A platform that enables NFT-driven digital coupons and discounts.

Performance metrics of Hedera and the low-cost business model entice businesses in need of scalable infrastructure. Adoption, however, is not very high among ground-level DeFi builders and crypto developers compared to Ethereum or even Solana.

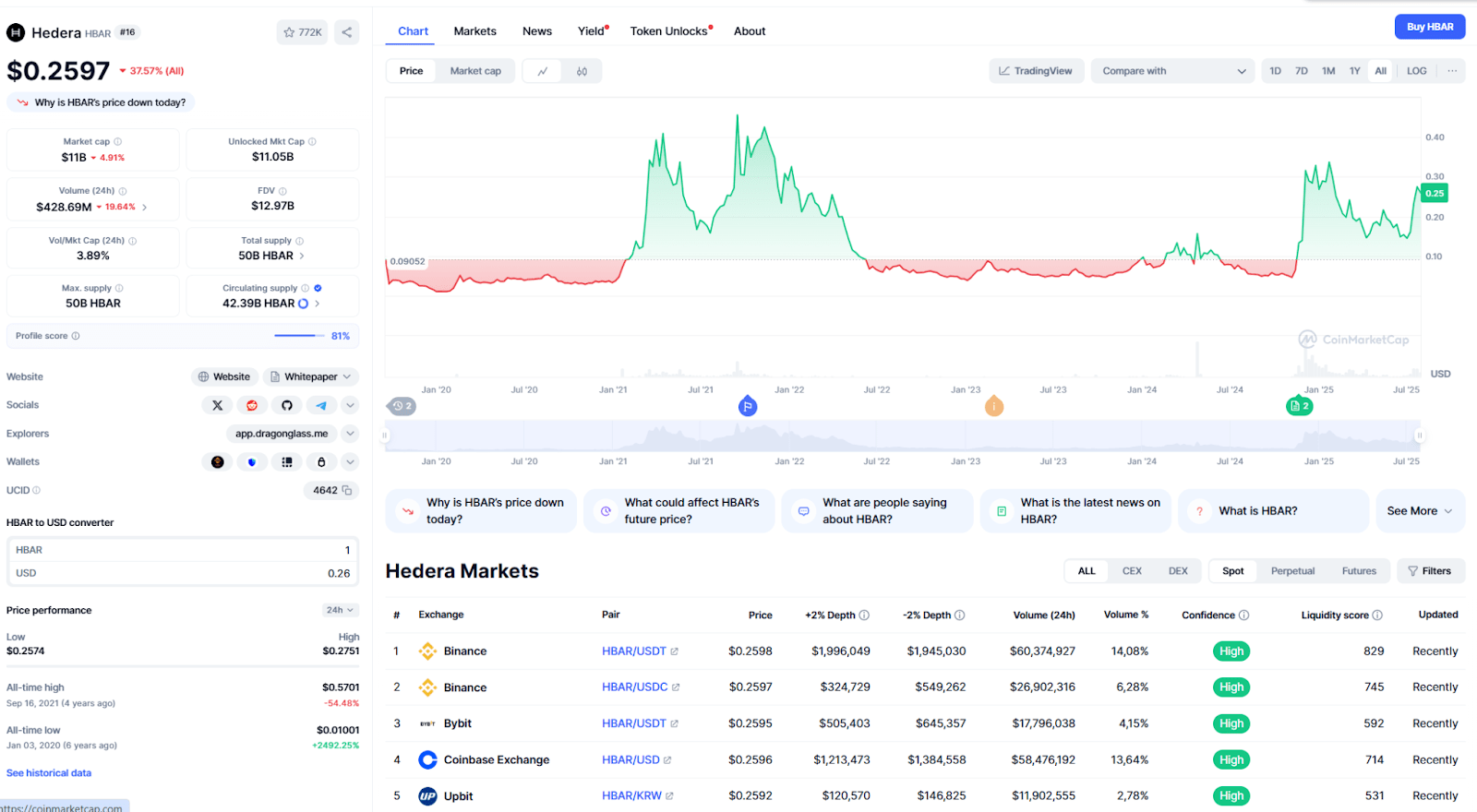

HBAR Price Movement and Market Analysis

Since its initial release, HBAR has experienced numerous price increases, most significantly during the course of general crypto market increases. Like most altcoins, the price is quite volatile and based on both larger trend movements and in-network developments.

Up through the end of 2025, HBAR is among the market cap's top 50 cryptos but has not achieved mass hysteria or retail investment that plagued more popular tokens. However, it does have the long-term backing of holders and is picking up steam among tech enthusiasts in the enterprise space.

Pros of Investing in Hedera

These are several reasons why HBAR is considered an asset worth investing in among certain investors:

- Scalability: With high throughput and low transaction costs, Hedera is designed to support multiple use cases that are threatened by the current blockchains.

- Energy Efficiency: The network is significantly less energy-intensive than Bitcoin or Ethereum, in concert with ESG-driven investing.

- Enterprise Partnerships: Ties with major corporations might enable the long-term adoption and legitimacy of Hedera.

- Strong Governance Structure: Rotating Governing Council ensures that none of the parties gain long-term control, unlike in most of the “founder-dominated” projects.

Risks and Concerns

However, none of the cryptocurrency investment is risk-free. Hedera is not problem-free as well:

- Centralization Criticism: In spite of its Council approach, certain critics cite that Hedera is not really decentralized.

- Small DeFi and NFT Ecosystem: The user and developer base of Hedera is smaller compared to Polygon, Ethereum, or even Solana.

- Token Supply Allocation: There is a lot of HBAR still retained in the treasury of Hedera, and how that is allocated determines price.

- Regulatory Framework: Being a network with connections to large corporations, Hedera could be more in the spotlight of the regulators based on the jurisdiction.

These hazards should be weighed appropriately, especially for long-term exposure.

Opinions of Analysts and Market Forecast

Crypto analysts are largely neutral on HBAR. Some commend its tech-driven approach and business use cases, but others find the project too centralized and unable to gain traction in its community ecosystem.

Performance- and reliability-motivated institutions and developers may favor Hedera. But retail investors that value decentralization and rapid token appreciation may not be so interested.

Performance within the Cryptocurrency domain, as is always the case, is tied to narratives, timing, and larger macroeconomic trends.

Conclusion

So, should you invest in Hedera? It all depends. If you are interested in speed, energy efficiency, and enterprise adoption, then Hedera is definitely worth considering. With its governance model, real-world use, and state-of-the-art tech, Hedera stands out from the vast majority of projects.

That being said, if you're intrigued by decentralization, ground-level developer environments, or high-risk, high-reward digital assets, Hedera may make you more conservative and self-contained. Always research for yourself, diversify your portfolio, and understand your risk tolerance prior to investing in a digital asset.

FAQ

Why is Hedera different from other blockchains?

Hedera runs on Hashgraph, not blockchain. The outcome is faster transactions, lower costs, and greater energy efficiency.

Is HBAR used for staking?

Yes. HBAR is implemented in proof-of-stake consensus. You can stake HBAR for backing the security of the network and for rewards.

Is Hedera centralized or decentralized?

Hedera is controlled through a rotating special Governing Council of major corporations. More centralized than some blockchains, it is not meant to end up in the grasp of a single entity.

Does Hedera support dApps?

Yes. Hedera is compatible with smart contracts and token building. But its developer community is less than that of Ethereum or Solana.

Has Hedera been implemented in production scenarios?

Yes. Google, IBM, and ServiceNow are among the members of the Governing Council, and others have built their solutions on the Hedera network.

Should you invest in Hedera?

There exists no absolutely safe investment. Hedera is technically and governantly well-constructed, but volatility in the market and growing ecosystems are risks.

Los mejores tutoriales

-

Что такое хард-форк?Jul 27, 2020

-

Стейкинг на Ethereum 2.0 и его основные особенностиAug 01, 2020

-

Инновации на основе блокчейна в сфере энергетикиAug 03, 2020

No hay comentarios aún. ¡Sé el primero!