How to choose the perfect moment to buy Bitcoin: 3 methods

Everyone knows: you need to buy Bitcoin when it is at a minimum. But how to predict this moment? Here are a few methods that can help you.

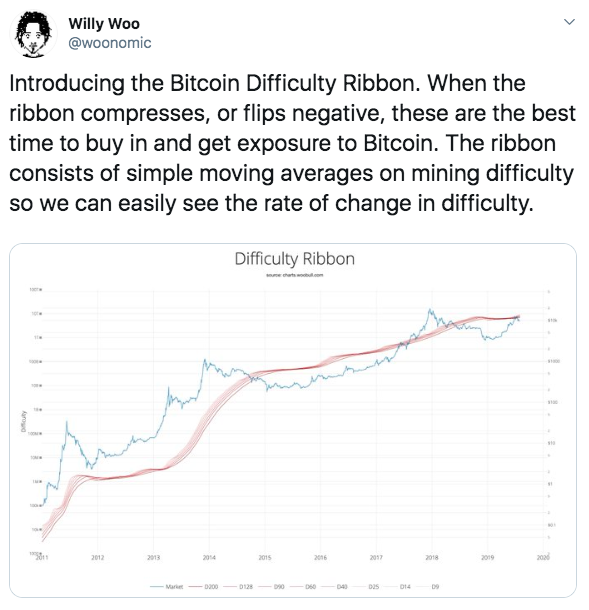

“Difficulty Ribbon”

In August, analyst Willy Woo introduced a tool called “Difficulty Ribbon.”

When miners manage to get a certain number of coins, they sell them to cover costs, which puts pressure on the cryptocurrency rate. Less productive miners are selling more cryptocurrencies to continue mining. If the costs do not pay off, miners leave the industry, and then the hash power and network complexity decrease, which means that the ribbon is compressed. Only productive miners who sell fewer coins remain on the market. When part of the miners leaves, low pressure from sellers allows the price to stabilize and start to rise again. When the ribbon is compressed - the best time to buy Bitcoin. Often miners leave when the market is in a bearish mood or after another halving. The ribbon is compressed at the moment when only half of the coins sharply begin to be mined, while the costs are still unchanged and the price of Bitcoin has not yet managed to react properly and has not stabilized. Therefore, for events such as halving and changes in the hash of the network, traders should closely monitor.

Weekend trading activity

In summer Bloomberg experts said that in May, 40% of the growth in the rate of the first cryptocurrency came on the weekend. David Tawil, president of cryptocurrency hedge fund ProChain Capital, said:

"Trading takes place on the weekend waiting for news. You are forced to grope the way since you don’t know if there will be an important announcement on Monday morning. I don’t think that in the world of cryptocurrencies, where events develop daily, it is a mistake to bet on the appearance of positive news on Monday.”

Also on Fridays, the US Commodity Futures Trading Commission (CFTC) reports on the behavior of traders, where it notes how investor interest in futures and options contracts has changed. According to experts, speculators can draw valuable information from the report and enter the market.

The Fisher and Buterin Method

Before you buy cryptocurrency, you need to evaluate it. Usually, the economist Irving Fisher’s formula is used to calculate the value of assets: “MV = PQ”. It can also be used to evaluate cryptocurrency projects. The formula takes into account the totality of cash and non-cash funds when working with cryptocurrency (M) and its circulation speed, the number of coin transfers from hand to hand for a certain period, (V), as well as the price of the underlying asset (P) and production volume (Q) . Ethereum founder Vitalik Buterin believes that a slightly modified formula can be used to evaluate crypto assets, where production volume (Q) is replaced by the number of transactions, their daily economic value (T):

“We give an example to prove this equality: if there are N coins, and each of this quantity passes from hand to hand M times a day, then the economic value of a coin for 24 hours is M * N. If an economic value of $T is represented, then the price of each coin is T / (M * N), and the “price level” itself is the opposite, therefore it is found using M * N / T. ”

Someone is guided by intuition when trading cryptocurrencies, someone is guided by methods such as indicated above. But you must always remember that none of the methods gives a 100% guarantee that you will earn.

What do you think about it? Share in comments and follow us on Twitter!

Stay tuned with Cryptogeek and follow the cryptocurrency blog together and you won't miss the breaking next news!