TenX Wallet Review 2021 - Is It Safe?

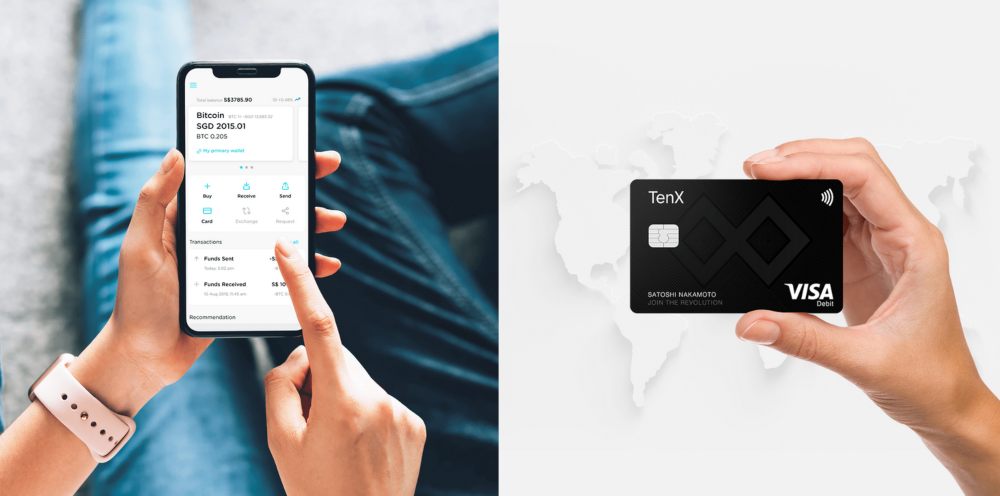

TenX is a multi-functional cryptocurrency service that contains such features as a cryptocurrency wallet, crypto-friendly debit card, in-built cryptocurrency exchange, a native token, and so on. TenX was launched in 2015. The ICO was held in 2017. The first TenX debit cards were issued in 2017, however, for some time in 2018, the cards were not supported. The creator of the platform is Toby Hoenisch. It was created with assistance from the PayPal fintech incubator. The platform is fully compliant with European regulations. The team is currently based in Singapore.

Main Features

One of the biggest recognized problems of cryptocurrencies is that using them in shops, cafes, or on most online markets is less comfortable (and less accessible) than using fiat money. Even regarding the fact that commissions in the case of fiat currencies are higher and transactions can take longer when it comes to cross-border transfers, most people still prefer using fiat currencies. This problem is being addressed differently by a number of cryptocurrency projects. TenX is trying to get the advantage of already existing payment infrastructure through bridging cryptocurrencies with Visa debit cards.

The importance of the existence of such an ecosystem as TenX cannot be underestimated. The company provides the tool of bringing cryptocurrencies to everyday life. TenX cards give people an opportunity to pay with cryptocurrencies for regular goods or services in regular venues whose staff people don't even suspect that the TenX users are spending crypto money. That's because cryptocurrencies stored on TenX wallets are instantly exchanged to local fiat money automatically. Moreover, crypto can be cashed out via the ATM. These opportunities make using cryptocurrencies effortless. However, the drawback is that TenX users cannot control the fees charged while these transfers. That's the price they pay for the convenience of TenX.

The importance of the existence of such an ecosystem as TenX cannot be underestimated. The company provides the tool of bringing cryptocurrencies to everyday life. TenX cards give people an opportunity to pay with cryptocurrencies for regular goods or services in regular venues whose staff people don't even suspect that the TenX users are spending crypto money. That's because cryptocurrencies stored on TenX wallets are instantly exchanged to local fiat money automatically. Moreover, crypto can be cashed out via the ATM. These opportunities make using cryptocurrencies effortless. However, the drawback is that TenX users cannot control the fees charged while these transfers. That's the price they pay for the convenience of TenX.

TenX wallet and debit card support three cryptocurrencies: Bitcoin, Litecoin, Ethereum, and PAY token, the wallet native token. Apart from crypto coins, TenX supports the only fiat currency, namely USD. What makes TenX cards attractive to the major public is that it is a VISA card hence it is accepted in any of dozens of millions of places where VISA cards are allowed as a payment means including numerous ATMs around the world. This feature makes TenX cards useful in real life and helps a wider cryptocurrency adoption, too. What brings even more convenience is that ATMs let users exchange crypto to local currencies. The card allows spending cryptocurrencies in one touch just like the fiat money is spent. Visa 3d Secure is also available for the TenX card users. This feature protects the funds during online shopping. TenX doesn't have a direct agreement with Visa. The interaction with Visa is conducted via the intermediary of the TenX's partnership with Wirecard Card Solutions Ltd.

The crypto coins are instantly converted to fiat currency when the cardholder is paying for something. The support of USD means that the card can be used for purchases of cryptocurrencies. It can be done via SOFORT or simply through a credit card. Moreover, the cryptocurrencies can be exchanged for one another within the TenX interface. For example, BTC can be changed to ETH, and vice versa instantly. The cardholders receive 0.1% cashback in TenX (PAY) tokens. This incentivizes TenX users to get these debit cards.

TenX allows monitoring of the prices of cryptocurrencies in real-time. To make this process more convenient, the platform provides an opportunity to set the price alerts for the currencies that interest users the most. The app provides access to the full history of transactions and purchases including transactions made via the app and the debit card. The platform is accessed via the mobile app available for Android and iOS users. The card can be issued both in the physical and virtual forms.

Security - Is TenX Safe?

As there are no banks to secure the cryptocurrency funds, the protection of digital money highly depends on the platforms (wallets, exchanges, etc) used for the storage. Before using any cryptocurrency platform, it is critically important to make sure the platform provides strong security measures and really takes care of the safety of the money of its users.

As was mentioned above, online shopping is secured by the Visa 3d Secure feature. 3d Secure is an additional protection layer. The technology manages authorizations of online payments. It initiates the data exchange between the merchant, card issuer, and at times a cardholder. This data exchange is set to verify the participants and make sure that the transaction is going to be legit. If everything is fine, the transaction gets executed.

Besides that, there are a number of other security measures. For instance, TenX debit card holders receive real-time notifications whenever the card is used. All the actions associated with the card are protected by a PIN — just like on regular credit cards. On some devices, facial recognition or fingerprint action can be used as an alternative to a PIN. The card can be locked by the user on purpose. No one will be able to perform any actions with the card until the user gets the card unlocked. Another security measure is well-known and well-spread in the cryptocurrency industry — it is 2-factor authentication. The feature makes it impossible to use the account without the physical possession of the user's device as all the critical actions such as withdrawals or logging in request the one-time password. The password is sent via SMS, an email address, but usually, it gets generated on the mobile device in the special app. The password is relevant for a short span of time (e.g. 30 seconds). A person that doesn't have a mobile device with the authenticator app cannot retrieve this code hence the account cannot be accessed and money cannot be stolen.

Besides that, there are a number of other security measures. For instance, TenX debit card holders receive real-time notifications whenever the card is used. All the actions associated with the card are protected by a PIN — just like on regular credit cards. On some devices, facial recognition or fingerprint action can be used as an alternative to a PIN. The card can be locked by the user on purpose. No one will be able to perform any actions with the card until the user gets the card unlocked. Another security measure is well-known and well-spread in the cryptocurrency industry — it is 2-factor authentication. The feature makes it impossible to use the account without the physical possession of the user's device as all the critical actions such as withdrawals or logging in request the one-time password. The password is sent via SMS, an email address, but usually, it gets generated on the mobile device in the special app. The password is relevant for a short span of time (e.g. 30 seconds). A person that doesn't have a mobile device with the authenticator app cannot retrieve this code hence the account cannot be accessed and money cannot be stolen.

There are more security measures provided by the platform. One of these measures is PCI compliance. It means that the PCI system providing payment safety globally is involved in the security of the TenX accounts and the funds stored in the TenX wallets.

Additionally, TenX has an E-Money License. The users' assets are stored in a Safe Segregated Account (SSA). So the money of the TenX users is guarded by the European bank. It is the requirement of the EU E-Money Directive. Such a feature is still quite rare in the cryptocurrency industry. The app updates itself automatically to ensure that users will always have the latest version which can be considered as most secure. The personal data is kept in the encrypted form. The user can request the blocking of the card chip or NFC anytime. This feature is useful when the user spots some kind of suspicious activity. The customer support is available 24/7 through live chats, ticket system, and so on. As the company has licenses and cooperates with regulators, there's no need to ask if TenX is a scam. There is no place for such assumptions. Generally, we can conclude that using TenX is quite safe.

Fees & Limits

There are several kinds of fees charged by Tenx. First off, the physical card issuance costs 15 Euro (for EU residents). The fee can be paid in BTC, LTC, or ETH. Another fee is the subsequent annual fee. It is charged only from the cardholders who spent less than $1,000 in the first year. The fee is 10 USD. The shipping and the first year of use are not subjected to the charging of commissions.

As for foreign exchange fees they are zero. The deposits are free, as well. Sending and withdrawal fees are set to zero but the company warns that in the future, these operations will be not free. According to the website, the fees will be based on market transfer rates. However, sending money within the TenX ecosystem will stay free. ATM withdrawals are not free. The users from the European Union have to pay 3 EUR per withdrawal. The in-app currency exchange is not constant. It is calculated based on the average rate on other exchanges. On top of that, the fee includes operational costs.

The company imposes some limits on users. The following figures are relevant to the users of the EU. The user can perform up to 50 transactions a day. The summarized value of these transactions cannot surpass €10,000. The weekly limit is twice as much as the daily limit and amounts to €20,000. The maximum number of transactions a week is 350. The value-wise monthly limit equals the weekly limit (only €20,000). However, as for the number of transactions, users can perform up to 1500 transactions per month. The yearly limit is €100,000 in value and 18000 in the number of transactions.

Another batch of limitations is associated with ATM transactions. TenX users cannot withdraw more than €1,000 per day via ATMs. The number of transactions is limited to just two. It is possible to perform up to 10 ATM transactions a week. The sum cannot surpass €2,500. The same figures are relevant for the monthly limits. There cannot be more than 100 transactions per year. The maximum amount is limited to €15,000.

One of the promising projects that fell apart.

The wall at allows to make the deposits with the debit card, that's a good news for traders.