PancakeSwap (CAKE) Review

This article reviews one of the most popular decentralized crypto exchanges today. Its name is PancakeSwap. As of August 2022, the user base of PancakeSwap exceeds 2 million. Read the article to learn the basic characteristics of PancakeSwap, how much PancakeSwap charges you for trades and withdrawals, what tokens you can trade there, and other facts. On top of that, you will learn if this platform is safe to use and if PancakeSwap is a scam.

- What is PancakeSwap?

- How Does PancakeSwap Work?

- The History of PancakeSwap

- What Can You Do on PancakeSwap?

- The Benefits of Using PancakeSwap

- How Does PancakeSwap Make Money?

- The Purpose of PancakeSwap Tokens (CAKE)

- How to Swap Tokens on PancakeSwap

- Is PancakeSwap Safe?

- Conclusion

What is PancakeSwap?

PancakeSwap is an open-source multi-functional decentralized exchange. It was launched in 2020 and soon became the most popular decentralized exchange. As the DEX is based on the BNB Chain, you can swap and trade all the BNB Chain tokens, NFTs, and perpetual crypto assets. The exchange supports over 3.5 thousand assets. PancakeSwap allows swapping tokens, placing limit orders, providing liquidity to the exchange, earning via staking, lottery, etc. Trading competition and price predictions are the other possible ways of making money on PancakeSwap.

As of August 2022, PancakeSwap supports 12 wallets that can be connected to the platform. They are Binance Wallet, Coinbase Wallet, Trust Wallet, Brave Wallet, MetaMask, Wallet Connect, Opera Wallet, MathWallet, TokenPocket, Coin98, SafePal, and Blocto.

Like other DEXs, PancakeSwap is a convenient way to exchange cryptos without sharing personal data with intermediary platforms. More than that, you don't have to trust your money to any entity as all trades occur between the exchange participants, not between the exchange and buyer/seller. Another benefit of any DEX (therefore, of PancakeSwap) is that they are not dependent on a single server like centralized exchanges. An attack on the server or the server's downtime can seriously harm the results of your trading activity or even get your funds wiped out. This is not the case for decentralized exchanges distributed among multiple servers. Successful hacker attacks on decentralized exchanges are extremely rare. Although many name low liquidity as one of the most obvious downsides of using DEXs, PancakeSwap managed to handle this issue and gain significant liquidity. Regarding daily trading volume, PancakeSwap is among the top50 crypto exchanges and the third biggest decentralized exchange after Uniswap and Jupiter.

How Does PancakeSwap Work?

PancakeSwap is an automated market maker (or AMM). Unlike more traditional exchanges, AMMs are not the platforms for trading between buyer and seller. Instead, AMMs (and PancakeSwap, as well) allow you to trade via one of several liquidity pools. Trades move the tokens in the pool, changing the balance in the pool and affecting the total value of the assets.

To continue operating, AMMs vitally need liquidity providers. That's why platforms like PancakeSwap incentivize users to lock their tokens on exchange in the liquidity pools. Users earn money through rewards for providing liquidity to the AMMs' pools. The rewards come from the transaction commissions. PancakeSwap is maintained through the PancakeSwap Treasury, a fund sustained from the fees.

The trading type that takes place on PancakeSwap doesn't require limit and market orders, order books, and other features typical for regular centralized exchanges. That's why several AMM platforms have the word "swap" in the name. However, traditional trading experience and skills can help to trade on the AMM platforms, including PancakeSwap, as understanding market dynamics is still crucial.

The History of PancakeSwap

The exchange was created in 2020 by an unidentified team of developers. Many DEXs at that time were Ethereum-based, but PancakeSwap creators preferred to use Binance Smart Chain (now known as BNB Chain). Obviously, the PancakeSwap team was realizing the potential of the BSC as it hasn't the scalability issues that make Ethereum a slower and more expensive platform for DEX building.

In 2020, the DeFi sector was booming, and the emergence of PancakeSwap, fast and cheap, was met with much enthusiasm. The leading competitor, Uniswap, is based on Ethereum and charges higher trading fees. It contributed to PancakeSwap's quick rise to fame.

What Can You Do on PancakeSwap?

The complete list of the features supported on PancakeSwap includes:

Trading

- Swap (instant tokens exchanged at the market price)

- Limit (trade takes place when the price reaches the value you choose, if ever)

- Liquidity (staking liquidity tokens in exchange for rewards deriving from trading fees; in the Farms sector, you can stake liquidity tokens in exchange for CAKE rewards)

- Perpetual (perpetual trading is trading futures contracts that have no expiration date; while trading perps, you can use margin to leverage the returns)

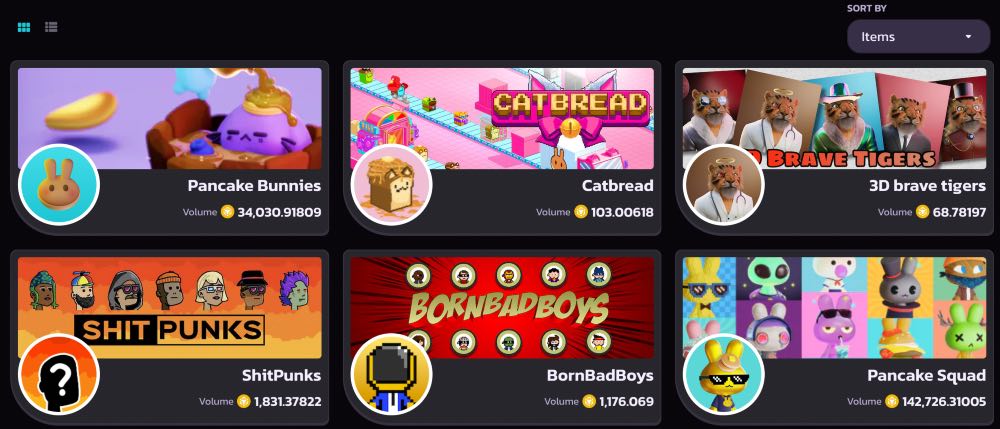

- NFTs (you can sell or buy NFTs in the respective sector of the website)

Earning

- Farms (in this sector, you can make money through staking tokens to provide liquidity to the pool)

- Syrup pools (there, you can lock certain tokens for specified periods and enjoy annual rewards)

Winning

- Trading competition (like many other exchanges, PancakeSwap offers users to participate in trading competitions; you or your team should outperform others in trading volume while trading eligible pairs in the specified time frame; the winner gets rewards, including NFT prizes)

- Predictions (As of August 2022, this feature is in a BETA phase; you might provide price predictions on specific tokens in return for rewards)

- Lottery (dozens of thousands of USD make up the prize fund in the PancakeSwap lottery; you just buy a ticket and get a chance of winning a portion of this fund)

- Pottery (staking coins for prolonged time spans with the chance of winning additional money on top of the APY; the feature is in the BETA testing phase now, August 2022)

The Benefits of Using PancakeSwap

Some consider PancakeSwap to be just a Uniswap on BNB Chain instead of Ethereum. As BNB Chain is more scalable, PancakeSwap is better when it comes to transaction speed and costs. The fees on PancakeSwap are lower than on Uniswap.

Another benefit of PancakeSwap is high liquidity. As of August 2022, PancakeSwap is among the 50 exchanges with the highest daily trading volume.

And finally, we should add that PancakeSwap doesn't collect your data. The platform is open-source and is subjected to independent audits. Using PancakeSwap is relatively safe.

How Does PancakeSwap Make Money?

Although this question makes sense for most decentralized exchanges as they don't collect fees, in the case of PancakeSwap, everything is quite clear. Unlike most DEXs, PancakeSwap does charge users with trading fees. Moreover, the fees on PancakeSwap are higher than on several centralized exchanges with comparable liquidity.

PancakeSwap charges traders, both takers, and makers, a 0.2% fee. PancakeSwap doesn't charge you anything for withdrawals on top of the miner fees (network fees), so the exchange only makes money via trading fees.

The Purpose of PancakeSwap Tokens (CAKE)

The exchange's native token is called PancakeSwap (CAKE). Its supply is limited by 750 million units. Holders can use CAKE tokens to improve the IFO returns or receive CAKE rewards for yield farming. It's understood that many of the supported tokens on PancakeSwap can be exchanged for CAKE and vice versa.

The token is doing quite well and is one of the 100 cryptocurrencies with the largest market cap. As of August 2022, the token's price exceeds $3.8.

How to Swap Tokens on PancakeSwap

The swapping process begins with visiting your wallet.

- Open your wallet and click on the DApps button.

- Choose the currency you need and tap on "Buy on PancakeSwap."

- Choose the preferred chain (please choose wisely as some coins are presented on several chains simultaneously)

- Connect your wallet to PancakeSwap via the Connect button

- Choose the amount you are willing to spend (don't forget to leave some to pay the commission)

- Specify the slippage tolerance percentage

- Click on Swap; that's it!

Please note that the process can differ a bit depending on the wallet you use.

Is PancakeSwap Safe?

There are some concerns over the coin selection. As PancakeSwap supports NFTs and thousands of cryptos, there is no wonder that some of these projects may not be that safe to invest in. Another red flag is the anonymity of the dev team. However, this situation is not unique to the crypto industry.

Security-wise, the exchange itself doesn't pose much threat. Your funds are not affected by the platform at all. Instead, they depend on the protection of your wallet. Some of the earning/winning/trading strategies can be risky, but we can't blame PancakeSwap for that.

Conclusion

PancakeSwap is one of the most successful young platforms in the digital finance sphere. The reasons are clear: the dev team gave people the vital product on time. Yes, it resembles Uniswap. However, PancakeSwap managed to become a solid rival to an already-established project. As of yet, this exchange seems to have bright prospects. In our opinion, PancakeSwap deserves its popularity.

Here are no reviews yet. Be the first!