Paybis Review 2024 - Is It Safe?

In order to safely and profitably purchase cryptocurrency, you need to use the services of reliable platforms. Today we will consider a Paybis service that offers to purchase cryptocurrency for fiat. Is it profitable and safe to use this platform? Is Paybis a scam or a reliable platform? We will ascertain it in this article.

- What Is Paybis?

- Features

- Paybis Fees

- How to Get Started with Paybis

- How to Use Paybis

- Verification

- Is Paybis Safe?

- Conclusion

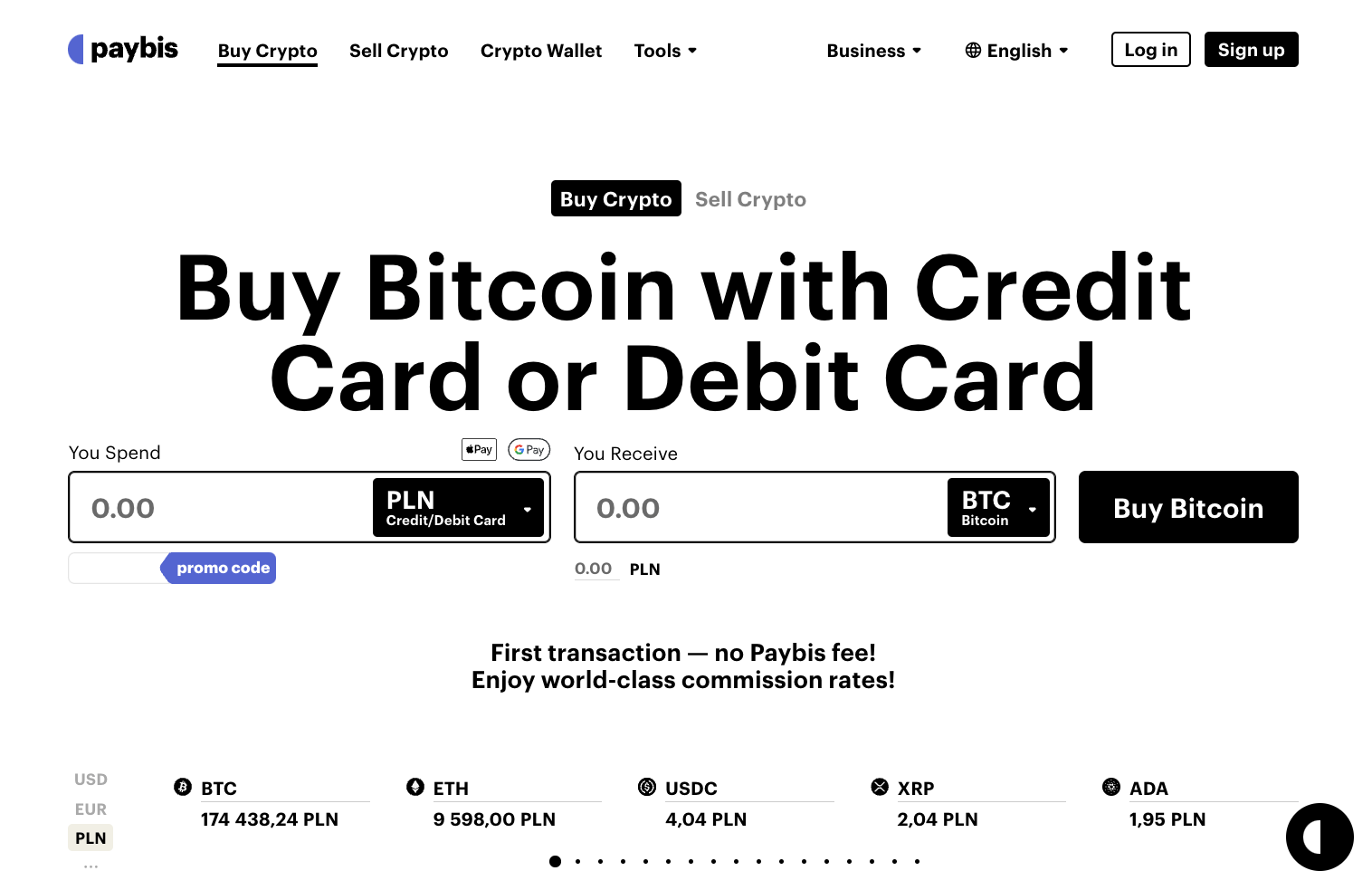

What Is Paybis?

Paybis is an exchanger registered in the Poland and US in 2014. The founders of this project are Innokenty Isers and Konstantin Vasilenko.

The service is focused on a narrow circle of countries: USA, Canada, Europe and other 180+ countries.

Paybis is a platform where you can buy, exchange, or sell any cryptocurrencies or electronic currencies. The system aims to provide readily available currency exchange services for everyone. The service supports 80+ cryptocurrencies, among them, are Bitcoin, Ethereum, Litecoin, XRP, Bitcoin Cash, Stellar, Binance Coin and TRON.

Paybis allows you to exchange fiat or digital currency in a few minutes. At the same time, a wallet is not always required, cryptocurrency can be bought paying in dollars or euros directly from a bank card. And most important, it is not necessary to be an expert on blockchain technologies and understand technical analysis, as is the case with the exchange: the system will do everything for you.

The platform is translated into 9 languages, including English and Spanish.

You can use the service both on the web platform and on iOS and Android.

Features

Customers choose Paybis due to a wide range of functions is available on this platform: the security of your data, a convenient interface, fast transaction processing, and verification, a payment card to withdraw any of your currencies, and much more.

Among all Paybis advantages, the following should be highlighted:

- High limits. You can purchase amounts of up to $20,000 per transaction or $50,000 per month.

- Instant payouts. Instant Bitcoin, Litecoin, Ethereum, Bitcoin Cash, or Ripple payout – no waiting time anymore.

- Make payments from almost everywhere. PayBis accepts payment from almost every country in the world, including USA, Europe, Asia, South America, and Africa

- 24/7 support. PayBis is unrivaled in the field, with LIVE 24/7 support and a customer satisfaction rating of 4.2, according to an independent survey on Trustpilot

- Available on the web platform, iOS and Android

Paybis Fees

According to the information on the Paybis website, you will have to pay 2 types of fees to buy cryptocurrency:

- Service commission - the fee Paybis charges for providing the service

- Network commission - the fee that is charged by the blockchain for confirming the transaction

All transactions that happen on Bitcoin's blockchain are charged a fee that miners receive for confirming your transaction.

Deposit options

Credit/Debit Card

Skrill

Giropay

Bank Transfer EU

Neteller

Online Banking for US

AstroPay

SPEI for LATAM countries

How to Get Started with Paybis

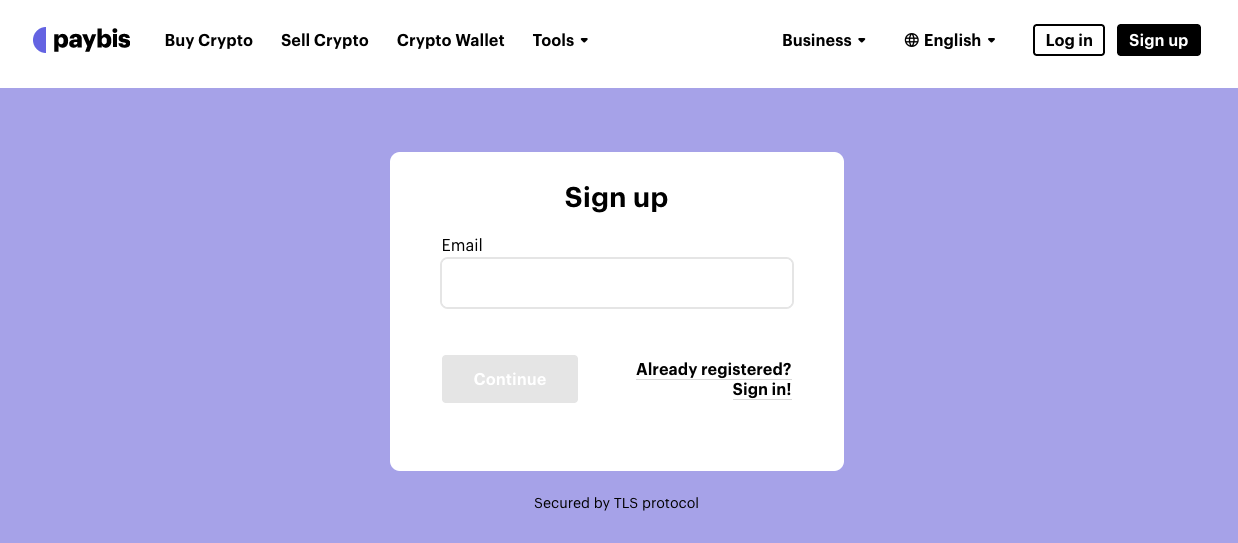

In order to start working with the service, you must register. To do this, click on the “Log In/Sign Up” blue button in the upper right corner to get started.

To sign up you need to fill the form with your E-mail and follow further instructions (Fill the form with your First Name, Last Name, Username, and Password (your password must contain at least one lowercase letter, one uppercase letter, and one numeric digit). Pass the Captcha and agree with “Terms and Conditions, AMK Policy and Rates”).

That’s it! Now you are ready to start working with Paybis.

How to Use Paybis

The site is very rich in information: there is general information about what cryptocurrency is and how it is earned, a detailed FAQ section (Frequently Asked Questions), a support portal with the function of creating tickets (new questions/tasks for support) and a blog.

After successful registration, you can proceed to the exchange. You can choose what you sell, and what you buy. Let's say you need to exchange $ 1.000 to Bitcoin and you will use a bank card. Set the initial data and click "Buy Bitcoin". Your first transaction will be with no Paybis fee!

The next time you'll need to pay the commission (look at the commission, it amounts to slightly more than $ 100, i.e. about 11% of $ 1.000, of which 5% for input, 5% for a transaction and $ 0.1 for output): it is immediately reflected in the calculator.

Now it remains only to wait for enrollment. And if you have not yet confirmed your identity, you will have to do this, otherwise, the transaction will not be approved (in some countries, transactions up to 1000 USD can be conducted without KYC). Since cryptocurrency is characterized by high volatility to minimize your losses, Paybis fixes the price reflected in the application for 30 minutes. And only then it starts to be updated every minute.

Verification

Paybis acts as part of an AML anti-money laundering policy. Therefore, it checks the identity of each of its customers and also monitors all operations. In case of suspicion, the account may be frozen or permanently blocked.

In total, the request for identity verification depends on many factors besides the crypto you want to buy or sell. These include IP, VPN, transaction amount, number of countries, and another combination of factors:

a) Simplified Due Diligence (No-KYC)

i. Email and phone number (when registering), first name, last name, and address (when entering the card).

b) Regular Due Diligence (KYC)

i. Photo ID

ii. Livness

iii. Address

c) Enhanced Due Diligence

i. SOF / SOV

ii. POA

All other

They also determine the minimum and maximum transaction amounts. In some cases, the company has the right to request a selfie with a credit card and even a photo with a printed / hand-written declaration. Most often, this is required at high speeds.

You can find more information on Verification on the website.

Is Paybis Safe?

Before you deposit money to any cryptocurrency platform you should make sure that the platform cares about the safety of the funds and data of the customers. Paybis claims to care about such things. Let's examine the security measures offered by the exchange and see if it's really safe to use it.

In short, we can tell that Paybis is a rather safe platform. More than that, the exchange is registered in Poland and the USA. It means that users must do KYC (know your customer) checks and comply with AML (anti-money laundering) laws. One of the Paybis characteristics makes it nearly impossible to lose money in case of the exchange hacking — Paybis doesn't hold the assets of its users. If cybercriminals hack the exchange, they won't be able to steal money from Paybis clients. On top of this, regulated companies are subjected to audits. Only a limited number of employees can access the data associated with the exchange users.

Paybis monitors all the transactions on the exchange in order to sort out suspicious activity and stop it if it gets detected. Moreover, you yourself can report the suspicious activity, for instance, if someone's offer looks like a bad-intention out for you. The reported offers are revised by the Paybis experts and the appropriate action is taken as a result.

What does seem disappointing is that Paybis offer little to no protection measures that can be controlled by users themselves. You cannot apply any security measure apart from reporting the suspicious activity and seal your account with a strong password.

Registration is confirmed via unsubscribe to email and unsubscribe via SMS.

Login is possible only via reply to email, it can be called two-factor authentication.

Paybis do not have passwords from accounts, so they can not be compromised. Account can be stolen only if you steal access to email.

You can send cryptocurrency from Paybis wallets only through confirmation from your phone.

Conclusion

Paybis looks like a very convenient platform: training and general materials for beginners, a concise and suitable form of a calculator, where you can see commissions, rate, and all input-output methods.

Paybis service has a convenient functionality. Everything is clear and accessible and does not require professional knowledge in the field of cryptocurrency. Security policy complies with EU requirements. But as for the fees and rates, we would rather recommend you to use such services as Simplex. However, Paybis could be a good choice.

They promised a guaranteed return on my investment but after investing my life savings, I got nothing in return. They seemed legitimate at first, but it was all a scam. I urge people to stay away from fake platforms and not risk their hard-earned money like I did. Report scam to cybertecx net for payout solution

Es una auténtica estafa. No os dejéis engañar

Paybis est une plateforme simple ,rapide et pratique.

I use it all the time