WETH vs ETH: What Is WETH (Wrapped Ether) and How to Wrap It?

Some of you may have only recently discovered what Ethereum is, and now it turns out there’s also wrapped Ethereum? How’s that? Does it have anything to do with gift wrapping?

Let’s find out all about ETH vs. WETH today!

What is wrapped Ether (WETH)?

To grasp the concept of wrapped tokens, you first need to remember that most of the coins run on their own blockchain. Bitcoin has the Bitcoin network, Ethereum has the Ethereum network, etc.

Cryptos that run on another blockchain are called tokens (we’ve discussed them in comparison to tokens in a recent article). For example, there’s the BitTorrent token that runs on the Tron blockchain (and complies with the TRC-10 standard) or ELON that runs on the Ethereum network (and complies with ERC-20). There are tokens that run on two platforms simultaneously, like FEG – it is featured on the Ethereum and the Binance network at the same time.

As you can see, words “coin“ and “token” describe two completely different concepts, but are often used interchangeably, so don’t worry, we get confused as well.

The different blockchain networks are not compatible with each other. For example, you cannot use Litecoin on the Ethereum network, since LTC has its own.

So, WETH is a version of Ethereum that can be used on another blockchain.

Why do we need to wrap ETH?

Say you want to deposit BTC on Aave (a crypto lending platform) to earn an interest rate on it. Since Aave is built on the Ethereum network, it cannot accept BTC from you (see above). But as always, you can go around the restrictions by wrapping your BTC and turning it into WBTC. This token runs on the Ethereum platform, so it can be easily used in the Aave ecosystem. Your problem is solved!

The Ethereum network is faster than Bitcoin’s, so it makes sense to use WBTC on it. However, Polygon network is even faster, so you can have faster and cheaper transactions on it if you use WETH.

How to wrap Ether (ETH)?

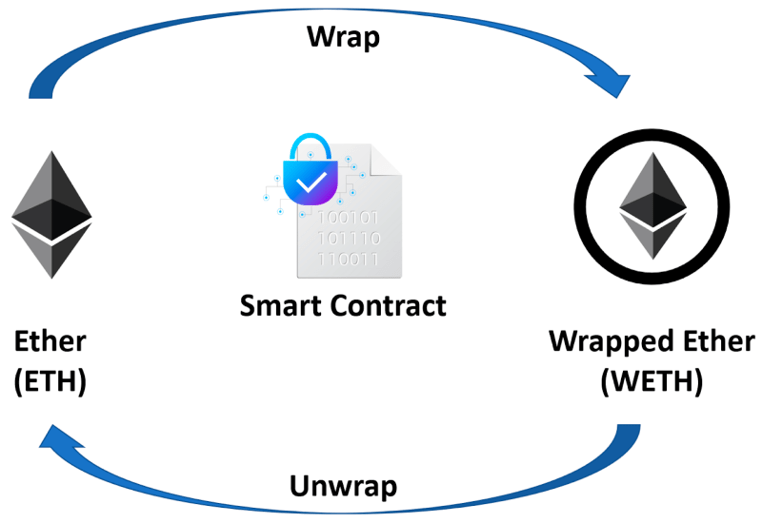

The process of wrapping is pretty simple: you deposit your ETH to an entity called a custodian. Usually it is a smart contract, but it also can be a DAO or a real person (we don’t recommend the last option, since it is much less safe). The job of the custodian is to verify if your coins are legit and then give you an equivalent amount of WETH.

Wrapping ETH on Uniswap

- Open UniSwap (via a browser or the mobile application);

- Set Ethereum as your network;

- Press "Connect Wallet";

- Set ETH and WETH as your exchange pair;

- Type in how much Ethereum you want to exchange (factoring in the gas fee, it should be a bit smallet than your balance);

- Click "Wrap";

- Wait for the transaction to be confirmed. If you want, you can check the transaction's status on etherscan.io

Wrapping ETH on MetaMask

- Download the MetaMask extension and add it to your browser (alternatively, download the app);

- Sign in;

- Go to polygonscan.com and click “Add Polygon network” (a button at the very bottom of the page near the right corner);

- Change the network in your MetaMask extension to “Polygon Mainnet”;

- Go back to polygonscan.com, search “Wrapped Ethereum”, copy the contract address and paste it in the same field as described above.

- Click “Import tokens” at the bottom of the menu;

- Paste the contract address (the fields “Token symbol” and “Token decimal” are supposed to be filled automatically).

- Click “Add custom token”;

- Click “Import token”.

Congrats! Now you’ll see WETH in your MetaMask.

If somebody has already sent you WETH and you do not see it in your MetaMask extension, do the following:

- Click the three dots to the right of the “Account”, then click “View account in Explorer”;

- Click the “Full screen” button near the “Token” section;

- Click on “Wrapped Ethereum”;

- Copy the contract address;

- Go to your Wallet extension;

- Click “Import tokens” at the bottom of the menu;

- Paste the contract address (the fields “Token symbol” and “Token decimal” are supposed to be filled automatically).

- Click “Add custom token”;

- Click “Import token”.

How to unwrap Ether (WETH)?

It is as simple as wrapping it – you just go to the custodian and request an exchange. Then you get a corresponding amount of ETH for your WETH.

Can you wrap ETH on other blockchains?

You can wrap Ethereum almost on any major blockchain network and start trading it with the network's native tokens and coins (for example, the BitTorrent and the Tron network from the example above).

How does wrapped ETH stay the same price as ETH?

To understand this, think of wrapped tokens as stablecoins. Stable coins are pegged 1:1 to a real world fiat currency; wrapped tokens do the same, but with another crypto.

When somebody buys 2 USD Coins (USDC), 2 USDC are minted. When somebody sells two USDC, then two are burned. The same goes for wrapped tokens – they are built to retain the 1:1 ratio to their bigger brother.

Which DeFi apps can I use WETH with?

Potential use cases for WETH include participating in a liquidity pool of a decentralized exchange like PancakeSwap or lending it on AAVE (we’ve already talked about it). Both of these options will earn you a decent interest rate.

Conclusion

Turns out wrapped Ethereum is pretty easy, isn’t it? It’s not only easy but also useful for those who want to explore the DeFi landscape more freely.

Currently, scalability is the main problem and also the main focus of many innovations in crypto. Wrapped tokens are the first solution to this which remains viable today and can very well become the standard in the future.