Shilling: Meaning In Crypto

As the cryptocurrency community is full of enthusiasts, it must be natural for many of them to talk about their favorite crypto projects with passion on various forums, subreddits, social media, etc. And some really do. And they are not even paid to do so. At least, not to all of them.

However, some of them get paid. These people are called "shills." And their fake reports about great experience with this or that cryptocurrency (or it could be a crypto exchange, a wallet app, etc) are the stealth way to promote the product in the day to day discussions on the themed forums.

The article explains what is shilling in cryptocurrencies, how it works, what are the types of shills, how to avoid being misled by the shills, etc.

Contents

What is Shilling in Crypto?

Sometimes in an online public discussion we stumble upon a person who drops messages like "the crypto Name is the best investment" going into further detail rather than speaking out on the discussion topic. If we approach such people with attention, we can notice that they are not interested in an ongoing discussion. All they speak about is a particular product that they "like" and never criticize and they always protect it whenever someone says negative things about this product.

So, in crypto, shilling is a covert advertising of a cryptocurrency (or a service), usually masqueraded as the project's genuine supporter's messages left in a public discussion for everyone to see. The people who write these messages, the “shills,” are the project’s employees, usually working under the pseudonyms.

A Reddit posts history displaying a typical shill behavior

Shilling is aimed at increasing the brand overall reach out, familiarizing people with it, creating a positive info background for the brand, and making people want to buy the advertised tokens or use the service. In general, shilling is a type of advertising aimed at increasing the demand for the token, which in turn increases the token's price.

One of the shilling characteristics is that shills overblow the alleged advantages of the project, ignore the criticism, or even spread misleading information about the project to make people want to buy it.

How Does it Work?

For stealth promotion shills use all Internet platforms where people tend to search info about cryptocurrencies. It can be communities on Reddit, YouTube channels, X (ex-Twitter), the Bitcointalk forum, Facebook, telegram chats, etc.

Shills enter any discussion where they can mention the name of the brand they advertise and use whatever reason to bring up its name and say something favorable to get the people's attention and make them interested in the project. Usually shills say about their own experience with the brand. They use it, they already gained some money from it, they like it, etc.

Not all of the products advertised are quality so they have to exaggerate their characteristics to make people believe that investing in them can bring good returns. Of course, shills never mention they are paid to leave such comments. Usually, such people can't confirm they really hold the tokens they promote. However, some shills really hold some crypto coins they advertise. Mostly to dump them as soon as the price goes up. Some shills consciously participate in the rug pull projects.

Types of Crypto Shilling

Not all the shills are easily identified. Some of them can seem genuine at first sight. You don't have to be paranoid but it's better to be aware of the ways shills act and trust the info you find yourself more than the random people's messages on the Internet. Following the shills advice may end up in real losses. We can outline several types of shilling. Distinguishing these strategies can help you to avoid being fooled.

The project team members

It's important to distinguish the project team members as they tend to hype up their brands, promise great returns for investors, and exaggerate their pros. Probably, they do it sincerely but anyways it's better to take their suggestions with a grain of salt.

Some teams have full-time employees whose job is to increase the outreach or the brand through seemingly genuine posts by the people who encountered the brand and really liked it and want to share their experience of investing in this project. They claim that the project is booming, they already multiplied their investments tremendously and advise others to invest in the token too asap.

Usually these people focus on the promise of high returns while ignoring the other characteristics of the token and not talking about the other tokens favorably or substantially.

Celebs and influencers

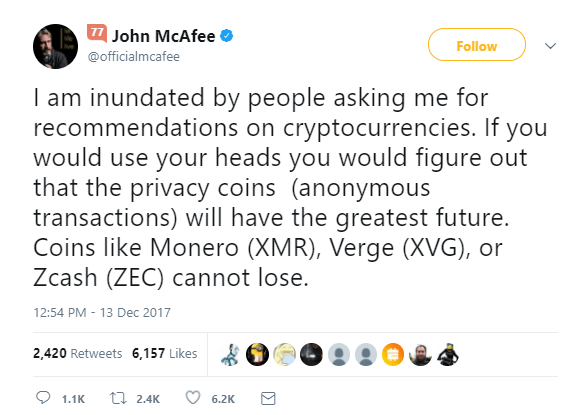

Some people with a vast following on social media out of blue can start shill cryptocurrency. It can be influencers or celebs who promote a particular cryptocurrency without necessarily being experts in the subject.

For instance, an athlete Floyd Mayweather and a music producer DJ Khaled were involved in promotion of a scam ICO in 2018. An IT sphere businessman and a programmer John McAfee was very vocal about cryptocurrencies and shilled a lot of crypto coins on Twitter in the 2010s. Later, he admitted he was paid to do so and helped these token's prices to skyrocket.

Image source: Steemit

It's better to ignore the celebs who all of a sudden became crypto experts and try to convince their followers to buy a particular crypto while not mentioning any others. You don't have to be a genius to understand that most probably these people were paid to promote products and there are no guarantees of the good quality of these projects.

Pump-and-dump shills

This type of shills pretend to be crypto investors with good knowledge of the crypto market. Some of them are real investors. They actually invest in the tokens they promote and do it openly so that the public will trust them more.

As these shills keep on promoting the token, the demand for it grows and the price reacts respectively. The shill will sell his/her tokens as soon as the asset reaches the target price. The token price drops, but the shill has already fixed the profit. The money lost by the followers is not the shill's problem.

Image source: SpeedTrader

This type of shill is distinguished by the focus on the future profits rather than on the use cases of the project and its technical characteristics.

How to Avoid Becoming a Victim of Crypto Shilling

To maintain cool-headedness and always understand quickly which messages don't deserve your attention, lean to the several easy rules:

Always do your own research (this rule even has a popular acronym – DYOR): If some info has caught your eye, check other sources to confirm if what you see is true. Try to find unbiased and weighted info on the matter. Check the reputation of the source and the project.

Avoid fear of missing out (this notion has an acronym too – FOMO!): We tend to fear missing the opportunity of investing money in something everybody else is investing in. Shills will try to convince you that many people have already bought the token and made money out of it. Don't let this fear command you. If you have done research and you are not impressed with the project, don't invest in it. You'll find a better option!

Always question authority: Even famous people may lie or make mistakes. You are not obliged to follow everything they advise. Celebs are not cryptocurrency experts. They can be misled by the entrepreneurs that hired them to promote their tokens. Search for reliable information about crypto investments in other sources.

Conclusion

There are various crypto shills on the Internet: some are the trusted celebs, others are convincing businessmen and investors, others just random strangers on cryptocurrency threads. They may do many harm as they mislead people who can end up investing in a weak crypto project and never see their money again. Shills try to seduce people with high and quick returns. You should be able to recognize and ignore them.

The main rule that will help you to avoid falling victim to crypto shilling is always doing research on the subject. Find alternative opinions, check other sources, find info about the product 's use case, not about its alleged investment potential. These tips will help you to see if the project is worth your attention and stay safe.

Tutoriais principais

-

Что такое хард-форк?Jul 27, 2020

-

Стейкинг на Ethereum 2.0 и его основные особенностиAug 01, 2020

-

Инновации на основе блокчейна в сфере энергетикиAug 03, 2020

Ainda não há comentário. Seja o primeiro!