What is Polygon (MATIC)?

The Matic technology, now known as Polygon, is a project aimed at solving scalability issues in other blockchain projects that run on the Ethereum network. Since the 2017 ICO boom Ethereum network has been experiencing, the net’s main weaknesses and speed issues have been in the crypto public eye and all hands on deck that can help find solutions quickly become popular and more than welcome - which was Matic’s case.

Ethereum’s network has been close to or at the very limit of its capabilities in the blockchain for quite a while and even more, since a near ‘mass’ adoption happened with platforms like Decentraland, CryptoKitties (by way of NFTs), and other DeFi enterprises like Uniswap, Compound, Balancer, Curve and AAVE – they are all run in Ethereum’s main network.

Let’s go back in time a few years to the year 2018, when Jaynti Kanani, Sandeep Nailwal, and Anurag Arjun decided it was time to put an end to the Ethereum network issues and start providing solutions. At that very moment, their main idea spun around creating a second layer net (sidechain) that could help relieve the transactional burden Ethereum was experimenting with at the time.

After successful financing rounds and ICO in 2019, Matic was finally audited and able to come forward and present itself to the general crypto public, ready to rumble.

In February 2021, Matic changed its name and became Polygon (although the MATIC symbol still remains Polygon’s official token) and gifted investors and curious eyes alike with a new and revised roadmap, designed to be a part of and adapt to new tendencies and tech like rollups* and Validium**, improving the network’s workflow and its users’ experience.

As mentioned before, the team behind Polygon’s project aimed mainly at solving the Ethereum network’s bottlenecks that occurred when the transactions were too many at a time. How could they do this? By creating a sidechain connected to it (or any other network really, it could be Solana, for example). This sidechain runs on PoS (Proof of Stake consensus) and allows transactions to run at high speed in Polygon’s chain. Secondly, Polygon uses Plasma, which is an equivalent of the Lightning Network*** but is compatible with Ethereum.

*For more info on rollups, click here.

**For more info on Validium, click here.

***The lightning network is a second layer added to BTC’s main blockchain to allow off-chain transactions and improve speed. CoinTelegraph has written a very cool article about it, that you can read by accessing this link.

Merging PoS and Plasma together allows developers to create bidirectional bridges with the Ethereum blockchain, allowing Polygon DApps to communicate and run in ETH’s main net without a problem. This means that an Ethereum user can easily send contracts or transactions to a DApp in Polygon’s chain without having to worry about compatibility problems or losing the information or money that was sent. The best of it all is that, although Polygon was created with Ethereum’s scalability problems in mind, the sidechain can be added to any other blockchain, allowing interchain communication and operability. Like connecting flights that don’t need to worry about the airport, they’re going to land because the permits have all been signed and approved and all the pilot has to do is pick a destination and just fly.

Polygon’s main features are:

1 - PoS consensus usage for the sidechain and Plasma smart contracts;

2 - Infrastructure that allows DApps in Polygon to interact with the Ethereum network;

3 - Constant work from the developers' team in the Polygon project, aimed at improving exponentially the user’s experience in the chain;

4 - It’s a public network capable of bridging transactions and interactions between multiple blockchains and networks;

5 - It has an amazing theoretical ‘limit’ of 200,000 transactions per second.

MATIC news

Polygon is yet to see a stop to all the popularity and track it has gained since its inception. Even during a despairing bear crypto market, Polygon manages to stay on top of the game, keeping a steady pace towards mass adoption and major brand and known companies partnerships. You can read the full article here.

Source: Crypto Slate.

Crypto Daily’s article about the tokens to watch out for during this altcoin season and next seasons to come has included Polygon, and rightfully so. A high market capitalization, a whopping #18 in CoinMarketCap’s cryptocurrencies rank, and the never-ending efforts from the team to keep on providing solutions make it a project to keep a close eye on.

MATIC price prediction

For MATIC’s price forecast we side with PricePrediction.net’s prediction. With their technical analysis of the token’s past performance in addition to the great developments, the Polygon team has already succeeded in providing scalability to one of the biggest blockchains in the crypto world. Furthermore, the ever-expanding roadmap leads us to believe this is just the start for the Polygon team and, as they increase the real-life usage of the network, the token value will also go up in price. MATIC’s price as of June 12th, 2022, is $0.043.

| Year | Average Price | ROI (if buying MATIC as of June 12th, 2022) |

| 2022 | $0.77 | 79.07% Total |

| 2025 | $2.23 | 418.60% - 58.99% (Annualized ROI) |

| 2027 | $4.44 | 932.56% (Total) - 52.30% (Annualized ROI) |

| 2030 | $13.36 | 3,006.98% (Total) - 49.47% (Annualized ROI) |

Is Polygon a good investment?

As of now, Polygon (MATIC) seems like a good investment or at least something to keep a close eye on. As always, this is not financial advice and every investor must always do their own research and make their own conclusions before investing in any project. Polygon has solved many of the issues that Ethereum experiences, bringing a palpable and real solution to the bumps in the road encountered by the blockchain’s users. Since it’s possible to use Polygon with other blockchains as well, its usability and popularity won’t go down anytime soon, especially with the new business partnerships announced.

Polygon staking

For staking Polygon all you need to do is find a staking provider and use their platform to generate interest and collect rewards. You can check out this interest calculator for a glimpse of how your investment could grow over time.

How and where to buy MATIC?

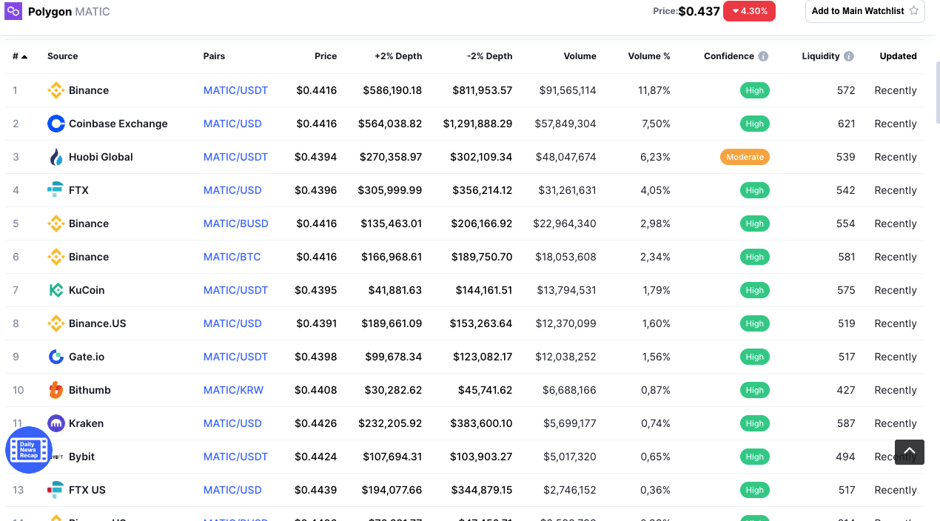

You can buy MATIC on many exchanges, with or without KYC. A full list can be encountered here. To buy MATIC, you need to have a verified account in the exchange you choose (in case of a KYC exchange) or a wallet compatible with the DEX of your liking (like Metamask) and enough funds to purchase the intended amount of MATIC tokens plus the gas fees and slippage.

Source: CoinMarketCap

How to mine MATIC?

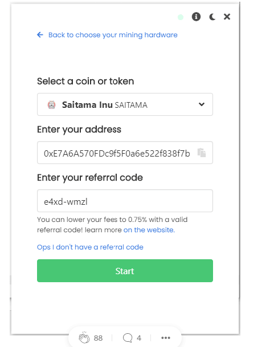

Luckily, mining MATIC is easier than mining BTC, for example, and doesn't require a big computational power or an ASIC miner (which tends to be expensive and energy-consuming). This mini-guide will provide you with a step-by-step guide to mine MATIC:

- Get a public crypto wallet address to receive your tokens after mining;

- Download the Unmineable Software - MFI version;

- Run the files as an Admin;

- Select either GPU or CPU cards;

- You will have to insert your wallet address in the Polygon chain;

- Your screen should look like this:

- Click on the ‘Start’ button.

If you’re looking for a more in-depth guide, this Medium article on how to mine MATIC will definitely be to your liking!

Conclusion

The Polygon network has a broad spectrum for its usage and scalability - allowing DApps to connect and interact between different blockchains is kind of a big deal and a very useful feature we can all profit from. Thanks to Polygon, payment systems, DEXes, and other DeFi apps have been bridged to each other while keeping gas fees as low as possible and ensuring good transactional speed. Projects like AAVE, Curve, and Clover Finance use Polygon’s network for their own growth and development, which indicates the project’s potential to keep on providing solutions and gaining notoriety.

レビューがありません。最初のレビューを書きましょう!