IDAX Exchange Review 2022 - The Exchange Is Shut Down

0.2% trading fee

Withdrawal fees:

https://www.idax.mn/#/fee

0.2% trading fee

Withdrawal fees:

https://www.idax.mn/#/fee

Update 10.03.2021: IDAX exchange is closed. Its founders committed an exit scam.

In November 2019, IDAX users found themselves unable to withdraw coins from the exchange. The rumors of an exit scam began to circulate on social media platforms. IDAX came up with the explanation saying that the network is overloaded with withdrawal requests. It didn't work. The exchange users were not convinced by it. As a result the price of the IDAX exchange native currency has dropped to zero. Soon, the exchange reps confessed that the IDAX CEO was gone and they cannot reach out for him. The name of the CEO was not identified. Another important fact that wasn't clear is if this person had access to the users' funds. In general, there is no way to verify if the exchange representatives were telling the truth. We can't say for sure that a CEO disappearance really took place. Below you can see a review we have made prior to the exchange's shutdown.

IDAX was a Mongolian cryptocurrency exchange launched in 2017. By both reported and adjusted trading volume this platform keeps positions in the Top 15 of cryptocurrency exchanges. IDAX exchange has a wide range of trading pairs including ones that are not available on other exchanges.

- What Is IDAX?

- Registration

- How to Add Funds on IDAX?

- How to Trade on IDAX?

- How to Withdraw From IDAX?

- Does IDAX Require KYC?

- IDAX Fees

- IDAX Token

- Is IDAX Safe?

- Customer Service

What Is IDAX?

IDAX is an abbreviation for International Digital Asset Exchange. Despite the fact that the headquarters of the company are located in Mongolia, the main traffic on this exchange is coming from China. Nevertheless, the company states that its mission is to provide service around the world and there are no formal limitations for users from other countries. One of the constraining factors is the lack of some languages in the interface of the exchange. The company has rep offices in South Korea and Singapore.

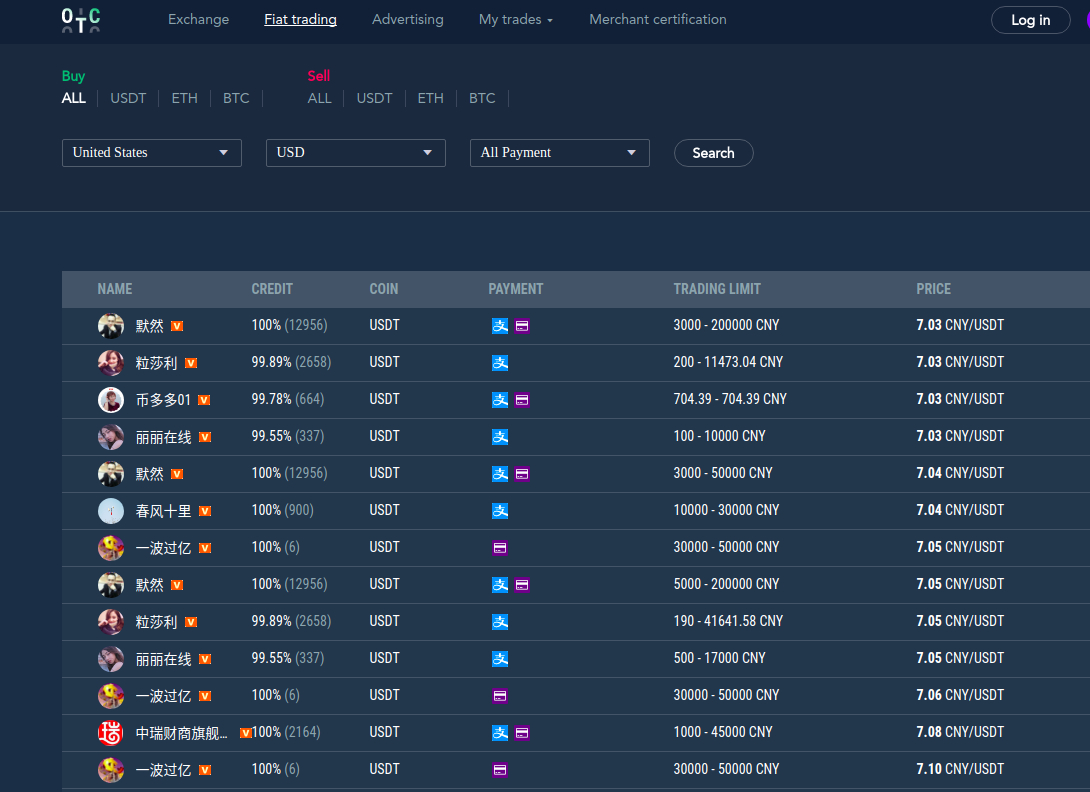

Among available special functions, there are futures trading and OTC (over the counter) trading. IDAX allows making fiat money transactions as like as cryptocurrency transactions. Currently, the exchange provides a choice of over 200 cryptocurrencies. The most popular trading pairs are BTC/USDT, ETH/USDT, and BTC/ETH.

Happy IDAX 2nd Anniversary!!🎊🎊

— IDAX (@IDAXpro) November 11, 2019

We're proud of what we've become. For these past 2 years, we've never stopped to keep improving.

Thank you all the users and partners for the great support 🤝🤝#IDAXturn2 pic.twitter.com/X3iMAC8dw8

Due to the fast development of the exchange, many reviews on IDAX exchange contain outdated information about the platform's functionality including such irrelevant statements as the lack of support of fiat currencies, unspecified deposit fees, etc.

Registration

The registration process is quite simple. It starts with the Sign-up button in the upper right corner of the website. As IDAX is a KYC-compliant exchange it requires some personal data from users including name, surname, nationality, ID number, photo, etc.

How to Add Funds on IDAX?

IDAX interface is user-friendly. Depositing money on the exchange is not a hard task. To send money on IDAX one needs to open the Balance tab and proceed to Deposit option. The next step is choosing the needed currency and its amount and typing in the wallet address (another way of adding wallet address is scanning the QR code). As soon as one receives confirmation, the deposit is successfully finished. Usually, it doesn’t take much time.

How to Trade on IDAX?

The trading process on the IDAX exchange is as intuitive as registration or deposit. As soon as one has a funded account, the next step is trading. We have already mentioned the Balance tab in the upper panel of the website before. There one finds Trade option, clicks on it, and chooses a certain currency.

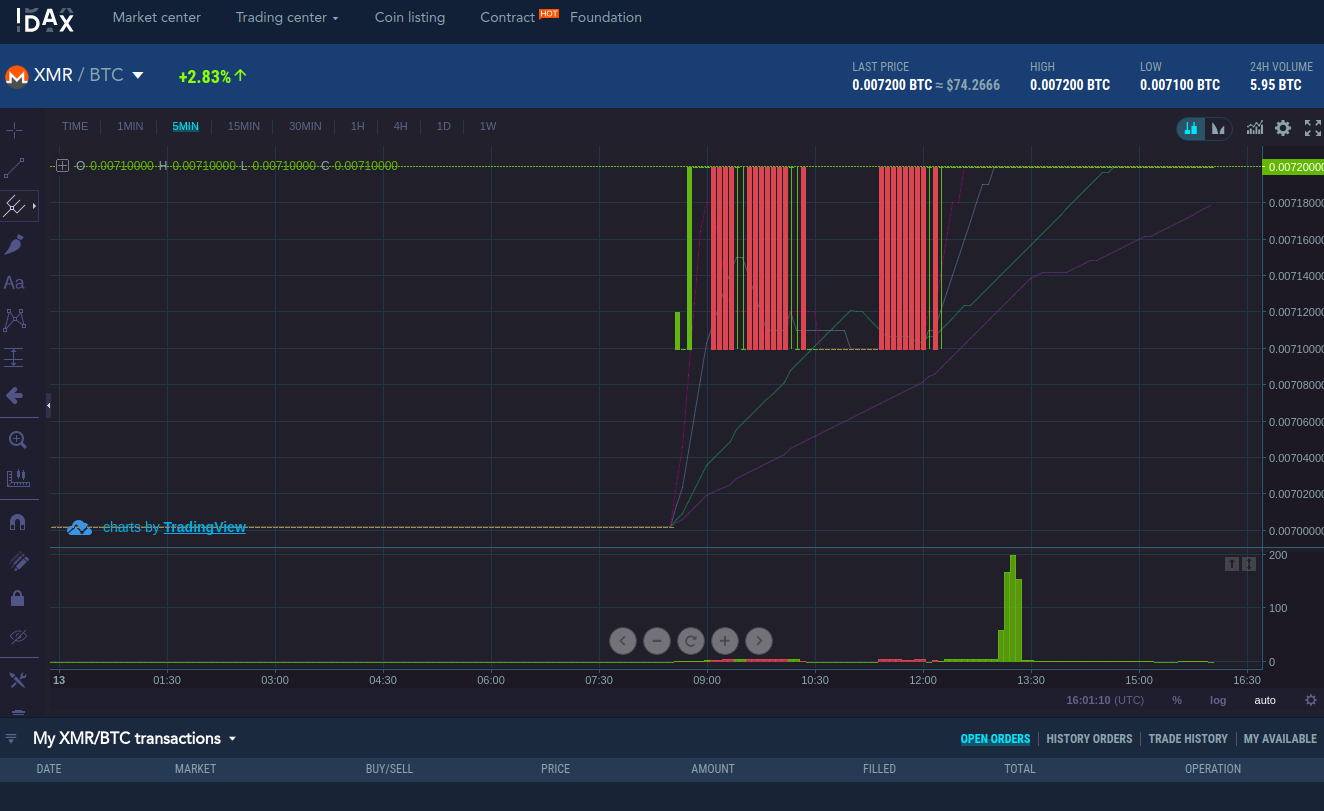

The matching engine of this platform is considered to be quite fast. Moreover, the website contains charts, graphs, and tools allowing to explore the market depth. IDAX has an API letting its users automate the process of trading. The means for avoiding trading in loss such as limit orders are also available on IDAX.

How to Withdraw From IDAX?

Withdrawal is as simple as all the rest actions on this exchange: one needs to click on the Balance tab in the upper panel of the website and choose the Withdraw option. Then some users have to perform identity verification. The last steps of the withdrawal process are specifying the needed currency and its quantity and inserting the wallet address. If all the security tests are passed successfully and no mistakes in wallet address or choice of currency/quantity were made, then money goes to the user.

Does IDAX Require KYC?

As it was mentioned before, IDAX follows the KYC/AML rules. The information required for completing KYC includes the real name and surname of the user, the photo fitting the special properties, nationality, phone number, email address, residential address, and many other details. This information can be provided prior to withdrawals or right in the moment of the withdrawal (then the withdrawal process will take longer).

IDAX Fees

Like many other crypto exchanges, IDAX takes no fees for deposit. Trading fees on this exchange are considered to be competitive. The platform encourages traders to increase the liquidity on the exchange charging diversified fees. Traders who create new orders (liquidity makers) pay less than those who only take orders (decreasing liquidity on the market). IDAX market makers are charged with 0.1% fees while takers pay 0.15%. These trading fees are low, however, some exchanges charge even lower fees.

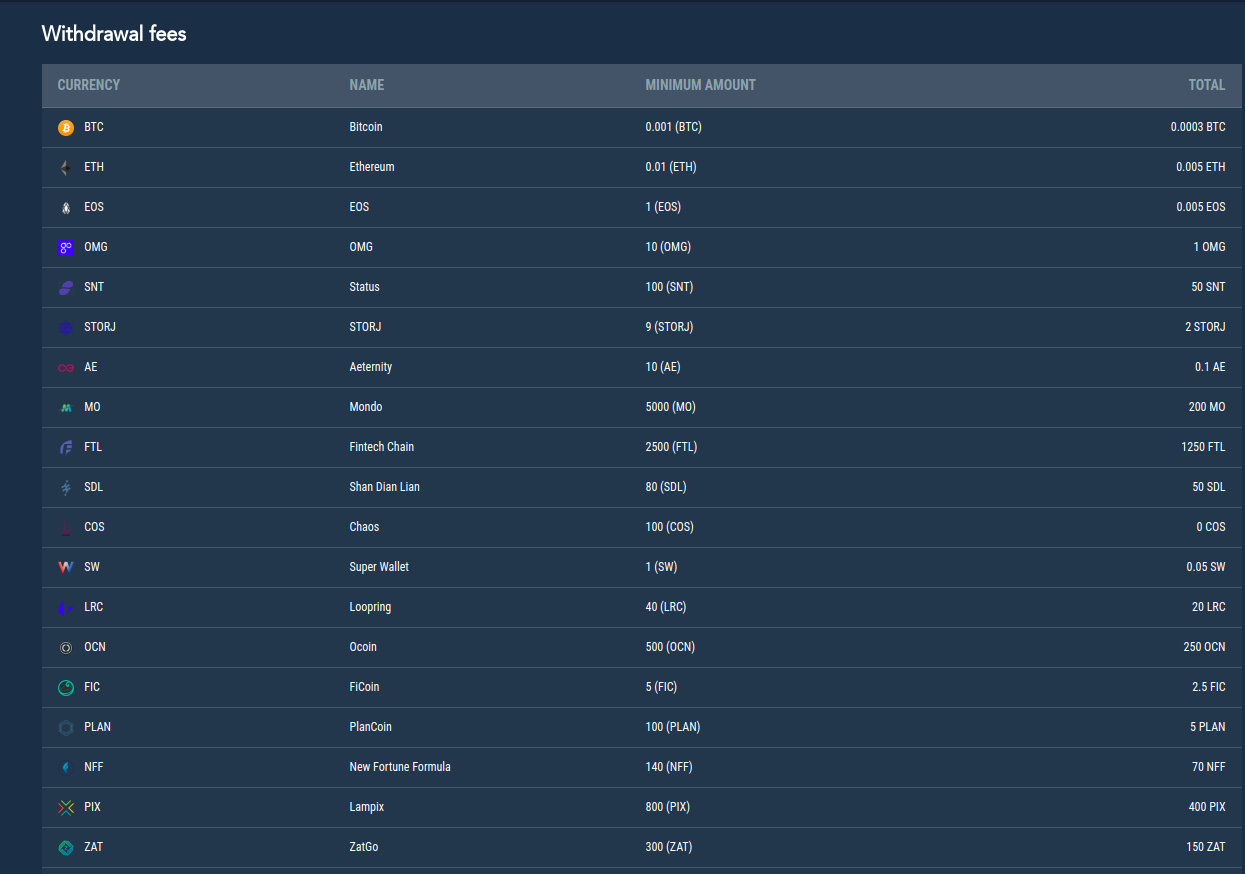

Withdrawal fees are flat and different for each currency. For example, the withdrawal of bitcoin costs 0.0003 BTC, Ethereum fee is 0.005 ETH. It's important to realize that the developers had set the minimum withdrawal amount for each currency (for instance, one can't withdraw less than 0.001 BTC or less than 0.01 ETH). The full list of withdrawal fees and limits is presented on the website.

IDAX Token

Usually, cryptocurrency exchanges have native tokens. IDAX is not an exclusion. IDAX token (or IT) has a total (and limited) supply of 200 million. IT is a decentralized ERC20 token developed by the GBC group and Genghis Khan bank of Mongolia. The purpose of this token is improving the value circulation of the IDAX network and distributing trust between the users of the platform.

IT appeared on the market in February 2019 having a price of over $3. The price has been fluctuating around this mark all this time. IT is a part of several trading pairs on IDAX.

Is IDAX Safe?

IDAX exchange provides multiple security measures, although we can't say that these measures can guarantee 100% safety. Some of the protection measures are the responsibility of the user: for example, it's up to the user to create a strong password, enable 2-step authentication, and stay away from phishing websites. Scammers have a lot of strategies that allow them getting users' credentials and steal money from their accounts. In such cases, the company does not have many tools to save the assets of users.

On IDAX there are four main security instruments besides strong password:

1. Users can enable authentication through SMS so a hacker won't be able to do actions without having the user's mobile phone.

2. 2-step verification becomes one of the 'must-have' features on many Internet platforms and this security measure is available on IDAX, too. The user can set 2-step verification via Google Authenticator or any other authy applications. It is another instrument that provides control over the account to the user because it is supposed that no one else has his mobile device.

3. Fund Password is an additional password requested (if enabled) every time when someone tries to withdraw funds. Simply put, Fund Password is a PIN.

4. Prevent Phishing Code is a more sophisticated protection measure requesting the code when someone tries to withdraw funds, change the account settings or log in. This measure makes the use of the platform much more secure.

As IDAX is a centralized exchange, the users' security depends on the ability of the developers to protect the servers from hacker attacks. In the case of a successful attack, users may lose both money and personal data. There are not many users can do about it.

Customer Service

IDAX has a 24/7 support service that is supposed to solve any troubles associated with the use of the exchange and answer the user queries. Nevertheless, it seems that currently, the customer service is far from perfect as in the comment section of the website and on the social media pages of the company people are complaining about diverse problems. Sometimes withdrawals take too long because the IDAX exchange network may be busy due to the big number of users. Others say that their accounts were blocked for an unknown reason, etc. Some reports are raising concerns over how legit IDAX is.

There is not much data that allows understanding if this criticism is overblown and it's hard to figure out if all these problems get solved, or not. That's the reason why your reviews about IDAX are welcomed. If you have an experience of trading on this exchange you can leave your review about IDAX exchange here.

I’ve made a numbers of the withdrawal and everything was great and smooth. But recently I’ve noticed that it had started to demand more time. I asked the support of it and they told me that’s ok and it can take some time and nothing more. Well, I hope so, but that’s really long.

What’s wrong with them? They don’t want to have traders?I’m sure, the support don’t care about the trader, My finds have been blocked for 1 months. And I didn’t get any proper explanation what I have to do to unblock them. They don’t have a clue how to work the clients or they are just scums. Never trade here. Never!

You have to be very careful with that guys. After the depositing you’ll need 3-4 days just to reach the support in order to get any info about your operations. My funds in IDAX was frozen and I’ve lost a lot. Don’t wanna have any deals with that exchange.