How to Borrow from Cash App

How to borrow from Cash App is a common question for users who need small, fast loans. In this guide, we explain the key steps, rules, and costs involved when you use Cash App’s borrow feature. You will learn who qualifies, how to request funds, and what to expect in repayment. Whether you need cash for an emergency or want a short‐term boost, understanding this tool can help you decide if it fits your needs.

Contents

Understanding Cash App Borrow

Cash App Borrow is a small loan service built into the Cash App wallet. Instead of sending money to friends, you tap to request a loan that the app approves in minutes. These loans range from $20 to $200, making them handy for quick needs. Cash App Wallet Review – Is It Safe? (Cryptogeek).

This feature uses data from your Cash App activity to set your loan limit. If you regularly receive deposits or have certain account history, the app may offer higher amounts. Approval does not require traditional credit checks, so your FICO score stays private.Funds arrive directly into your Cash App balance. You can spend or transfer the money as you wish. Before you borrow, check the offer screen for your personal limit and terms. That way you know exactly what you will repay.

Eligibility and Requirements

First, you need a verified Cash App account. That means you have confirmed your name, birth date, and Social Security number. Cash App uses this information to meet banking rules and to assess loan offers.Second, your account history matters. The more deposits and activity you have, the more likely Cash App will approve a higher loan. If you just opened your account, you may see smaller offers or need to wait until more history builds up.Finally, you must accept the terms on screen. Each offer shows a set payment schedule and a fee. If you tap Accept, you commit to repaying the full amount plus the fee. Declining the offer won’t affect your ability to borrow in the future.

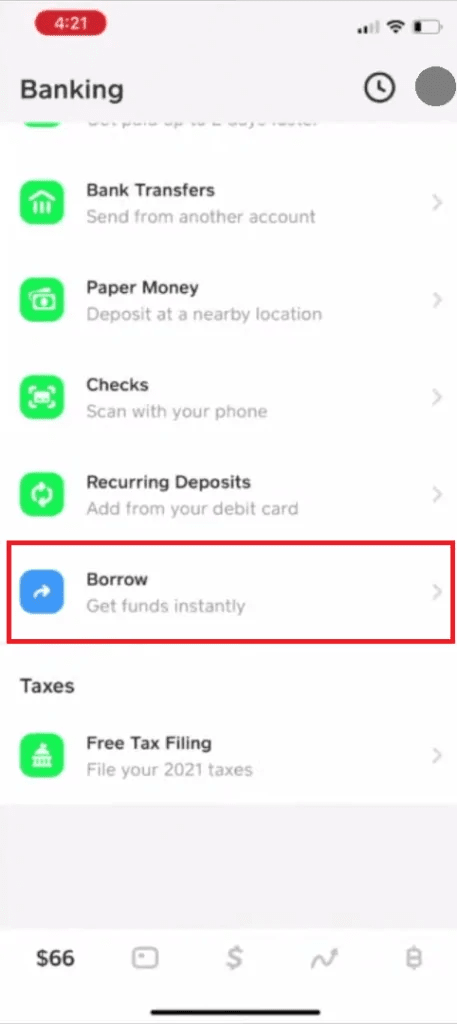

Setting Up and Activating Borrow Feature

Open Cash App and tap the Banking tab at the bottom of the screen. If you see a Borrow option, tap it to review your personalized offer. If you don’t see it, update the app or complete verification steps in your profile.

When you tap Borrow, Cash App displays the maximum loan you can take. You can choose a smaller amount if you prefer. The screen also shows the repayment date and the fee you will pay. Take time to read those details before moving on.To accept, tap the button that confirms your loan choice. The app then sends the money to your Cash App balance instantly. You will also see the repayment schedule appear in your transaction history, so you can track upcoming due dates.

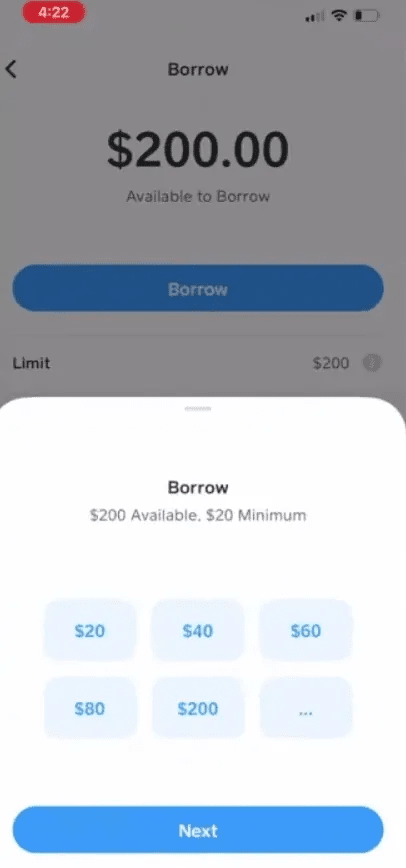

Requesting a Loan through Cash App

After setup, go back to the Borrow tab to submit a new request. Enter the amount you need, up to your limit. You might see options like $20, $50, or your maximum. Pick what suits your budget.Next, review the fee and repayment date. Cash App charges a flat fee rather than interest rate. For example, a $100 loan may carry a $5 fee due in four weeks. These terms vary by user, so always check the offer screen.When you confirm, funds hit your balance immediately. From there, you can send to your bank, pay bills, or pay someone on Cash App. The tool works like a bridge for short gaps, but plan to clear the balance by the due date.

Repayment Terms and Fees

Repayment happens automatically on the date shown in your loan details. Cash App deducts the loan plus fee from your balance. If you keep enough cash in your account, the process is seamless.If your balance is low, Cash App attempts to withdraw from a linked bank account. That may take extra days to clear. Be sure to keep funds available or set a reminder to transfer money before due date.Failing to repay on time can lead to additional fees or suspension of your borrowing feature. To avoid surprises, check your repayment schedule in the app and make manual payments if needed. Responsible use helps maintain future offers.

Real-World Use Cases

Imagine you face an unexpected car repair bill and your paycheck is a week away. Cash App Borrow can fill that gap quickly, letting you handle the expense without late fees or missed work.Another story comes from a student who needed funds for textbooks before classes. Rather than turning to high‐cost payday loans, they used Cash App’s small offer to cover the cost for a month.Small business owners also tap this feature when they lack working capital. They borrow to restock supplies or cover shipping and repay when sales come in. Timely borrowing and repayment keep their Cash App offers healthy.

Comparing Cash App Borrow to Alternatives

Payday loans often carry annual rates over 300 percent. By contrast, Cash App’s flat fees translate into much lower cost for a month‐long loan. You avoid rollovers that balloon your balance.Peer-to-peer lenders may offer lower rates but require lengthy applications and credit checks. Learn more in our CoinRabbit lending review on Cryptogeek. Cash App keeps it simple with minimal form-filling and instant approval for many users.Traditional bank overdrafts let you borrow small amounts but can include surprise fees. With Cash App, you see your exact fee upfront. That clear pricing helps you plan repayment without hidden costs.

Conclusion

How to borrow from Cash App boils down to a few taps and a clear view of your fee and repayment date. By meeting account requirements and reading terms closely, you can use this feature for short-term needs. Always plan to repay on time to avoid extra charges and to keep future offers. With the right approach, Cash App Borrow can be a simple way to handle small cash shortfalls.

FAQ

Can anyone borrow from Cash App?

Not everyone. You need a verified account with enough transaction history. Cash App reviews your activity to decide if you get an offer and what limit applies.

How much can I borrow on Cash App?

Limits vary by user. Typical offers range from $20 to $200. Cash App sets your maximum based on your account history and deposit patterns.

What fee does Cash App charge?

Cash App uses a flat fee, not an interest rate. Fees depend on the loan size and your profile. You see the exact charge before you accept the loan.

What happens if I miss the repayment date?

If you miss the due date, Cash App may charge extra fees or disable borrowing until you clear the balance. It might also attempt to take the funds from a linked bank.

Can I repay early?

Yes. You can make a manual payment at any time in the Borrow tab. Paying early can reduce your payable fee days and keep your account in good standing.

Voici encore aucun commentaire. Soyez le premier!