What Is Pulsechain & How To Buy It?

Sometimes, the Ethereum launch is considered the second biggest event in cryptocurrency history after the creation of Bitcoin. The reason is clear: Ethereum introduced a new approach to blockchain-based projects, which led to a massive transformation of the entire cryptocurrency industry.

Before Ethereum, blockchains were meant to serve as the backbone of cryptocurrencies' payment systems. With Ethereum, the focus was shifted towards various use cases of the new platforms, offline and online, while cryptocurrency started to turn into utility tokens that fuel the networks.

Despite Ethereum's benefits, this network has notable scalability issues that make it expensive, and operations can get too slow due to congestion.

Many developers created their own ecosystems, like EOS, Cardano, Solana, etc. Such projects are often called "Ethereum killers", although none of them managed to outshadow Ethereum despite getting praise and relative success in the industry.

Other developers create tools to solve Ethereum's issues instead of replacing them with new ecosystems. One such project is Pulsechain. This article explores Pulsechain's characteristics, reviews the PLS and HEX tokens, and explains where and how to buy Pulsechain tokens.

Contents

What is Pulsechain?

Pulsechain is an Ethereum fork, a layer-1 blockchain aimed at solving Ethereum scalability issues. For this purpose, Pulsechain uses methods similar to those that Ethereum started to use, beginning with the Merge phase. As Pulsechain is an Ethereum fork, its security benefits from the Ethereum source code.

Let's see what chances Pulsecoin brings to Ethereum to improve the user experience.

Fee-burn: Pulsechain burns transaction fees. This measure aims to make the Pulsechain token deflationary. Scarcity is believed to drive the token's price. A similar measure has already helped Ethereum reduce an Ether token issuance to around zero.

Proof-of-stake: When Pulsechain was initiated, the Ethereum blockchain relied on proof-of-work. This consensus mechanism is widely recognized for its environmental harm.

Pulsechain chose a different model, delegated proof-of-stake, to abandon mining and its ecological impact. Soon after the Pulsechain launch, Ethereum switched from proof-of-work to proof-of-stake.

Transactions are validated by the nodes with the most significant stakes, which makes malicious activity on the network too costly. Furthermore, the tokens staked by validators as collateral can be slashed if they abuse their power.

Reduced block time: Another method aimed at improving the speed of transactions is reducing the time for creating blocks to three seconds. As of September 2024, Ethereum doesn't do anything like that, so in this regard, the Pulsechain solution remains valid.

Pulsechain was launched in 2023 by Richard Heart, who previously created an ERC-20 token, HEX. The Pulsechain ecosystem aims to become a major blockchain bridge. The idea behind Pulsechain was to bring a single new token like it was with HEX but conduct a huge airdrop of versions of all the ERC-20 tokens with the launch of Pulsechain. It was intended to attract more supporters from the start.

Is Pulsechain Safe?

Before you invest in Pulsechain, you should make sure the platform is safe. As mentioned above, Pulsechain is mature and stands on the shoulders of Ethereum. The network is protected via solid cryptography. Minimalistic design contributes to the platform's security, as with fewer elements of the network design, the opportunities for finding a breach in protection are reduced, too.

Another element of Pulsechain protection is the platform's third-party audits. These audits look for potential flaws and breaches and identify vulnerabilities and violations, ensuring a constantly high level of security.

In addition, network security is enhanced via rate limitation. It reduces the possible abuse scale and harm and blocks spam and DDoS attacks. As mentioned above, the network is safeguarded via delegated proof-of-stake.

What is PLS and HEX?

The PLS token is the Pulsechain platform's utility token. It is used to pay transaction fees and elevate transaction priority by increasing fees. In addition, the PLS stake is required to participate in transaction validation and platform distributed governance.

The PLS token is integrated with HEX, another brainchild of Richard Heart. HEX is a self-described Certificate of Deposit based on blockchain. With PLS it is possible to maximize interest rates on HEX.

HEX's primary purpose is to serve as a currency, meaning that it is primarily used as a means of exchange and a store of value. Generating income via HEX is possible via staking.

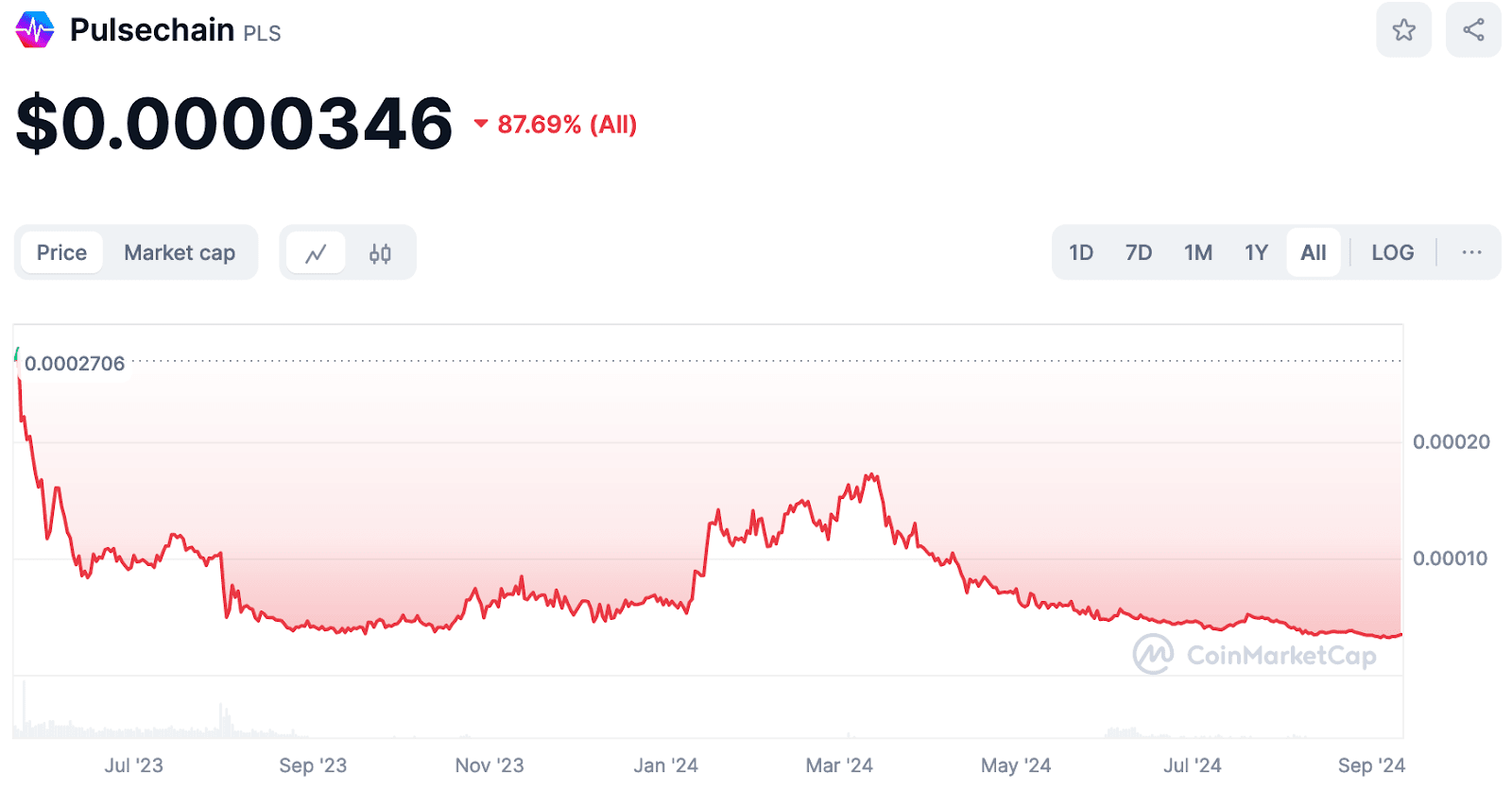

As of September 2024, neither token can boast of being at the top in terms of market capitalization, although both HEX and PLS have over half a billion in market cap.

Both tokens are traded on MEXC. As for other leading exchanges, HEX is available on Uniswap. The prices of both cryptocurrencies may grow strongly if they get listed on key crypto exchanges.

Where and How to Buy Pulsechain (PLS)?

As of September 2024, Pulsechain (PLS) token is hard to find on most exchanges. Currently, the only big exchange supporting PLS is one of the biggest exchanges MEXC. Other big exchanges are yet to list PLS.

Check the list of all the exchanges where you can buy PLS tokens:

- MEXC (a PLS/USDT pair)

- SafeTrade (USDT, PLSX, and WPLS)

- XeggeX (Ether and Tether)

- SmarDex (PLS is traded against wrapped Ether)

Despite weak support from exchanges, there are several ways to acquire PLS tokens. See how to buy PLS tokens below.

Bridge ETH from Ethereum to Pulsechain: To do this, you will need a web3 wallet (MetaMask, Web3 Freewallet, or the other) and some Ethereum-based tokens of ETH, DAI, USDT, or USDC on your balance.

You can bridge your crypto on https://bridge.pulsechain.com/ and then swap it for PLS on https://app.pulsex.com/. The Pulsechain team advises using DAI rather than WETH, as the former has higher liquidity.

Buy PLS on the exchange: Before you start, make sure that the security standards applied by the exchange satisfy your demands, and check if you are OK with the fee policy and rates on the exchange.

Also, you should ensure that the exchange you want to use provides service in full in your country. Usually, you can find this info in the terms and conditions section, or you can just google it.

Then, you will need to register on the exchange, deposit crypto (or buy it by card if such an option is supported), and sell what you have for PLS. Make sure your wallet supports PLS because keeping your coins on exchanges is not safe, and it's better to withdraw them after purchase.

FAQs

Is PLS a good investment?

We cannot give investment advice. Nevertheless, we can outline some characteristics that can help you in doing your own research on the PLS token's potential.

First, the Pulsechain project is still in its infancy phase. The token is barely presented on major crypto exchanges, so it’s early to judge if its price will eventually take off. In many regards, its future depends on the success of the Pulsechain team and its efforts to promote its product and make it attractive to users.

Where can I buy a PLS token?

As of September 2024, you can swap some tokens to PLS (see the instruction in the previous chapter) or buy them on MEXC, SafeTrade, XeggeX, or SmarDex.

Should I buy PLS now?

As of September 2024, the PLS token’s price has declined for at least one month. It has been below the July 2024 rate for the last four weeks. If you are going to invest in the Pulsechain token, it can be seen as a buying opportunity, as the price hasn’t been that low in several months.

Nevertheless, it may get even lower in the future. Use candlestick chart patterns and trading indicators to decide whether to buy PLS now or wait for a better opportunity.