What Will Silver Be Worth in 2050? A Crypto Investor’s Guide to the Future of Hard Assets

Why should crypto investors consider the price of silver in 2050? Silver and cryptocurrency are both alternative currencies providing hedges against fiat currencies. While Bitcoin (BTC) has been dubbed "digital gold," the more classic but essential physical resource is silver. Silver's role in the bucket of crypto investments provides many valuable lessons in diversification and stability in the coming years.

Contents

- Silver vs Bitcoin Historic Performance

- Use Case: Silver and Blockchain – Tokenization and DeFi

- Industrial Demand: Will Silver Be Required by CryptoTech?

- Silver in a Diversified Cryptocurrency Portfolio

- 2050 Price Forecast – Scenarios from the Crypto Economics

- Conclusion: Silver and Crypto – Enemies or Allies?

- FAQs

Silver vs Bitcoin Historic Performance

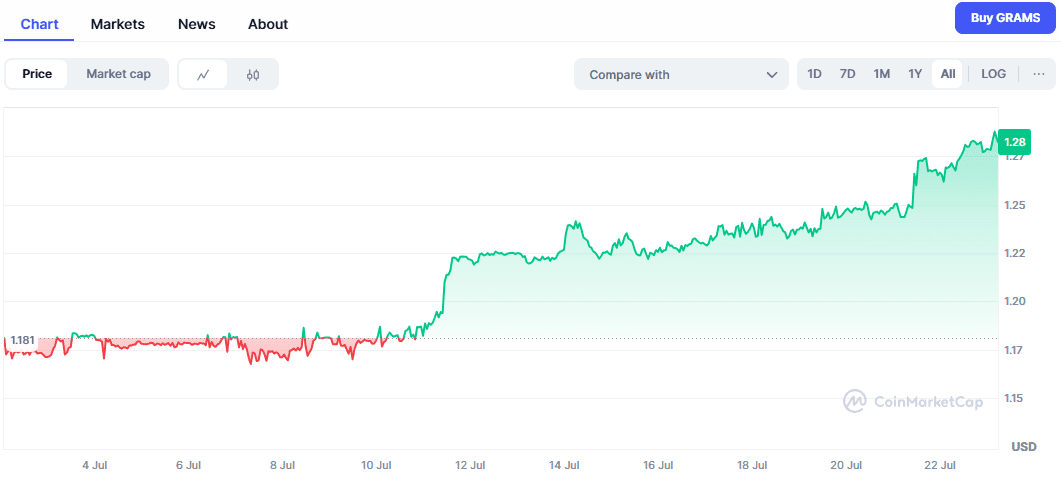

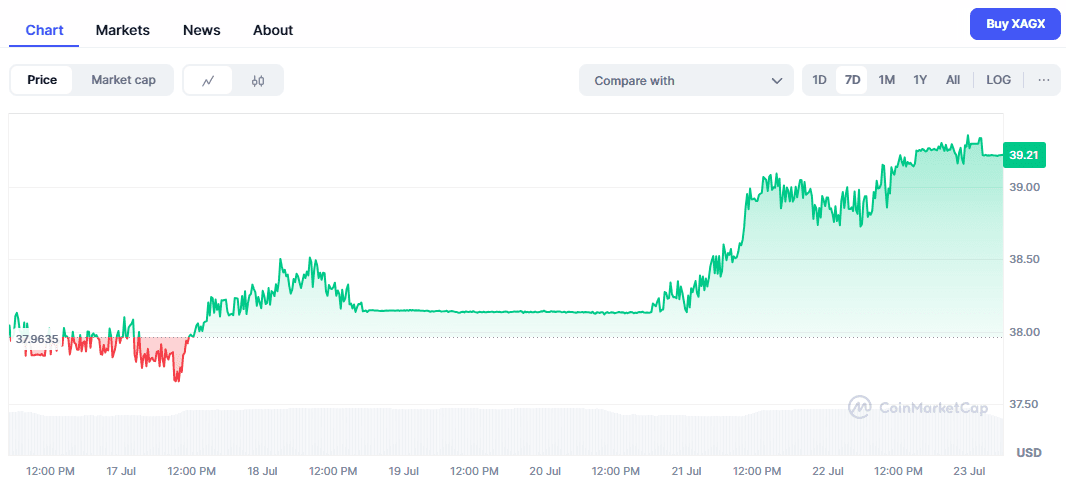

Relative to prior performance, silver and Bitcoin have varied attributes. Bitcoin, created in 2009, has had extreme volatility and the potential for fast exponential growth with peak values reached and steep declines in the short term. Silver has centuries-old prior stability with predictable volatility. Having rallied near $50 the ounce twice before, in 1980 and 2011, it has responded to speculation in funds and economic fear with offering investors more limited risk compared to cryptocurrencies.

Most significantly, in times of economic recession, silver has remained a phenomenal safe-haven asset. Bitcoin, though extremely profitable in upswings, carries the risk in the case of long-term bearish trends. The difference between both these assets' trends indicates complementary positions in an investor portfolio, both in growth and stability.

Use Case: Silver and Blockchain – Tokenization and DeFi

Blockchain technology has significantly expanded the tokenization of assets, as seen from gold-backed stablecoins like PAX Gold (PAXG). A silver-backed version could equally emerge and bring silver into decentralized finance (DeFi). Such stablecoins would allow crypto investors to hold tokenized physical silver on decentralized exchanges (DEXs), and also use it as collateral within lending protocols.

Crypto investors interested in staking-backed yields can explore platforms featured in Best Crypto Staking Platform, which cover tokenized assets, stablecoins, and DeFi yield strategies.

Real-world assets (RWAs), i.e., silver, contribute meaningfully in the DeFi ecosystems through the addition of liquidity and financial flexibility. Silver tokenization would deliver fractional ownership, low cost of transaction, and greater accessibility to the market. Investors in crypto can benefit from seamless exchange of silver tokens by including precious metals in crypto-oriented portfolios.

Industrial Demand: Will Silver Be Required by CryptoTech?

One critical but overlooked crypto-silver interrelation is technological interdependence. Crypto miners' equipment, particularly microchips and ASIC miners, is greatly reliant on silver due to the higher electrical conductivity it possesses. Increased crypto usage and the development of blockchain infrastructure in turn enhances silver consumption.

Stablecoins and blockchain technologies need reliable server infrastructures, hence the added requirement for silver through electronics production. Furthermore, the growth in Web3 applications and decentralized apps enhances the uptake in renewable energies, especially solar energy, indirectly stimulating the need for silver given the key role it plays in photovoltaic cells.

Therefore, the industrial demand for silver coupled with crypto and blockchain technologies positions it for robust long-term growth and stability with consequential attractive opportunities for investors.

Silver in a Diversified Cryptocurrency Portfolio

Crypto investors face significant market volatility. Diversifying investments with tangible assets like silver can mitigate risks, especially during crypto market downturns. Silver provides physical stability independent from fiat currency fluctuations and traditional stock market risks, offering essential balance within digital-heavy portfolios.

For example, the 2022 crypto crash kept the price of silver steady and brought the digital volatility hedging spotlight on the precious metal. Investor exposure in crypto by way of the addition of silver combines the volatile growth potential of digital currencies with the more temperate volatility typical of precious metals in more balanced and more sustainable investment strategies.

Just as XRP holders can earn passive income through lending or staking solutions described in our Staking XRP Guide, crypto investors may similarly benefit from silver-backed tokens, diversifying income streams with both digital and physical asset yields.

2050 Price Forecast – Scenarios from the Crypto Economics

The price in 2050 for silver can be assessed through various crypto-economic scenarios. When CBDCs significantly reduce the role of fiat currencies, investors will focus more on physical stable assets like silver, hence causing the price to go up.

Or, should Bitcoin form the basis of world financial regimes, the value of silver as a physical substitute asset may hold up as it retains its utility as a balancing counterweight to digital volatility.

Also, should tokenization of tangible assets become common practice, silver-backed tokens may gain extensive use in DeFi, greatly expanding demand and potentially raising the market value of silver.

Conclusion: Silver and Crypto – Enemies or Allies?

After all, cryptocurrencies and silver don’t compete; they complement each other in diversified portfolios. Both classes have unique attributes: crypto’s tremendous growth prospect and silver’s tangible stability. Together, they provide crypto investors with complete, responsive investment strategies, increasing both resilience and profitability by 2050.

FAQs

Why should crypto investors consider silver?

Silver offers stability and diversification benefits, helping reduce risks associated with crypto market volatility.

Could silver-backed cryptocurrencies become common?

Yes, silver-backed stablecoins, similar to gold-backed tokens like PAXG, may gain popularity, enabling investors to trade tokenized silver easily within blockchain platforms.

How does blockchain technology influence silver demand?

Blockchain infrastructure, ASIC miners, servers, and renewable energy tech needed for crypto ecosystems rely on silver, increasing industrial demand and potentially driving silver’s long-term value.

Is silver better than Bitcoin as an investment?

Silver and Bitcoin serve different purposes; silver provides stability and lower risk, while Bitcoin offers significant growth potential with higher volatility. Combining both can optimize investment portfolios.

Will tokenized silver impact traditional silver markets?

Tokenized silver can increase market accessibility and liquidity, potentially driving higher demand and impacting traditional silver market dynamics positively.