Cryptohopper Reviews 2021

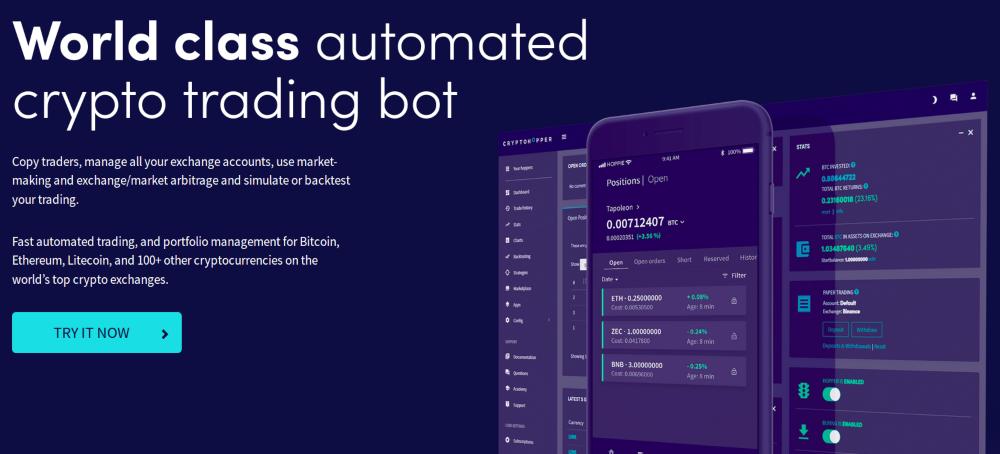

Cryptohopper is an algorithmic cryptocurrency trading platform (or trading bot). Such platforms are used for the automation of strategies of traders. More than that, Cryptohopper can be used to receive signals from professional traders (signalers). The platform itself is not an exchange so users trade on side exchanges. The process is managed via the API keys. Cryptohopper is created in Amsterdam, Netherlands. The bot is regarded as software as a service. Cryptohopper boasts a combination of a user-friendly interface with rich functionality.

History

Two brothers from the Netherlands, Pim and Ruud Feltkamp, developed Cryptohopper in 2017. The platform was based on Raspberry pi. Initially, the Feltkamp brothers created Cryptohopper for their own use. In the time of the cryptocurrency market bull run, their product became popular among other traders, so Cryptohopper surfaced together with crypto hype. At some point, the brothers made their product publicly available.

A throwback to three years ago: the moment when we made it possible to follow crypto signals, as the first in the crypto space. To date our most copied feature by our competitors. https://t.co/URQjyQ8tUb

— Cryptohopper (@cryptohopper) November 3, 2020

In 2018, the company introduced a number of serious changes to its product. The marketplace interface was improved. Cryptohopper added new pre-established indicators. Moreover, Cryptohopper became capable of detecting candlestick chart patterns. A bigger number of available signalers became available in 2018, too. Little by little, this indie software gained an impressive following surpassing 150 thousand users by 2019.

General Information

First off, it's important to stress that Cryptohopper allows using it both manually and automatically. The main purpose of Cryptohopper is to make trading easier and allowing people to trade when they are busy with other things through automatization. Trading with Cryptohopper requires no app installation. The accounts are available online from any type of device. All the processes managed by Cryptohopper are executed in the cloud. It means that users don't have to keep their devices on while trading. More than that, low Internet speed cannot affect the process.

The platform is compatible with 13 exchanges. OKEx, KuCoin, Huobi, Bitvavo, Bitpanda Pro, and HitBTC are official partners of Cryptohopper. Kraken, Binance, Binance US, Huobi, Coinbase Pro,

The platform is compatible with 13 exchanges. OKEx, KuCoin, Huobi, Bitvavo, Bitpanda Pro, and HitBTC are official partners of Cryptohopper. Kraken, Binance, Binance US, Huobi, Coinbase Pro,

Poloniex, Bittrex, and Bitfinex are not official partners but the bot can be used to manage accounts on these exchanges, too.

Instead of wasting much time on trading, Cryptohopper is offering to use the trading bot. The strategy used by the bot is selected by the user. Moreover, users can configure existing strategies or create new ones. The bot is capable of trading all the time non-stop. One of the benefits of handing over the trading process to the bot is that the bot is not prone to emotions. Bot's trading behavior is based on statistics and technical analysis and strictly limited by the chosen strategy. Unlike humans, the bot is capable of making several trades on different platforms simultaneously without lagging and the risk of confusion.

One of the notable Cryptohopper features is the market making bot. It searches for profitable options on trading on the spread and switches automatically in order to keep the profitability as high as possible. Market making trading benefits exchanges as they receive more liquidity while traders usually enjoy smaller trading fees (normally market maker fees are lower than market taker fees).

It's important to be quick in the changing trend. The Cryptohopper order book is managed via drag and drop so the position in the order book can be changed quickly and effortlessly. Users can change their strategies reacting to the signals of the trend change. Also, the strategies can be changed automatically. Even in this case, users are still free to change the configuration of the current strategy anytime.

Another nice feature is the exchange and market arbitrage. This feature creates an opportunity to benefit from the differences between the prices on different exchanges and pairs. Without the need to withdraw the funds from exchanges Cryptohopper users can earn money from these price discrepancies. The platform looks for arbitrage trading opportunities automatically as soon as the user connects to the exchanges that have funds.

Users are free to create custom trading strategies. These strategies will be configured to react to the market events effectively and on time buying and selling coins at the specified price range. The visual editor provided for the configuration of strategies is very low key. Users just need to drag and drop the elements they need and add numbers where it's necessary. Instead of coding, users just choose the proper tech analysis indicators, specify if it's a buy or sells action, and do the further configuration. The users with coding skills can develop their strategies via JSON, however, according to the Cryptohopper website, most people prefer graphic interface. The users can trade via their strategies themselves or opt to sell them via the Cryptphopper marketplace to other users.

The automation is designed in a way to fully replace most of the actions human traders do. That's why apart from general trading features, Cryptohopper provides the ability to configure the order type switching, holding some money as a reserve, and other useful programmable actions. Among the other opportunities brought up by automation is so-called "scalping". The algorithm can analyze the prices of 75 coins simultaneously and sell them as soon as the potential profit reaches 0.8% or more. Manually, such a strategy doesn't bring any significant effect but the ability to sell dozens of coins 24/7 creates a real opportunity for gaining profit.

Additionally, the bot can be used for trading simulation to test strategies before investing real money or selling them via the marketplace. This feature alternatively known as paper trading can be applied to gain trading experience before dipping your toes into the stormy sea of trading.

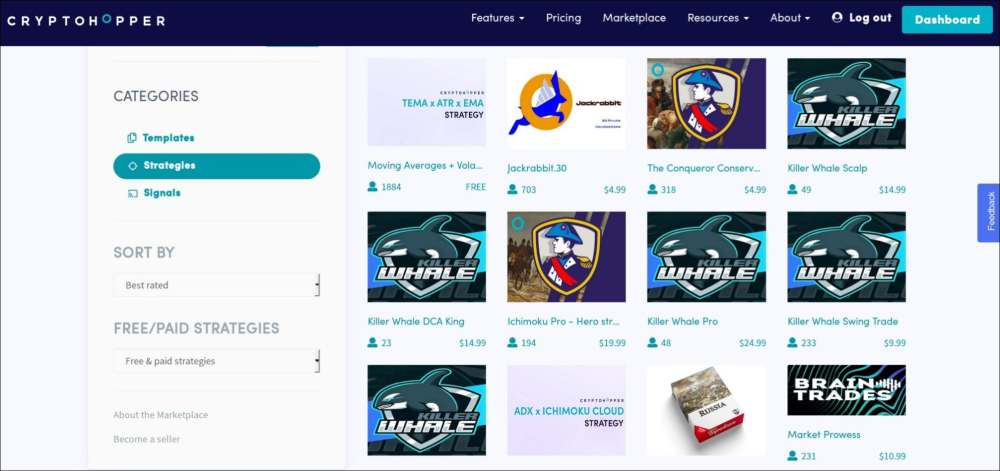

Marketplace

The bot website has a Tapoleon page where users can sell or buy strategies, signals, and templates created by other users. This marketplace is good both for newbies and experienced traders as there are many different things out here. The novices in trading can benefit from popular trading strategies, sell signals, and templates sold by others while spiced traders can make money on selling their own strategies there. Moreover, users can share their experiences and discuss trading-related topics in chats associated with Cryptohopper.

The trading process is managed via a so-called Base. Base can be configured by users but another option is to buy the Base configuration which is called template. Templates can be quite simple configuring only the basic settings, or more complex and detailed. The template users should check the exchange settings and balances and connect via the API keys of the exchange. The template interface has a Coins and Amounts tab where users can choose which currencies should be traded and specify the amounts of these coins. Templates can be updated automatically or adjusted manually. The automatic updates have a certain duration. When the update period is over, the user can update the template only manually or opt to buy a new template. When choosing the templates, the potential buyers can see the detailed description of its properties, the price, the rating of the template, the endurance of its updates, the number of times the template was sold, the reviews of its users, and the contact information needed to purchase the template. The sellers are obliged to answer the queries of buyers of the templates. Templates can be refunded only in 30 minutes after the purchase. Templates can be used for different bots including Market Arbitrage bots, Exchange bots, and Market Making bots.

The term "strategies" is applied for combinations of numerous technical indicators and candlestick chart patterns that set the signals sent to the user by the trading bot (it can be either buy or sell signals). These strategies can be bought on Tapoleon or configured (created) by users and sold to others via the same marketplace. It's understood that another option is configuring a strategy for their own use — it's not necessary to buy or sell them. Just like templates, strategies presented on the marketplace are accompanied by a description, price, the contact information of the seller, updates duration, and so on. Please note, that not all sellers mention the technical indicators used in their strategies in the description. However, some of them won't mind telling you more about the strategies they are selling via direct messages. Before buying a strategy it's better to check first if it's refundable. This info can be found on the page with the strategy description.

The term "strategies" is applied for combinations of numerous technical indicators and candlestick chart patterns that set the signals sent to the user by the trading bot (it can be either buy or sell signals). These strategies can be bought on Tapoleon or configured (created) by users and sold to others via the same marketplace. It's understood that another option is configuring a strategy for their own use — it's not necessary to buy or sell them. Just like templates, strategies presented on the marketplace are accompanied by a description, price, the contact information of the seller, updates duration, and so on. Please note, that not all sellers mention the technical indicators used in their strategies in the description. However, some of them won't mind telling you more about the strategies they are selling via direct messages. Before buying a strategy it's better to check first if it's refundable. This info can be found on the page with the strategy description.

And finally, the signals. You might know them by different names such as mirror trading, social trading, or copy trading. The principle is easy to grasp — signals are associated with the activity of the professional traders. When they do certain things (place some orders, etc), the user is getting the respective signals to perform the same actions on the chosen exchange. There are many signalers that can be followed on Cryptohopper.

The Cryptohopper website recommends to pay attention to the following factors while choosing a signaler:

- Learn if the signaler is sending signals to the exchange you use and the Base currency you have chosen.

- Also, it's important to make sure the signaler is sending signals for your selected coins. There is a Hero Hopper subscription on the platform which allows receiving signals for every coin supported by the preferred Base currency.

- Note if the signaler is sending signals frequently. If not, you might miss some profit out.

On the Cryptohopper website, users can see the rating of each signaler, the number of signals sent in the last 3 months, average profit per trade, how many users are subscribed to the signaler, how to contact her/him, and other information including user reviews, statistics, and so on. Subscription to a signaler requires paying a monthly fee which varies from one to another.

The signaler description contains the subscription fee. The Exchange section provides the list of exchanges on which the signaler sends the signals. This list is changing with time, so it's important to check which exchanges were added or delisted. In the same section, users can learn about the performance, sent coins, and stats the signaler has on each exchange. The Total Sell Signals number indicates how many sell signals were performed in the last 7 days. The Last Month Performance is a score calculated by adding the smallest trade made in last month with the biggest trade. This rate is updated once a day. This section contains other details and stats reflecting the signaler's performance.

Another section that can help in choosing a signaler is the Performance Report. In this section, users can see the signals that are sent for free in real-time or see the paid signals with a 24-hour delay. The user can insert the exchange, Base currency, or selected coins into the Search bar to clear the list from the signalers that don't match the user's needs. Anytime the signals can be paused for a period determined by the user. This feature is useful for those who don't want to trade in the current market trend or simply want to take a rest from trading for some time.

Pricing

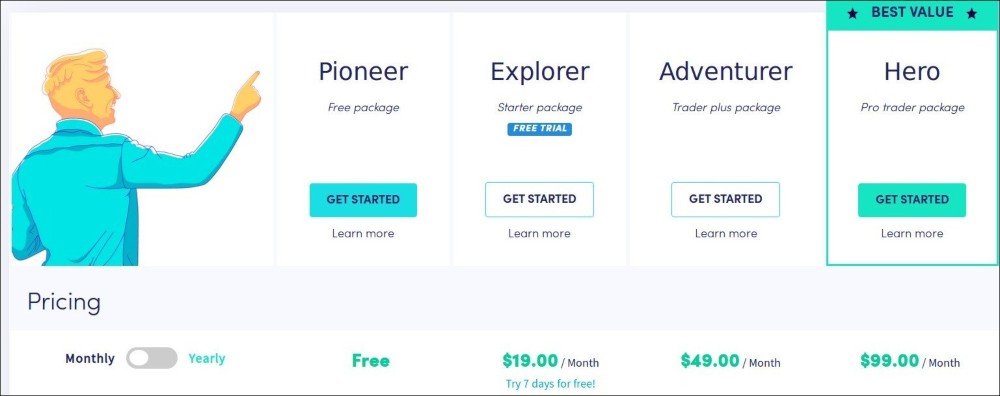

Cryptohopper offers four types of accounts different in privileges and pricing.

- Pioneer accounts are free. It allows working with 20 positions, managing portfolio, trading manually. All exchanges supported by Cryptohopper are available.

- Explorer accounts can be used for free in the first 7 days. The price of such an account is $19 per month. It widens the number of positions to 80. The account owners can select up to 15 coins and use up to 2 triggers. TA is executed every 10 minutes.

- Adventurer accounts boast more features while the price is $49 per month. This account is capable of working with 200 positions, the max amount of selected coins is increased up to 15, the maximum number of triggers is 5, and there is the Exchange Arbitrage function available. TA is executed every 5 minutes.

- Hero account costs $99 per month. It manages up to 500 positions, with up to 75 selected coins and 10 triggers. TA has a 2-minute interval. Any coins supported on the exchanges are available for signals. The Market Making, Market Arbitrage, and Algorithm Intelligence features are available for Hero account owners.

Is it safe to use Cryptohopper? Is Cryptohopper legit?

The servers of Cryptohopper are hosted on Amazon Web Services which is regarded as quite a safe option although some might argue that decentralized hosting would be better. The company is active on social media and many users can get assistance via Reddit, Telegram, and so on. As the trading is performed via API keys, security is mostly the responsibility of the used exchanges. Trading bots cannot withdraw the funds belonging to users. So even in the case of compromising the account on Cryptohopper, hackers won't be able to steal money. Cryptohopper doesn't share any user data with third parties.

Because of an error in the database software of @AWSSupport, the databases keep on rebooting every few minutes. They are investigating the issue, as well as our developers. Will keep you updated!

— Cryptohopper (@cryptohopper) October 11, 2020

As the cryptocurrency industry is attractive for fraudsters, it's important to figure out if Cryptohopper is a scam before using it. Although there are many user and professional reviews praising Cryptohopper as one of the most convenient bots for algorithmic trading, there are people claiming that their funds were managed inappropriately and they believe that the company is not legit. Some alleged users are not satisfied with the customer support responses to issues. It seems that the reputation of Cryptohopper is ambivalent so it's better to approach this platform with caution and read more user reviews before making a decision on whether to use it or not.

I use this tool all the time, works well