NEM (XEM) price prediction 2022-2030 - Should You Really Buy It?

For the past decade, we've seen a relatively high interest in cryptocurrencies. Once Bitcoin caught on back in 2010, it wasn't long before we began to see new coins, called altcoins, to appear on the market. While some don't last very long, others are here for several years.

If you are interested in getting on board the crypto train, knowing which crypto to invest in can be crucial. As we've seen in the past month, Bitcoin's price increased more than double its previous all-time high, and it keeps on going. This means that whoever purchased a Bitcoin in November can now sell it for a 3 times higher price than the one during the purchase.

As we mentioned, there are tons of other cryptocurrencies and if Bitcoin is not your cup of tea, keep reading. Today, we'll be talking about NEM and its coin XEM. First, we will explain what it is and then do a NEM price analysis, ending the article with a NEM price prediction and if you should invest in it.

What is NEM?

NEM stands for New Economy Movement, and it represents a blockchain platform aiming to provide improvements over the existing blockchains. The platform's primary goal is to enable asset management at a more efficient rate for a lower cost. The native cryptocurrency for NEM is XEM.

| The price as of February 2022 | $0.1 |

| Market cap as of February 2022 | $913,397,580 |

| Rank as of February 2022 | #97 |

| All-time high | $1.87 (January 7, 2018) |

| Decline (compared to all-time high) | 94.6% |

| All-time low | $0.00008482 (September 5, 2015) |

| Growth (compared to all-time low) | 118776% |

| Popular markets | FMFW.io, HitBTC, GokuMarket, Upbit, Binance |

The platform began its life back in 2015 as a fork of the already existing NXT, which acted as a payment system with its own currency. While it is a fork of NXT, the team's goal behind NEM was to have a faster and more scalable blockchain platform than before. There are two aspects that NEM introduced that enable it to be a better platform: POI and harvesting.

POI or Proof of Importance is an entirely different system than the already existing POW or POS. During the mining process with Proof of Work, the side with the highest mining power has an advantage. Higher mining power means that electricity costs are relatively higher, leading to a less effective way of getting new coins. Proof of Stake has a lesser impact on electricity, but it still has its flaws. There is a mining process involved, but unlike POW, the advantage goes to the side that holds more coins. Essentially it "forces" people to hold the cryptocurrencies instead of spending them.

POI works differently by determining how much a person has invested in the blockchain and awarding them. If you have 10000 XEM, the service will allocate 10% of your coins as vested on the first day. On the second day, it will do the same with 10% of the remaining non-vested coins. Once the amount of vested passes the non-vested, you will get the reward.

The harvesting side of things is also carried out differently. During a normal mining process, you put your computing power to use and mine. With NEM, you link your account to a supernode, meaning that the power consumption remains the same. The supernode will just use the score of your account.

There are a couple of options for the wallets, but the one we would recommend is NEM Freewallet. Apart from the wallet features, you can also use this service to purchase XEM.

NEM (XEM) price history and charts

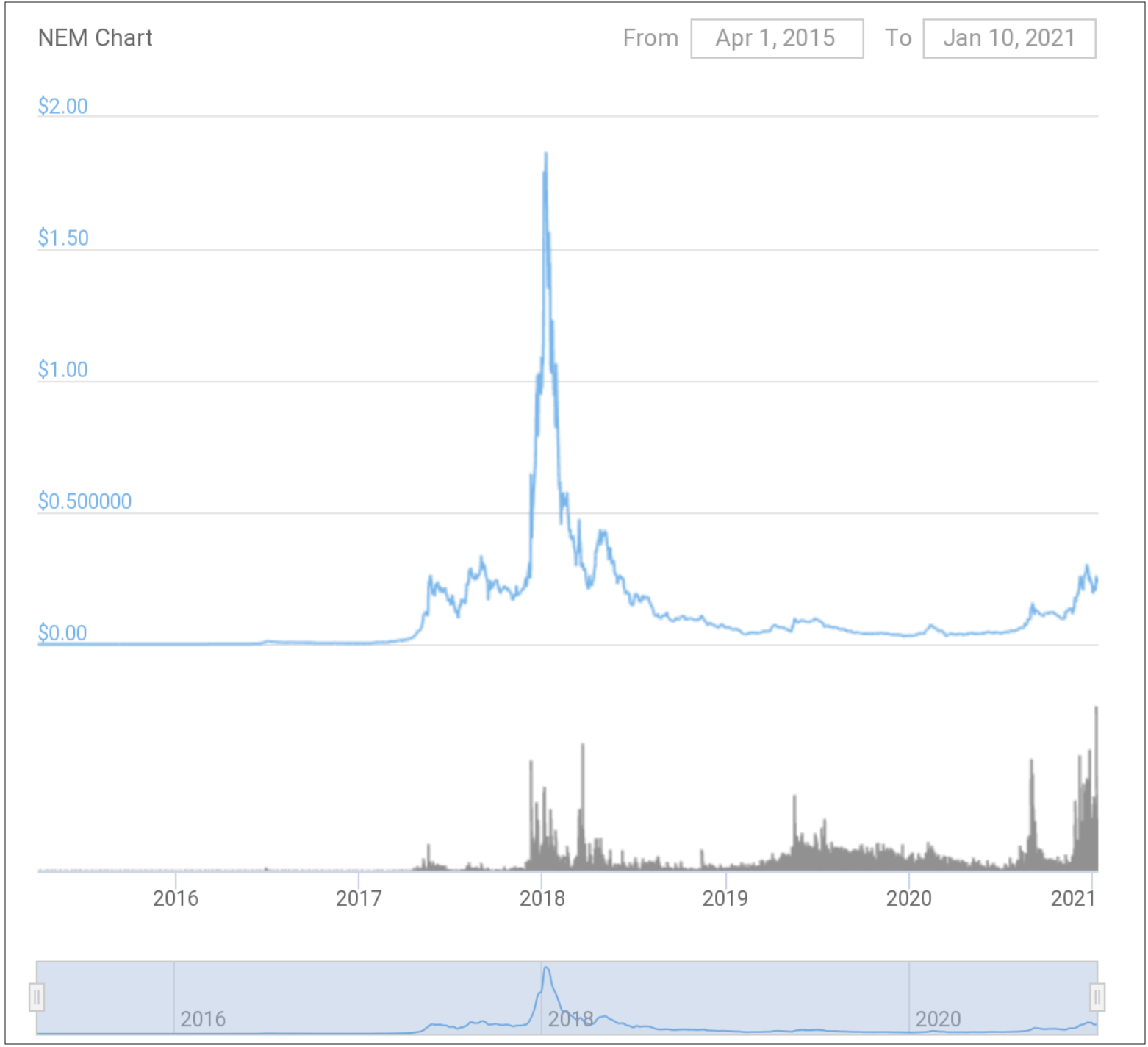

Now that we've covered the platform, it's time to look at NEM (XEM) price history. Looking at the past price, we can safely say that it has been relatively uneventful.

Looking back at the chart from April 2015 till today, there is just one colossal spike, and the rest is nothing spectacular. The price started off with a price of $0.00024 and remained below the 1 cent mark for almost two years. The following several months, XEM saw quite a significant increase, passing a quarter before dipping back to around $0.1. The end of august saw the highest price XEM has seen for 2017, reaching over $0.3. In the next months, the price continued to drop with a few smaller spikes, and at the end of the year, we saw the most significant increase. In less than two months, the price managed to reach its all-time high of $1.87, which was followed by a nosedive leading to a little over $0.2 at the beginning of April in 2018. By May in the same year, the price managed to pass the $0.4 mark. From that point, the price began to drop gradually with a few smaller spikes and drops, and the trend continued all the way to September 2020. The price began to rise, almost reaching $0.3 in late December and then slightly dropping. The beginning of 2021 saw a huge crypto rally. Just like most major cryptocurrencies, NEM went through 3 peaks in 2021: the biggest one in the spring, another in August, and the last one in November. In December, together with the rest of the crypto market, NEM went down.

NEM (XEM) price prediction

If you are the type of person that already has XEM in their NEM Freewallet or looking to purchase, you must be wondering how the prices will go in the future.

We predict that the prices will keep on growing. Considering that this is a cryptocurrency that is not as volatile as some of the others, we should see a gradual increase last year. We expect that it would gain around $0.15 by the end of 2022.

There are some rooting for a new all-time high this year, however, it's early to judge clearly. As for the next several years, we expect to see a similar linear increase this year. A rough estimate would be that by the end of 2023, XEM could get up to $0.2 or $0.25. We and other experts expect the NEM price to keep on growing. By the end of 2024, the XEM might reach at least $0.3. A year after its price can cross the $0.5 line. By 2031, the price can reach up to $3.33.

| Year | Min Price | Average Price | Max Price |

| 2022 | $0.14 | $0.15 | $0.18 |

| 2023 | $0.2 | $0.22 | $0.25 |

| 2024 | $0.3 | $0.35 | $0.4 |

| 2025 | $0.51 | $0.55 | $0.62 |

| 2026 | $0.64 | $0.66 | $0.79 |

| 2027 | $0.99 | $1.05 | $1.25 |

| 2028 | $1.36 | $1.38 | $1.55 |

| 2029 | $2.18 | $2.34 | $2.64 |

| 2030 | $3 | $3.03 | $3.33 |

Keep in mind that there are some factors that we cannot predict that would increase or decrease the value. Our current opinion is based on what we've seen in the past and how the market works. In other words, the price can go either way by the end of 2030.

Conclusion

Now is the time to answer the big question: should you invest in XEM. Generally, it depends on what you are looking for. As we've said multiple times, a quick profit with cryptocurrencies is dangerous and often leads to loss.

If you are expecting to purchase XEM today and make a fortune next month, that will not happen. If you plan to invest in the long run and wait for a good price, then that is something that could happen. (Crypto exchanges for buying this coin: HitBTC, Binance, Cryptopia, Mercatox, IDEX, etc.) Keep in mind that considering the cost of the coin, you may need to purchase a larger amount to have a profit bigger than a few dollars.

Here are no comments yet. Be the first!