Crypto Rallies Amid Ongoing Inflation Concerns and Regulatory Crackdowns

Despite a challenging market, traders have been seeking shelter in large technology companies, leading to an impressive performance from megacaps like Apple and Microsoft, and causing the Nasdaq 100 to approach a bull market. In contrast, banks such as Wells Fargo and Bank of America have been struggling, reaching their lowest levels since November 2020. Investors have been pessimistic about the outlook for short-dated Treasuries, but there are some positive economic indicators such as a second consecutive week of easing unemployment benefit applications and rising sales of new homes.

Meanwhile, the Bank of England has raised interest rates despite turmoil in the banking sector, predicting that the UK economy will avoid a recession for now, but investors are pricing in more certainty of at least one more rate hike later this year.

In Asia, equities are facing declines, despite the technology-driven rally on Wall Street, with stock futures pointing to declines in Hong Kong and Australia. The dollar has slightly strengthened against major peers after six consecutive sessions of weakening. Government bond yields in Asia opened lower, and investors remain pessimistic about the economic outlook, with many believing that the Fed will need to slash interest rates later this year.

In the crypto world, due to recent bank runs and ongoing inflation concerns, Bitcoin price increased by over 4% to reach approximately $28,200 while Ether surged over 5% in value. At the same time, the US is stepping up its regulatory actions against cryptocurrency companies, including Sushi DAO, businesses owned by Justin Sun, and Coinbase, which was recently served a Wells notice by the SEC. This has been met with disapproval from certain cryptocurrency executives. Next month, the EU is scheduled to discuss new regulations to establish its MiCA framework.

Additionally, Do Kwon, one of the co-founders of Terraform Labs, was arrested in Montenegro and charged with fraud by US prosecutors for allegedly deceiving investors about certain aspects of the Terra blockchain.

Arbitrum’s ARB Token Launches, Causing a Frenzy Among Early Users

Arbitrum is a Layer 2 scaling project that aims to improve the scalability and reduce the cost of transactions on the Ethereum network. The project is rewarding early users with its ARB governance token, which gives holders the power to participate in the DAO that will govern the Arbitrum One and Nova networks. The airdrop is a way for the project to distribute tokens to its early adopters while also giving them control over the future development of the platform.

The ARB token will not have any other use cases beyond governance rights, meaning it won’t be used to pay transaction fees on the network. However, it currently trades on centralized exchanges such as Gate.io, making it accessible to a wider audience. The token’s price surged to $14 shortly after the claim process began, but it eventually settled around $1.4 as more wallets claimed their allocations.

The project plans to transition to a self-executing DAO, which means that governance decisions will be automatically executed on-chain. However, there will be a 12-member council that can intervene in emergencies, such as malicious governance actions being forced through. The remaining 428 million tokens are yet to be claimed, and eligible addresses have 184 days left to claim their tokens, if they haven’t already.

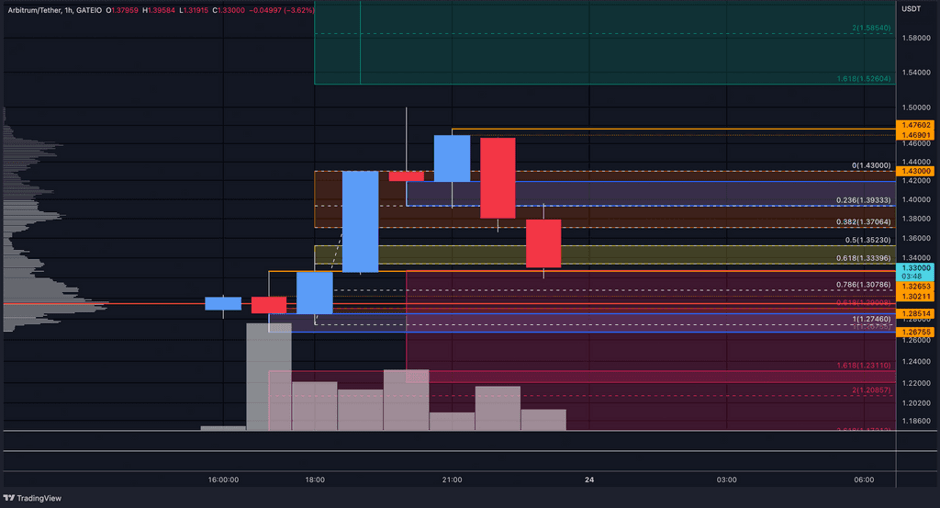

Arbitrum (ARB) $1.3765 (+4.39%) - Neutral Outlook

Overview:

- Closest 1H support zone: 1.3523 - 1.3340

- Closest 1H resistance zone: 1.3933 - 1.4190

- Key Level: 1.4760 (1H High of Mar. 23 21:00)

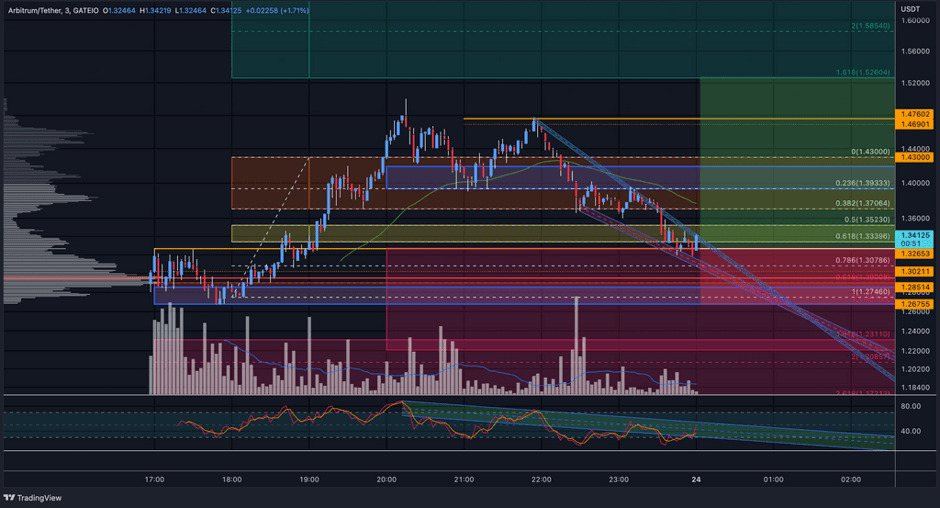

According to data from Gate.io, ARB has risen from its opening price of 1.29 to a high of 1.50 in the eight hours since its launch but has now settled around 1.34. Given the limited amount of price data available, the hourly timeframe is the most reliable for interpreting the general trend. Currently, ARB is experiencing a pullback from its peak and is trading within the hourly golden zone of 1.3340 to 1.3523. As long as the price of ARB does not close below the lowest point of 1.26755, the trend remains bullish and a lower-low formation has not been validated.

Looking at the 3-minute chart, there is a bullish divergence in the RSI, suggesting that the current price of ARB is oversold and due for an upward correction. If the price continues to decline, the volume profile indicator shows that most of the orders are placed near a demand zone of 1.2851 to 1.2676, which is close to the opening price and suggests that there will likely be volatile action in that range.

1H Resistance zones

- 1.3933 - 1.4190

- 1.4690 - 1.5000

- 1.5260 - 1.5550

1H Support zones

- 1.3523 - 1.3340

- 1.3079 - 1.2676

- 1.2311 - 1.2086

Do not trade with platform you don't know I about and even if you are sure of it don't trade more than you can afford to loss.

I lost a lot trading with a scam broker who I tend to give a better profit return

I was able to recover $28,500 from them with the guidance of Jeff silbert a recovery expert. Reach out to Jeff for assistance into a better trade and how tao recover from previous loses

WhatsApp +84 94 767 1524.

Email: jeffsilbert39 gmail com.

Am here to testify about the handwork of A Great Verified Hacker ( Mr Morris Gray )Who helped me recover back my lost funds from the hands of scammers who Ripped me off my money and made me helpless, I could not afford to pay my bills after the whole incident, But a friend of mine helped me out by given me the contact info of trusted Recovery Expert, his email: Morris gray 830 @ gmail . com contact him or chat him up on (+1- /607-69 )8-0239 ) and he will help you recover your lost funds If you have been a victim of any binary/ cryptocurrency or online scam, Mobile spy, Mobile Hack contact this Trusted and Verified hacker, He is highly recommendable and was efficient in getting my lost funds back, 11btc of my lost funds was refunded back with his help, He is the Best in Hacking jobs, contact him ( MORRIS GRAY 830 AT) GMAIL (DOT) COM.….

( MorrisGray830 At gmail Dot Com, is the man for the job ) This man is dedicated to his work and you can trust him more than yourself. I contacted him a year and a half Ago and he didn’t succeed. when i got ripped of $491,000 worth of bitcoins by scammers, I tried several recovery programs with no success too. I kept on. And now after so much time Mr Morris Gray contacted me with a success, and the reward he took was small because obviously he is doing this because he wants to help idiots like me who fell for crypto scam, and love his job. Of course he could have taken all the coins and not tell me , I was not syncing this wallet for a year, but he didn’t. He is the MAN guys , He is! If you have been a victim of crypto scam before you can trust Morris Gray 10000000%. I thought there were no such good genuine guys anymore on earth, but Mr Morris Gray brought my trust to humanity again. GOD bless you sir…you can reach him via ( MORRIS GRAY 830 at Gmaill dot com ) or Whatsapp +1 (607)698-0239..

mail: jeffsilbert39 gmail. Com

WhatsApp +84 94 767 1524