Is it safe to use Bitbuy in 2023? Read this Review

We want to talk about the most used cryptocurrency exchange in Canada: Bitbuy.

By reading our review you will discover if it fits your needs and why it became an example for international crypto platforms.

Bitbuy website - Homepage

Bitbuy website - Homepage

What is Bitbuy?

Bitbuy is a centralized crypto exchange thought for the Canadian market.

Born in 2013, it has been working hard to improve its features and increase the partnerships with third party companies to provide its customers with a reliable service.

In fact, we will focus on safety for a specific reason: this crypto exchange takes security very seriously, and that’s why it became an example for other companies around the world.

Despite the fact that it is focused on a specific country, Bitbuy has achieved a record for what concerns insurance, giving its users peace of mind.

But before talking about that, let’s break down its main features.

Bitbuy: An Overview of its Features

As mentioned, Bitbuy allows Canadian users to buy and trade cryptocurrencies.

Canadian users can choose among nine cryptos:

- Bitcoin

- Ethereum

- Litecoin

- XRP

- EOS

- Stellar Lumens

- Bitcoin Cash

- Chainlink

- AAVE

Users can trade with two platforms:

- Express: it represents the easiest way to trade cryptos. It just allows you to convert a crypto into another crypto - or fiat.

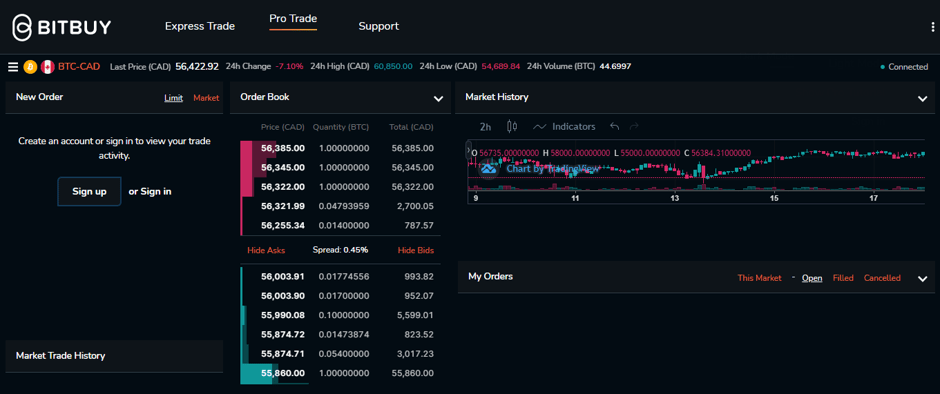

- Pro Trade: this platform provides its users with more functionalities.

It is integrated with TradingView, to show you constantly updated price charts.

With Pro Trade you can set limit and market orders and examine the order book.

If a user wants to invest more than $50,000 CAD on Bitbuy, the OTC service is the right choice.

A plus of Bitbuy is support, and also in this case it proves its efficiency.

Over-the-counter transactions are made directly between counterparties. This procedure avoids an excessive slippage and allows traders to profit from live price quotes.

When a trader wants to invest $50,000 CAD or more on Bitbuy, the exchange offers a personalized service, providing the experience of its best experts.

Moreover, users can create both personal and business accounts.

Bitbuy: Let’s Break Fees Down

Bitbuy fees are extremely competitive, and the company is very transparent about them.

As for any other exchange, trading fees are divided into maker and taker fees: the maker fee amounts to 0.1% of transactions, while the taker fee is 0.2%.

The same fees apply to API clients.

As we mentioned earlier, Bitbuy offers its clients two platforms to trade: Pro and Express - being express the most basic form of trade, that is, conversion.

Well, for what concerns Express, the fee is always 0.2%.

When it comes to fiat deposits and withdrawals, the only supported currency is Canadian dollar.

Users can fund their accounts in two ways: Interac e-Transfer (we’ll talk more about this later) and bank wire.

If a user chooses the Interac e-Transfer, the minimum deposit is $50 and the maximum is $10,000 every 24 hours. The fee amounts to 1.5% of the deposit, but it is processed almost immediately.

For what concerns the bank wire, the minimum deposit is higher than minimum deposits allowed by other exchanges: in fact, users have to deposit a minimum amount of $20,000. The maximum amount is $500,000, the fee is 0.5% and the deposit is processed in 2 or 3 business days.

When it comes to withdrawals, the only differences are:

- The Interac e-Transfer is processed within 24 hours;

- The bank wire withdrawal fee is 1%.

Bitbuy fees for cryptos are completely different.

Crypto deposits are always free and there are no limits.

Withdrawal fees and minimum withdrawals change according to the crypto.

Can you use Bitbuy in the USA?

No, you can’t use Bitbuy in the USA, nor in other countries.

The only country where Bitbuy operates is Canada.

If you have a look at the registration form you will realize it very soon: as a part of the common questions to comply with KYC (Know Your Customer) procedures, the mobile phone field doesn’t allow you to add your phone number - where you should receive a registration code - unless it is a Canadian number.

Actually, users outside Canada can’t even access the website: if you try to visit the homepage you will see a window that simply tells you that your country is not supported and you should contact support for more info:

Bitbuy homepage if you visit the website from an unsupported country.

Bitbuy homepage if you visit the website from an unsupported country.

What about Bitbuy Security Features?

It is safe to say that Bitbuy is among the safest crypto exchanges in the marketplace. This is a plus for this centralized platform that has never been hacked.

First off, Bitbuy is a money services business (MBS), and it is registered under FINTRAC.

FINTRAC - or Financial Transactions and Reports Analysis Centre of Canada - is the Canadian financial intelligence unit, in charge of preventing money laundering and the financing of dangerous activities. Moreover, it is in charge of protecting the personal information of all actors under its control.

Being Bitbuy a registered company, you can trust this third party to make your financial operations in the crypto market.

Of course, Bitbuy respects all those practices shared by any other centralized crypto exchange:

- Registration process;

- Verification levels;

- 2FA - two-factor authentication - enabled (enabled for all transactions) for security reasons.

Bitbuy uses Secure Socket Layer (SSL) protocol to protect its users. This technology is common among all secure websites: it simply means that what you share with the website is kept private, thanks to SSL certificates that website owners get from specialized agencies.

The exchange, to demonstrate its reliability, makes use of audits carried out by outside companies. It does it by completing a Security and Proof of Reserve audit, to ensure that the company is respecting security protocols and managing the funds of its customers correctly.

Moreover, as mentioned on its website, Bitbuy provides proof of solvency: by proving its ability to meet its financial goals and keep a very transparent accounting activity, you can be sure that Bitbuy is a well established company that won’t suddenly disappear.

You should consider these aspects carefully, since they are the reason why you can expect to trade safely.

But that’s not all.

The real difference between Bitbuy and other centralized platforms is that they provide you with an impressive insurance policy.

In 2020, Bitbuy announced that it would cooperate with Knox, a Canadian company specialized in insured Bitcoin storage.

This partnership would make Bitbuy the first exchange in the world to offer 100% insurance on Bitcoin deposits.

Another partner of Bitbuy is BitGo: their cooperation results in a comprehensive insurance policy, not necessarily focused on Bitcoin.

If you consider cold storage as a fundamental reason to choose a specific exchange, you will further consider trading with Bitbuy.

We all know that the difference between hot and cold storage relies on the capability of wallets to be connected to the web - if they can’t be connected they are “cold storage” wallets, otherwise they are hot wallets.

Crypto exchanges need to keep a certain part of their crypto reserves online, available for clients. But the higher the percentage of funds they keep offline, the better - this avoids thefts and hackings.

Well, Bitbuy keeps an impressive 95% of its reserves in cold storage.

But there is another exchange that does even better: Coinbase.

Let’s Compare two easy-to-use Crypto Exchanges

With an outstanding 98% of its reserves in cold storage, Coinbase and Bitbuy can be compared because of their functionalities.

Even if Coinbase is one of the most popular crypto exchanges in the marketplace, it is mainly used by US traders and beginners.

It is true that both these platforms also offer solutions to more advanced traders: the Pro Trade version of the Canadian exchange and the Pro version of Coinbase offer more complex functionalities, but not as advanced as those offered by other crypto exchanges.

Let’s say that even if both platforms want to keep things easy, they still have some differences.

The main difference is in the number of cryptos supported: while Bitbuy supports only some of the most traded cryptocurrencies, Coinbase offers more pairs.

But if you have a look at their trading platforms they are very similar:

Bitbuy Pro Trade

Bitbuy Pro Trade

You can find the order book, a price chart and limit/market orders. Coinbase just add stop orders:

Coinbase Pro

Coinbase Pro

The main difference between Bitbuy and Coinbase is that Coinbase is created for anyone, while Bitbuy is very specific for Canadian customers.

This characteristic is reflected by fees and the integration of specific payment systems.

Coinbase, operating in several countries, have different policies according to the region but can’t prioritize the needs of specific customers.

Canadian customers suffer this condition by paying higher fees - at least 3.99% of the deposit.

Moreover, Canadian users can trade only crypto pairs on Coinbase: this goes against the “make-it-easy” policy, since - especially for beginners - trading crypto pairs isn’t as intuitive as trading crypto-fiat pairs.

Basically, the reason why Bitbuy is so popular in Canada is that Bitbuy wants to improve aspects that other crypto exchanges don’t consider for the Canadian market.

Also the integrated payment system respects this idea.

By supporting Interac, Bitbuy allows Canadian users to make transactions very fast - transfers are almost instant - and safely.

Interac is a banking network that works mainly in Canada.

It is widely used by Canadians as a debit card system, but it is also extremely useful because of its integrated electronic system, e-Transfer.

Of course, by integrating this payment method into the exchange - along with bank wire, Bitbuy made a great choice for the Canadian market. It made Canadian traders’ lives far easier when it comes to deposit funds, trade and especially cash outs. Compared to Coinbase, when it comes to withdrawals Canadian users find the whole procedure extremely hard if they want to get fiat money - because they can trade only crypto pairs - and the only option they have is PayPal.

Should Other Platforms Take It As An Example?

For sure you realized that Bitbuy has good and bad characteristics.

Among the good ones we can note easiness, safeness, transparency, an outstanding insurance policy and high-quality partnerships.

Among the bad ones, the first is that it is focused only on Canadian traders.

Another bad aspect is that minimum wire transfer deposits are very high.

What can be a con for more experienced crypto traders is that it offers a low number of possible orders and crypto pairs.

Despite its cons, we should consider that the company has been keeping a coherent business strategy, without giving up on improvements.

Moreover, as we mentioned earlier, this company achieved a record.

Offering 100% insurance for deposits is a great achievement, and something that every trader would like to see on centralized crypto exchanges.

Precisely because they are centralized, we need to trust them as we need to trust more traditional financial institutions, and such a proof of reliability would be very appreciated.

Electronic transfers take place in the shortest possible time. This is a significant advantage, but is diminished by the absurdly high fees. Yes, the exchange works great, but it just doesn't make sense for me to trade here