Reimagined Finance ($REFI) Crypto Review 2022

While many people still prefer to earn via trading on centralized cryptocurrency exchanges, an increasingly growing number of crypto enthusiasts are gravitating towards DeFi (Decentralized Finance) solutions.

DeFi platforms allow users to earn crypto via options including staking and providing liquidity to decentralized exchanges. We’re experiencing a strong shifting in attitudes away from traditional finance (TradFi) methods to a more decentralized manner of income.

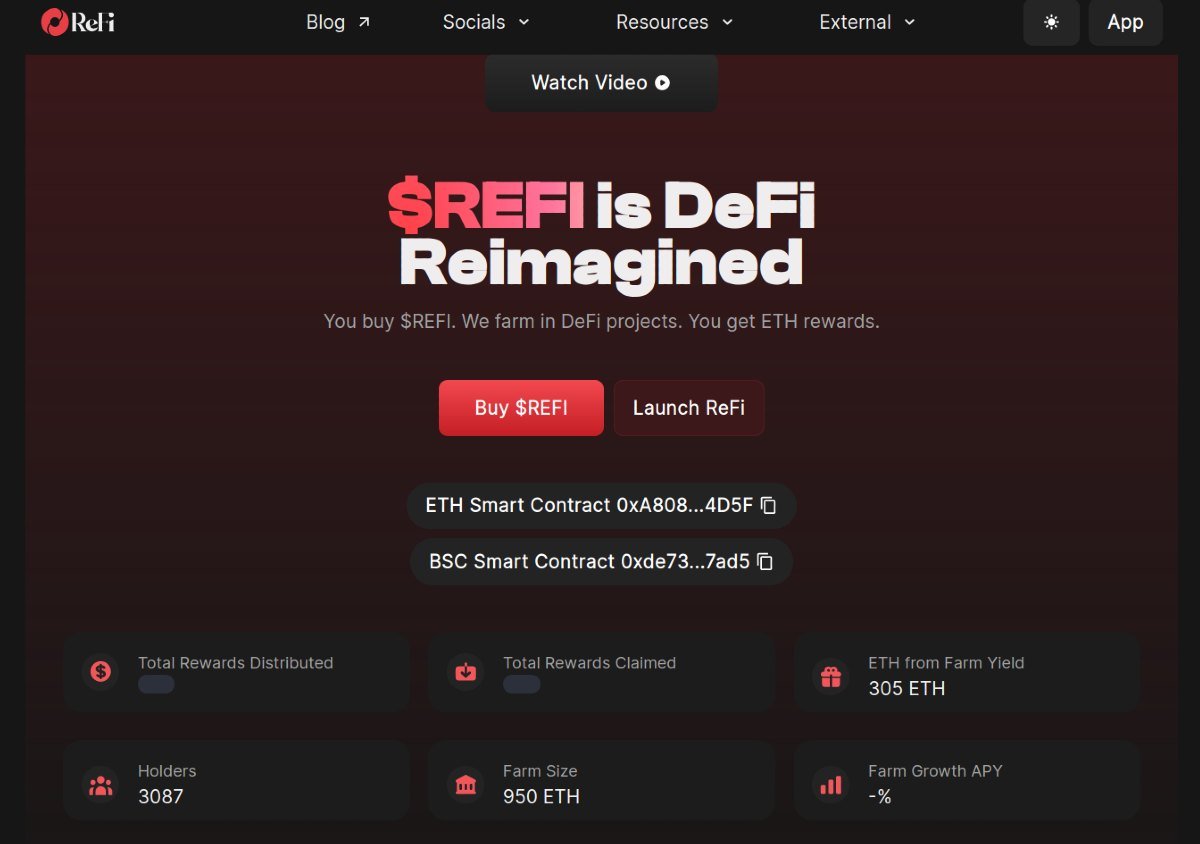

Reimagined Finance (ReFi) is a new DeFi project changing the status quo around existing farming methods. Through ReFi’s Farming-as-a-Service (FaaS) availability users can earn farming rewards from multiple protocols using one simple interface.

We’ll review ReFi’s primary features while providing our opinion, if ReFi is trustworthy and safe, while answering additional crucial questions.

What Is Reimagined Finance (ReFi)?

Reimagined Finance (or ReFi) is an Ethereum-based platform allocating assets across decentralized yield farms. Users simply hold their coins and are rewarded with dividends from ReFi’s multi-protocol farming strategy. According to ReFi, one of their goals is to make it easier for people to access DeFi tools and provide an opportunity to enjoy passive income. The company promises stable returns and a user-friendly interface.

ReFi offers a native token ($REFI) of the same name. The tokens are used for accessing dividend payouts and serves as an incentivization for platform users. ReFi has paid over $3 million (1410 ETH) to its investors in December 2021 and January 2022. To start using ReFi you should connect your wallet. The platform supports the following brands: MetaMask, Trust Wallet, WalletConnect, Coinbase Wallet, and ImToken.

ReFi offers a native token ($REFI) of the same name. The tokens are used for accessing dividend payouts and serves as an incentivization for platform users. ReFi has paid over $3 million (1410 ETH) to its investors in December 2021 and January 2022. To start using ReFi you should connect your wallet. The platform supports the following brands: MetaMask, Trust Wallet, WalletConnect, Coinbase Wallet, and ImToken.

The platform was launched in 2021. As of January 2022, the ReFi team includes 20+ members.

$REFI Token

ReFi has a utility token ($REFI). As of January 25, 2022, the reported market cap is $42 million. The REFI token's price is $0.043, over a 10x gain since December 2021, when the price was $0.0049. The coin is available for trading on Uniswap.

Main Features

The main feature and purpose of Reimagined Finance is allocating your capital among the yield farms. As the ReFi platform provides a cross-platform service, you can diversify your portfolio and enjoy the benefits. Farming is completed on holders' behalf by ReFi. Holders are required to hold a minimum of 10K $REFI tokens to enjoy the farming dividends and reflection benefits.

$ReFi has officially launched on #BSC via PancakeSwap! 🎉🔥

— ⭕ ReFi | Reimagined.fi (@ReimaginedFi) February 14, 2022

⭕️ Minimum of 1 $ReFi token to receive rewards

⭕️ Compounding on #BSC without tax

⭕️ Fully-functional bridge to $ETH

Contract address is on our official website: https://t.co/TbnueMZvAT. Beware of other fake addresses! pic.twitter.com/ZHYPSAsrx1

5% of all buys and sells are converted to ETH reflections automatically. 7% of buys/sells are sent to the treasury These funds are used for cross-platform farming, by the farming team. The profits are returned as dividends to the REFI tokens holders in the form of ETH. You can provide a wallet address and see the estimated returns based on the current balance and recent transactions. Connecting your wallet to the website allows access to the dashboard where you can find the current balance and pending dividends.

Diversified investment helps you to avoid losses, achieve stable returns, and maximize your profits in the long run.

Is Reimagined Finance Safe?

Before you decide to invest, due diligence is required to ensure Reimagined Finance is not a scam, but a safe and reliable platform. The technology itself is safe due to the decentralized nature of the DeFi services. The ReFi team works closely with the community and currently, there are no signs of scam activity from the platform's side.

Investing is always a risk, especially when it comes to such a volatile market as cryptocurrencies. However, the ReFi team does a good job of mentoring its user base on how to avoid losses. In the ReFi blog, there are detailed descriptions of possible strategies of investing aimed at safe and profitable yield farming.

It is possible, however, to lose a serious portion of your returns due to the instability of the $REFI token. We should bear in mind that this token is very young and its price tends to go up and down, especially now, in the times when the crypto market is going through the merry-go-round phase. The good sign is that ReFi continues its work and development, keeps in touch with its user base, and has a clear road map. It plays well for the potential of the platform's token and its future.

I use refi personally and love it. no stress, no work involved. just collect ETH