Spell Token (SPELL) Review: An In-Depth Look at the SPELL Ecosystem

Spell Token (SPELL) is the official utility token of the Abracadabra.money and is the decentralized finance (DeFi) product with the mission of lending and borrowing with the assistance of interest-bearing tokens. Spell has been of great fascination in the crypto space according to its connection with the broader ecosystem of DeFi products and its operation of powering Abracadabra's governance and rewards system. In this analysis, we're going to further explore the Spell Token (SPELL), its means of operation, and its place in the cryptocurrency market.

Contents

- What is Spell Token (SPELL)?

- Technology Behind the Project

- Token Spell's Engagement with the DeFi Community

- Magic Internet Money (MIM) and Its Connection with SPELL

- Staking and Yield Opportunities

- Cross-Chain Compatibility and Development

- Tokenomics and Supply Distribution

- Risks and Considerations

- Conclusion

- FAQ

What is Spell Token (SPELL)?

Spell Token (SPELL) is the reward and governance token of the Abracadabra.money platform. Abracadabra is the lending platform where the users can deposit interest-bearing tokens such as yvUSDT or yvWETH (Yearn Finance tokens) and withdraw the platform’s stablecoin named Magic Internet Money (MIM) as a loan in return.

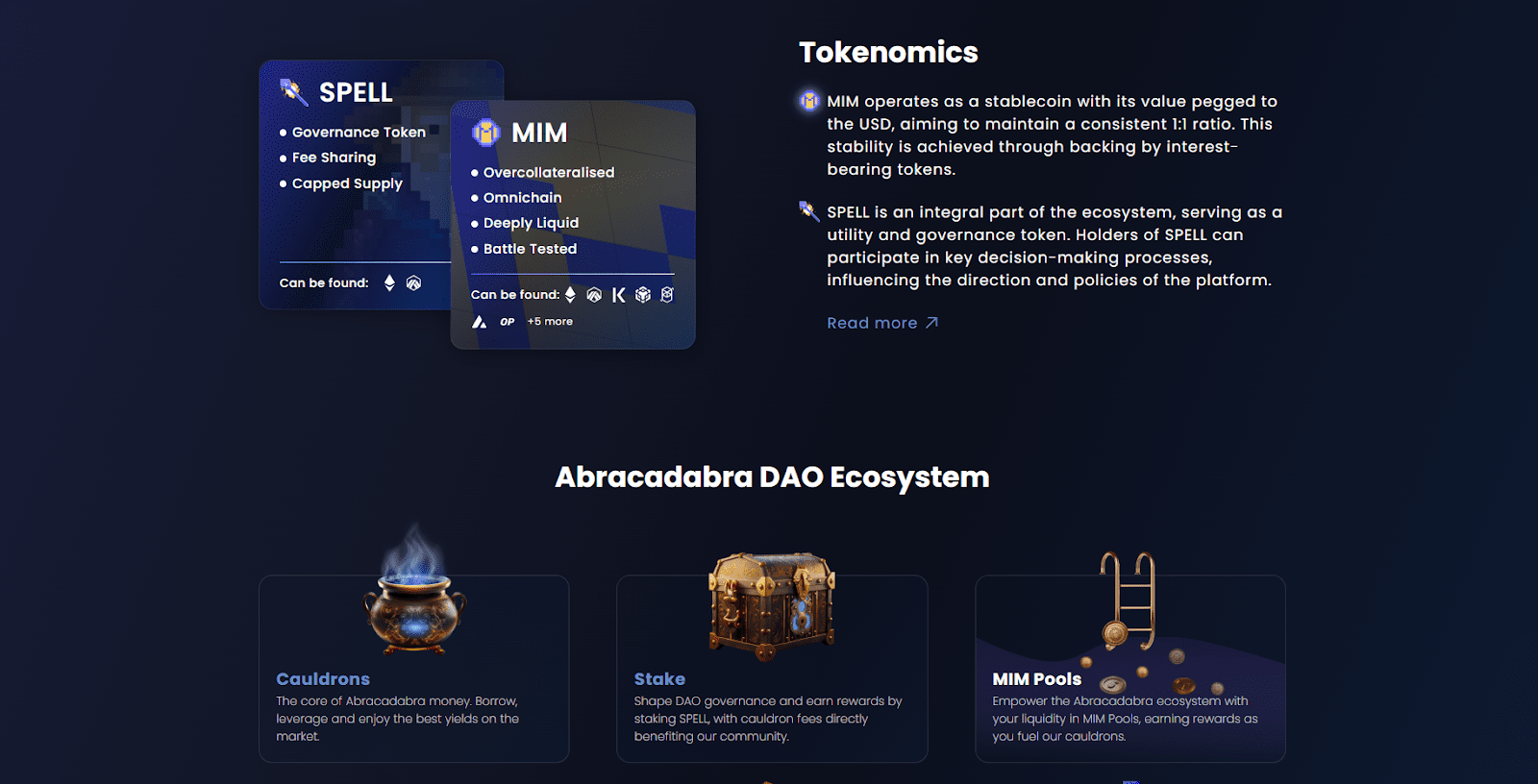

SPELL also plays the critical role of rewarding users and encouraging liquidity providers and enabling community voting. By owning or staking the SPELL token, users participate in decision-making processes of the future of the protocol, for instance, proposals for fees, acceptance of new assets, or rewarding of tokens.

Its design is aimed at the users of DeFi who wish to maximize yield, borrow funds against assets, or get inactive funds to work in an efficient lending mechanism.

Technology Behind the Project

By its own design, Abracadabra.money uses a smart contract system deployed across multiple blockchains, including Ethereum, Avalanche, Arbitrum, Fantom, and more. This cross-chain convenience allows users from disparate ecosystems to have the same lending and borrowing opportunities.

Its main product is collateralized debt positions (CDPs), as first popularized by MakerDAO. But where MakerDAO only allows for few assets, Abracadabra allows borrowing of MIM against interest-bearing tokens. This means users don’t need to stop earning yield while leveraging their tokens as collateral.

The SPELL token is ERC-20 compliant and is fully integrated into the platform’s staking and farming agreements. Through the staking of SPELL, the holders of the token are qualified to receive a share of the protocol fees and governance rights.

Token Spell's Engagement with the DeFi Community

SPELL has branded itself as more than the mere reward token. In the broader DeFi ecosystem, it serves as a bridge between users and decentralized governance. Through voting with the staking of SPELL, the holders vote with voting power and authority over proposals that can change fundamental aspects of the protocol, i.e., the rates of interest or the collateral types supported.

This design creates a feedback loop: the people who are benefiting from the protocol are motivated to participate in its own future development themselves. It also acts to make the platform sustained by a decentralized community of token holders instead of a centralized team.

In practice, SPELL is typically paired with MIM in the exchange's liquidity pools like Curve, SushiSwap, and Uniswap, boosting the action of trades and yield prospects of the liquidity providers.

Magic Internet Money (MIM) and Its Connection with SPELL

To understand the objective of SPELL, you should also understand MIM. Magic Internet Money is a decentralized stablecoin soft-pegged to the United States dollar. Abracadabra smart contracts' users create and mint MIM by locking collateral.

SPELL indirectly benefits from the success of MIM. As increasingly of the users mint and spend MIM, more fees are generated for the protocol. These are passed to the SPELL holders as rewards for long-term holdings.

This interaction between SPELL and MIM is the key to the sustainability of the network. MIM brings utility and liquidity, and SPELL facilitates the handling of incentives and governance of the community.

Staking and Yield Opportunities

SPELL Staking is one of the main ways investors can earn from having the token. As users stake the SPELL into the system, rewards of sSPELL are earned. This staked version of the token earns a fraction of the system’s revenues over time and is usually collected in the form of MIM or other stable coins.

The longer the SPELL is 'staked', the more sSPELL the user earns, encouraging long-term involvement. This mechanism aligns the incentive of the users with the health of the protocol.

In addition, you can also utilize SPELL in the liquidity pools and get rewards from farming and trading fees. These pools are usually incentivized by the platform itself so the users get more SPELL tokens in addition to the earned fees from the swaps.

Cross-Chain Compatibility and Development

One of the most notable characteristics of the SPELL token and the Abracadabra protocol is its multi-chain launch. The service is open to users on several large blockchains, and the SPELL token itself resides on several of those networks.

This flexibility allows the users to interact with the protocol in networks with lower gas rates or higher liquidity. This also subjects SPELL to higher integration potential and opportunities with other DeFi projects on each chain.

By going live on chains as quick and cheap as Arbitrum and Avalanche, Abracadabra and SPELL also attracted the users of the chains who prefer alternatives to Ethereum and boosted the demand of each network.

Tokenomics and Supply Distribution

The total supply of the SPELL is 210 billion tokens. These tokens are distributed into several categories as follows:

- Incentives for liquidity mining and rewards for users

- Allocations for team and development

- Reserves and treasury for the platform

- DAO and governance incentives

Some of the SPELL is released over time as a motivation for action on the platform. Meanwhile, team tokens are typically vested to prevent selling off promptly and to synchronize long-term interests.

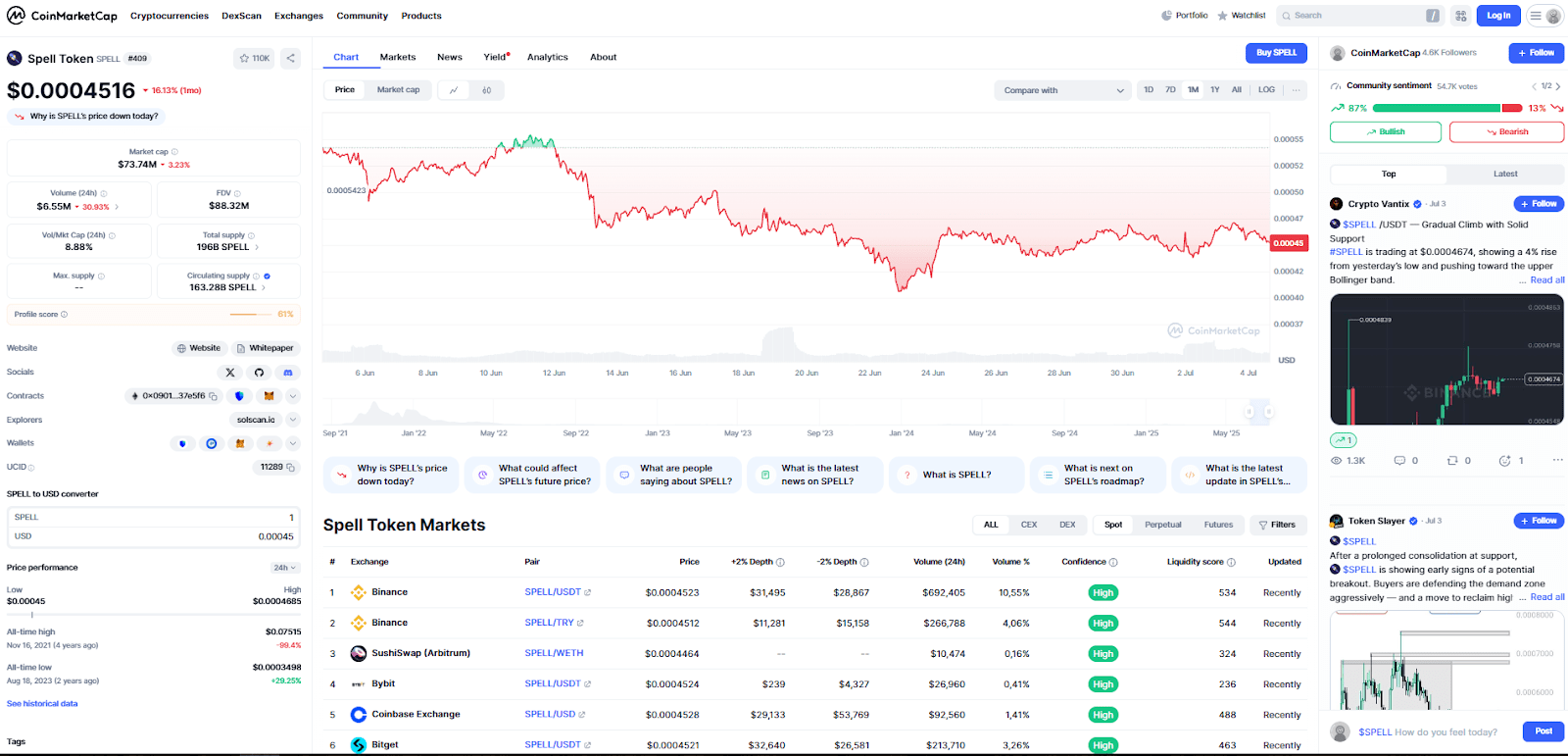

SPELL tokenomics are designed to allow for rewards to the users and sustainable growth, but like most DeFi coins, its supply-side and price mechanisms can be affected by market sentiment and demand from the users.

Risks and Considerations

Similarly with any DeFi project, Abracadabra and SPELL present specific risks. Smart contract exploits, liquidity changes, and unannounced governance moves can all affect funds and token prices of the users.

Furthermore, whereas voting is possible with the holders of SPELL, participation is usually tilted towards big holders or colluding parties. This sometimes creates an impression of lack of genuine decentralization.

MIM, as an uncollateralized stablecoin, relies on trust and overcollateralization. In the event of extreme system stress or de-pegging, it could hurt the users of MIM and also the holders of the SPELL token.

All investors and users should always conduct their own research, remain cognizant of the risk, and avoid overexposure to one specific asset.

Conclusion

SPELL Token (SPELL) is the linchpin of the Abracadabra.money system and allows for issuance of rewards, staking, and decentralized governance. Through its integration with Magic Internet Money as well as its multi-chain availability, SPELL allows for an open and decentralized approach towards lending and borrowing in DeFi. Its usability features and staking model provide ongoing participation rewards, and its integration with MIM keeps the system perpetually self-sustaining. As with any crypto asset, you should be wary of the holdings of SPELL, but its involvement with one of the more exotic lending platforms of DeFi is definitely one to watch.

FAQ

How does the Spell Token (SPELL) work?

SPELL is Abracadabra.money's utility and governance token and is used for voting proposals, staking, and collecting part of the fees of the protocol.

How do I stake SPELL?

You can stake SPELL through the Abracadabra platform. Once you have staked, you will be rewarded with sSPELL tokens whose values increase with time and allow you to vote in governance.

What is the connection between MIM and SPELL?

MIM (Magic Internet Money) is the Abracadabra-stablecoin and the service's governance and reward token is the SPELL. Further utilization of the MIM means higher fees and the fees go to the SPELL stakers.

Does SPELL have a presence on multiple blockchains?

Indeed, SPELL is implemented on various chains, i.e., Ethereum, Arbitrum, Avalanche, and so forth. This gives the users the facility of interacting with the dApp from their desired network.

Is it worth investing in SPELL?

Just like with any DeFi token, there is risk and reward potential with SPELL. Its market price is dependent on the development and adoption of the Abracadabra protocol and market demand in general. Always do your own research before you invest.

Here are no reviews yet. Be the first!