Where and How To Buy Tectonic Crypto (TONIC)?

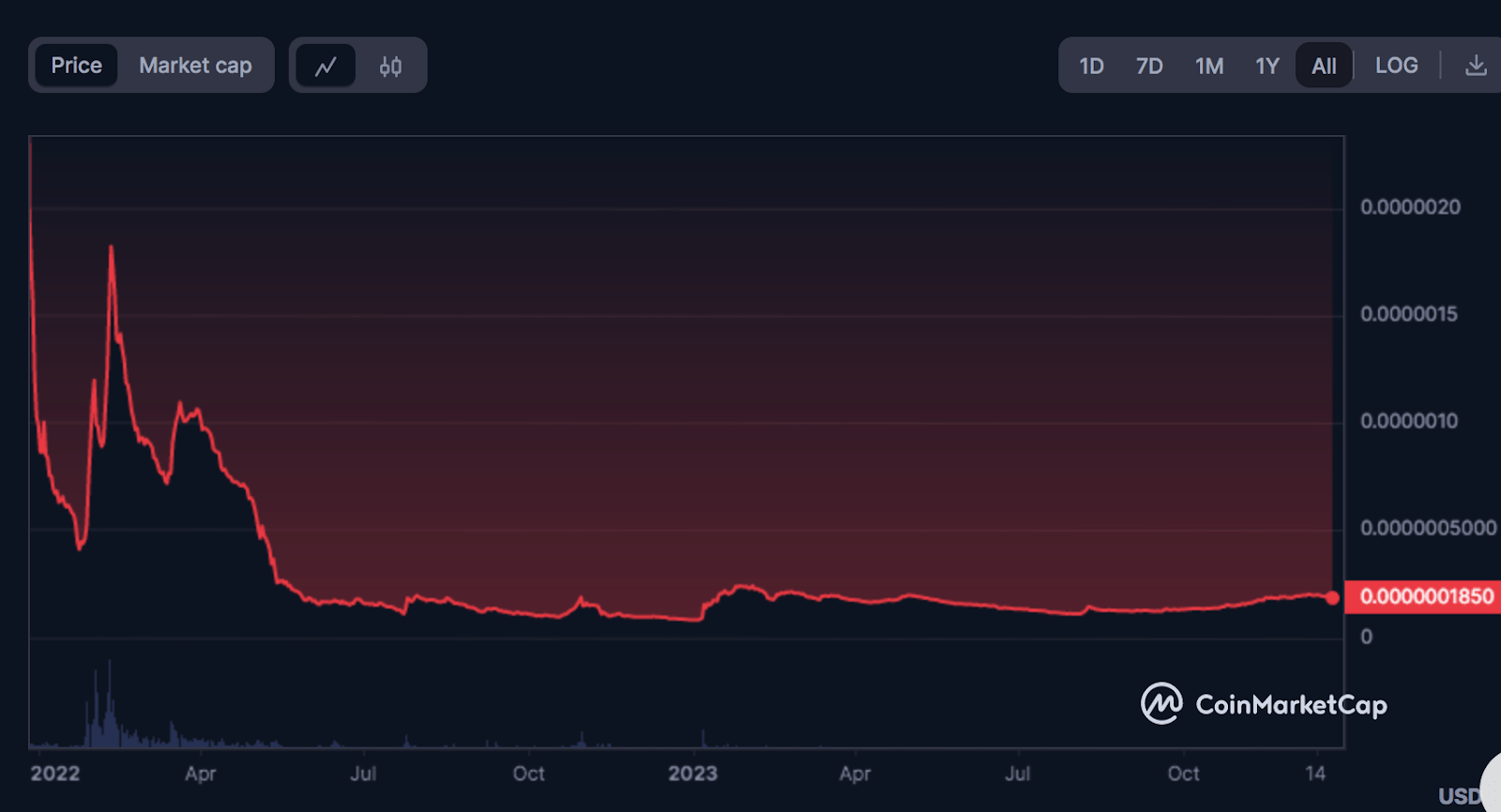

The TONIC token debuted strongly in December 2021. Despite weathering a bearish phase in 2022, it continues to draw new investors. This article delves into the Tectonic platform, providing insight into where and how to purchase Tectonic crypto (TONIC). Additionally, you'll discover whether TONIC is a good investment.

Contents

What is Tectonic?

Tectonic serves as a decentralized, non-custodial money market protocol presenting users with various avenues for passive income in the crypto sphere, including yield farming and a wide array of crypto assets available for borrowing. The Tectonic framework closely resembles that of Compound, a well-regarded protocol within the crypto space.

Tectonic's mainnet was rolled out in December 2021 on the Cronos blockchain. Early development of Tectonic involved Particle B, a startup accelerator collaborating with Cronos-based projects.

The brain behind Tectonic is Gary Or, a product designer, entrepreneur, and former Chief Technology Officer of Crypto.com. His extensive professional background as a blockchain products expert prior to spearheading Tectonic underscores his industry acumen.

Users have the ability to hold specific assets via the Tectonic protocol in exchange for rewards, allowing them to partake as liquidity providers. The amassed crypto supply is pooled and managed through smart contracts, serving as a fungible liquidity source for the protocol. Notably, users are free to withdraw their assets at any point, with no requirement to lock them within the Tectonic system. Rewards are paid in corresponding tTokens, like tETH or tUSDC, and the supplied assets can later be redeemed.

Moreover, the platform functions as a gateway to ICO bonding, offering additional avenues to capitalize on crypto holdings without needing to sell or lock them. Users can also engage in lending or borrowing of crypto assets for trading purposes. Interest rates for liquidity lenders are not fixed, with the platform's smart contracts dynamically adjusting rates based on the utilization of specific markets. When borrowing from the Tectonic supply pools, users can utilize crypto assets as collateral, each carrying varying loan-to-collateral ratios. For instance, an asset featuring a 50% ratio would allow users to borrow only half the value of the collateralized asset.

Here's a brief overview of what users can accomplish using Tectonic:

- Earn interest by holding spare crypto on the protocol without requiring asset management or lockups.

- Borrow crypto for profitable short trades (margin trading).

- Participate in yield farming to capitalize on returns.

- Access diverse cryptocurrencies and activities through Tectonic, including participation in ICOs and IDOs among other opportunities.

To ensure platform security, Tectonic undergoes third-party audits facilitated by Slowmist, a blockchain security auditor. Moreover, Tectonic intends to establish a fund composed of 10% of the interest paid by borrowers. As the platform's source code is open, it is accessible for auditing to identify any potential flaws.

The Tectonic Token (TONIC)

Integral to the Tectonic protocol, the TONIC token serves various roles within the ecosystem, including governance and staking to bolster the Community Insurance Pool.

As of December 23, 2023, TONIC is priced at $0.00000018, with its market capitalization exceeding $45 million, positioning the asset at 539th place in market cap rankings. The price of TONIC is markedly influenced by fluctuations in Bitcoin's price, often aligning with the broader trends of the crypto market.

In 2023, TONIC is traded on Crypto.com, a platform where Tectonic's founder, Gary Or, previously worked as an CTO. Another avenue for trading TONIC is VVS Finance, a Cronos-based decentralized exchange. The prospect of TONIC reaching new highs hinges on potential listings on major crypto exchanges.

Where to Buy Tectonic Crypto (TONIC)?

As of December 2023, purchasing TONIC with fiat money in one click is not facilitated. However, this can be achieved on Crypto.com with a few additional steps – one of them necessitating the acquisition of a Crypto.com Visa card.

Alternatively, users can purchase a different cryptocurrency and exchange it for TONIC tokens on Crypto.com or VVS Finance.

How to Buy Tectonic Crypto (TONIC)?

TONIC is traded against several cryptocurrencies: USDT, USDC, VVS, and WCRO. Hence, to acquire TONIC, users should first purchase one of these assets using fiat money. The simplest options are stablecoins like USDT and USDC, easily available in the industry. Most crypto exchanges supporting fiat-to-crypto transactions offer USDT or USDC. Alternatively, users could utilize a P2P service to buy crypto. Depending on the chosen exchange, top industry leaders include Binance, Kraken, Coinbase, KuCoin, among others. It's important to conduct thorough research, considering user feedback and terms before making a purchase.

The process of purchasing crypto across various exchanges may vary, so here, we'll offer general instructions.

- Select a reputable exchange and create an account. Utilizing an exchange app can also be advantageous.

- If the exchange mandates a Know Your Customer (KYC) procedure, complete it. This step makes using the exchange more convenient and secure. Moreover, activate protective features available on the exchange, beginning with enabling 2-factor authentication.

- Locate the "Buy Crypto" tab (this feature may have a different name depending on the exchange used) and purchase USDT or USDC using your bank card or another preferred method.

- Choose a trustworthy crypto wallet and install it. Subsequently, withdraw your cryptocurrencies to this wallet.

- Create an account on Crypto.com or VVS Finance. Exchange your stablecoins for TONIC or trade them for TONIC on either service. Then, configure the TONIC wallet and transfer your tokens from the exchange to this wallet, as holding crypto on exchanges can pose risks.

- You're all set!

Be sure to review the tax regulations pertinent to crypto trading or ownership in your region and adhere to them accordingly.

Is Tectonic Crypto (TONIC) a Good Investment?

We refrain from offering investment advice. However, we did publish an article containing a TONIC price prediction earlier. TONIC may be viewed as a speculative asset, as historically, its performance has been closely tied to broader crypto market trends.

Does TONIC hold potential? Certainly! The project is helmed by an experienced professional and boasts features that position Tectonic as an appealing platform for investors of various profiles. If the project's team continues to advance and secures listings on major exchanges, TONIC stands a significant chance of substantial growth. At present, we don't foresee a significant decline, as the TONIC price tends to move in tandem with the broader crypto market, which isn't in a state of collapse.

TONIC presents an option as a diversification token within your portfolio. However, concentrating all investments in TONIC doesn't seem to be a prudent strategy. Before choosing to invest in Tectonic, conduct thorough research on the subject.

Final Thoughts

As of December 2023, acquiring the TONIC token is quite challenging. While the token is traded on a prominent crypto exchange (Crypto.com), its availability elsewhere is nearly non-existent, significantly affecting its market performance. Nonetheless, we cannot assert that the project is doomed, as it continues to evolve, and recently, its price has shown an upward trend.

Although purchasing the token for fiat currency directly is not feasible, it can be acquired using USDT or USDC. Additionally, native tokens from Crypto.com and Cronos can also be employed for purchasing TONIC tokens. These cryptocurrencies can be acquired on other centralized exchanges supporting fiat-to-crypto transactions. Another alternative for purchasing TONIC with fiat involves obtaining a Crypto.com Visa card.

Hopefully now you know how to do that and if you find TONIC a worthy token for your portfolio it won’t be a hard task for you to purchase some.