3Commas Reviews 2021

Nowadays, cryptocurrency trading has reached fabulous volumes. The number of available trading instruments is evergrowing. The amount of people involved in trading is getting bigger and bigger, as well. At some point, it became clear the human abilities are not enough to get the maximum off cryptocurrency trading. That's when the trading bots have hit the game.

Unlike human beings, trading bots are immune to emotions and strictly rely on tech analysis. Moreover, they make dozens of math operations simultaneously hence they can trade on several markets at the same moment. It makes them superior traders that can gain huge profits. The trading bots market is expanding. In this article, we will talk about the company 3Commas. The platform is aimed at making efficient trading easier via the application of trading bots. The company cites its main principles: a clear interface, sophisticated trading tools in an easy form, and transparent business.

Basic Facts - What is 3commas?

3Commas was launched in 2017. The company has offices in Vancouver, Canada, and Tallinn, Estonia. It supports over 20 exchanges and has a user base of over 220 thousand people. The platform is used to manage multiple trading bots. All the available bots are managed via a single account. 3Commas can be used globally. The service is available on mobile devices and on the web. Paper trading mode allows trying the functionality of 3Commas to get an experience and good understanding of crypto trading and service features before investing real money. Additionally, 3Commas is used for social trading. Users can see the strategies applied by others and copy the trades they like. The platform is designed not only to bring the profits to the max but also it helps to avoid losses. Considering the user-friendly interface, this makes 3Commas an attractive service for beginning traders.

Smart Trading

3Commas can be used differently as the list of features provided by the platform is long and diverse. Let's start with Smart Trading. This feature allows manual trading on different exchanges through the 3Commas dashboard. To do so the user should connect her/his exchange account to the 3Commas account. It requires visiting an exchange account and retrieving the API keys from it. These keys should be inserted in the respective boxes in the My Exchanges tab. The dashboard allows adding the favorite trading pairs to the respective panel to be able to focus on these coins.

The charts are displayed on the 3Commas dashboard the way they are displayed on the exchanges' websites. All the indicators and order books are in place, too. Under the charts, one can fill out the orders. On 3Commas, traders not only specify the price but also put the limit on the amount of money they are eager to spend (in percent). Traders can post trailing orders so the buy/sell price is automatically decreasing/increasing following the market trend after reaching the desired buy/sell price. It helps users to make sure that they will get the best prices no matter what happens on the market.

don't forget to turn on trailing profits to earn more!

— Michael Madden (@unimike958) January 14, 2021

3Commas supports multiple order types so traders can secure themselves from losses and take advantage of fee discounts on exchanges like HitBTC, Binance, Kraken, and other platforms that charge market makers with lower fees. Limit orders are not compatible with trailing, however. Conditional buying orders don't show up in the order book until the price is reaching a specified value. It helps to appear in the book at the best moment. Stop-loss orders are available, too. What's interesting, there is a check box called "Stop Loss Timeout''. A user specifies the amount of time that should pass after the price hits the indicated value, so the order is triggered only if in this timeframe the price continues to fall. If the price recovers in this time gap, the order is not triggered. It helps to avoid selling at a stop-loss price in moments of short-term price declines.

Also, it is possible to split the targets. For instance, a trader can decide to sell a certain amount of her/his coins if the price grows by 5% and sell another portion of her/his funds only if the price grows by, let's say, 20%. 3Commas website contains a lot of educational articles that allow making a deeper dive into the functionality of the platform.

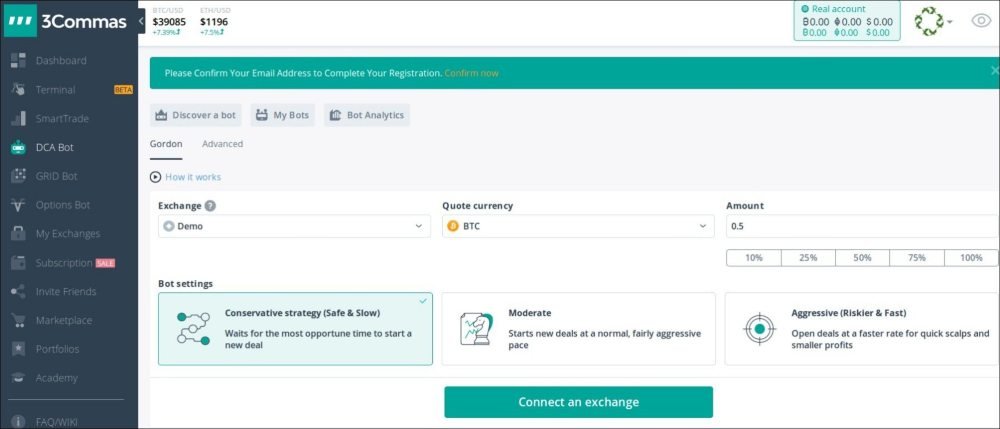

Trading Bots

Another noteworthy feature of 3Commas is the opportunity to set and deploy trading bots. The bots are managed in the My Bots tab. Once again, the trader will need the API keys generated on the preferred exchange to establish the connection between the exchange and a 3Commas account.

First off, the user should choose the pairs for a bot to trade. More than that, there is a list of trading pairs recommended by 3Commas. The next step is indicating the maximum possible number of active deals, choose the strategy in the corresponding section, and select the profit currency (there are quote or base currency options). Then, it's necessary to specify the base and safety trade sizes to indicate the minimum amount of a chosen currency per trade and the amount the bot will be buying in the downward trend. Target profit percentage is another important indicator that determines the price change at which the order is executed. As the bot keeps on constant trading and is capable of working with dozens of deals simultaneously, it's better to keep the target profit low (like under 1 percent). Low target profit will provide multiple profitable deals in a short time span. The quantity of these deals may play out well when the profits will be combined.

First off, the user should choose the pairs for a bot to trade. More than that, there is a list of trading pairs recommended by 3Commas. The next step is indicating the maximum possible number of active deals, choose the strategy in the corresponding section, and select the profit currency (there are quote or base currency options). Then, it's necessary to specify the base and safety trade sizes to indicate the minimum amount of a chosen currency per trade and the amount the bot will be buying in the downward trend. Target profit percentage is another important indicator that determines the price change at which the order is executed. As the bot keeps on constant trading and is capable of working with dozens of deals simultaneously, it's better to keep the target profit low (like under 1 percent). Low target profit will provide multiple profitable deals in a short time span. The quantity of these deals may play out well when the profits will be combined.

The next thing is the maximum safety trades count. It's recommended to keep this number below the max possible number of open deals. The safety trade is opened at some certain price change (0.2 to 10 percent). This amount is also determined by the user. Another thing that must be determined before the trading starts is the choice between the backload and front load. It's done via the safety order volume and safety order step scale sliders. It influences the number of coins used for each step. To filter out the low volume currencies the user should put an amount into the box titled "Don't start trade with trading 24h volume less than..." The amount is indicated in BTC. The recommended amount can differ depending on exchanges used by traders and other factors.

Then, there should be set the amount (in percent) that triggers stop-loss orders, the minimum and maximum price to open a deal, and a cooldown between deals (set in seconds). Also, it's necessary to choose an algorithm. With the Long algorithm on, the bot is buying low and selling high. A Short algorithm is about selling a coin at the price set by the user, and then, buying at a lower price. In the Trade Start Condition section users can choose from the following options: Telegram channel, Trading view, QFL, Manually, and Trading view custom signal. Besides that, it is necessary to specify the time circle for starting new trades, and choose if it will be a Buy or Sell order. When everything is set, it is possible to check everything one more time and share, copy, or edit the setting. If everything is alright, the user can click Start to initiate the trading process. The details can be edited anytime. The My Deals and Bot Analytics tabs provide all the info about the ongoing trading process.

I did. Its called using @3commas_io https://t.co/ykP56uBifV Smartrade with S/L.

— Justin Wu (@hackapreneur) January 11, 2021

Alternatively, (e.g. for training or testing), it is possible to set a single-currency trading bot and see how it works before starting a huge-scale trading activity. Bots analyze the trading activity of others. It's possible to copy trading (use the successful strategies applied by other people).

Other Features

Another way to benefit from using 3Commas is through the Portfolios feature. This is also about copy trading (or social trading). People make portfolios of multiple coins in different amounts, balance them through the coins ratios. Then, people can see the portfolios of other traders on 3Commas and finally copy and edit their bags to reach the best combination of coins for effective gains. The auto-reallocation feature helps to master portfolios that are better for certain exchanges.

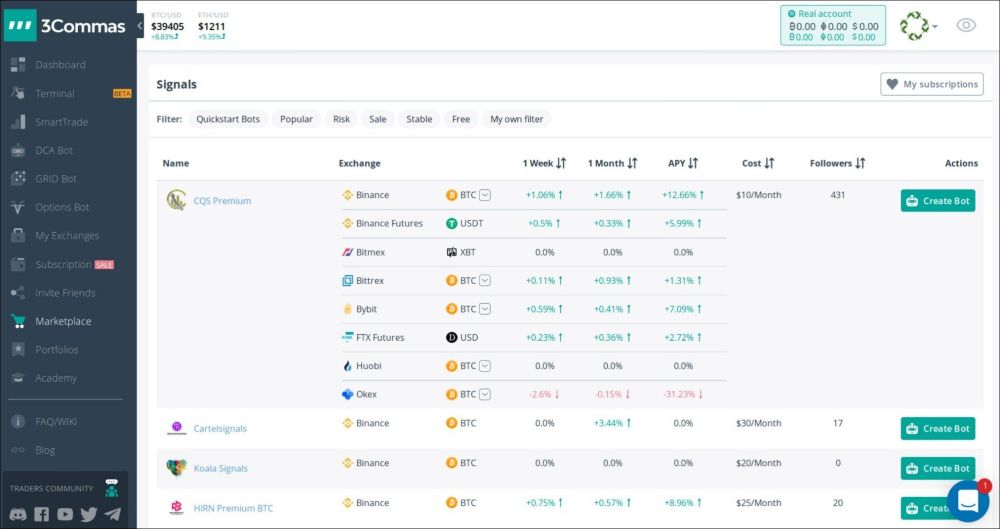

Users can set browser or mobile app notifications about deals. They can be also sent via email or Telegram. The mobile app can be downloaded from the App Store or Play Market. On the marketplace, users can spend some money in exchange for trading signals from the market professionals.

Users can set browser or mobile app notifications about deals. They can be also sent via email or Telegram. The mobile app can be downloaded from the App Store or Play Market. On the marketplace, users can spend some money in exchange for trading signals from the market professionals.

Costs & Fees

3Commas makes money via paid subscriptions, not via fees. The fees are collected on the exchanges connected to 3Commas. A Free plan allows using one DCA bot, one Grid bot, one Options bot, make one Smart Trade, buy, sell, convert the portfolio to BTC or USDT, and one use of the futures bot. A Starter plan ($29 per month) is adding long and short algorithms, concurrent take profit and stop-loss orders, and a Smart Trade terminal. An advanced plan ($49 per month) is adding custom signals from TradingView, view and copy bots, and a single DCA bot. The most expensive plan is Pro ($99 per month). It unlocks all functionality to the account owner.

Is It Safe to Use 3Commas?

As the trading takes place on side exchanges, the safety depends on the protection measures taken by traders on the exchanges they are connected to. Throughout the time of the 3Commas existence, no stories about the platform's misconduct towards users have surfaced. The only Reddit post claiming that 3Commas is a scam because it's skimming the users' money appeared to be very dubious.

Tracking stolen crypto — Century Web Recovery helps Scam victims recover their lost funds. Century Web Recovery is a legitimate Crypto recovery company Who are considered to be one of the most reliable and experienced crypto recovery Experts that provides bitcoin recovery services to scam victims. Utilizing the latest and most advanced recovery tools to date, Century Web Recovery is capable of retrieving lost funds for Crypto scam victims safely, quickly, and affordably. If you happen to have lost your funds to crypto scams, Embark on a journey to reclaim your lost Bitcoin with Century Web Recovery. Email Add; ( century@cyberservices.com ) WhatsApp: +18288143630 Telegram: @centurywebrecovery

Кидалово с возвратом и лагающие серверы.

Решил отписаться в связи с постоянно падающими серваками с смс в телеге: «простите за неудобства, сервис не работает, торгуйте на бирже» - надоело.

Оплатил за 12 месяцев 600$, а возвратом за оставшиеся 5 месяцев готовый вернуть всего 100$!

Сервис - скам

Muito eficiente para o que se propoe.

The price is very expensive, there are better platforms and a cheap price

It helps me to diverse my traiding activities. Good thing to trade from time to time