Zap (ZAP) Price Prediction 2022-2030

Contents

What is ZAP?

The Zap cryptocurrency was created and operates on the Ethereum platform as a "fuel" for Oracle (In short, it is a database management system) and decentralized applications of the ZAP ecosystem. The coin provides access to Oracle channels that will be available in the Zap store.

| The price as of February 2022 | $0.01 |

| Market cap as of February 2022 | $2,592,693 |

| Rank as of February 2022 | #1772 |

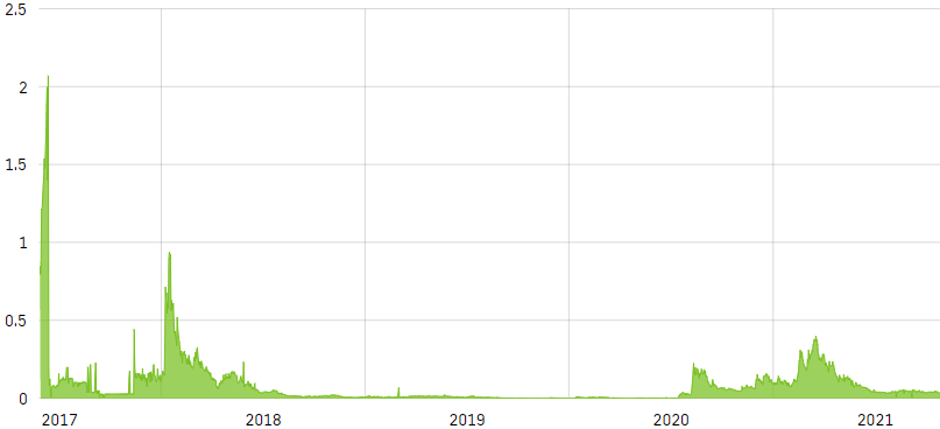

| All-time high | $1.16 (January 13, 2018) |

| Decline (compared to all-time high) | 99.1% |

| All-time low | $0.00132942 (November 15, 2019) |

| Growth (compared to all-time low) | 686.5% |

| Popular markets | Uniswap, Bitrue, CEX.IO, ProBit Global, HitBTC |

Cryptocurrency lies on ERC20 and according to the project team, the main task is to simplify for developers of decentralized applications (Dapp) the possibilities of finding reliable and necessary data for their smart contracts. Such a technique will provide all parties to smart contracts with the opportunity to agree on the source of data and be sure to receive them within the stipulated time frame and the required amount.

The developers believe that thanks to the tremendous work done to create "oracles", the ZAP platform will contribute to the widespread introduction of smart contracts into everyday life.

The main ecosystem of the ZAP Store project is an innovative, market-oriented solution to the problem of "oracles“, which enables all data owners to create an ”oracle" and make a profit after placing their data on the blockchain. Since the ZAP Store is a free ecosystem, the number of barriers to participation in the data economy decreases and competition between data owners increases, which gives investors the opportunity to choose the best quality data.

The advantage for investor users is the possibility of investing in "oracles", which they believe will be useful in the future and make a profit after such "oracles" become ubiquitous. Additionally, it is possible to invest in the development of previously selected "oracles".

Features and challenges of the coin

"Oracle" means a means of transmitting information from external sources to smart contracts or any decentralized application. This tool is necessary for the functioning of decentralized applications whose work depends on data from external sources. Can conduct independent economic activity on the blockchain.

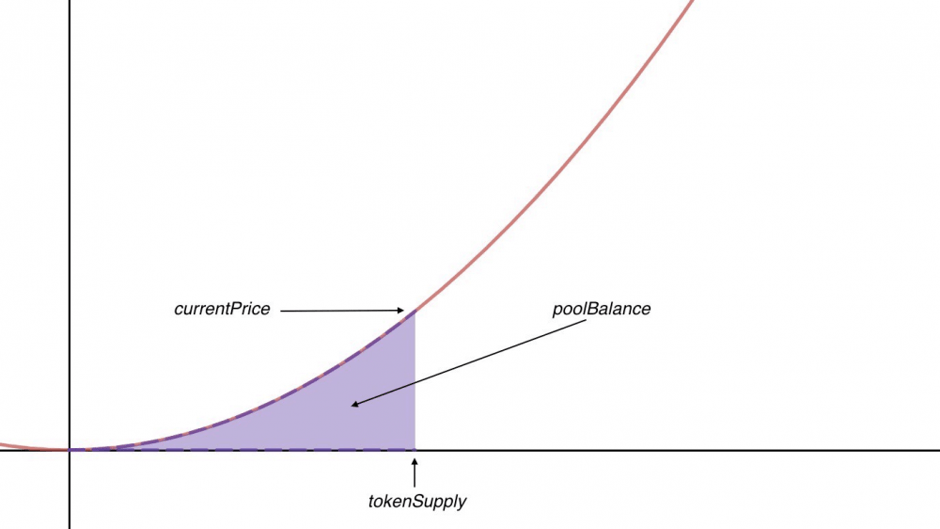

By "connected curve" is meant a smart contract that acts as a marker of the market of algorithms that provide full liquidity based on a predetermined and constant price structure. In general, the Zap protocol is relevant to coins precisely due to the presence of such "connected curves”

The price is determined by the size of the Zap bid in the contract. Every time someone binds, they lock their Zap and receive a secondary token that can be used to pay for the service or product provided. In addition, the secondary token can be sold back under the contract at a price determined by the smart contract itself based on the amount of the combined Zap. After the purchase or sale under the contract, the secondary token is burned, and the price is adjusted accordingly.

If the secondary token is redeemed, the service provider receives a Zap payment from the smart contract, and the secondary token is burned.

If the secondary token is returned to the smart contract, the subscriber of the service will receive a ZAP, and the secondary token will be burned.

The cost of the service may be more or less than the initial cost of the "connected curve”

Example of a "connected curve" x^2

The main advantage of using certain "oracles" is to provide smart contracts with timely information about the current situation in the world. The information is taken from a single source or data stream (for example: flight data or sports statistics).

Such use of a single source of a certain "oracle" brings out another problem: trust. In the ZAP Store, the security problem associated with single "oracles" is solved by providing a user-friendly set of consensus models, among which users choose the most convenient for themselves.

Scope of application of Zap

- Monetization of data ("Oracles")

- Creating new ERC20

- Creating a DAO (Decentralized Autonomous Organization) A

DAO is an organization that is managed using computer code and a specific set of programs.

- Decentralized contests

- Fundraising

- Tokenization of property

- Traded Futures Market

- Tokens on the ZAP ecosystem

Options for using cryptocurrencies

Insurance - The ZAP Store Data Market will provide insurance companies with the opportunity to provide self-acting insurance that automatically pays out to eligible customers. With the help of smart contracts, insurance payments can be determined in advance, which simplifies the process for both insurers and consumers. In this scenario, doctors in a decentralized insurance network will use their private key to sign a smart contract, freeing up funds to pay for their services. This is an example of how users can act on "oracles".

Shipping - The scale of trade is huge. Billions of parcels are sent around the world every year, and yet millions of these parcels do not reach due to factors such as incompatible tracking or control methods, negligence or even outright fraud or theft. The coin and its services will help to legalize the tracking of shipments, stocks, etc., as well as their insurance.

Dapps - Currently only those Dapps are available that work only on the basis of information about the blockchain. These decentralized applications, although valuable in themselves, have not even begun to touch on what Ethereum, smart contracts and decentralized applications are capable of, there must be a way to make information off-network available for contracts.

Price Prediction 2022 - 2030

There is no algorithm or any way of mining the ZAP token at the moment, because the coin is used for transactions where it serves as the currency of payment / purchase.

By the end of 2022, the price might reach up to $0.019. Experts expect the serious spike of the Zap price in 2023. At the end of the year, the price might reach $0.029. In the worst case, it won't be lower than $0.022. The growth will continue in the following year. By the end of 2024, Zap might gain up to $0.04. The year after it might reach up to 6 cents per 1 token. According to analysts' forecasts, the coin may reach its maximum of $0.48 by 2030, which is 48 times its current value (as of February 2, 2022).

| Year | Min Price | Average Price | Max Price |

| 2022 | $0.011 | $0.013 | $0.019 |

| 2023 | $0.022 | $0.024 | $0.029 |

| 2024 | $0.033 | $0.035 | $0.04 |

| 2025 | $0.04 | $0.045 | $0.06 |

| 2026 | $0.069 | $0.086 | $0.095 |

| 2027 | $0.1 | $0.12 | $0.15 |

| 2028 | $0.18 | $0.2 | $0.26 |

| 2029 | $0.29 | $0.33 | $0.38 |

| 2030 | $0.41 | $0.44 | $0.48 |

Here are no comments yet. Be the first!