USDC vs USDT: Identifying the Main Disparities

USDC vs USDT is a popular comparison among crypto users, traders, and investors looking into stablecoins. Stablecoins have become essential elements in the cryptocurrency market, providing the stability of fiat currency with the flexibility of cryptocurrency. Some of the most popular stablecoins are USD Coin (USDC) and Tether (USDT), both of which are backed by the US dollar. But how do they differ?

Let's get into the in-depth comparison of USDC vs USDT.

Contents

What Are Stablecoins?

Stablecoins are cryptocurrencies meant to be stable in value, most often fixed to conventional assets such as fiat currency or commodities. Their design is meant to minimize volatility, which is central to their use in both trades and storing value in the crypto market.

Both USDC and USDT are stablecoins that are fixed to the dollar.

Stablecoins enable peer-to-peer transactions without the intervention of intermediaries, including banks. Learn more about stablecoins in our comprehensive guide. They have benefits including quicker processing, reduced fees, and accessibility worldwide. They are becoming effective in international remittance, crypto trading, and decentralized finance (DeFi).

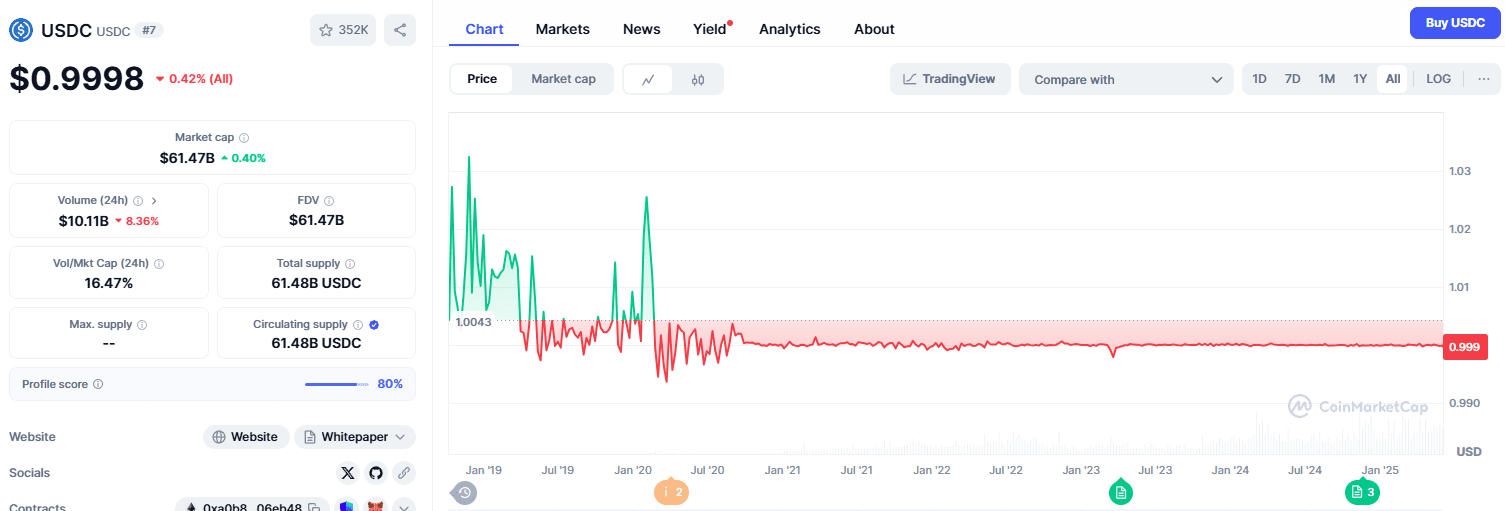

Overview of USDC

The USD Coin (USDC) is a dollar-backed stablecoin. It has been launched since September of 2018 and is managed jointly by Circle and Coinbase via the Centre Consortium. Explore the best platforms to exchange USDC.

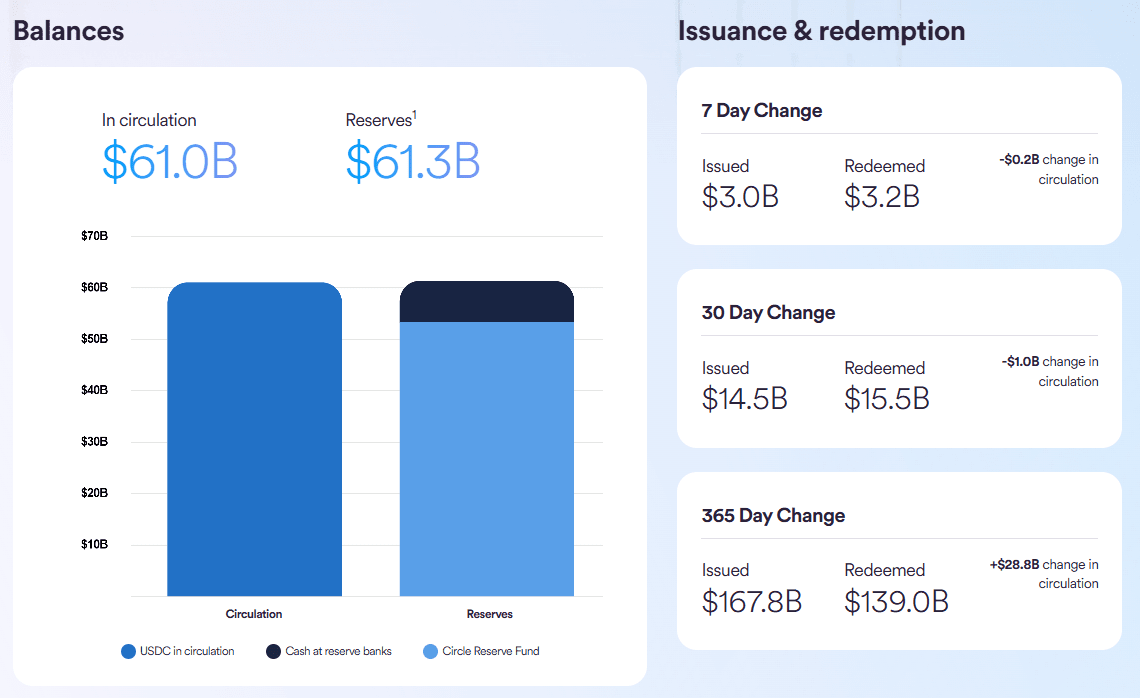

USDC boasts transparency and compliance, publishing regular audits of its reserves. The fundamental aim of USDC is to offer users a secure, stable, and transparent digital asset.

All tokens in circulation are backed by an equivalent value of fiat currency, which is held in institutional-grade banks and other licensed institutions. This builds trust among users as well as stability.

USDC is available on several blockchain platforms, including Ethereum, Algorand, Solana, and Stellar, for broad adoption and use in a range of decentralized applications.

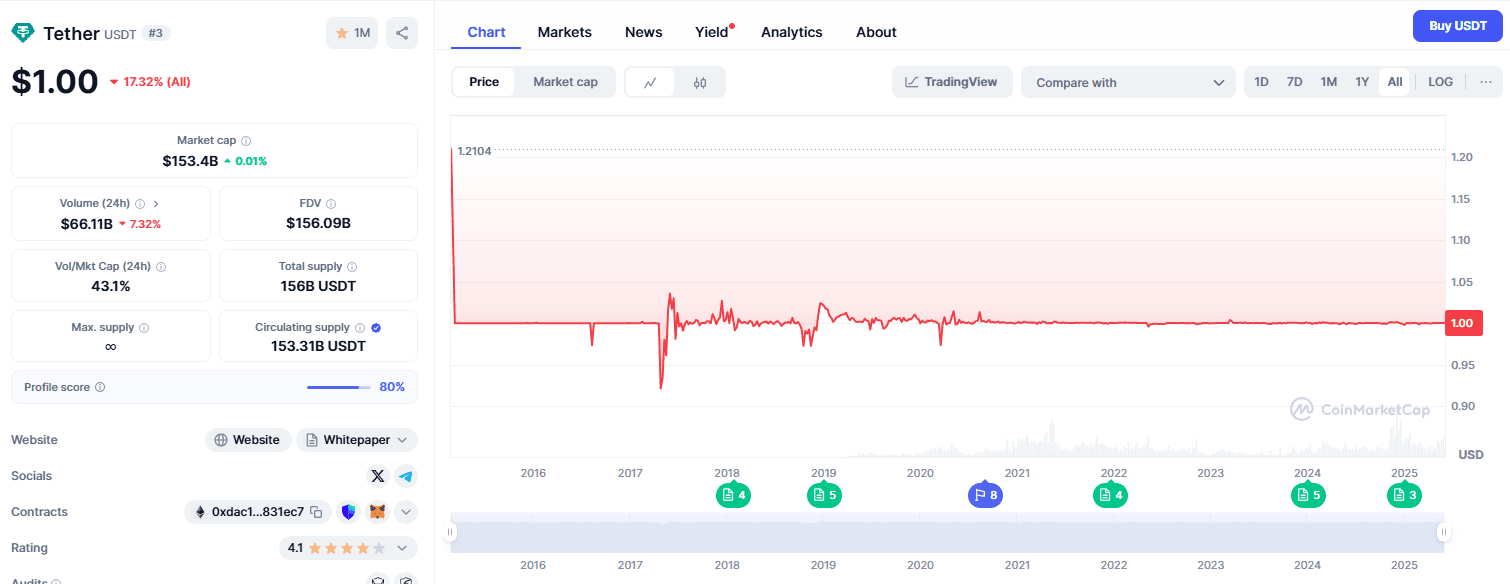

USDT, or Tether

USDT is one of the oldest stablecoins, launched in 2014 by Tether Limited. Find out where to buy Tether (USDT) with our platform reviews. It is one of the most popular stablecoins in use worldwide despite having been involved in a series of controversies about transparency and reserve backing.

USDT's value is fixed to the value of the US dollar, keeping to a 1:1 ratio using reserves. These reserves are said to comprise a combination of cash, commercial paper, and other assets. Reserve transparency issues, though, have occasionally undermined its legitimacy.

In spite of controversies, USDT is still popular on the strength of its cross-exchange acceptance and broad support on a number of blockchains, including Ethereum, Tron, Binance Smart Chain, and several other platforms.

Transparency and Audits: USDC vs USDT

A key differentiator for USDC is transparency. USDC is transparent and regularly audited by well-respected third parties, such as Grant Thornton LLP. These audits guarantee that the assets supporting USDC tokens are transparent and correct.

Meanwhile, USDT has also been criticized for uneven transparency reporting and auditing. While Tether Limited issues infrequent accounting firm reports, critics charge that those audits are not of adequate complexity and transparency, which has resulted in uncertainty about Tether's reserves.

This disparity in transparency will make it more desirable for users who value security and compliance with regulation.

Technological Foundations

USDC and USDT both use blockchain technology, albeit with a different multi-chain strategy.

- USDC largely is built on Ethereum but has branched out to other blockchains, including Algorand and Solana, to lower the cost of transactions and speed up transaction times.

- USDT originally operated under Omni Protocol but has since grown to support several blockchains, including Ethereum, Tron, Binance Smart Chain, and EOS, among other platforms.

The multi-chain setup provides users with options regarding the network to use, either for lower fees or faster speeds.

Both the stablecoins employ smart contracts, providing fast, secure, and transparent transactions. But the greater network acceptability of USDT tends to make it the most popular among traders who require instant and extensive accessibility.

Adoption and Market Presence

USDT has a strong advantage when it comes to adoption. It leads in stablecoin trading volumes among most cryptocurrency exchanges, thanks to its first mover status in the market. Its extensive presence and liquidity contribute to it being a favorite among traders.

USDC, on the other hand, is consistently gaining market share, albeit primarily among institutional investors and regulated platforms.

Regulatory compliance and transparent backing have led to adoption among users who value safety and stability. More and more DeFi platforms have been embracing USDC in light of its transparent, solid reputation, and regulators' favor, further boosting its popularity in decentralized finance.

Real-world Applications

USDT's ubiquitous usage in crypto exchanges and trading pairs makes it a go-to stablecoin for short-term trading and providing liquidity. Traders use USDT to facilitate rapid switching between cryptocurrencies and fiat-equivalent positions.

USDC is most suited for longer term holding, institutional investment, and DeFi usage. Discover top DeFi coins and how USDC fits into the DeFi ecosystem. It is appropriate for businesses and institutions looking for stable digital assets and is driven by transparent reserves and regulation.

Major crypto platforms and institutions such as Binance, Kraken, and Coinbase, as well as decentralized platforms like Compound and Uniswap, utilize both stablecoins quite extensively, demonstrating their utility and significance in the crypto space.

Where To Exchange Tether (USDT) - Best Platforms With Reviews

Key Organizations Driving USDC and USDT

- USDC is operated by Centre Consortium, which is co-established by Coinbase and Circle, two highly respected and well-regulated institutions in the cryptocurrency market. Circle is renowned for adherence to regulation and transparent practices.

- Tether Limited, which issues USDT, is linked with Bitfinex, a well-established cryptocurrency exchange. In spite of the controversies, strong market presence and liquidity of Bitfinex have kept USDT dominant.

Regulatory scrutiny and market trust towards these organizations significantly influence users' stablecoin choices.

Conclusion

In a comparison between USDC and USDT, the selection of either of them is more a matter of individual needs such as transparency, regulatory adherence, ease of transaction, and liquidity.

- USDC offers more transparency and regulatory support, favoring long-term holders and institutional investors.

- USDT provides greater adoption and ease of transaction for active traders.

Based on individual needs, an appraisal of these characteristics will inform the best option between USDC and USDT.

FAQ

Is USDC safer than USDT?

USDC is seen as relatively more secure through frequent audits and transparent backing of reserves, while USDT has experienced transparency issues and regulatory exposure.

Why is USDT more widely used?

USDT is the earliest well-adopted stablecoin and provides more liquidity, most popular among traders and crypto exchanges.

Are USDC and USDT always equal to $1?

No, they are not always equivalent to $1. Both fix a 1:1 rate to the USD, although temporary deviations are possible through market supply and demand.

Which stablecoin is more suited for DeFi?

USDC is generally favored in DeFi usage for its transparency, regulated backing, and compatibility with an array of DeFi platforms.

Can you lose money investing in USDT or USDC?

You cannot lose cash investing in either USDT or USDC. Though stablecoins are designed to be of stable value, issuer solvency or market circumstances may, theoretically, result in losses. Due diligence is important prior to investment.

Voici encore aucun commentaire. Soyez le premier!